www.smcindiaonline.com

AWARDED THE BEST, TIME AND AGAIN.

www.smcindiaonline.com

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

| IPO | 15 |

| FD Monitor | 16 |

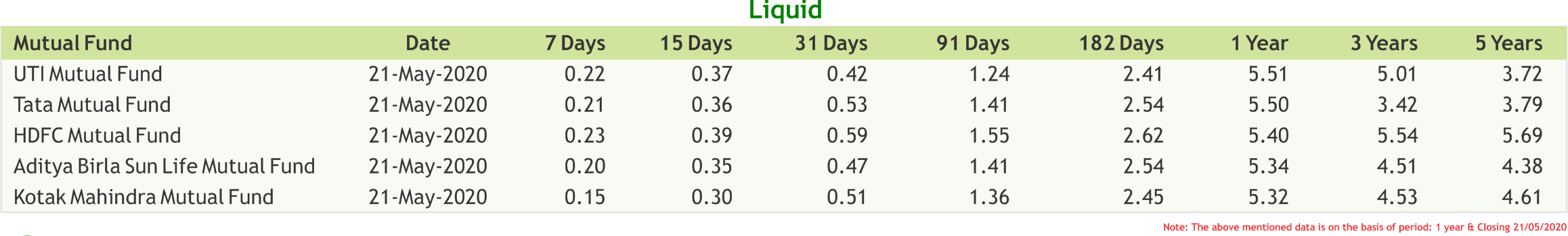

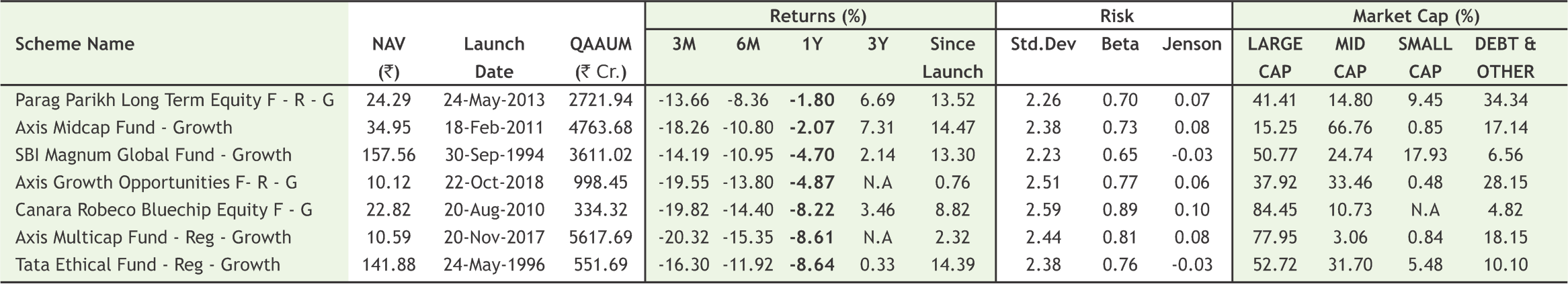

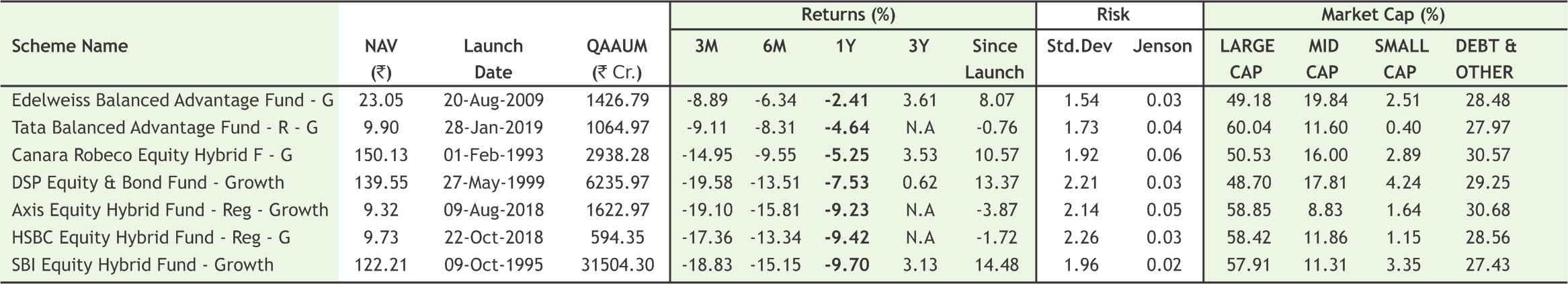

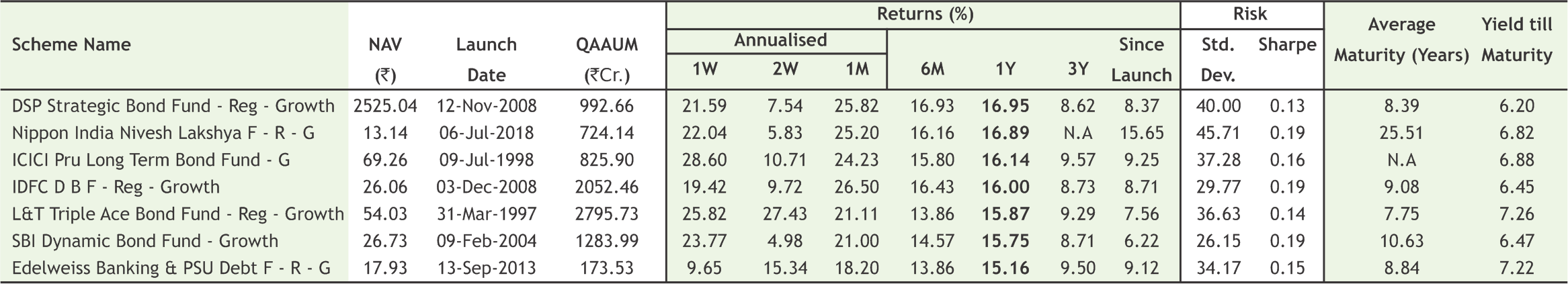

| Mutual Fund | 17-18 |

I

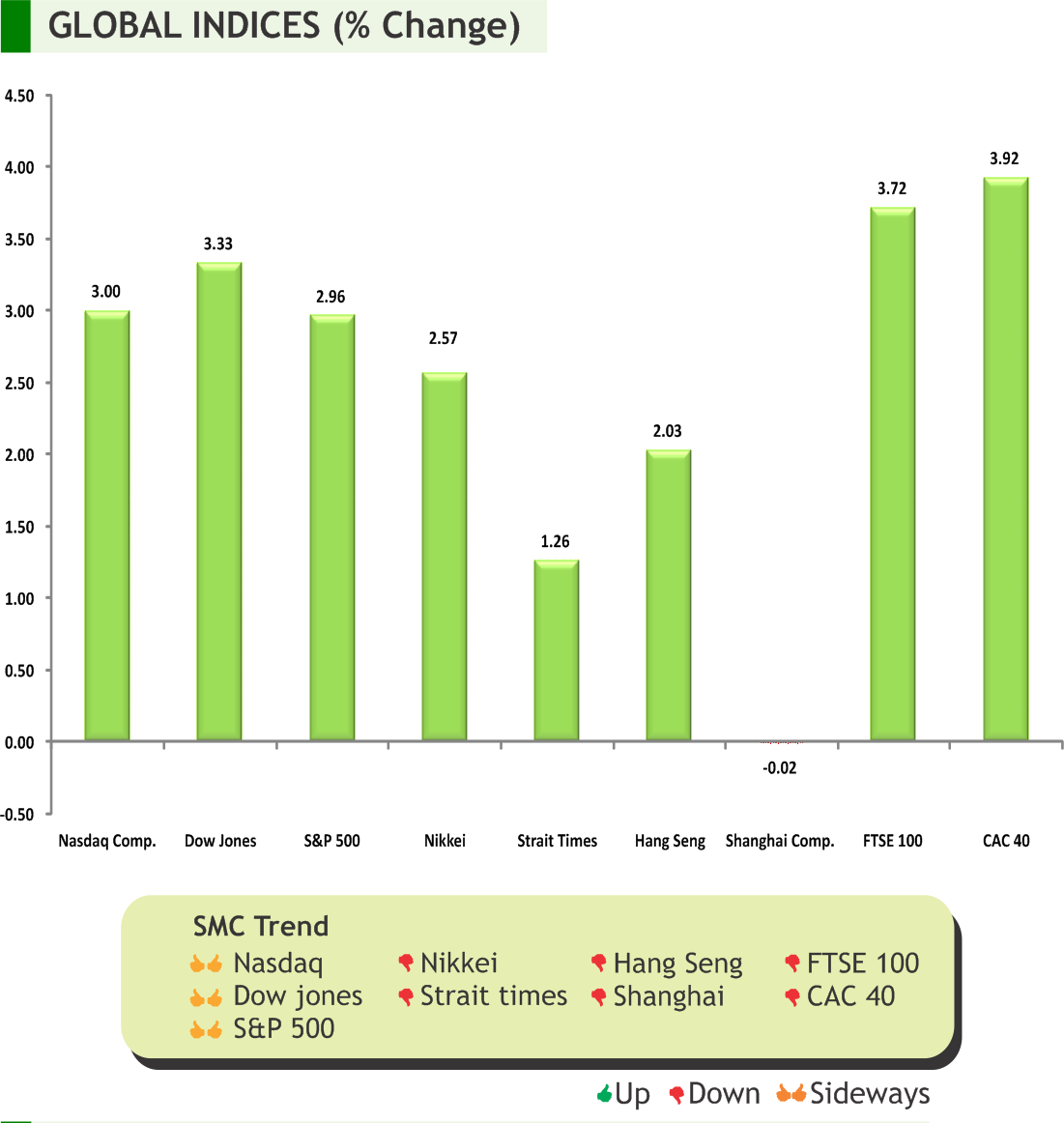

n the week gone by, global stock market witnessed a volatile movement as U.S.- I China tensions curbed investor risk appetite and after data showed another wave of Americans applied for unemployment benefits because of the coronavirus pandemic, caused global equity markets to stumble. Besides, the news that Beijing was set to impose new national security legislation on Hong Kong ruined the sentiments of the market participants. The move drew a warning from President Donald Trump, who said the United States would react “very strongly” against it. Meanwhile, China has set a budget deficit target for this year of “at least” 3.6 percent of Gross Domestic Product (GDP). Oil prices headed for a fourth straight week of gains, amid more evidence that fuel demand is recovering as countries ease business and social restrictions that were imposed to counter the coronavirus pandemic.

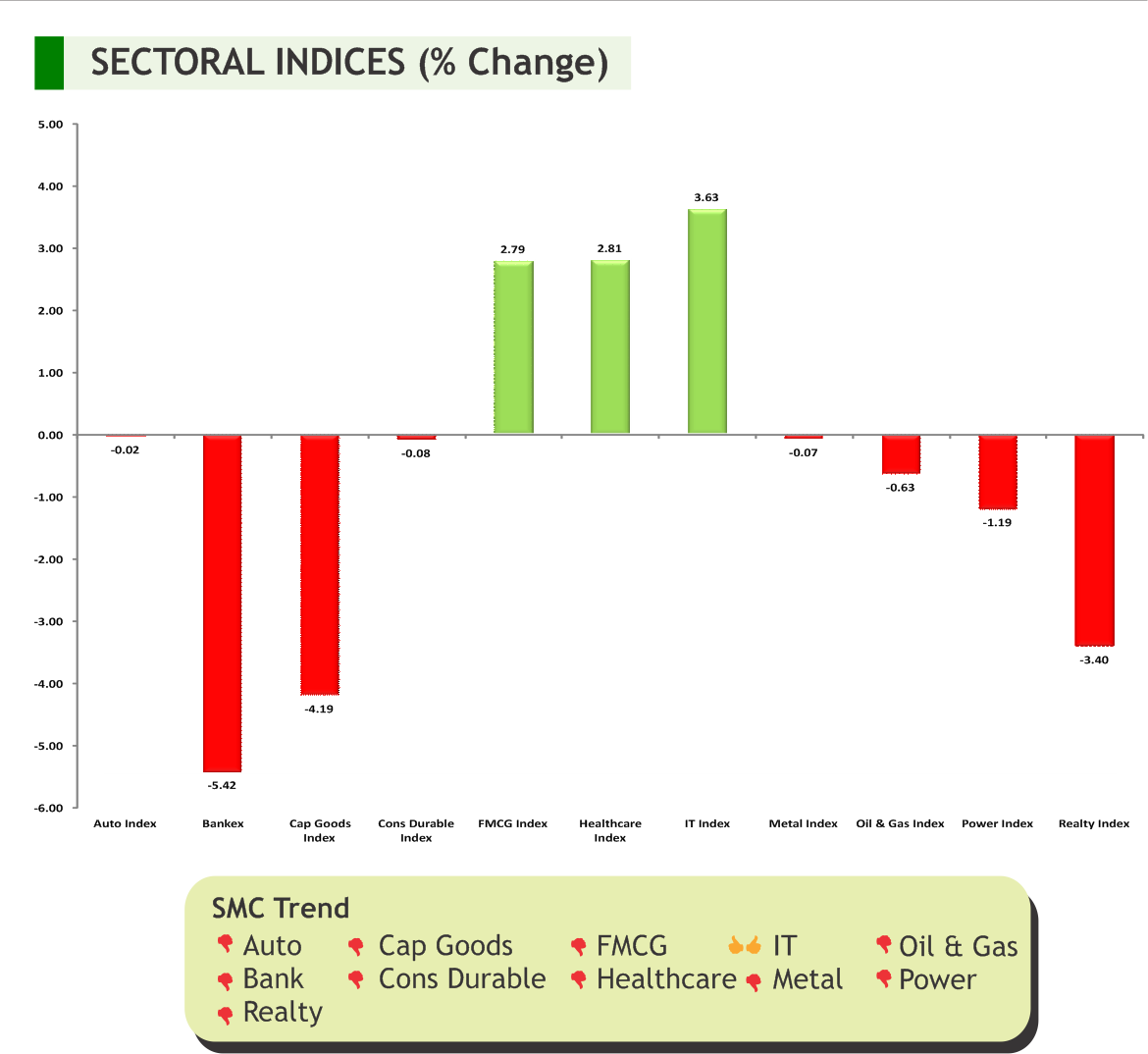

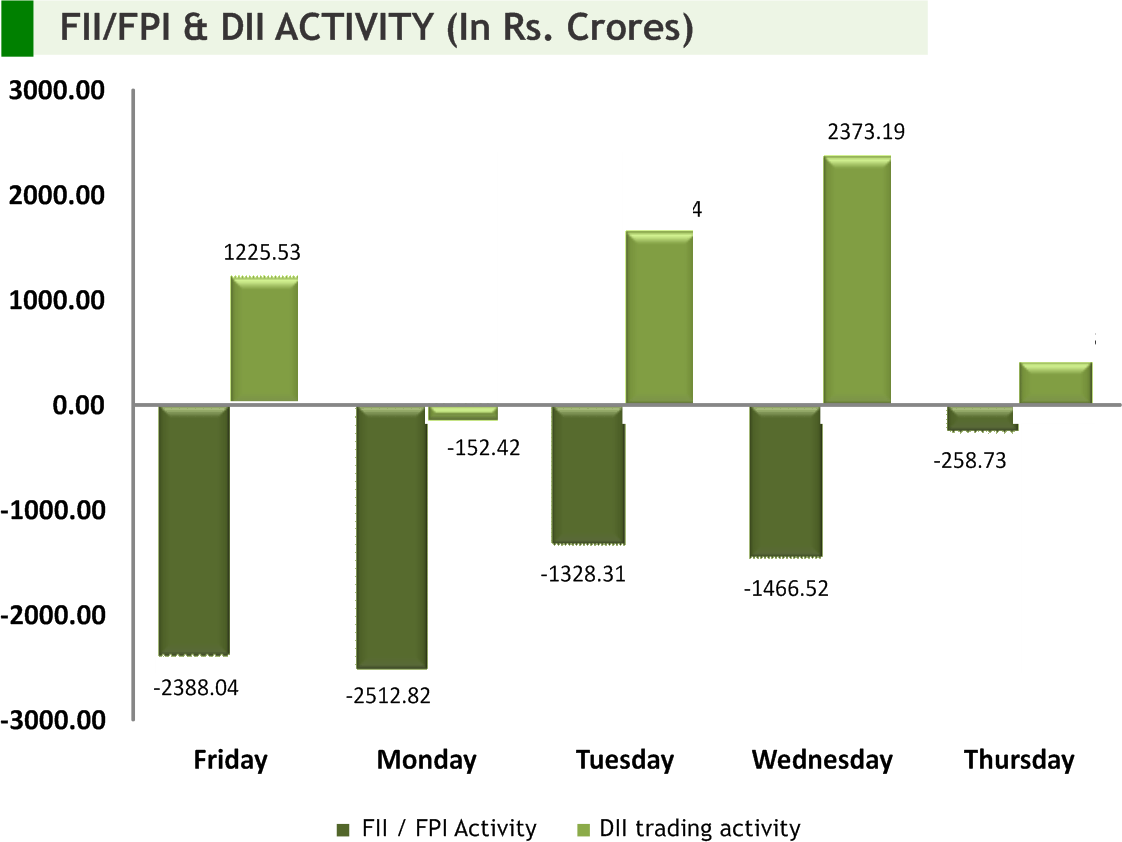

Back at home, domestic markets witnessed bouts of volatility tracking global cues amid a rapid rise in Covid-19 patient count at home. Investors preferred to wait on the sidelines for further cues on opening up of the economy. RBI has announced 40 basis points cut in repo rate to 4 percent. This is the governor's third such presser in the context of COVID-19 related measures in last two months. The first one was on March 27 and the second on April 17. The domestic currency rupee also continued to remain weak against the US dollar as headwinds due to US-China trade tiff and worries over the second wave of coronavirus infection weighed on investor sentiment. Meanwhile, ratings agency ICRA sharply revised its growth expectation for India to a 5% contraction in the current fiscal from 1%-2% growth earlier. The rating agency has also said the stimulus package contained more enabling provisions to support economic recovery after the lockdown was lifted rather than address the immediate needs of various sectors. Going forward, quarterly earnings and global market jitters over USChina tensions over Beijing's plan to impose a national security law on Hong Kong will continue to influence the investor sentiment.

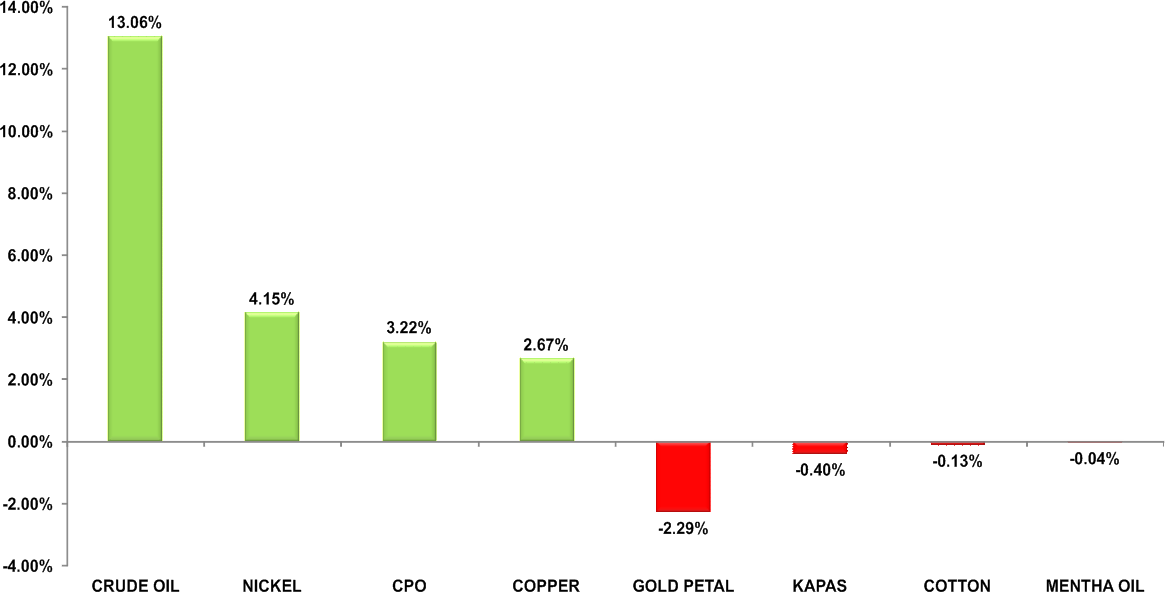

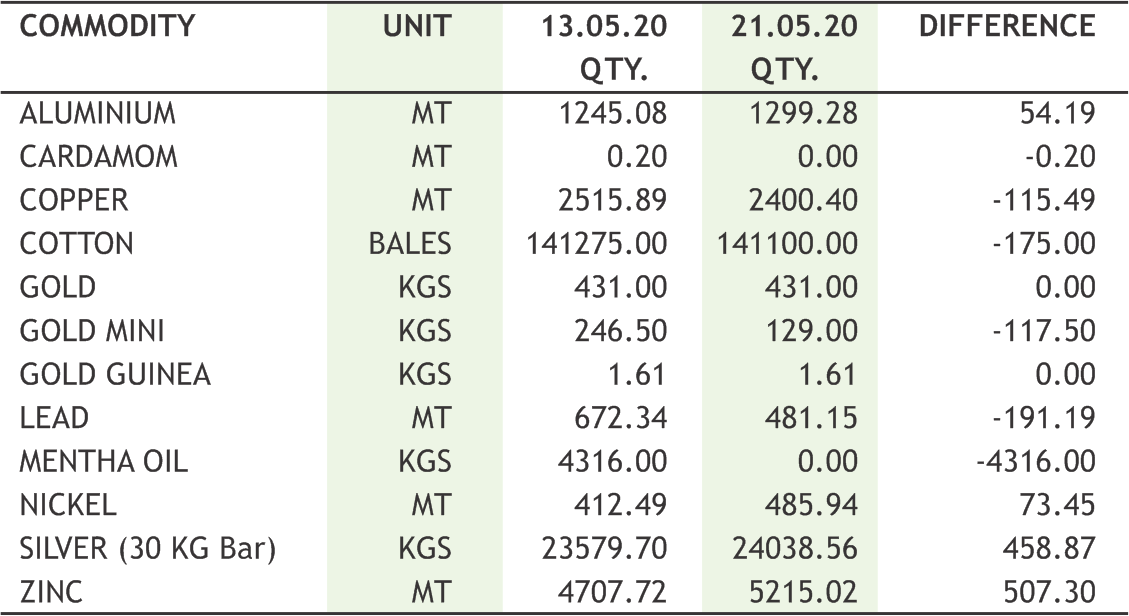

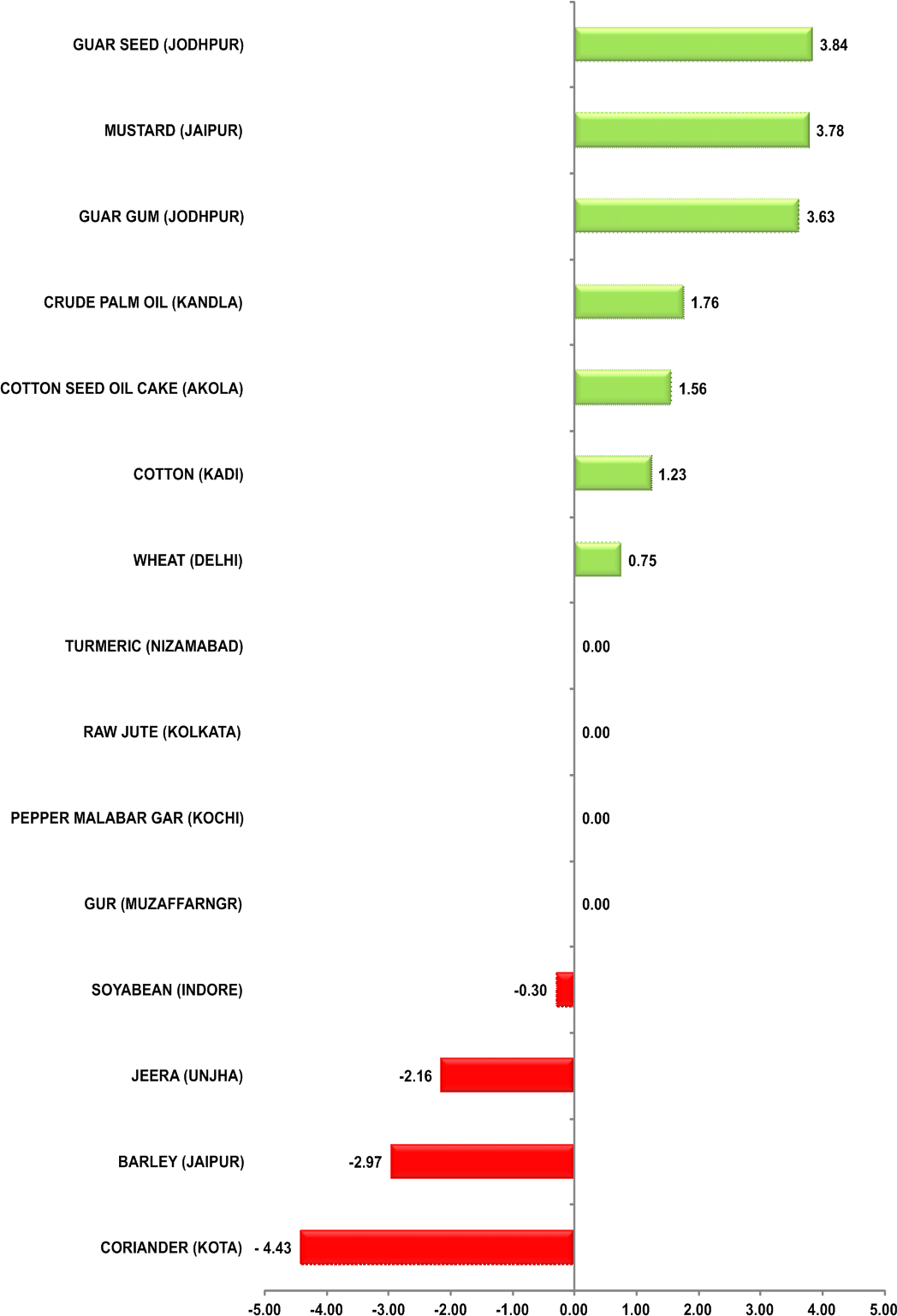

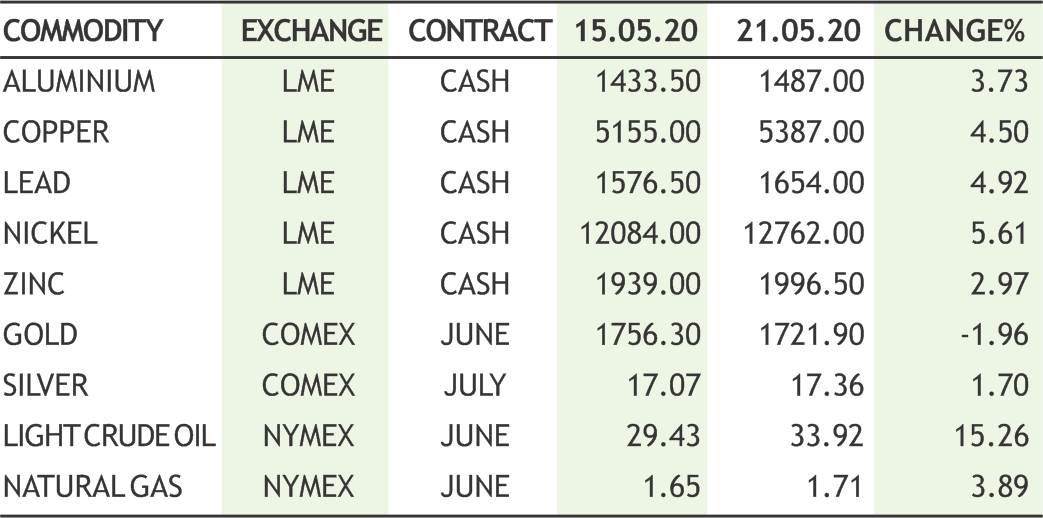

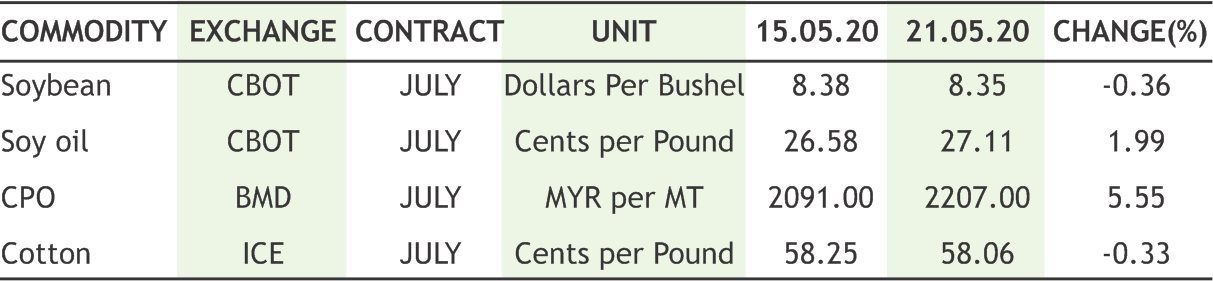

On the commodity market front, the week gone by was all about the magical upside in crude prices amid some profit booking in bullions from higher levels. Industrial metals too caught the attention with its further rise. In agri, new trade equations with Malaysia influenced the prices. More import from Malaysia after a brief ban on CPO import, propped up CPO futures, even in India. Crude has risen more than 80% this month as production cuts have kicked in and demand has started to return. Oil and gas prices should rise as governments gradually lift travel restrictions. It is advisable to accumulate on correction only near the level of 2200 and the upside potential is of around 2700-2750. Gold will remain the favorite of investors on rising geopolitical tensions amid China omitted the 2020 target. It should trade in a range of 46000- 47500. Durable Goods Orders, GDP, Core PCE Price Index, PCE Price IndexPCE Price Index of US, GDP of Italy, Canada, Mexico and Germany, Core Inflation Rate of EU etc are many strong triggers that will influence commodities prices going forward.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Economy

• The Reserve Bank of India (RBI) governor announced that both the repo rate and the reverse repo rate would be reduced by 40 basis points during the coronavirus crisis. The governor extended the ongoing moratorium on loan repayment, which was due to end on May 31, by another three months to August 31. The governor also said the Gross Domestic Product growth in 2020-’21 is likely to remain in the negative and the monetary committee expects the headline inflation in the first half of 2020 to remain intact.

Pharmaceuticals

• Laurus Labs has received an approval from USFDA under PEPFAR (President's Emergency Plan for AIDS Relief) for two ANDAs (Abbreviated New Drug Application) TLE 400 (Tenofovir/ Lamivudine/ Efavirenz - 300/300/400mg) and TLE 600 (Tenofovir/ Lamivudine/ Efavirenz - 300/300/600mg) tablets.

• Lupin announced the launch of authorized generic version of Bausch Health's Apriso® (Mesalamine Extended-Release Capsules 0.375 g) in the U.S. Mesalamine Extended-Release Capsules 0.375 g (authorized generic version) are indicated for the maintenance of remission of ulcerative colitis in patients 18 years of age and older.

• Biocon announced that its subsidiary Biocon Biologics India has received the Certificate of GMP compliance from EMA for multiple Biologics Drug Substance (DS) and Drug Product (DP) manufacturing facilities at Biocon Park, Bengaluru.

Capital Goods

• K E C International has secured new orders of Rs. 1,203 crore across its various businesses; T&D business and SAE Towers have secured orders of Rs. 917 crore for T&D projects in India, Bangladesh, Africa and the Americas. The Civil business has secured orders of Rs. 176 crore for industrial [civil works for Flue Gas Desulfurization (FGD) project] and residential projects in India. The Cables business has secured orders of Rs. 110 crore for various types of cables/ cabling projects.

Tea

• Tata Consumer Products announced that it will acquire PepsiCo's stake in NourishCo Beverages (NourishCo/Company), a 50:50 JV between the two Companies. This move is consistent with Tata Consumer's focus on widening its portfolio in the Food and Beverages space.

Metals

• Welspun Corp has been awarded contracts for supply of 102 KMT of pipes. Out of these orders, 90 KMT (approx.) is for our US facility, including a large order received from one of the company's very prestigious North American customers for a pipeline to be commissioned in the USA. Accordingly, the Company's order book stands at 764 KMT valued at approximately Rs 6,200 crore, after considering execution up to April 2020.

Information Technology

• Cyient has signed a Statement of Intent with the Emergent Alliance, to use their combined data knowledge to provide new insights and practical applications to the global COVID-19 response. As part of the alliance, Cyient is working alongside some of the world's largest organizations, data specialists, and governments to support future decision-making on regional and global economic challenges that will get people back to work and help businesses thrive post-pandemic.

INTERNATIONAL NEWS

• US leading economic index tumbled by 4.4 percent in April after plunging by a revised 7.4 percent in March. Economists had expected the index to plummet by 5.9 percent compared to the 6.7 percent slump originally reported for the previous month.

• US initial jobless claims dropped to 2.438 million, a decrease of 249,000 from the previous week's revised level of 2.687 million. Economists had expected jobless claims to tumble to 2.400 million from the 2.981 million originally reported for the previous week.

• The Chinese government dropped setting economic growth target for the first time amid uncertainties posed by the coronavirus, or Covid-19, pandemic. At the annual session of National People's Congress in Beijing, Premier Li Keqiang said the country will face some factors that are difficult to predict in its development due to the great uncertainty regarding the Covid-19 pandemic and the world economic and trade environment.

• Consumer prices in Japan were up just 0.1 percent on year in April - matching forecasts and slowing from the 0.4 percent increase in March. Core consumer prices, which exclude volatile food costs, fell an annual 0.2 percent on year versus expectations for a flat reading following the 0.4 percent gain in the previous month.

|

|

4

5

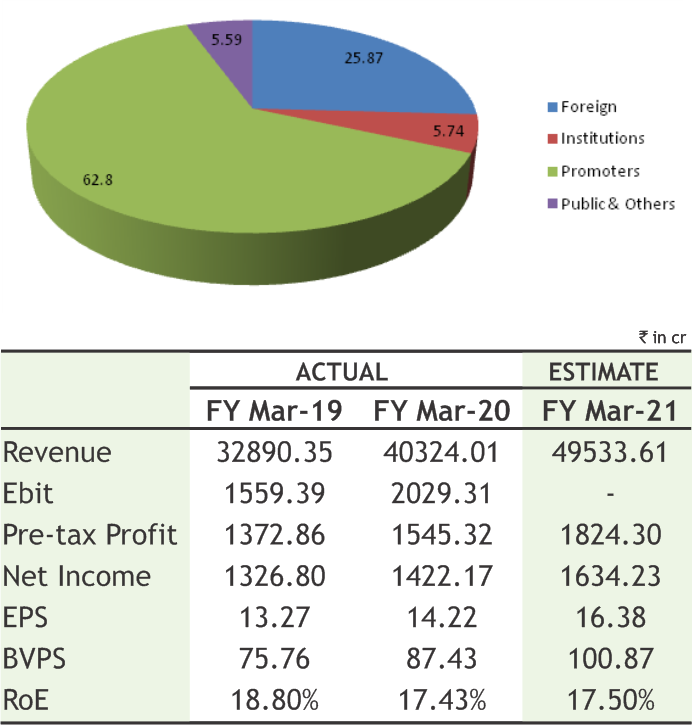

SBI LIFE INSURANCE COMPANY LIMITED

CMP: 729.90

Target Price: 842

Upside: 15%

| Face Value (Rs.) | 10.00 |

| 52 Week High/Low | 1030.00/520.00 |

| M.Cap (Rs. in Cr.) | 72992.17 |

| EPS (Rs.) | 14.22 |

| P/E Ratio (times) | 51.33 |

| P/B Ratio (times) | 8.35 |

| Stock Exchange | BSE |

Investment Rationale

• SBI Life Insurance Company is one of the leading life Insurance companies in India. The company has strong distribution network of 186,495 trained insurance professional and widespread operations with 937 offices across country.

• The Value of New Business (VoNB) eased 6% to Rs 540crore in Q4FY2020, while VoNB margins improved to 18.7% in FY2020 from 17.7% in FY2019 and 18.3% in 9MFY2020.

• Total protection new business premium has increased by 10% to Rs 640 crore in Q4FY2020 from Rs 580 crore in Q4FY2019. The share of total protection NBP (individual and group) has jumped to 16.8% in Q4FY2020 from 13.4% in Q4FY2019.

• AUM has grown by 14% to Rs 160360 crore end March 2020 from Rs 141020 crore end March 2019 with debtequity mix of 79:21. Approx. 93% of the debt investments are in AAAand Sovereign instruments.

• The company has exhibited strong 13th month persistency of 86.14% in FY2020 as compared to 85.07% in FY 2019.61st month persistency has improved to 59.90% in FY2020 as compared 57.23% in FY2019.

• The Company's net worth increased by 15% from Rs 7580crore as on 31 March 2019 to Rs 8740crore as on 31 March 2020.The solvency ratio as on 31 March 2020 was at 1.95 as against the regulatory requirement of 1.50x.

• The Company has diversified distribution network comprising of strong bancassurance channel, agency channel and others comprising of corporate agents, brokers, micro agents, common service centers, insurance marketing firms, web aggregators and direct business. NBP channel mix for FY 2020 is bancassurance channel 60%, agency channel 20%, and other channels 20%.

• The company has posted 5% growth in net premium

collection to Rs 11862.98 crore in Q4FY2020, aided by 15% growth in the renewal business to Rs 8130 crore, while new business premium declined 12% to Rs 3800 crore in Q4FY2020.

Risk

• Global slowdown of the financial market and economies

• Significant regulatory or economic developments in insurance sector

Valuation

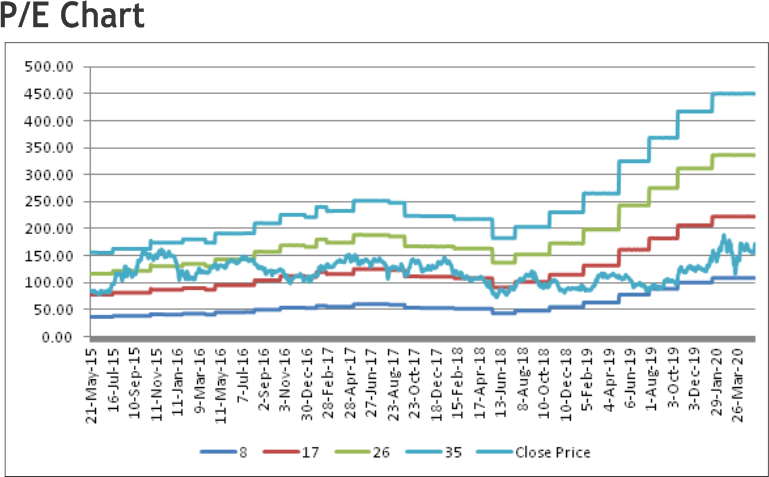

The company has maintained healthy business growth, supported by strong growth in premium collection and investment income. The management of the company expects share of protection to be in double digits in next three years on APE basis from 8% currently. While, the protection share is expected to touch 15% on NBP basis from 11%. Moreover, the company expects healthy growth in the productivity of banca channel, while aims to achieve 20% growth in banca channel. Thus, it is expected that the stock will see a price target of Rs.842 in 8 to 10 months time frame on a current P/Bvx of 8.35x and FY21 BVPS of Rs.100.87.

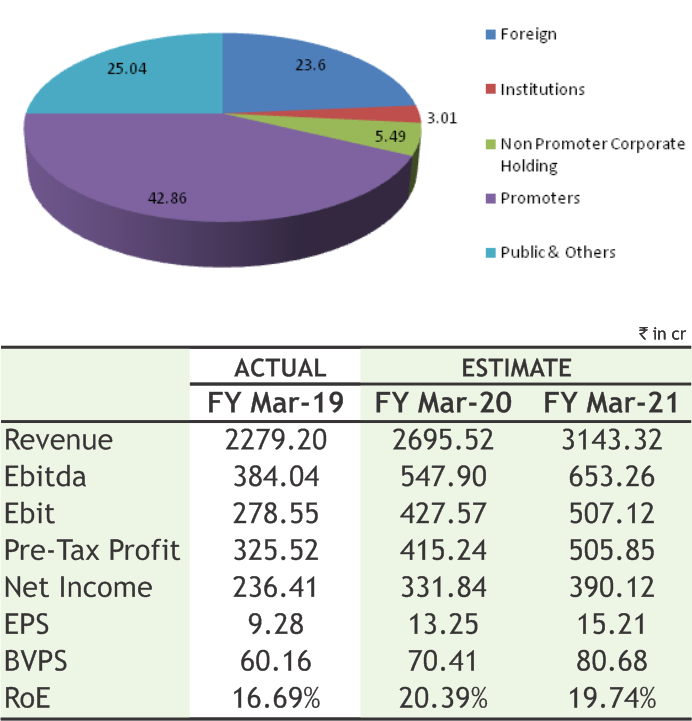

GRANULES INDIA LIMITED

CMP: 168.35

Target Price: 199

Upside: 18%

| Face Value (Rs.) | 1.00 |

| 52 Week High/Low | 188.85/84.25 |

| M.Cap (Rs. in Cr.) | 4280.26 |

| EPS (Rs.) | 12.88 |

| P/E Ratio (times) | 13.07 |

| P/B Ratio (times) | 2.52 |

| Dividend Yield (%) | 0.59 |

| Stock Exchange | BSE,NSE,MSEI |

Investment Rationale

• Granules India Limited is a pharmaceutical company with presence acros s the pharmaceutical manufacturing value chain, including active pharmaceutical ingredients (APIs), pharmaceutical formulation intermediaries (PFIs) and finished dosages (FDs). The Company's business operations include three areas: core business, emerging business, and contract research and manufacturing services (CRAMS).

• The company’s major focus would be on the bottom line which is expected to be driven by better product mix, new launches from the company, and contribution from the new facility in Vizag and Metformin facility and new Oncology facility (yet to be commercialized). The Vizag facility has been commissioned and is expected to break-even in FY21 and contributes meaningfully from FY22.

• During Q3FY20, it has reported a profit of Rs 64.03 crore up by 6.16% yoy, impacted by an impairment los s of Rs 32 crore in Granules -Biocause Pharmaceutical, which is now being sold by the company. Revenue from operations in Q3 grew 11.4 percent YoY to Rs 704 crore. For the next three years, the management of the company expects a 25% PAT CAGR.

• The company has received 3 ANDA approvals and has filed 2 ANDAs this quarter. As on December 2019, there are 19 ANDAs awaiting approvals.

• From the concall of Q3 FY20, Capex during 9M FY20 was Rs. 129 crore and the company guided to FY20 capex of Rs 150 crore. The next round of huge capacity addition would be after 3-4 years and the

company aims to maintain a debt-EBITDAratio of 1x. • The gross debt as on December 2019 stood at Rs 902 crore as compared to Rs 1,040 crore at the end of Q3FY19. The R&D spends expensed for the quarter stood at Rs 22 crore.

Risk

• PromoterPledging

• Increase in R&D spend

Valuation

The company has a healthy balance sheet with strong cash balance; it has continued same performance and reported good bottom line due to growing profitability from its joint venture companies. Moreover, the management has committed towards adhering to regulations and standards benchmarked globally and produce quality drugs for its marquee clients which are giving good strength to the company. Thus, it is expected that the stock will see a price target of Rs.199 in 8 to 10 months time frame on a current P/Ex of 13.07x and FY21 EPS of Rs.15.21.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

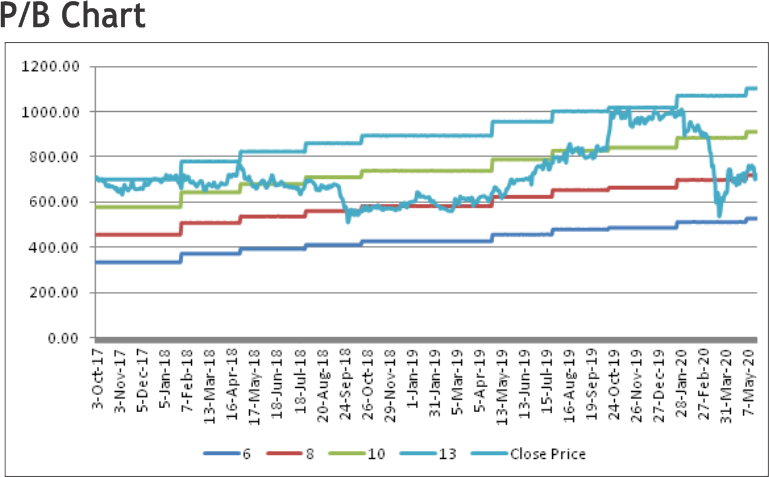

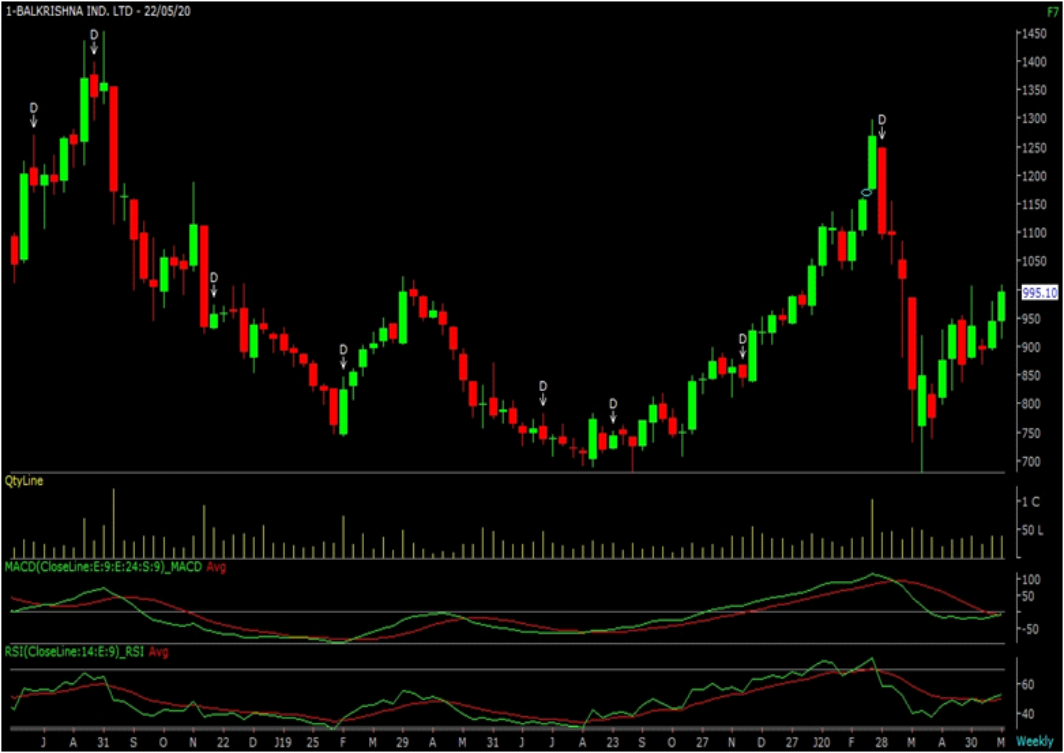

The stock closed at Rs 995.10 on 22nd May 2020. It made a 52-week low at Rs 679 on 23rd March 2020 and a 52-week high of Rs. 1297.95 on 20th February, 2020. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 929.31

The stock witnessed sharp recovery from yearly lower of 679 levels and trading in higher highs and higher lows, sort of “Rising Wedge” on weekly charts, which is bullish in nature. Last week, stock gained by over 5% and is likely to close on verge of breakout of pattern along with high volumes, buying is aggressive for the stock. Therefore, one can buy in the range of 980-985 levels for the upside target of 1070-1090 levels with SL below 920.

The stock closed at Rs 639.35 on 22nd May 2020. It made a 52-week low of Rs 355.20 on 13th March 2020 and a 52-week high of Rs. 641.85 on 22nd May, 2020. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 499.11

Short term, medium term and long term bias are looking positive for the stock as it is trading in higher highs and higher lows on broader charts. Apart from this, it was formed a “Bull Flag” pattern on weekly charts and has given the breakout of same in last week, ended over 12% gains along with huge volumes so follow up buying may continue for coming days. Therefore, one can buy in the range of 627-633 levels for the upside target of 690-700 levels with SL below 585.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

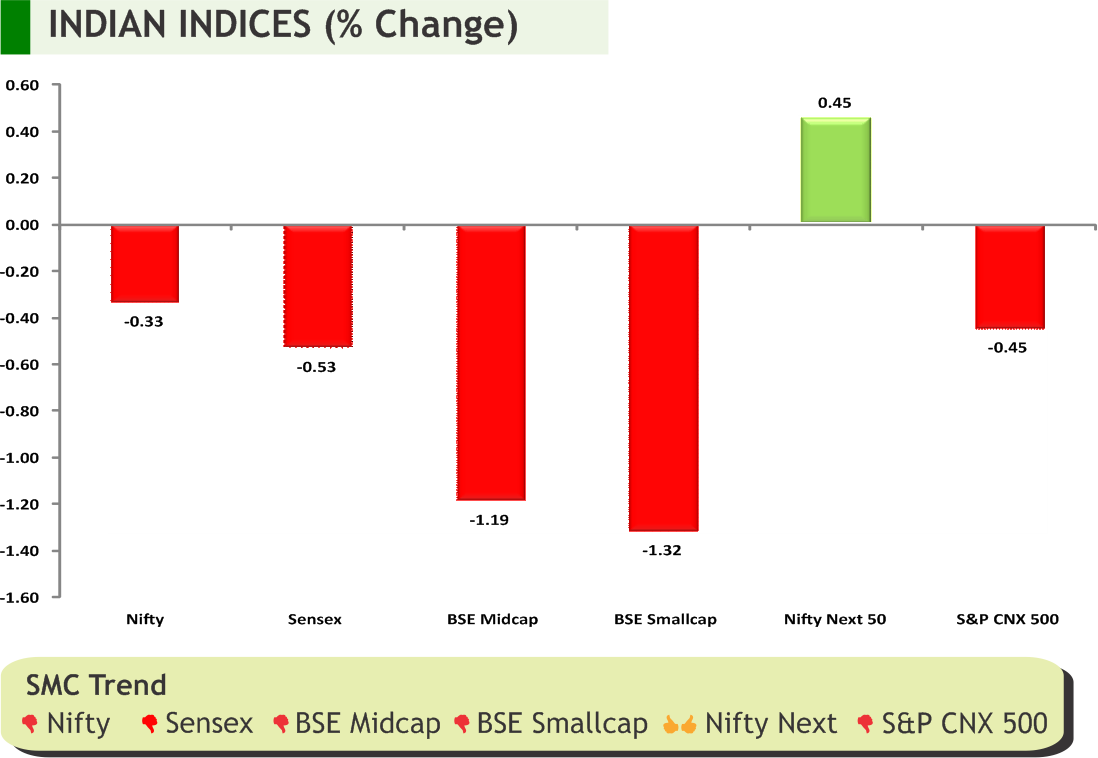

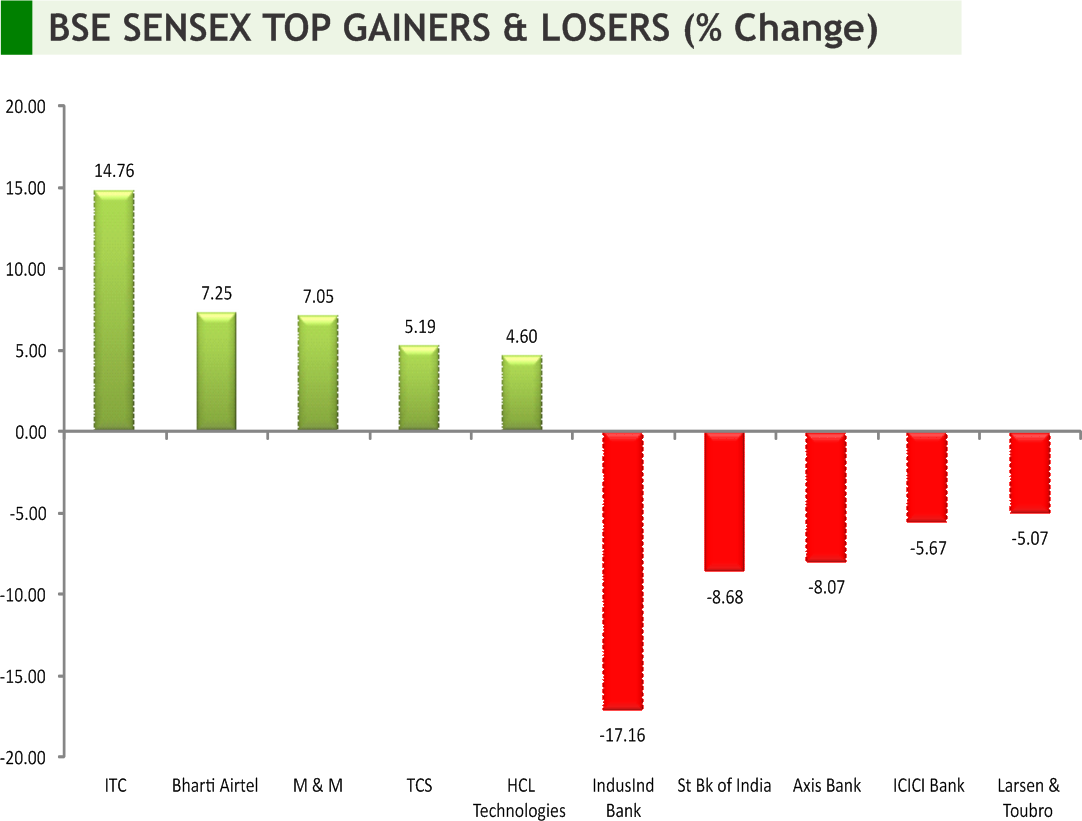

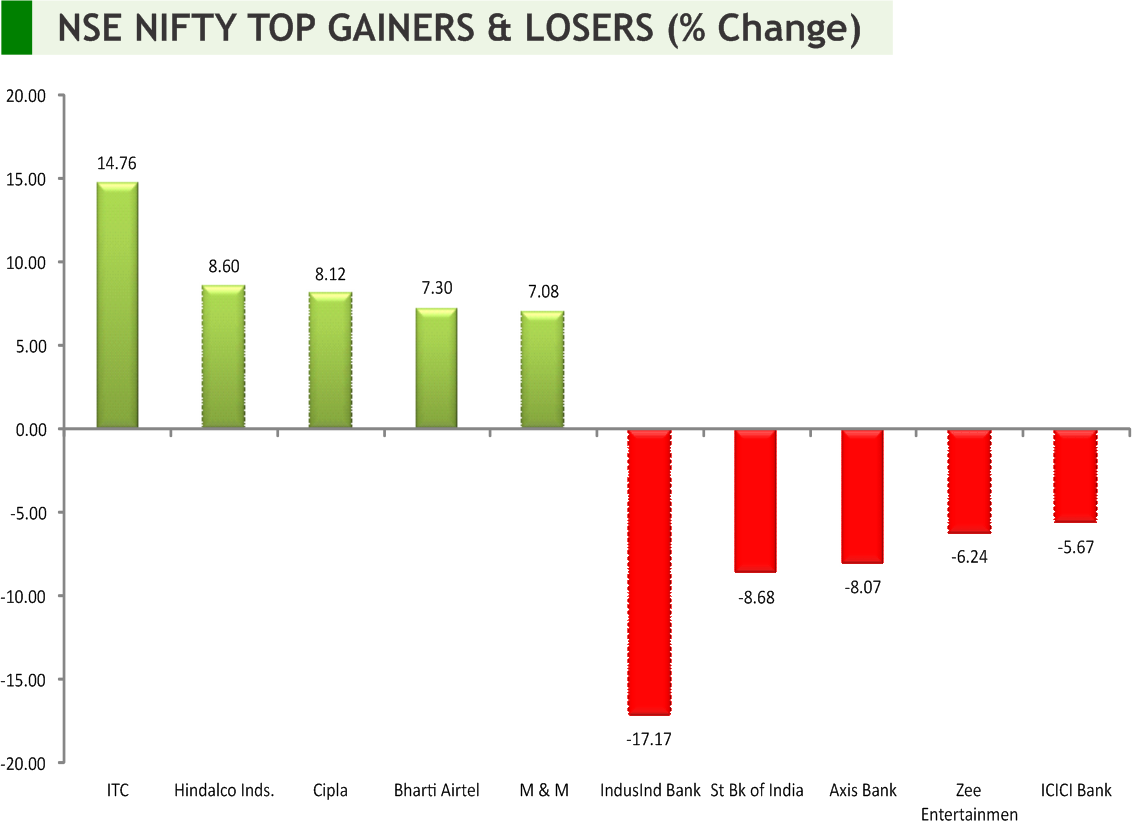

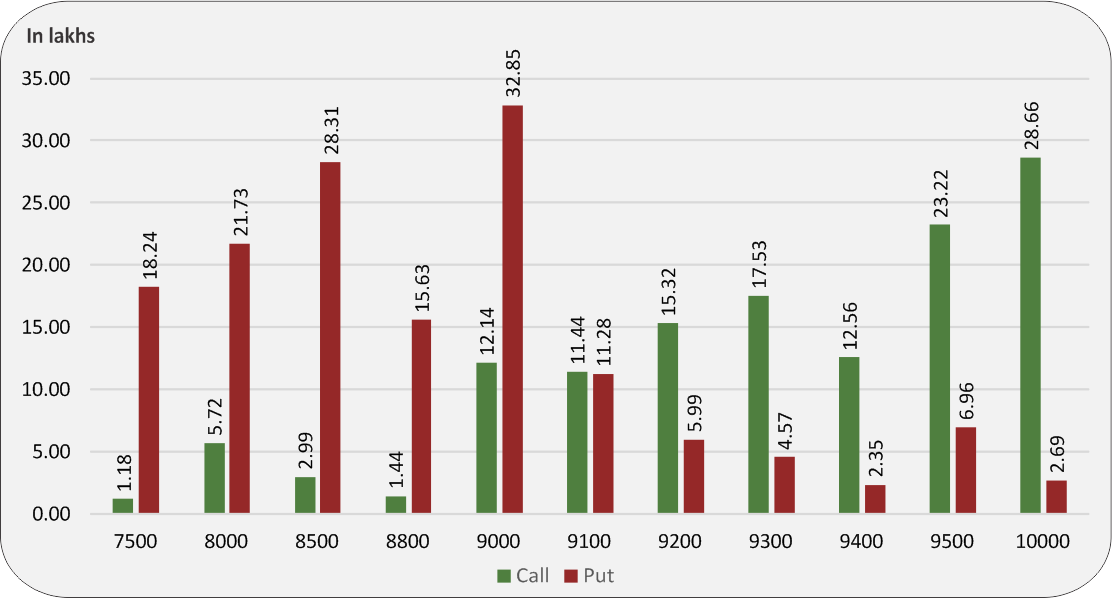

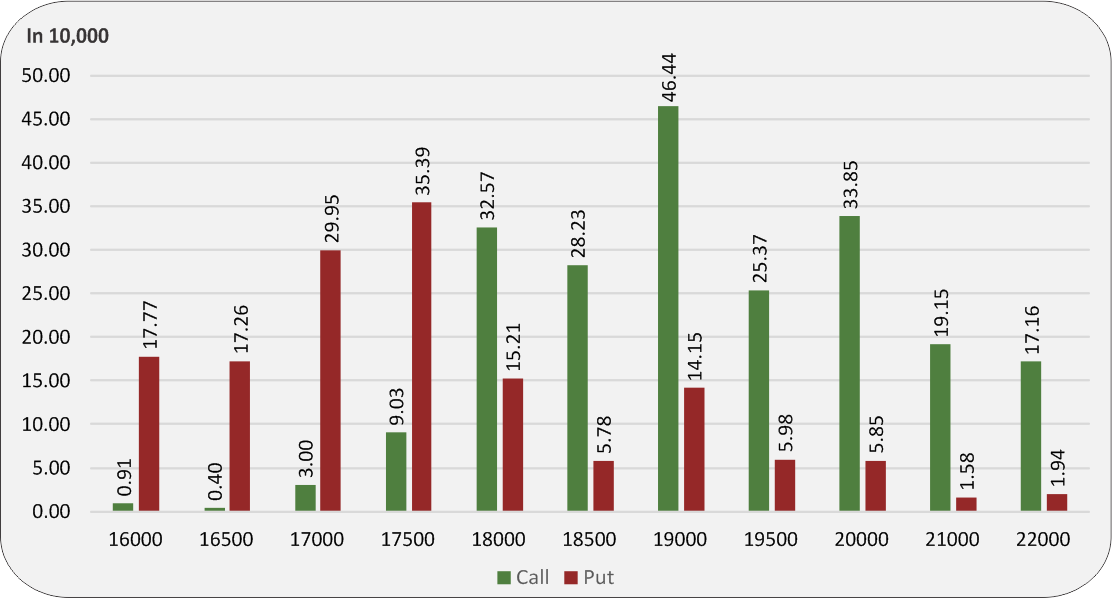

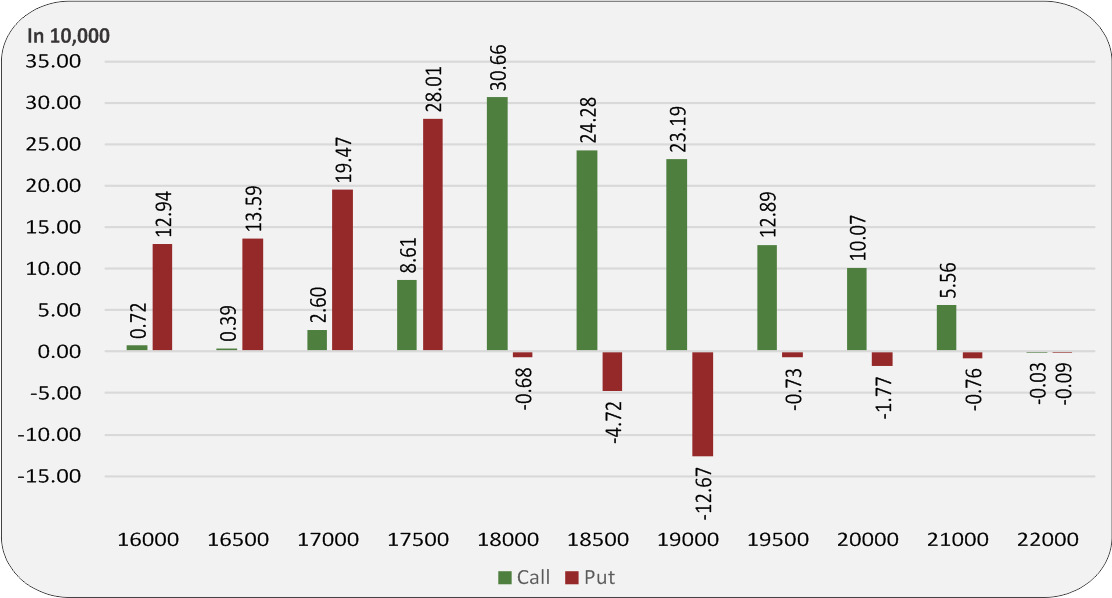

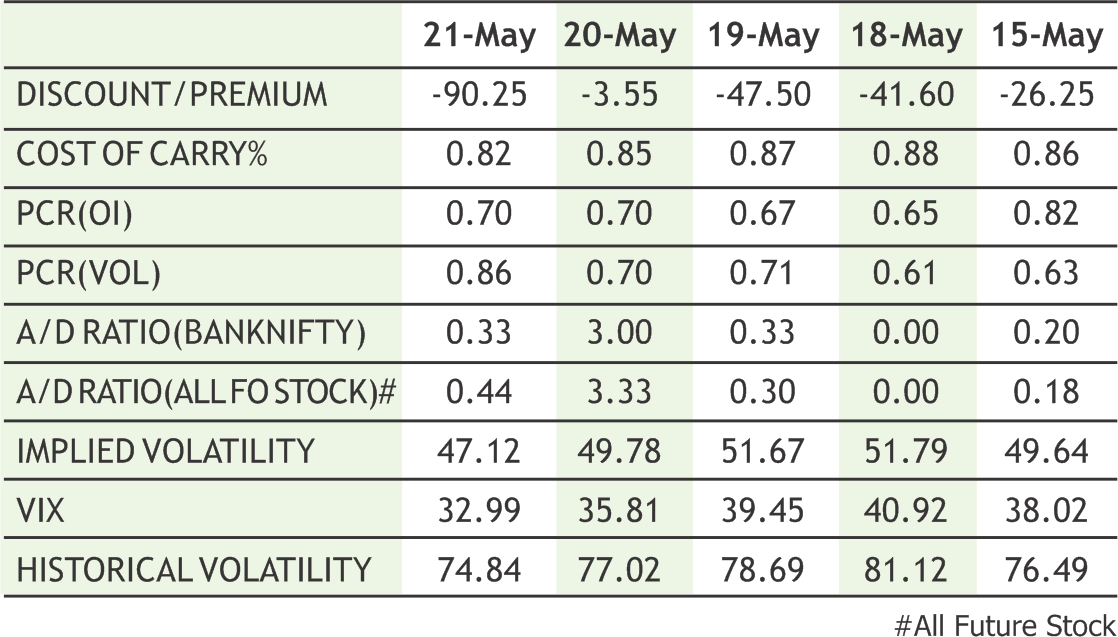

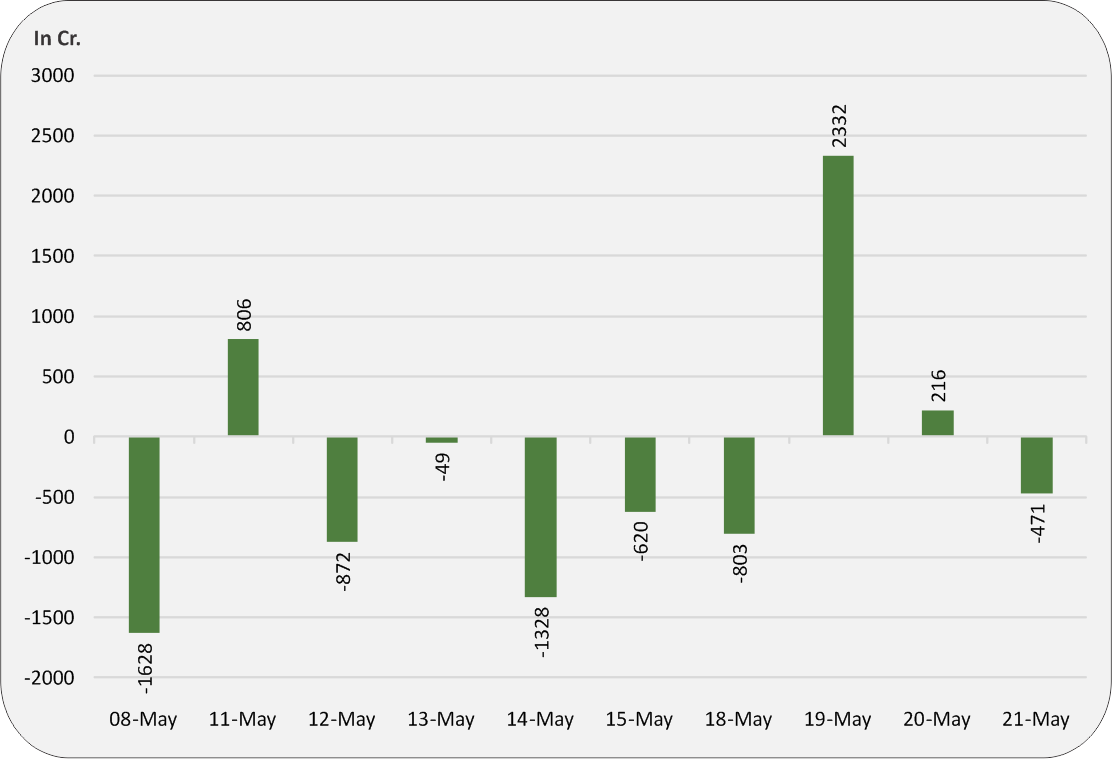

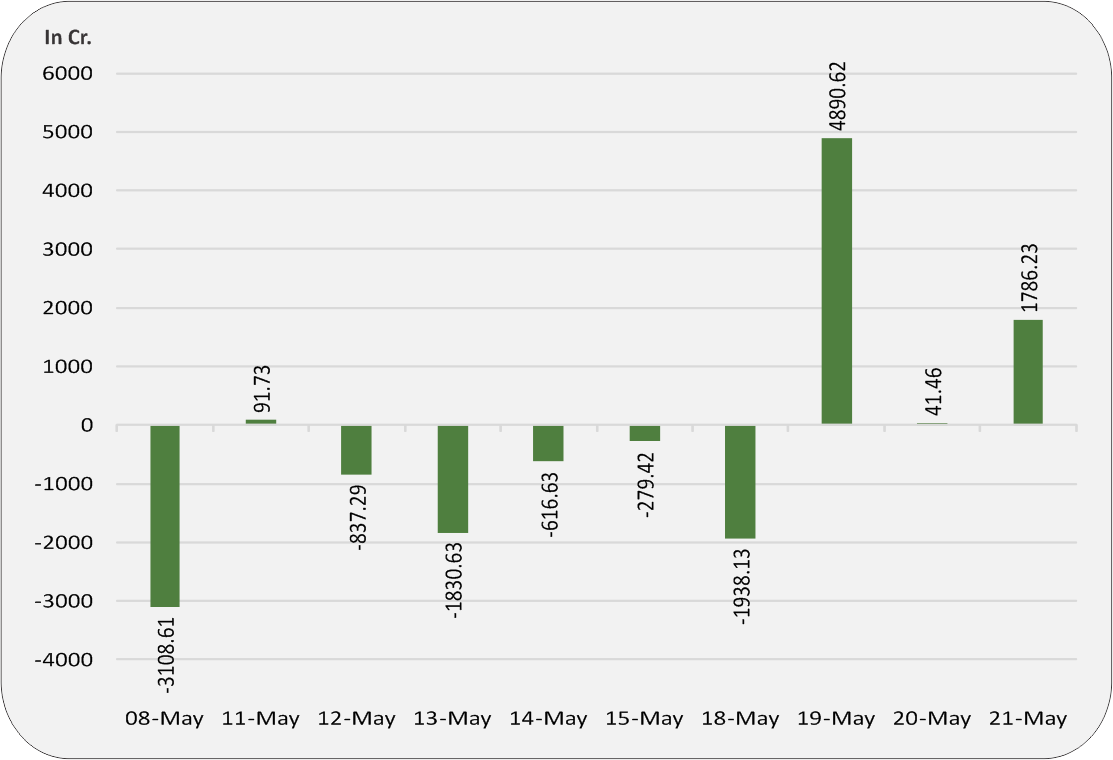

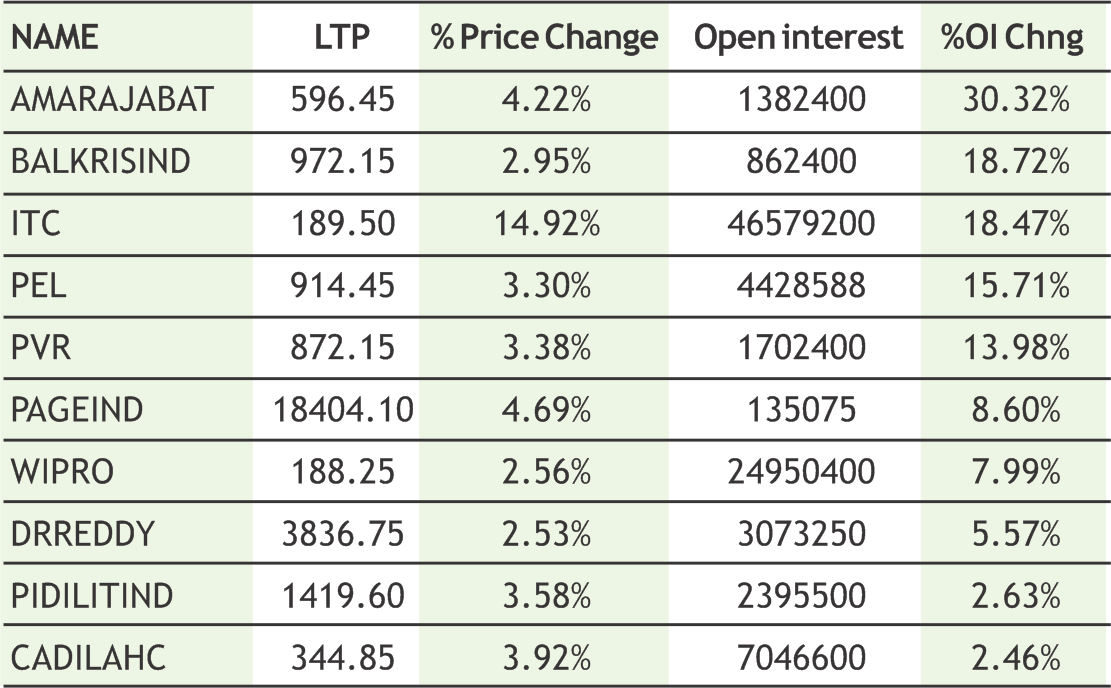

Indian markets fell for third consecutive week, majorly dragged by the financials and banking names like HDFC, ICICI Bank, Axis Bank and the Bajaj twins as market participants remained unsatisfied by the RBI despite slashing the repo rate by 40 bps to 4%. From derivative front, once again tug of war was seen among bulls and bears as call writers at 9300 strike while put writers at 9000 strike kept the index in well define range. From the technical front, 8800-9300 range would be crucial for upcoming week and move beyond this range would gauge further direction into the index. The Implied Volatility (IV) of calls closed at 29.29% while that for put options closed at 31.77%. The Nifty VIX for the week closed at 32.99% and is expected to remain volatile. PCR OI for the week closed at 1.05 down as compared to last week at 1.09 which indicates more call writing than put. At the current juncture, traders should remain focussed on stock-specific moves and are advised to trade cautiously tracking global markets as volatility is likely to grip the domestic markets in the coming few sessions as well.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

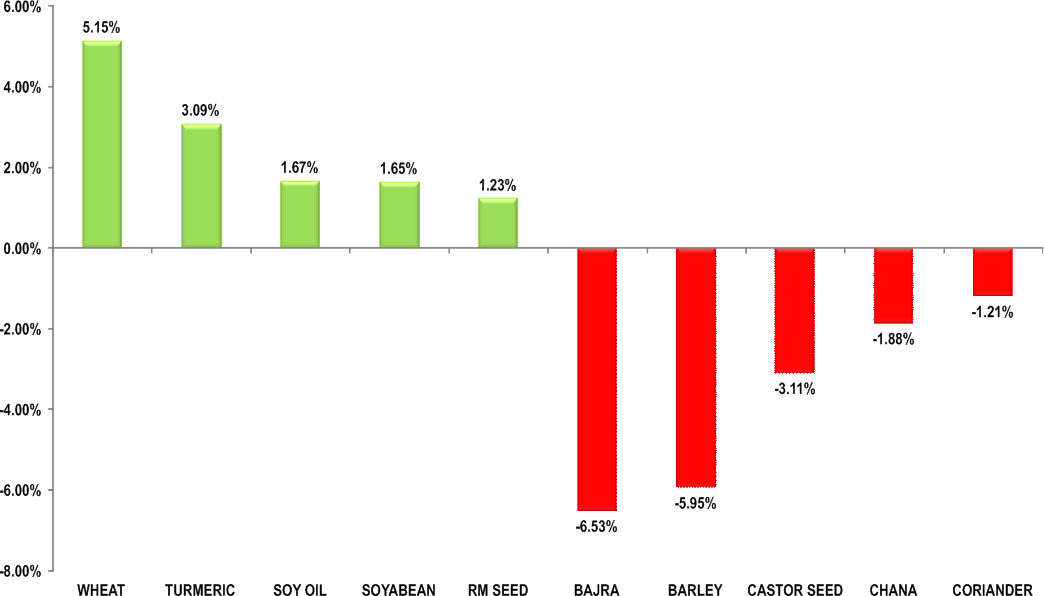

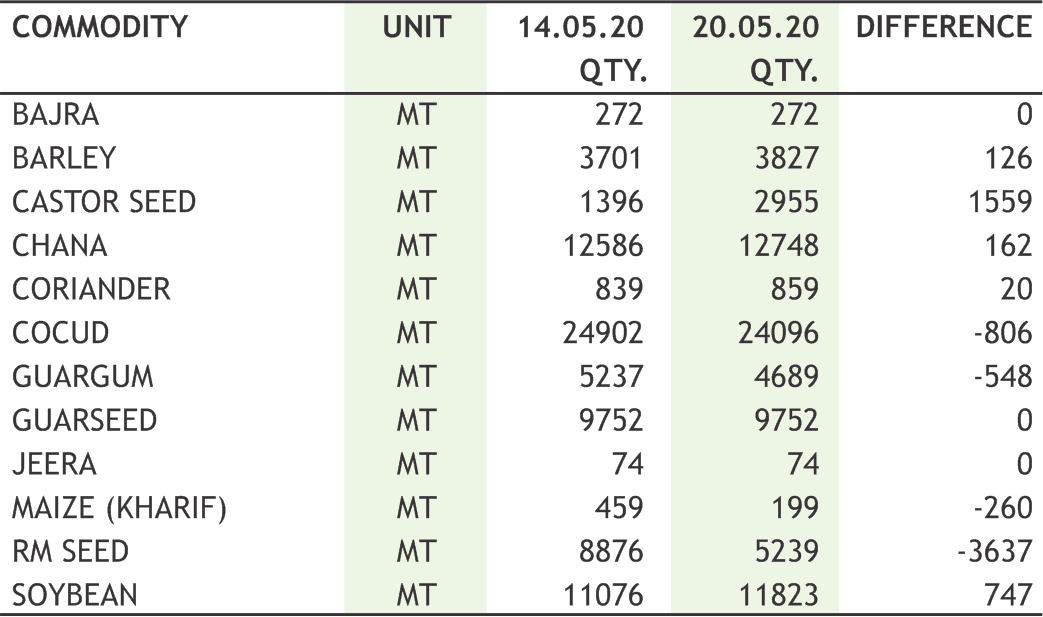

Turmeric futures (June) is expected to trade on a positive note in the range of 5200-5500 levels. On the spot, higher demand is being witnessed which is boosting turmeric sales in Erode market. At the Erode Turmeric Merchants Association Salesyard, finger turmeric was sold at Rs.5,109-6,376 a quintal and root variety at Rs.4,809-6,003. At the Erode Cooperative Marketing Society, finger turmeric was sold at Rs.5,170-6,429 and root variety at Rs.4,960-5,959. Of 749 bags kept for sale, 575 bags were sold. The State Government is facilitating transport system and goods carrier system to improve more quantity of turmeric to be sold & be procured by the traders. In the present scenario, much of the yellow spice is being purchased by the turmeric powder grinding units. Jeera futures (June) is likely to consolidate in the range of 13100-13600 levels and trade with a downside bias. The market participants would closely watch the auctions that are going to take place from this weekend in a staggered manner and accordingly take cues from the process. Just when arrivals started peaking, the yard was closed since March 22 due to the outbreak of novel coronavirus. In days to come, we may see selling pressure over the counter as the farmers would try to offload their produce & on the contrary, the off-take will be limited with major wholesale consuming sectors such as restaurants and hotels remaining closed. Dhaniya futures (June) taking support near 5500, may gain higher towards 5899 levels. The demand from bulk buyers such as spice companies increased following relaxation in some restrictions. In Ramganj, the key trading centre in Rajasthan, the badami variety was sold at 5,800 rupees per 100 kg and the eagle variety at 6,000 rupees.

Bullion counter may trade with positive bias as rising U.S.-China tensions over coronavirus and new legislation on Hong Kong and further US stimulus is assisting the prices ; Gold may test 47900 and take support near 45800. The fundamentals are still supportive for gold. Meanwhile, there was a slight improvement in the manufacturing activity in Europe and the U.S., the PMI data also was slightly better. Gold steadied as an escalation in U.S.-China tensions underpinned bullion's safe-haven appeal, although positive economic data and easing lockdowns in some countries set up the precious metal for a weekly drop. However, U.S.-China frictions dampened risk appetite, underpinning bullion and offsetting pressure on the metal's prices from the slightly better data. Beijing's plan to impose new national security legislation on Hong Kong drew a warning from U.S. President Donald Trump that Washington would react "very strongly" to the legislation. Tension between the two countries has also heightened in recent weeks, as they exchange accusations on the handling of the coronavirus pandemic. U.S. economic data is likely to become grimmer as the effects of the pandemic become clearer, and it is difficult to know what the recovery could look like, New York Federal Reserve Bank President John Williams said. Silver may trade with mixed trend where it may take support near 44200 whereas may face resistance near 48290. The lower-for-longer interest rates with quantitative easing in full swing, macro and geopolitical uncertainty and strong investor flows should continue to support gold prices on a longer horizon. On Comex Gold may take support near $1685 whereas on upside it may face resistance near $1760. Also Silver on Comex may trade in range of $16-$18.

Soybean futures (June) is expected to witness correction towards 3650 facing resistance near 3820 levels. The counter is taking negative cues from the international market amid growing concerns that the U.S. government's rhetoric about China's response to the coronavirus pandemic will dampen Chinese demand for U.S. supplies. U.S.-China tensions have spiked in recent weeks, with Pompeo and President Donald Trump slamming Beijing's handling of the outbreak. Mustard futures (June) is witnessing a bull run, and this uptrend is likely to continue till 4400-4450. But, before taking fresh long positions we would advice to wait for some correction as the fundamentals of demand & supply are in tug-of-war. On demand side, it is estimated that India's exports of mustard meal are expected to halve in 2020-21 (Apr-Mar) from 961,312 tn exported last year due to waning demand from traditional buyers amid the COVID-19 pandemic. Demand for the Indian-origin meal in the global market has also softened because of lower buying from the livestock sector. However, the downside may get restricted & take support near 4250 as the supply is lower than expected supply of fresh crop in spot markets due to restrictions to curb the spread of coronavirus in the country. Soy oil futures (June) may consolidate in the range of 760-785 with upside getting capped. In the international market, the upside movement of soy oil on CBOT is getting limited as the demand has shifted to palm oil. CPO futures (May) is looking bullish towards 610-615 levels. Recently, India & Malaysia have signed deal to come back into business of palm oil & Malaysian government expects this positive development to strengthen palm oil prices in the market.

Crude oil prices may trade on strong note. Crude oil surged to its highest level since March’2020 supported by various factors including demand recovery after government easing the restrictions imposed due to COVID-19. After witnessing profit booking from higher level crude may again rebound and may test 2750 whereas may take support near 2290. Crude prices have slumped in 2020, with Brent hitting a 21-year low below $16 a barrel in April as demand collapsed. With fuel uses are rising and more signs that the supply glut is being tackled. Global supply has been curtailed to a great degree and we are on a clear path to a gradual recovery now. So far in May, OPEC+ has cut oil exports by about 6 million bpd, according to companies that track the flows, suggesting a strong start in complying with the deal. Qatar Petroleum will slash its spending by around 30% this year in the face of the sharp drop in oil and gas prices due to the coronavirus epidemic. Natural gas may continue to trade in wider range 120-140. Producers were operating the fewest oil and natural gas drilling rigs on record in the United States at 339 on May 12, the lowest level in the Baker Hughes Company’s rig count data series that dates back to 1987. The decrease in natural gas prices has been over a longer period than oil prices; natural gas prices were already at multi-year lows in early 2020. The weather is expected to be warmer than normal over the next 2- weeks in US, but there is little impact on natural gas demand.

Cotton futures (June) facing resistance near 16220, can witness correction towards 15000-14800 levels. There are several bearish factors that may lend negative cues to the fbre prices. Firstly, there is over 15% unsold cotton stock and acute lack of demand. The procurement agencies and private ginners have slowed down their purchases because of the huge price depreciation and extended lockdowns. Secondly, sowing has already started in some north Indian states and farmers are seen shifting from paddy to other competing crops, mainly cotton, due to shortage of labour and also because of higher returns. Average yield is expected to rise to 491 kg per ha from 480 kg last year, said US Department of Agriculture in a report. In days to come, more correction can be seen in chana futures (June) as it can descend towards 4000, hence sell on rise is recommended in this counter near the resistance of 4150. The peak arrival of good quality moong is on the way & is expected to peak till end of this month & this is likely to add selling pressure. Moreover, summer crop sowing well on track, impressive increase in area under pulses. About 10.35 lakh ha area coverage under pulses as compared to 5.92 lakh ha. during the corresponding period of last year. Mentha oil futures (June) will possibly go down further to test 1140-1120 levels. The oil from new mentha crop has started arriving at the key wholesale market of Barabanki in Uttar Pradesh, being harvested in Bareilly, Sitapur and Konch districts. Production is seen at a record high of 55,000-60,000 tn this year, up nearly 50% as it was more profitable than other crops such as bajra, urad or maize.

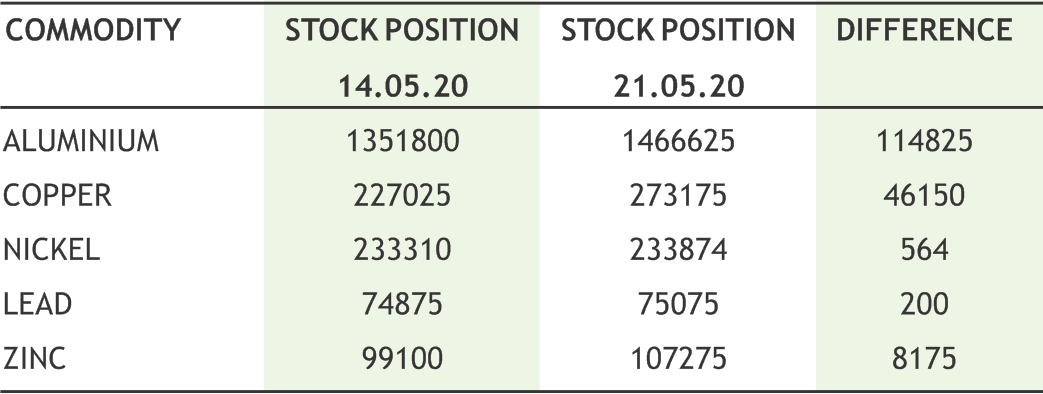

Base metals may trade with positive bias. Chinese Premier Li Keqiang is expected to unveil stimulus measures when the National People's Congress starts on Friday to spur its economy. Meanwhile, the general manager of stateowned metals group Chinalco is calling on China to rein in "blind expansion" of copper smelting capacity Smelters in China. Copper may test 416 while taking support near 390. But the prices may lower as mounting Sino-U.S. tensions and concerns about a rebound from the coronavirus-led economic slump may curb risk appetite and demand for metals. Tensions may stoke worries that a U.S.- China “Phase 1” trade deal could be threatened. Zinc may recover towards 160 levels by taking support near 145 levels while Lead may face resistance near 138 levels while taking support near 128 levels. The lead market recorded a surplus of 19,000 tonnes in the three months to March this year after an oversupply of 13,000 tonnes in the same period in 2019, according to the ILZSG. Nickel may witness recovery towards 960 levels while taking support near 900 levels. Rising demand in the spot market from alloy makers mainly are supporting the prices. China’s nickel ore imports dropped 70% YoY in April as mining operations and shipments from the top supplier—the Philippines—were suspended to stem the spread of the COVID-19 pandemic. Aluminum also may remain in narrow range of 129-135 levels. The huge costs involved in suspending and restarting aluminum smelters have mostly prevented any significant supply cuts. As per WBMS, world primary aluminium surplus came in at 709,000 mt vs 761,000 mt, a key factor holding back any recovery in prices.

10

|

CRUDE OIL MCX (JUNE) contract closed at Rs. 2563 on 21st May’2020. The contract made its high of Rs. 3620 on 28th Feb’2020 and a low of Rs.1361 on 22nd Apr’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs.2062.27 On the daily chart, the commodity has Relative Strength Index (14-day) value of 61.41.

One can buy around Rs. 2250 for a target of Rs.2650 with the stop loss of Rs. 2100.

RMSEED NCDEX (JUNE) contract closed at Rs. 4340 on 21st May’2020. The contract made its high of Rs. 4355 on 21st May’2020 and a low of Rs. 3820 on 13th Mar’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 4238.93 on the daily chart, the commodity has Relative Strength Index (14-day) value of 62.89.

One can buy around Rs.4250 for a target of Rs. 4500 with the stop loss of Rs. 4130.

ALUMINIUM MCX (MAY) contract was closed at Rs. 130.20 on 21st May’2020. The contract made its high of Rs. 145.40 on 20th Jan 2020 and a low of Rs. 128.30 on 20th Mar’2020. The 18-day Exponential MovingAverage ofthe commodity is currently at Rs. 130.76 on the daily chart,the commodity has Relative Strength Index (14-day) value of 39.74.

One can sell at Rs. 130.50 for a target of Rs.124 with the stop loss of Rs 133.

11

Ÿ China has set 2020 budget deficit target of at least 3.6% of GDP

Ÿ The expected onset of southwest monsoon 2020 over Kerala on May 28 – Skymet

Ÿ The Fed’s latest policy meeting minutes reinforced its promise to hold U.S. interest rates at near zero and to continue providing the economy with cheap money until it was clear of Covid-19

Ÿ The NCDEX AGRIDEX Futures contract expiring in the months of June 2020, July 2020, September 2020 and December 2020 would be available for trading w.e.f. May 26, 2020.

Ÿ The global zinc market surplus declined to 47,300 tonnes in March from a revised surplus of 140,500 tonnes in February, data from the International Lead and Zinc Study Group (ILZSG) showed.

Ÿ China’s nickel ore imports dropped 70% YoY in April as mining operations and shipments from the top supplier—the Philippines—were suspended to stem the spread of the COVID-19 pandemic.

Ÿ China’s refined copper output in April rose 9.2% compared to a year earlier and was 6.2% higher than the previous month.

Ÿ So far in May, OPEC+ has cut oil exports by about 6 million bpd, according to companies that track the flows, suggesting a strong start in complying with the deal.

The week gone by was all about the magical upside in crude prices amid some profit booking in bullions from higher levels. Industrial metals too caught the attention with its further rise. In agri, new trade equations with Malaysia influenced the prices. More import from Malaysia after a brief ban on CPO import, propped up CPO futures, even in India. Gap between CPO and Refined Soya minimized. Malaysia agreed to import rice and sugar from India. Back to crude, it saw a massive jump of more than 20% and it seems that market was fully ready not to send this counter in negative territory once more in May expiry. WTI rose for a sixth day past $34 a barrel, the longest streak for the front-month contract since February 2019. Additional cut by US and other countries apart from OPEC + amid some renewed demand gave upsurge to the prices. China’s oil demand rises back to pre-pandemic levels. China’s oil demand is thought to have rebounded to about 13 mb/d, just shy of the 13.4 mb/d level seen before the initial lockdown. Meanwhile, China’s air quality is now worse than it was before the pandemic. The U.S. and Canada have lost somewhere between 3.5 and 4.5 mb/d. U.S. shale production will decline by 197,000 bpd June, compared to May. Natural gas was mostly in range. Average gas output in the U.S. Lower 48 states fell to 89.5B cf/day so far in May. Global demand for natural gas will decline by nearly 2% this year, as commercial and industrial activity is reduced due to coronavirus lockdowns. Base metals saw some upsurge on ease of lockdown news, nevertheless the upside was capped as COVID 19 positive cases crossed 50 lack. It is hampering the labor supply and transportations. Buyers are also inactive so far. Gold prices were on course for their first close over $1,750 an ounce since 2012 on Wednesday, supported by hopes of further monetary policy loosening around the world that continues to channel money out of bonds and into bullion. Silver again outperformed, rising above $18 an ounce for the first time since late February.

It was a good week for spices, apart from oil seeds and edible oils futures. Turmeric and coriander saw good upside on improved offtake in spot market. It is reported that the AMPC of Unjha, will resume auction of the spice seeds from this weekend in a staggered manner. Soyabean was in range. The reason being is that this kharif season has brightened the prospects for soybean cultivation starting next month. Mustard performed better as demand for mustard at this time is good from millers. Mentha prices were down. This season, the acreage of menthe in the major grown state of Uttar Pradesh has totaled to 200,000 hectares.

|

|

12

|

|

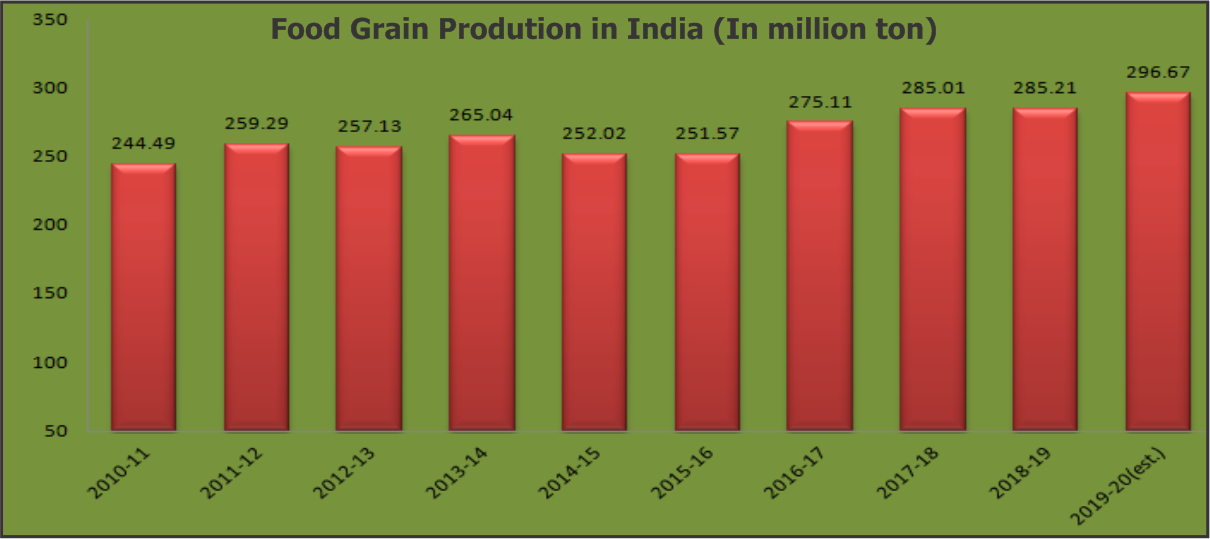

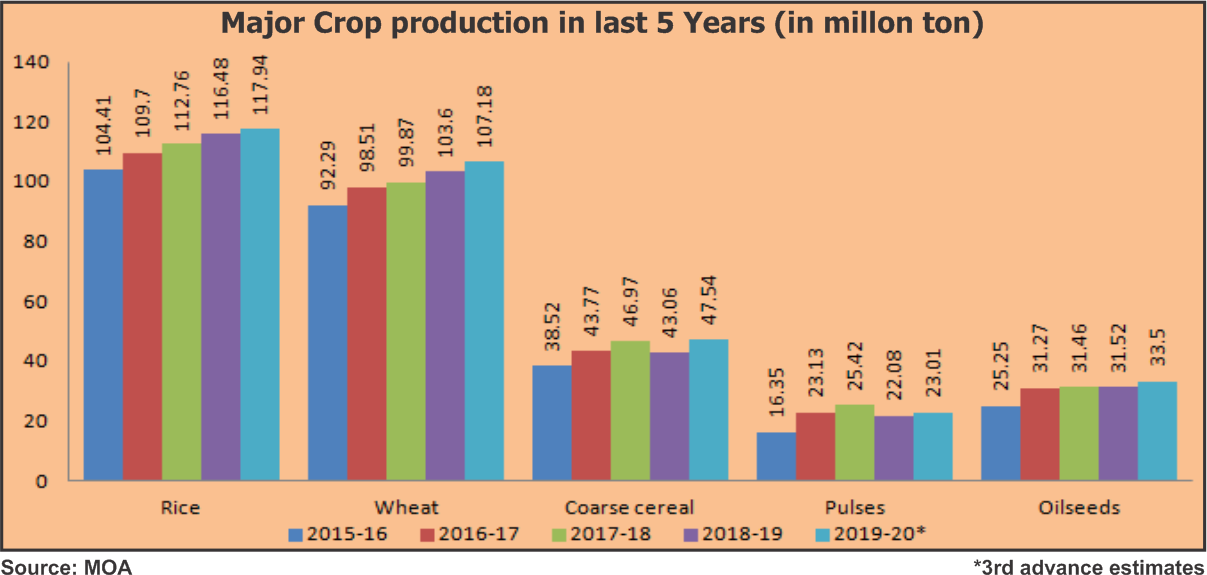

The 3rd Advance Estimates of production of major crops for 2019-20 have been released by the Department of Agriculture, Cooperation and Farmers Welfare May 15, 2020. As per Third Advance Estimates for 2019-20, total Foodgrain production in the country is estimated at record 295.67 million tonnes which is higher by 10.46 million tonnes than the production offoodgrain of 285.21 million tonnes achieved during 2018- 19. However, the production during 2019-20 is higher by 25.89 million tonnes than the previous five years’(2014-15 to 2018-19) average production offoodgrain.

• Total production of Rice during 2019-20 is higher by 8.17 million tonnes than the five years’average production of 109.77 million tonnes.

• Production of Wheat during 2019-20 is higher by 11.02 million tonnes than the five years average wheat production of 96.16 million tonnes.

• Production of Nutri / Coarse Cereals is higher by 4.50 million tonnes than the five

• Total Pulses production during 2019-20 is higher by 2.19 million tonnes than the Five years’ average production of 20.82 million tonnes.

• Total Oilseeds production in the country during 2019-20 is higher by 4.10 million tonnes than the five years average oilseeds production.

• Total production of Sugarcane in the country during 2019-20 is estimated at 358.14 million tonnes.

• Production of Cotton is estimated at record 36.05 million bales (of 170 kg each) is higher by 8.01 million bales than the production of 28.04 million bales during 2018- 19. Production of Jute & Mesta is estimated at 9.92 million bales (of 180 kg each).

The record production spells good for farmers, government and for better economic growth, during ongoing coronavirus pandemic. The Department of Agriculture, Cooperation and Farmers Welfare, Government of India is taking several measures to facilitate the farmers and farming activities at field level during the lockdown period in the wake of Covid 19 pandemic. Government of India has been making concerted efforts to facilitate farmers in direct marketing and assure better returns. By advising to maintain social distancing in the mandis to prevent the spread of Corona Virus the States have been requested to promote the concept of ‘Direct marketing’ to facilitate farmers/ group of farmers/FPOs/Cooperatives in selling their produce to bulk buyers/big retailers/processors etc.

13

|

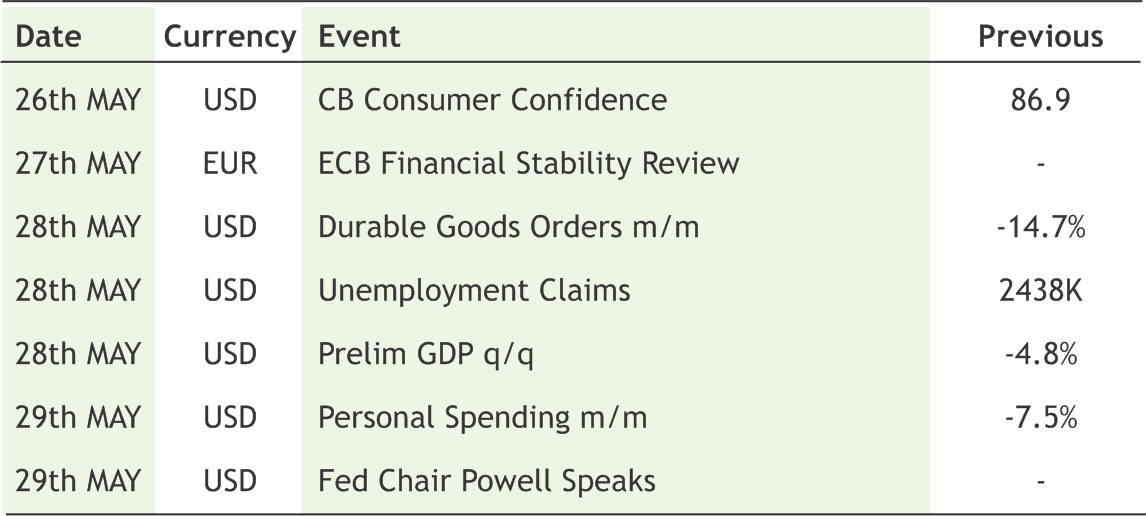

| 18th MAY | IMF chief warned full global economic recovery unlikely in 2021 |

| 19th MAY | UK Jobless Rate Unexpectedly Fell to 3.9% |

| 19th MAY | UK Productivity fell the Most since 1974 |

| 19th MAY | Bank of England not ruling out negative rates in future - Tenreyro |

| 19th MAY | Three quarters of Singapore economy will resume operations from June 2 - government |

| 21th MAY | Japan exports fell most since 2009 as pandemic wipes out global demand |

| 22th MAY | India Unexpectedly slashed repo rate to 4% |

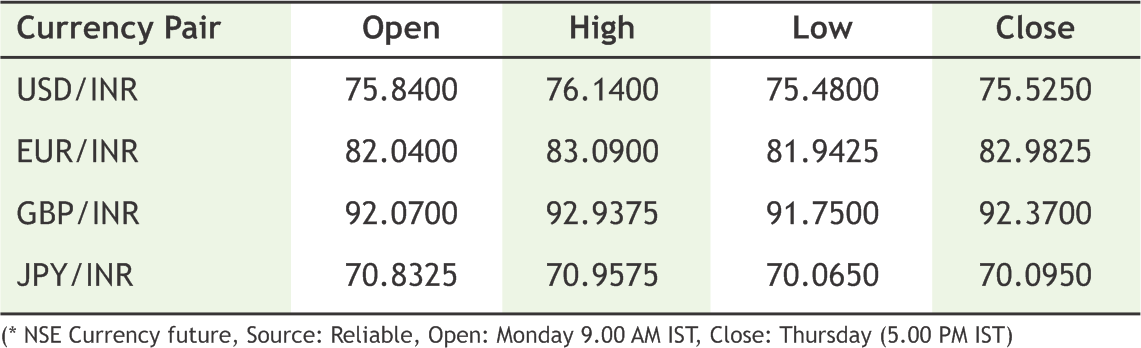

Indian rupee recorded another week of marginal move amid lack of fresh trigger from global markets. Dollar flows into Indian businesses notably PE funds hit the markets prompted traders to trim long positions in dollar against rupee mark. However, strong intervention to bid dollar by RBI at lower level warrant the outright fall in USD/INR pair. Admittedly the domestic Industrial output has slumped & other timely survey highlights the severity of the economic fallout and any recovery post lock-down which has been extended till 31st May will be very slow. We are maintaining our bearish view in rupee in coming week. Meanwhile euro rallied after optimism creates for the fiscal package announced of €500 billion by both Germany & France is a welcome move towards fiscal union. However, the benefit to other members especially Italy which is the most affected during on-going pandemic crisis would be little more than roughly 2-3% of Italian GDP over a period of one year. We will get the entire details of fiscal roadmap on 27th May (Thursday) that which member’s countries are in and who is opposing. Apparently it is a complicated process and any hint for the failure of interest amongst euro zone members will push euro to fall further. Going forward next week how US-China trade war flare up and further implementation of fiscal roadmap in euro zone will guide the forex move.

|

USD/INR (MAY) contract closed at 75.5250 on 21-May-2020. The contract made its high of 76.1400 on 18-May-2020 and a low of 75.4800 on 21-May-2020 (Weekly Basis). The 21-day Exponential MovingAverage oftheUSD/INR is currently at 75.87

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 49.24. One can buy @ 75.50 for the target of 76.50 with the stop loss of 74.99.

EUR/INR (MAY) contract closed at 82.9825 on 21-May-2020. The contract made its high of 83.0900 on 21-May-2020 and a low of 81.9425 on 18-May-2020 (Weekly Basis).The 21-day Exponential Moving Average of the EUR/INR is currently at 82.53

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 52.51. One can buy at 82.60 for a target of 83.30 with the stop loss of 82.10.

GBP/INR (MAY) contract closed at 92.3700 on 21-May-2020. The contract made its high of 92.9375 on 20-May-2020 and a low of 91.7500 on 18-May-2020 (Weekly Basis). The 21-day Exponential MovingAverage oftheGBP/INR is currently at 93.28.

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 41.18. One can sell at 92.65 for a target of 91.75 with the stop loss of 93.15.

JPY/INR (MAY) contract closed at 70.0950 on 21-May-2020. The contract made its high of 70.9575 on 18-May-2020 and a low of 70.0650 on 21 May-2020 (Weekly Basis). The 21-day Exponential MovingAverage ofthe JPY/INR is currently at 70.64

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 49.1. One can buy at 70.00 for a target of 71.00 with the stop loss of 69.50.

14

|

15

|

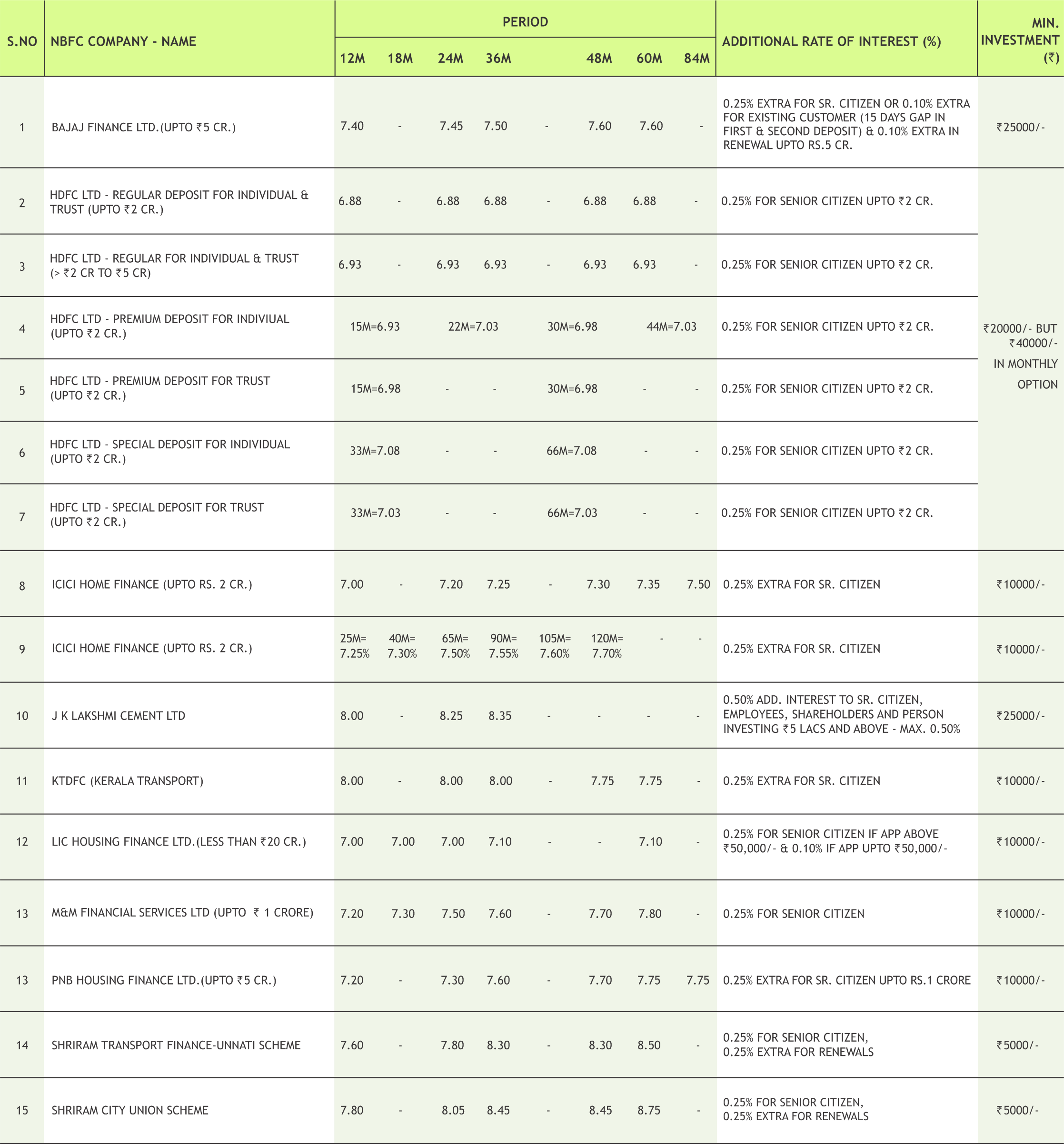

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

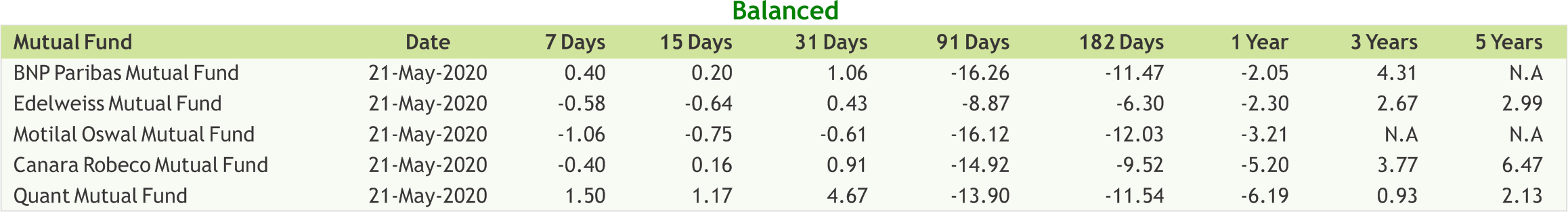

Aditya Birla SLbars fresh inflows in two debt funds; but no restrictions on redemptions

Aditya Birla Sun Life Mutual Fund has temporarily suspended fresh subscriptions and switch-in applications in Aditya Birla Sun Life Medium Term Plan (ABMTP) and Aditya Birla Sun Life Credit Risk Fund (ACRF). The fund house has suspended new investments in these schemes from May 22, 2020. Redemptions from these funds, though, will be allowed, as usual.

SEBI allows listing of mutual fund units of schemes in process of winding up

The Securities and Exchange Board of India has allowed listing of mutual fund units of the schemes that are in the process of winding up on the stock exchanges with immediate effect. This move will allow Franklin Templeton Mutual Fund to list their units for those investors who wish to exit. On April 23, Franklin Templeton Mutual Fund had said it would wind up six schemes - Franklin India Low Duration Fund, Franklin India Dynamic Accrual Fund, Franklin India Credit Risk Fund, Franklin India Short Term Income Plan, Franklin India Ultra Short Bond Fund and Franklin India Income Opportunities Fund - citing severe illiquidity and redemption pressures caused by the COVID-19 pandemic.

SEBI allows mutual funds to invest additional 15% AUM in G-Sec, T-bills

The Association of Mutual Funds in India (AMFI) has written to the Securities and Exchange Board of India (SEBI) seeking investment in G-Sec, T-bills for Corporate Bond Fund, Banking & PSU Fund, and Credit Risk Fund. Responding to AMFI, SEBI has said mutual funds can invest additional 15 percent of AUM in G-Secs & T-Bills in corporate bond, banking & PSU and credit risk funds. G-Secs & T-Bills are considered to be safer and most liquid form of instrument. The regulator has said that such additional investment in G-secs or T-Bills is optional for asset management companies. SEBI aims to make the portfolio of these three category of funds liquid given that the fund houses witnessed tremendous redemption pressure particularly after Franklin Templeton Mutual Fund shut its six schemes creating panic.

|

|

|

|

17

|

|

|

|

|

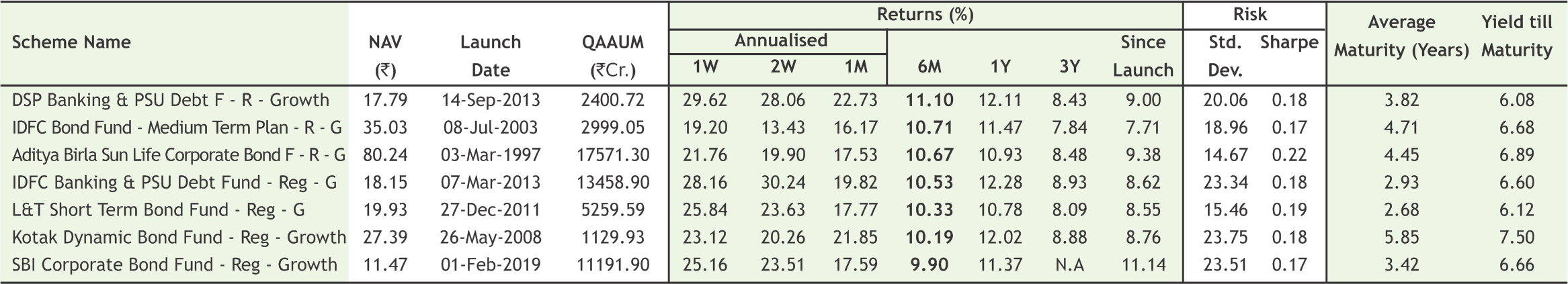

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

18

![]() Comprehensive Investment Solutions

Comprehensive Investment Solutions

![]() Goal Based Investment Advise

Goal Based Investment Advise

![]() Lower Risk by Diversifying Portfolio

Lower Risk by Diversifying Portfolio

![]() Long-term Focus

Long-term Focus

Call Toll-Free 180011 0909

Visit www.smcindiaonline.com

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in