2020 : Issue 720, Week : 27th - 31st January

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2020 : Issue 720, Week : 27th - 31st January

A Weekly Update from SMC (For private circulation only)

NEY

NEY

www.smcindiaonline.com

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

| IPO | 15 |

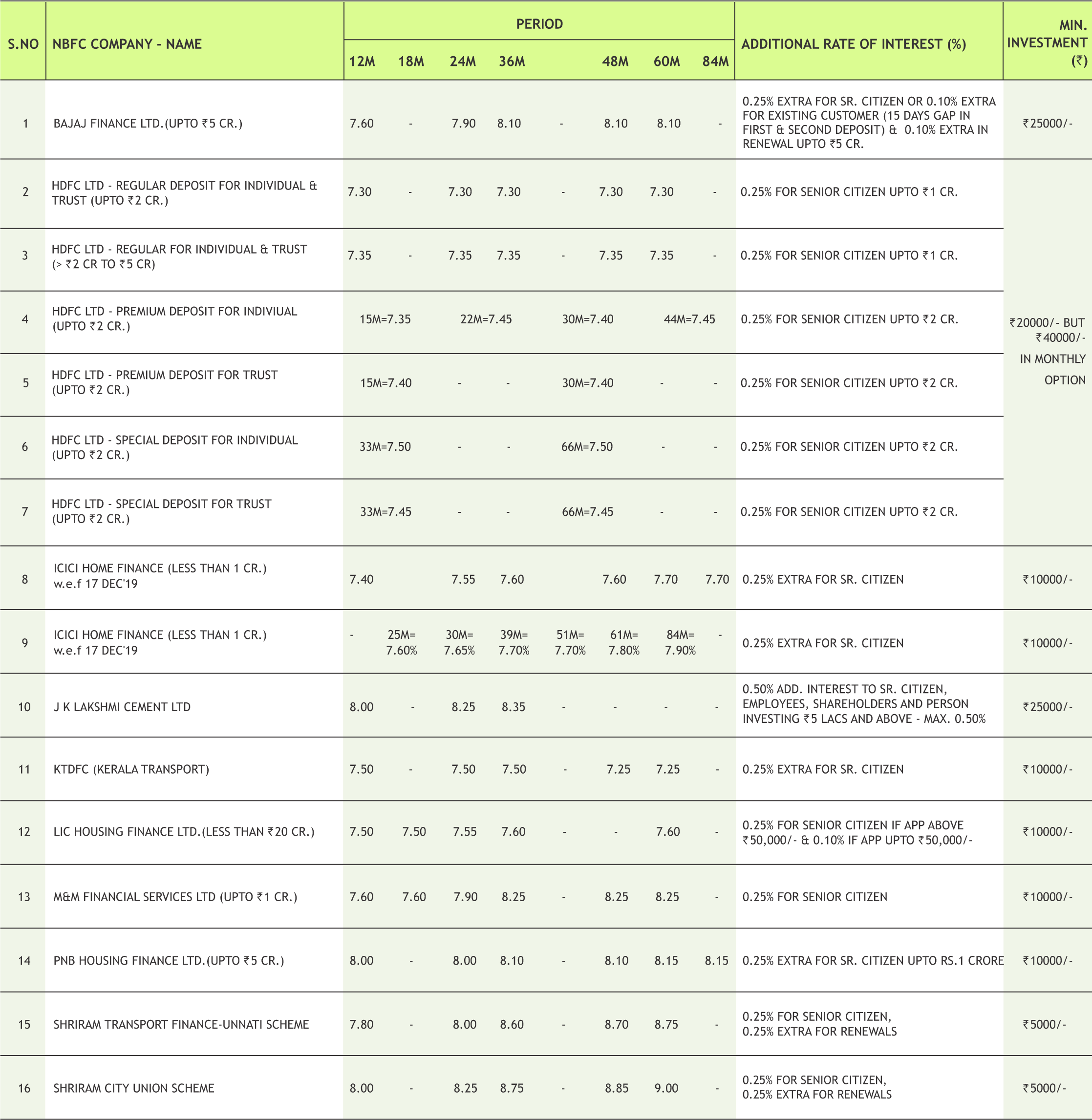

| FD Monitor | 16 |

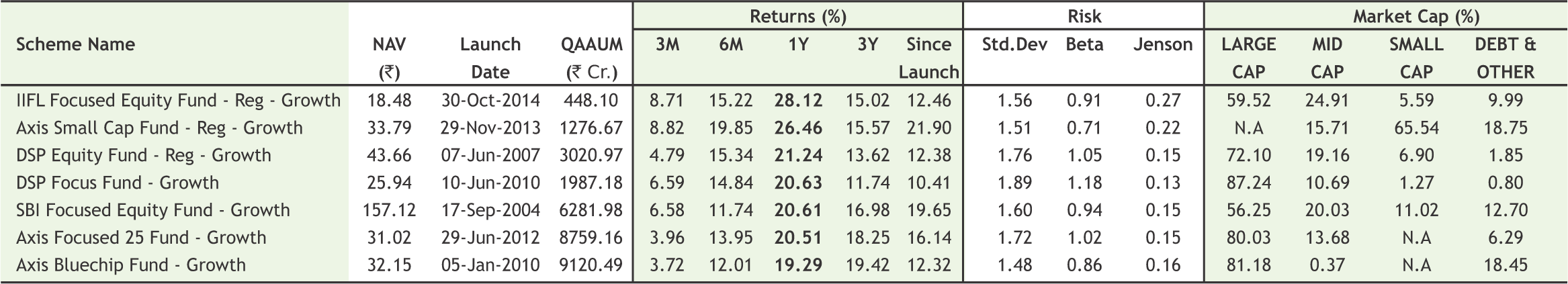

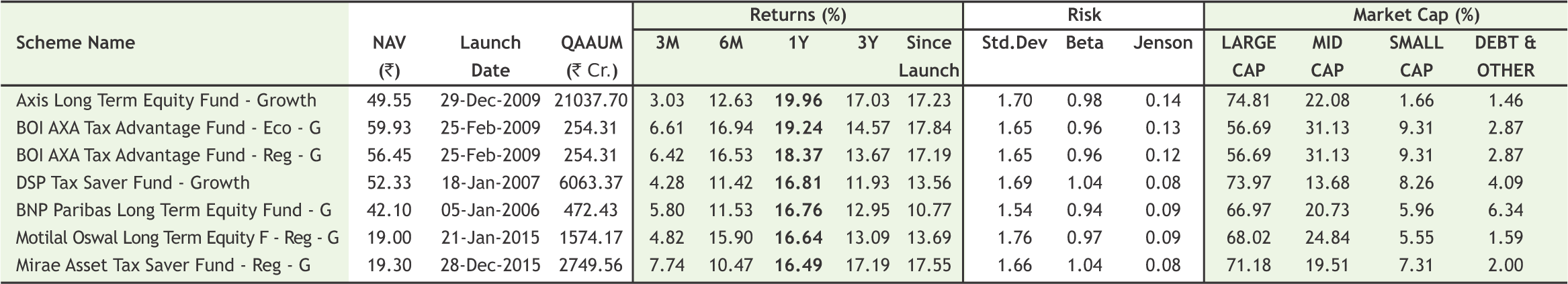

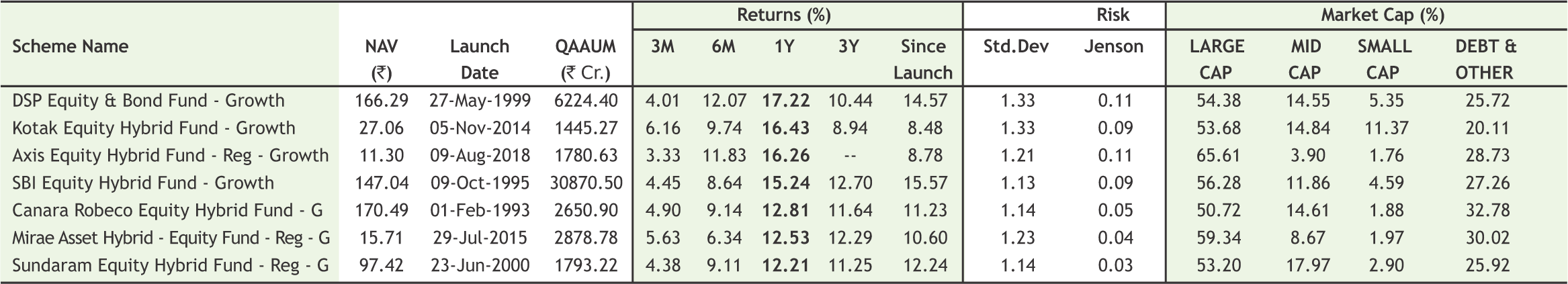

| Mutual Fund | 17-18 |

I

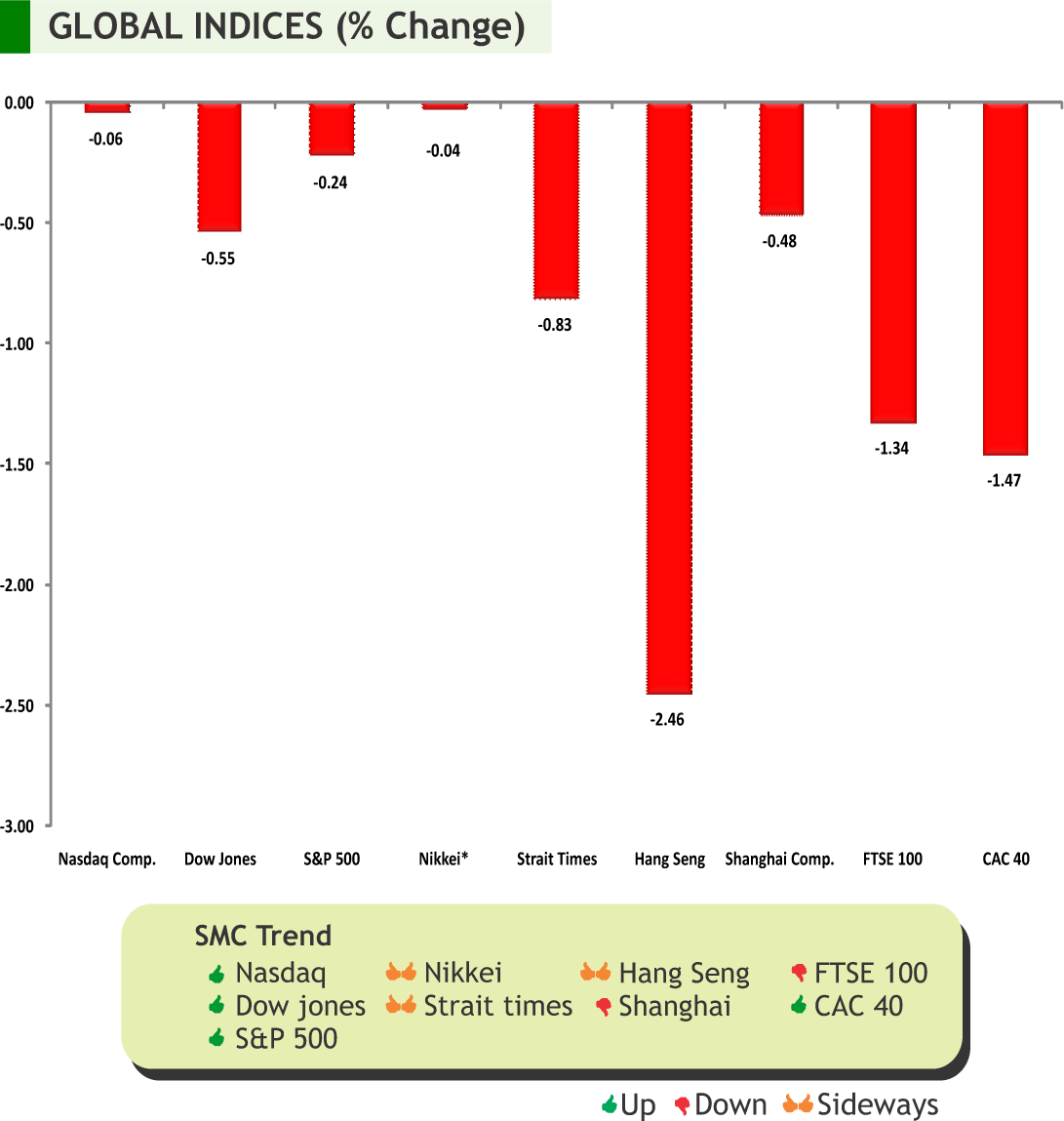

n the week gone by, global markets looked worried as investors took stock of the I spread of a new strain of coronavirus from China and weighed the possible consequences of a global pandemic. Also the news that IMF has lowered the global growth forecast rattled the sentiments of the investors. Meanwhile, Japan’s exports fell 6.3 per cent in December from a year earlier; signalling that weak external demand is keeping a lid on the export-reliant economy. In another development, Britain moved a step closer to its January 31 exit from the European Union when the legislation required to ratify its deal with Brussels passed its final stage in parliament. Oil Prices tumbled to seven-week lows amid warning of an oil surplus by the International Energy Agency.

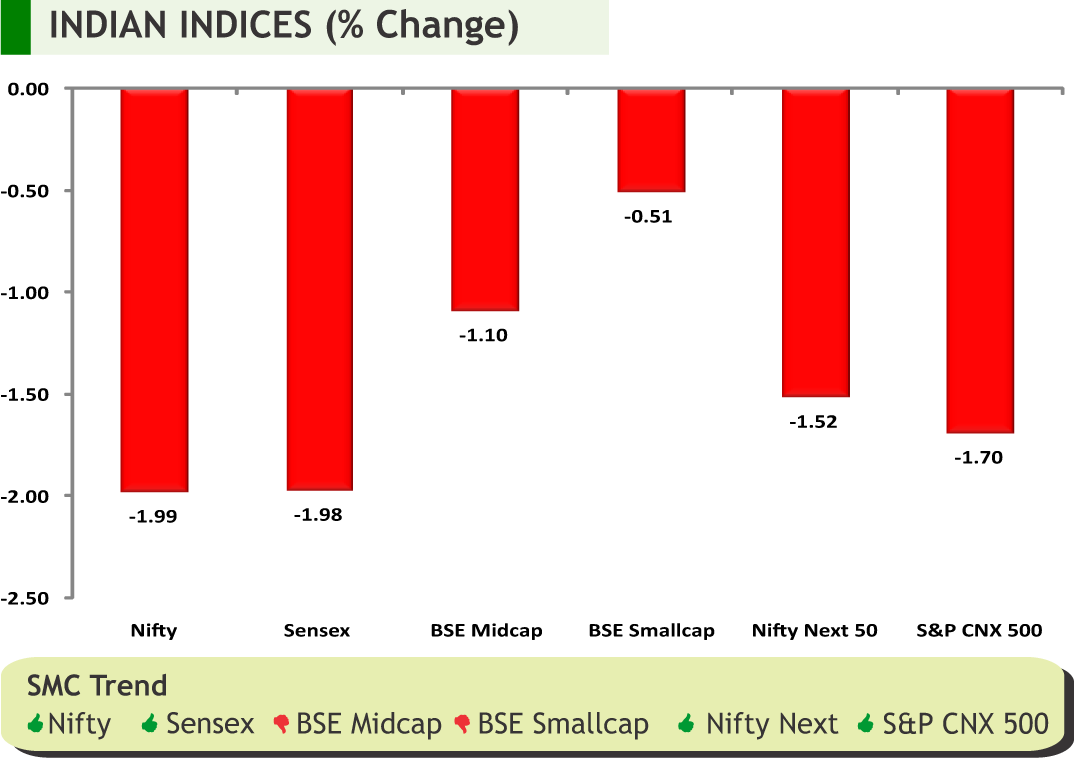

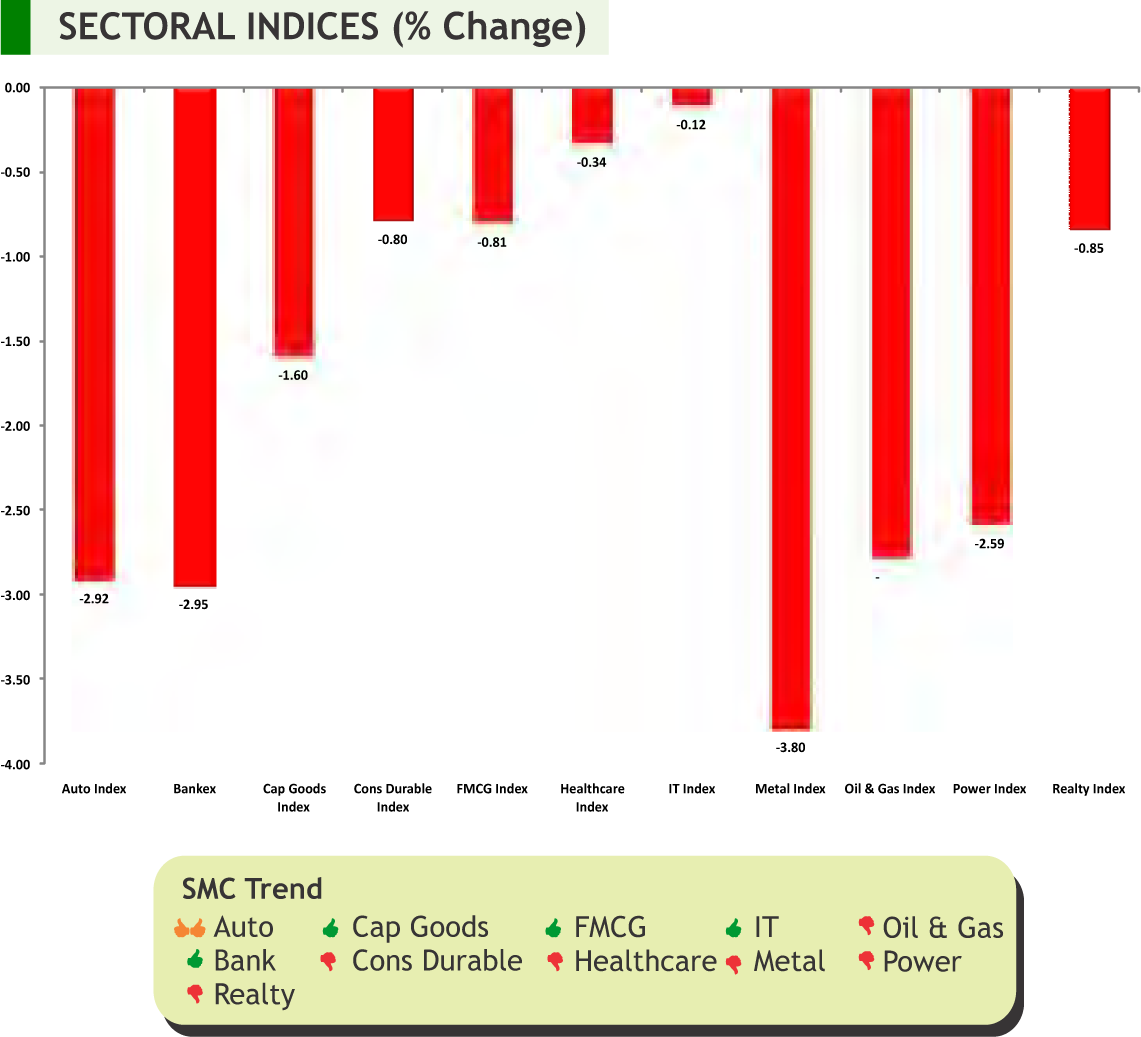

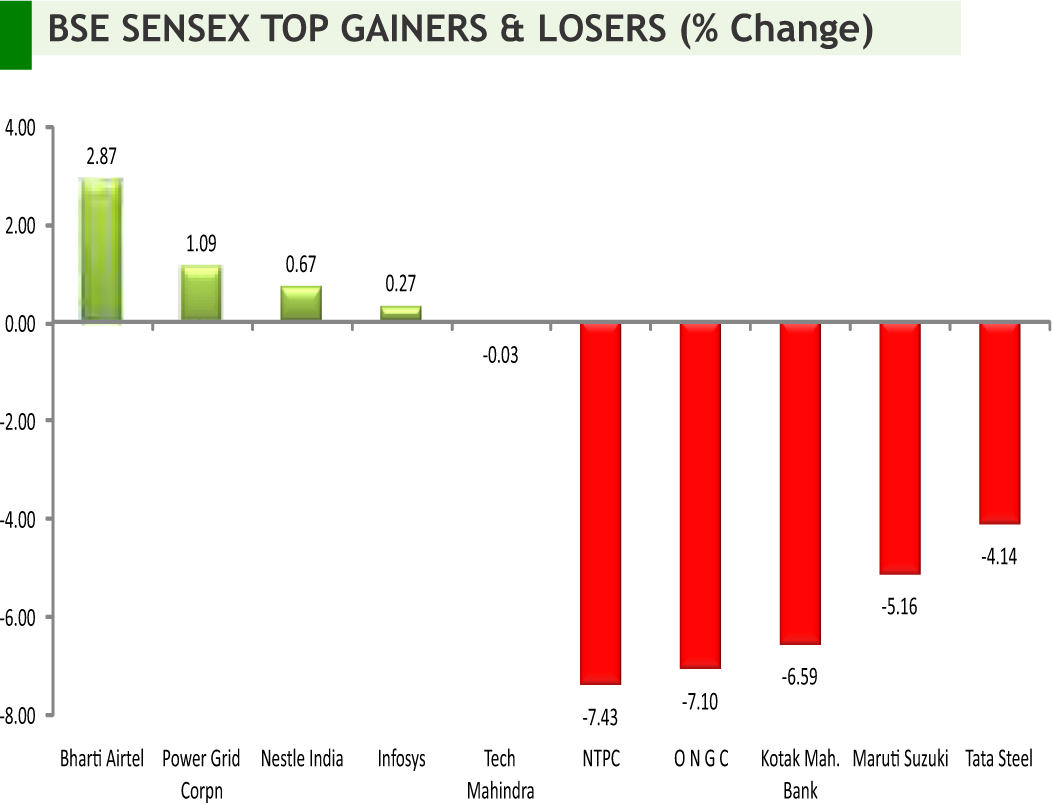

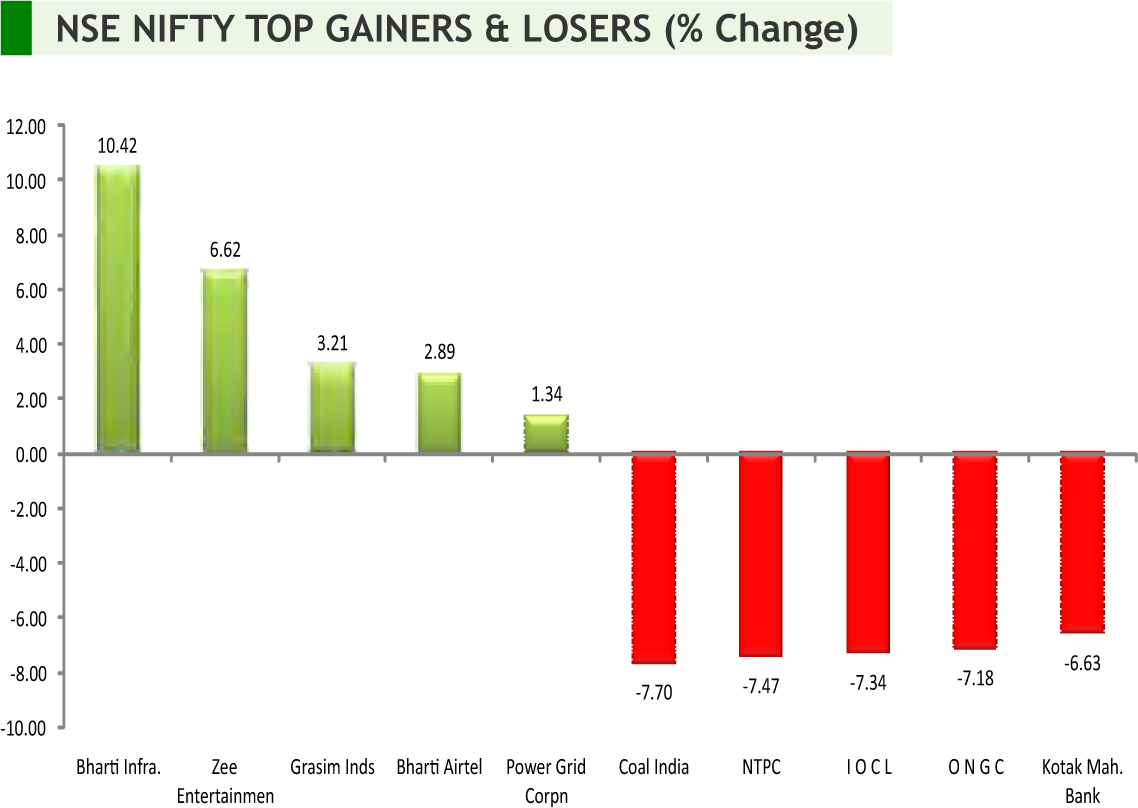

Back at home, domestic markets continued to see volatile trade due to factors such as caution ahead of the Union Budget, tepid quarterly earnings and mixed global cues. Also IMF's markdown of India's growth forecast weakened the sentiments of the investors. Domestic currency too remained weak as against the US dollar amid concerns over IMF revising downwards India's growth forecast and weak quarterly earnings. Volatility is expected to remain high on account of the upcoming Budget 2020. Finance Minister Nirmala Sitharaman is due to present the Budget on February 1, amid expectations that she could announce measures to revive the weakening economy, which has slipped to a more than six-year low. Investors are advised to hold some cash as budget may throw some new opportunities. Further, the earnings announcement for corporates would induce stock specific volatility going forward.

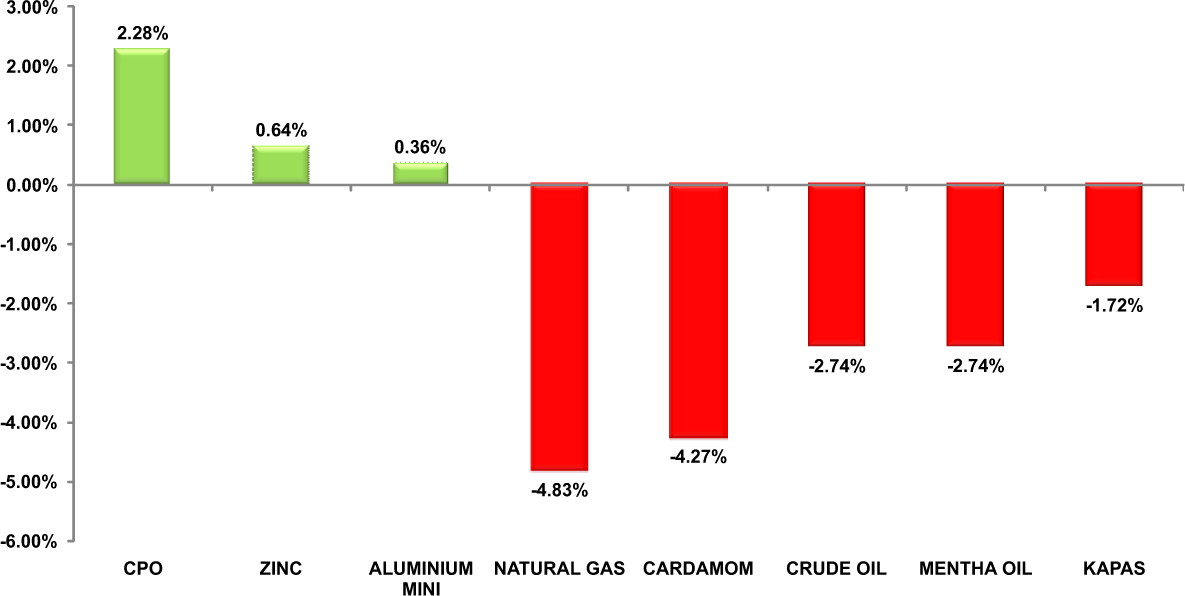

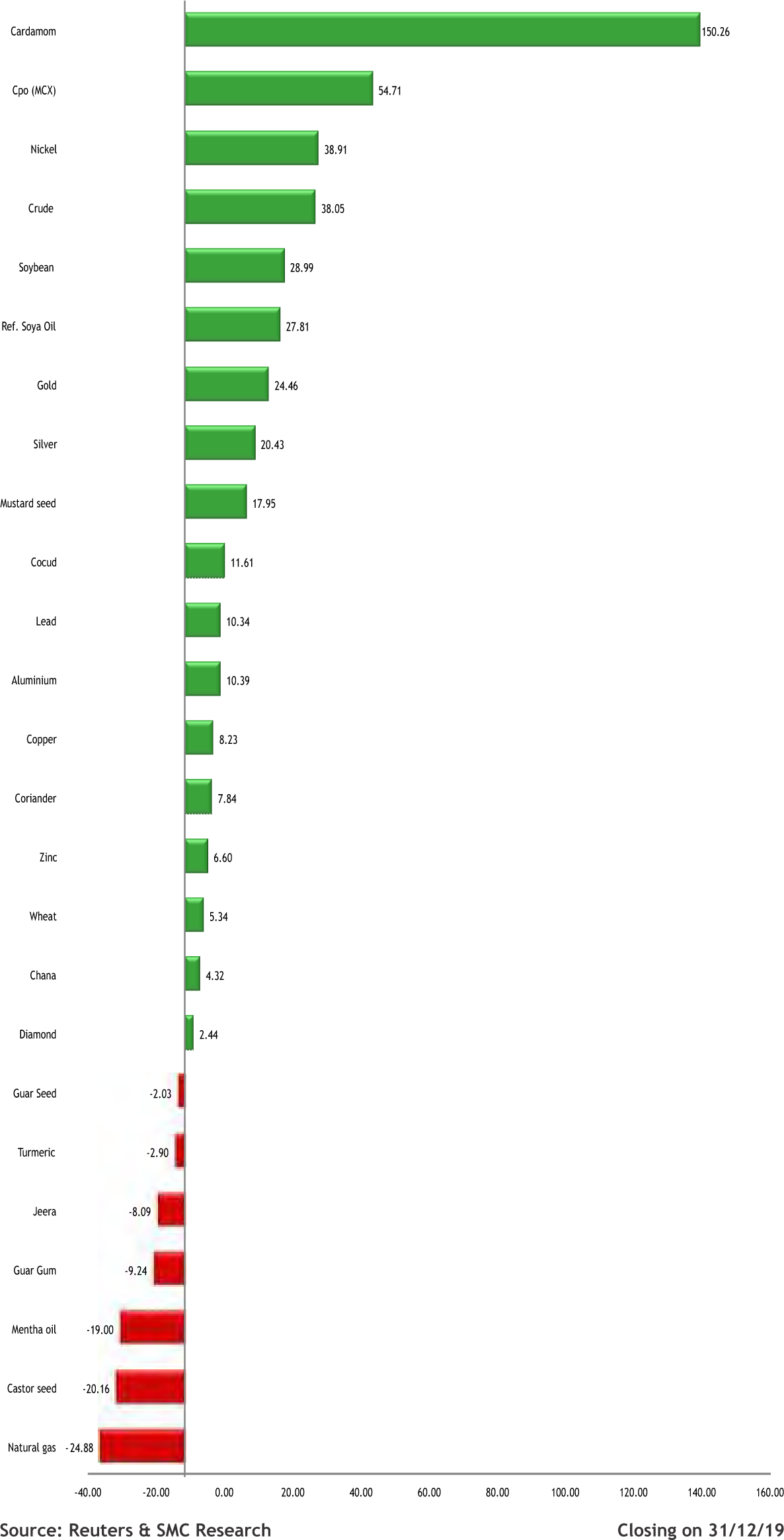

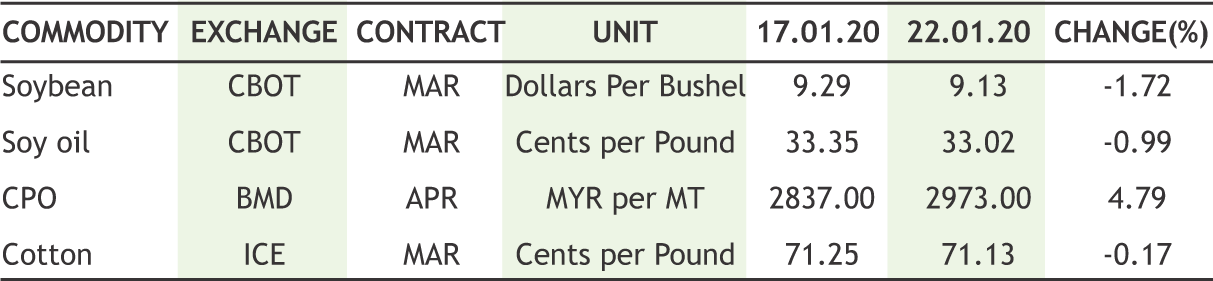

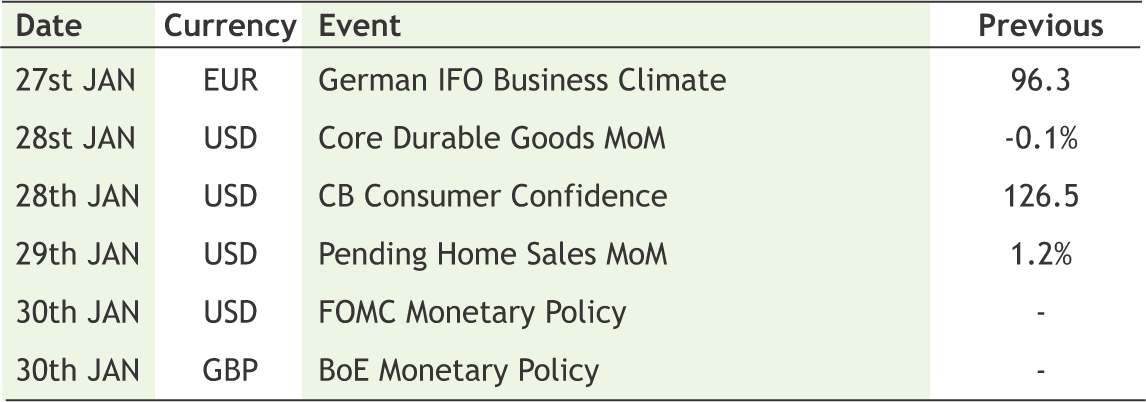

On the commodity market front, the week gone by was full of action pack except for base metals after the sign of the First phase deal between the US and China. As of now Dollar index found hurdle near 97.5 and from there it saw fall. Bullion counter witnessed selling pressure after denting the safe-haven buying, even though investors remain in fear about the new flu-like coronavirus in China. Gold may take support near 39100 and resistance near 40530 whereas silver may take support around 45200 and resistance around 47000. Crude oil prices may witness selling as IEA in its Annual World Energy Outlook said U.S. shale output will continue to blunt the influence of other energy producers including OPEC & NON-OPEC. Natural gas can remain on the weaker bias as it can test 125 by taking resistance near 148 on feeble demand. German, US & UK Manufacturing PMI, German Ifo Business Climate Index, US New Home Sales, US Durable Goods Orders, US CB Consumer Confidence & Trade Balance, Pending Home Sales of US, Fed Interest Rate Decision, BoE Interest Rate Decision, US GDP, OPEC Crude oil Production etc are loads of important triggers for commodity trade.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Economy

• The International Monetary Fund cut the global growth forecasts for this year and next, mainly due to the weaker-than-expected expansion in India. Global growth for this year is projected at 3.3 percent, which is 0.1 percentage point less than the forecast made in October, the international lender said in the latest update to its World Economic Outlook report.

Information Technology

• HCL Technologies announced the launch of a dedicated HCL Microsoft Business Unit focused on Microsoft technologies. This will extend Microsoft's offerings of Business Applications, Microsoft Dynamics 365, Microsoft Azure, loT, and Al/Machine Learning, as well as help employees accomplish more in the modern workplace with Microsoft 365 and Windows 10.

• L&T Technology Services has joined the Qualcomm® Smart Cities Accelerator Program from Qualcomm Technologies, Inc. to collaborate on providing smart ecosystem solutions and services to help global enterprises accelerate the digital transformation to smart urban infrastructure.

Realty

• Dilip Buildcon announced the completion of the project - Rehabilitation and Up-gradation of Majalgaon (101/740) to Kaij (159/258) (Section-III) of Mantha Taluka Border to Barshi National Highway to Two Lane with paved shoulder in the state of Maharashtra on Engineering Procurement and Construction (EPC) Basis Contract.

• NBCC (India), which was selected to acquire the debt-hit realty developer Jaypee Infratech is ready with the backup plan in case it did not get Rs 750 crore of Jaiprakash Associates Ltd (JAL). JAL had deposited the money with the Supreme Court’s registry and it was later transferred to the National Company Law Tribunal (NCLT).

Automobile

• Tata Motors entered into the premium hatchback segment with the rollout of Altroz at a starting price of Rs 5.29 lakh (ex-showroom India). Unveiled in December last year, the Altroz, which is the industry's first BSVI diesel-ready car is also the first vehicle model based on the brand's Alfa platform and the second vehicle showing the Impact 2.0 design language.

• Maruti Suzuki said its BS-VI compliant vehicles have reached cumulative sales of 5 lakh units ahead of the implementation of stricter emission norms from April 1. This achievement reaffirms the growth potential of new engines and technologies in India.

Oil & Gas

• GAIL India plans to invest over Rs 45,000 crore over the next five years to expand the National Gas Pipeline Grid and city gas distribution network to help push for greater use of environment-friendly fuel. The gas pipelines are planned to take the fuel to the east and northeast regions as well as to consumers in the south as part of the government push to raise the share of natural gas in India's energy basket to 15 per cent by 2030 from the current 6.2 per cent.

Retail

• Reliance Retail is aggressively ramping up a new network of grocery stores that will also be used for last-mile delivery of food and grocery as part of the Mumbai conglomerate’s ambitious omnichannel venture.

INTERNATIONAL NEWS

• US existing home sales spiked by 3.6 percent to an annual rate of 5.54 million in December after tumbling by 1.7 percent to a rate of 5.35 million in November. Economists had expected existing home sales to jump by 1.2 percent to an annual rate of 5.43 million.

• The U. K. government borrowing for December decreased from a year ago and was less than expected. The public sector net borrowing, or PSNB, excluding state-owned banks fell to GBP 4.765 billion from GBP 4.981 billion in the same month of 2018. Economists had forecast a borrowing of GBP 5.200 billion.

• Japan all industry activity index rose 0.9 percent month-on-month in November, after a 4.8 percent fall in October. In September, industry activity increased 1.9 percent. Economists had expected a 0.4 percent rise for November.

• Japan posted a merchandise trade deficit of 152.5 billion yen in December. That narrowly beat forecasts for a shortfall of 152.6 billion yen following the 85.2 billion yen deficit in November.

| Stocks | *Closing Price | Trend | Date Trend Changed | Rate Trend Changed | SUPPORT | RESISTANCE | Closing S/l |

|---|---|---|---|---|---|---|---|

| S&P BSE SENSEX | 41386 | UP | 08.02.19 | 36546 | 36300 | 35300 | |

| NIFTY50 | 12180 | UP | 08.02.19 | 10944 | 10900 | 10600 | |

| NIFTY IT | 16466 | UP | 21.07.17 | 10712 | 15200 | 14800 | |

| NIFTY BANK | 31015 | UP | 30.11.18 | 26863 | 27700 | 27000 | |

| ACC | 1548 | DOWN | 23.01.2020 | 1548 | 1500 | 1470 | |

| BHARTIAIRTEL | 524 | UP | 15.03.19 | 338 | 480 | 460 | |

| BPCL | 469 | UP | 30.08.19 | 355 | - | 450 | |

| CIPLA | 465 | UP | 25.10.19 | 460 | 450 | 440 | |

| SBIN | 323 | UP | 01.11.19 | 314 | 315 | 305 | |

| HINDALCO | 205 | UP | 13.12.19 | 208 | 200 | 194 | |

| ICICI BANK | 528 | UP | 20.09.19 | 418 | 510 | 500 | INFOSYS | 784 | UP | 20.12.19 | 732 | 750 | 730 |

| ITC | 238 | DOWN | 31.05.19 | 279 | 260 | 270 | |

| L&T | 1332 | DOWN | 15.11.19 | 1378 | 1360 | 1380 | |

| MARUTI | 7147 | UP | 27.12.19 | 7345 | - | 7050 | |

| NTPC | 114 | DOWN | 16.08.19 | 118 | 120 | 124 | |

| ONGC | 118 | DOWN | 06.12.19 | 127 | 126 | 132 | |

| RELIANCE | 1527 | UP | 16.08.19 | 1278 | - | 1500 | |

| TATASTEEL | 480 | UP | 01.11.19 | 396 | 450 | 440 | |

Closing as on 23-01-2020

NOTES:

1) These levels should not be confused with the daily trend sheet, which is sent every morning by e-mail in the name of "Morning Mantra ".

2) Sometimes you will find the stop loss to be too far but if we change the stop loss once, we will find more strength coming into the stock. At the moment, the stop loss will be far as we are seeing the graphs on weekly basis and taking a long-term view and not a short-term view.

| Meeting Date | Company name | Purpose |

|---|---|---|

| 27/01/2020 | H D F C | Quarterly Results, Others |

| 27/01/2020 | Dr Reddy's Labs | Quarterly Results |

| 27/01/2020 | United Spirits | Quarterly Results |

| 28/01/2020 | Cummins India | Quarterly Results,Interim Dividend |

| 28/01/2020 | Maruti Suzuki | Quarterly Results |

| 28/01/2020 | M & M Fin. Serv. | Quarterly Results |

| 29/01/2020 | Tata Power Co. | Quarterly Results |

| 29/01/2020 | NIIT Tech. | Quarterly Results |

| 29/01/2020 | Bajaj Finserv | Quarterly Results |

| 30/01/2020 | Colgate-Palm. | Quarterly Results |

| 30/01/2020 | Tata Motors | Quarterly Results |

| 30/01/2020 | Bharat Electron | Quarterly Results,Interim Dividend |

| 30/01/2020 | Dabur India | Quarterly Results |

| 30/01/2020 | LIC Housing Fin. | Quarterly Results |

| 30/01/2020 | Marico | Quarterly Results,Interim Dividend |

| 30/01/2020 | Tata Motors-DVR | Quarterly Results |

| 30/01/2020 | Bharti Infra. | Quarterly Results |

| 31/01/2020 | Hind. Unilever | Quarterly Results |

| 31/01/2020 | Castrol India | Accounts,Dividend |

| 31/01/2020 | ITC | Quarterly Results |

| 31/01/2020 | St Bk of India | Quarterly Results |

| 1/2/2020 | Amara Raja Batt. | Quarterly Results |

| 3/2/2020 | Tata Chemicals | Quarterly Results |

| 4/2/2020 | Exide Inds. | Quarterly Results |

| 4/2/2020 | Tata Global | Quarterly Results |

| 4/2/2020 | Titan Company | Quarterly Results |

| 5/2/2020 | Berger Paints | Quarterly Results |

| 5/2/2020 | Cipla | Quarterly Results |

| 5/2/2020 | Divi's Lab. | Quarterly Results |

4

5

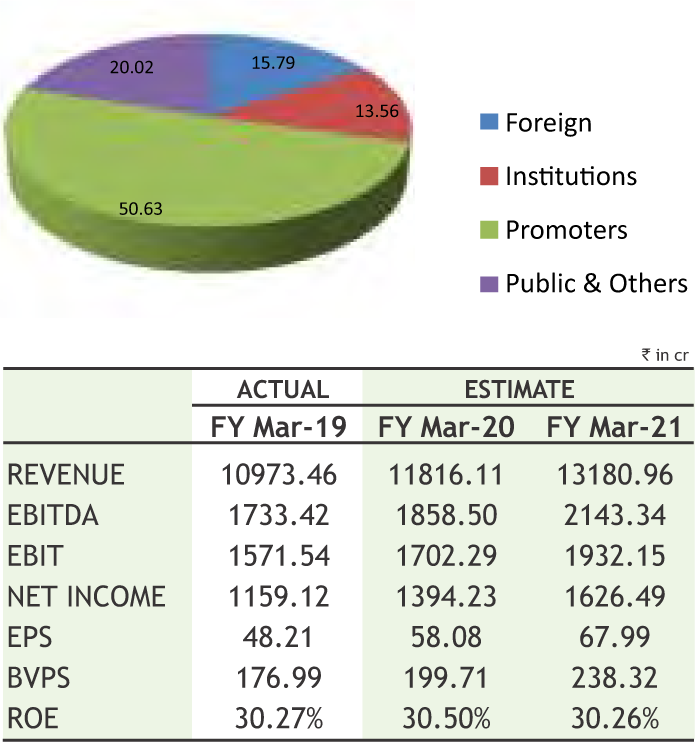

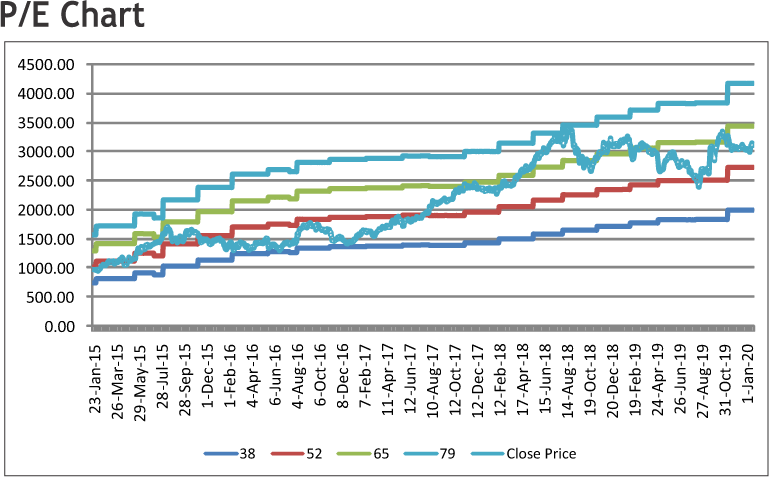

Britannia Industries Limited

CMP: 3106.15

Target Price: 3535

Upside: 14%

| Face Value (Rs.) | 1.00 |

| 52 Week High/Low | 3443.90/2302.00 |

| M.Cap (Rs. in Cr.) | 74693.06 |

| EPS (Rs.) | 54.73 |

| P/E Ratio (times) | 56.75 |

| P/B Ratio (times) | 21.32 |

| Dividend Yield (%) | 0.48 |

| Stock Exchange | BSE |

Investment Rationale

• Britannia Industries (BIL) is one of India's leading food companies. Britannia's product portfolio includes biscuits, bread, cakes, rusk, and dairy products including cheese, beverages, milk and yoghurt. BIL has a presence in more than 60 countries across the globe.

• The company has strengthened its brand equity through focused campaigns and invested in building capabilities & structures for both its base business & strategic business units to drive future growth. With a focus on tightening belt in this phase of low growths, the management of the company has accelerated the cost efficiency initiatives to maintain the shape of business.

• The company is ramping up its network and has 21.3 lakh outlet and 20000 rural distributors. It would continue to expand its distribution reach with newer offerings like milk shakes, salty snacks, crossaints and cream wafers etc. by improving visibility and launching the same across various states country. It currently owns 10 manufacturing and has continuously upgraded capacities at its plants over the years incurring a cumulative capex of Rs. 1,440 crore over the four fiscals ending FY2019.

• The management of the company intends to inhouse the entire dairy manufacturing (with focus on value-added dairy lines like cheese, milk shakes etc.) at its Ranjangaon plant over the next two years at a total cost of Rs. 500 crore and capex is expected to partially funded by debt. Meanwhile Ranjangaon Food Park has become fully operational with 12 Lines with the total capacity of 140,000 TPA. Presently it has 8 biscuits lines, 2 cake lines, 1 Croissant line and 1 salty snack line. In

addition to that the greenfield dairy capex it is also expected to incur capex of Rs. 400-500 crore per annum to maintain, upgrade and enhance capacities at its existing plants.

• During Q2FY20, domestic volume grew by 3% on the back of distribution expansion, gaining traction from new products and market share gain.

Risk

• Changes to the economy

• Volatility in commodity prices

Valuation

The management of the company expects double digit growth in its overall business and in line with that planning to more investment in brands to wide its distribution network through focus on direct reach. It has made continued focus on its premiumisation & Innovation journey and revamp of its portfolios. Thus, it is expected that the stock will see a price target of Rs.3535 in 8 to 10 months time frame on a one year average P/Ex of 52x and FY21 EPS of Rs.67.99.

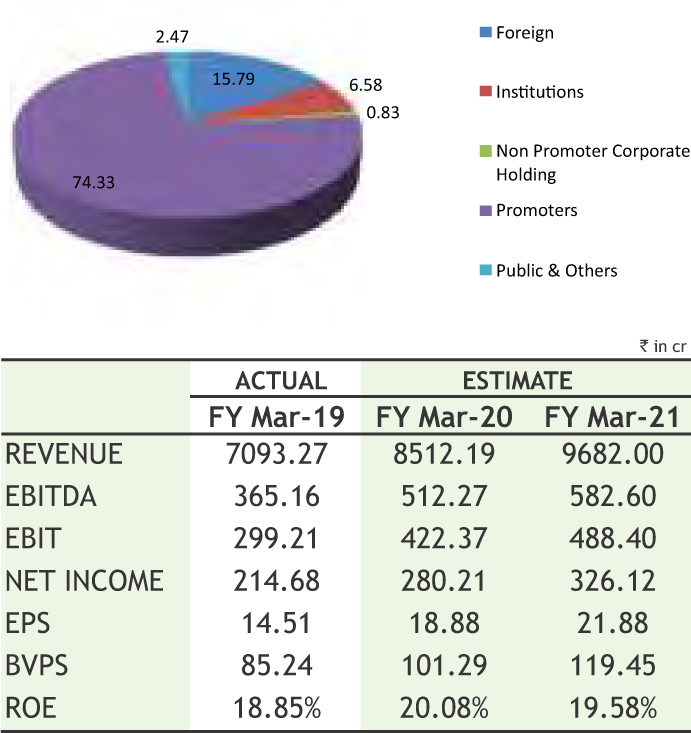

Securities & Intelligence Services India Limited

CMP: 503.05

Target Price: 570

Upside: 13%

| Face Value (Rs.) | 5.00 |

| 52 Week High/Low | 535.00/351.20 |

| M.Cap (Rs. in Cr.) | 7376.62 |

| EPS (Rs.) | 19.30 |

| P/E Ratio (times) | 26.06 |

| P/B Ratio (times) | 5.44 |

| Dividend Yield (%) | 0.35 |

| Stock Exchange | BSE |

Investment Rationale

• Securities & Intelligence Services India Limited (SIS) is a market leader in all the 3 business segments of Security, Facility management & Cash Logistics services. It is the 2nd largest & fastest growing Security services company in India and the largest security services company in Australia. It is also the 2nd largest Facility Management Services Company in India. SIS is the 2nd largest Cash Logistics Service provider in India.

• The company has consistently strengthened its market position in key service segments and geographies through the organic and inorganic routes and has emerged as the leading security service provider in India and Australia.

• On the development front, acquisition of Henderson Security Services Pte. Ltd., Singapore and Henderson Technologies Pte. Ltd., Singapore (collectively referred to as Henderson) and Platinum 4 Group Limited (P4G) in FY2019 has provided it entry into the security services markets in Singapore and New Zealand, respectively.

• Apart from the acquisitions of Henderson and P4G, SISL had acquired three other entities in FY2019 - SLV Security Services Private Limited (SLV), Rare Hospitality and Services Private Limited (Rare) and Uniq Detective and Security Services Private Limited (Uniq).

• Over the past five years, its consolidated revenues have grown at a robust CAGR of 22% and during Q2FY20, it has reported healthy scale up in operations and also expanded its profit margins in Q2 FY2020, aided by margin-accretive acquisitions done over FY2019, as well as organic growth across entities. Consolidated revenues increased from Rs 1690.20 cr in Q2 of FY19 to Rs 2,089 cr in Q2 of FY20,

reported at 23% growth. Additionally, it’s operating profit margins expanded by 36% on a YoY basis during the quarter, driven by operating leverage benefits and the margin-accretive acquisitions.

Risk

• Working capital intensive nature of operations

• Competitive nature of industry

Valuation

The company has strong track record on quarterly as well as yearly basis. According to the management, impressive client wins, strong focus on operations and rigorous monitoring of costs have helped all the business units deliver good revenue and profitability metrics. The management believes that the recent acquisitions would help in strengthening its position in key micro-markets in India (i.e. Gurugram and Bengaluru) and in segments (i.e. facility management in the healthcare segment) and expand its footprint to Singapore (via Henderson) and New Zealand (via P4G). Thus, it is expected that the stock will see a price target of Rs.570 in 8 to 10 months time frame on a one year average P/Ex of 26.06x and FY21 EPS of Rs.21.88.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

The stock closed at Rs 1548.35 on 23RD January 2020. It made a 52-week low of Rs 1326.00 on 18th February 2019 and a 52-week high of Rs. 1765.05 on 28th May 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 1515.78

As we can see on chart that stock has consolidated in narrow range and has given the breakout of same along with high volumes. Apart from this, stock has formed an “Inverted Head and Shoulder” pattern on daily charts and it has given the breakout on Thursday by registering gains over 2%. So, follow up buying is anticipated. Therefore, one can buy in the range of 1520-1530 levels for the upside target of 1620-1650 levels with SL below 1470.

The stock closed at Rs 277.00 on 23rd January, 2020. It made a 52-week low at Rs 208.05 on 04th February 2019 and a 52-week high of Rs. 299.00 on 23rd September 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 257.60

Short term, medium term and long term bias are looking positive for the stock as it is trading in higher highs and higher lows on charts. Apart from this, it is forming an “Ascending Triangle” pattern on weekly charts and trading on verge of breakout of same with decent volumes. So buying momentum can continue for coming days. Therefore, one can buy in the range of 272-274 levels for the upside target of 300-305 levels with SL below 262.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

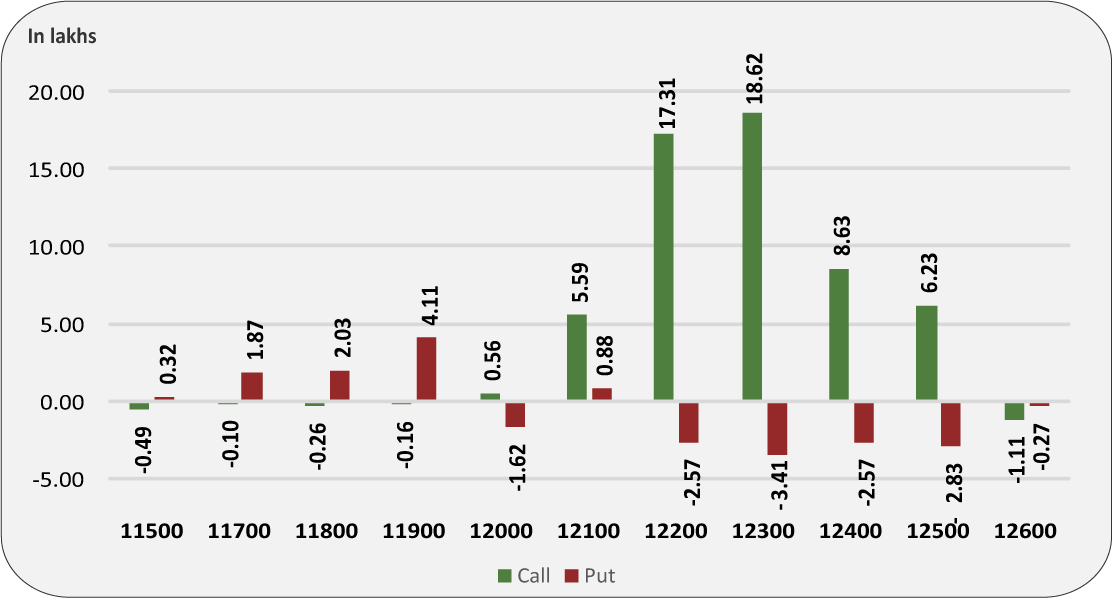

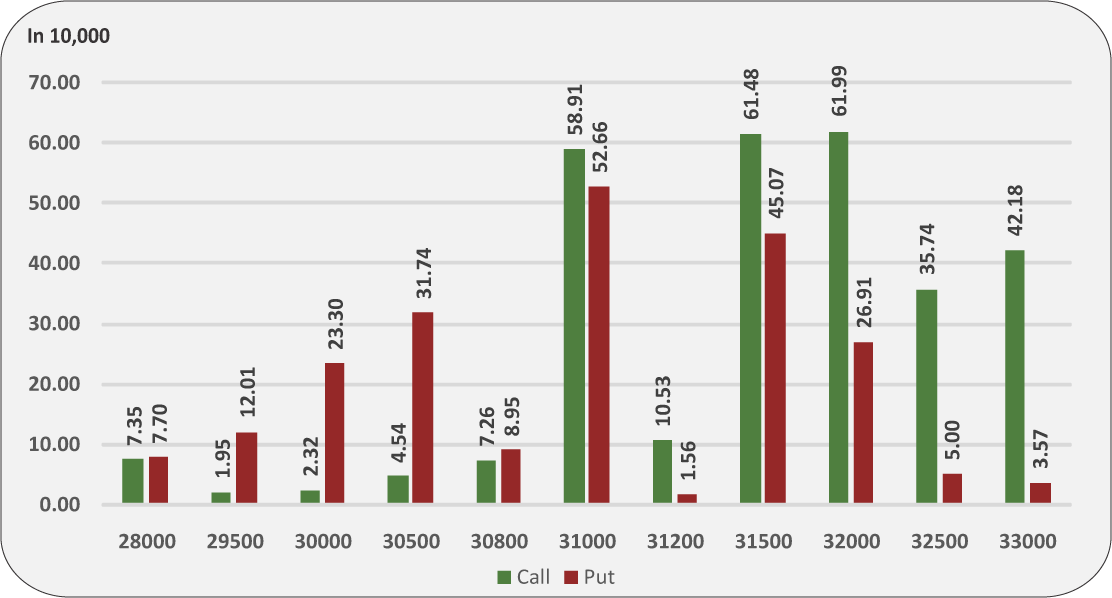

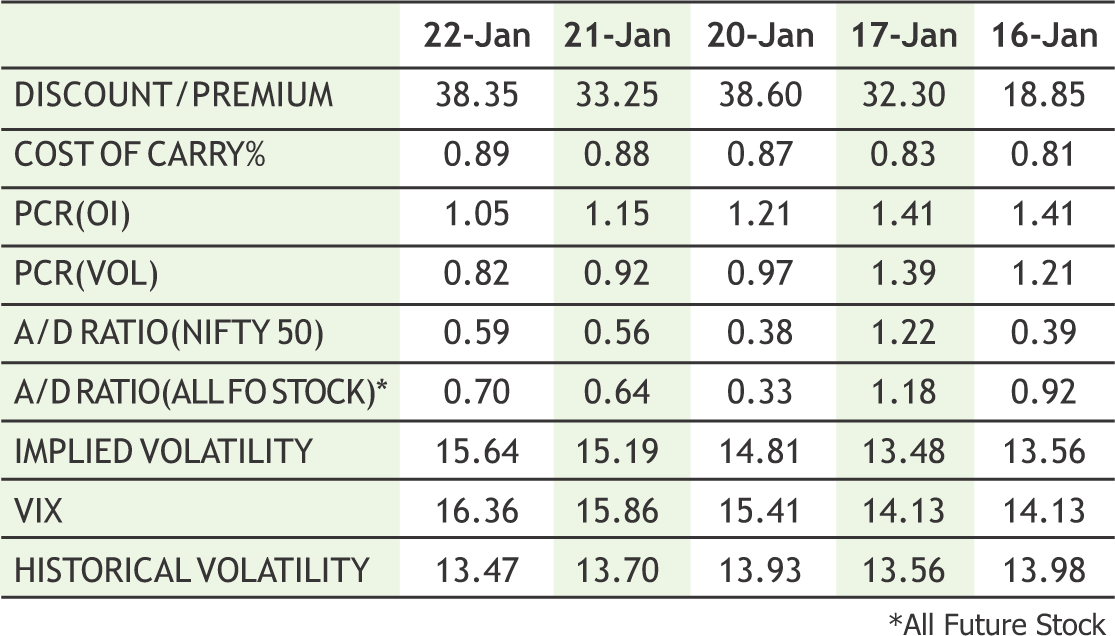

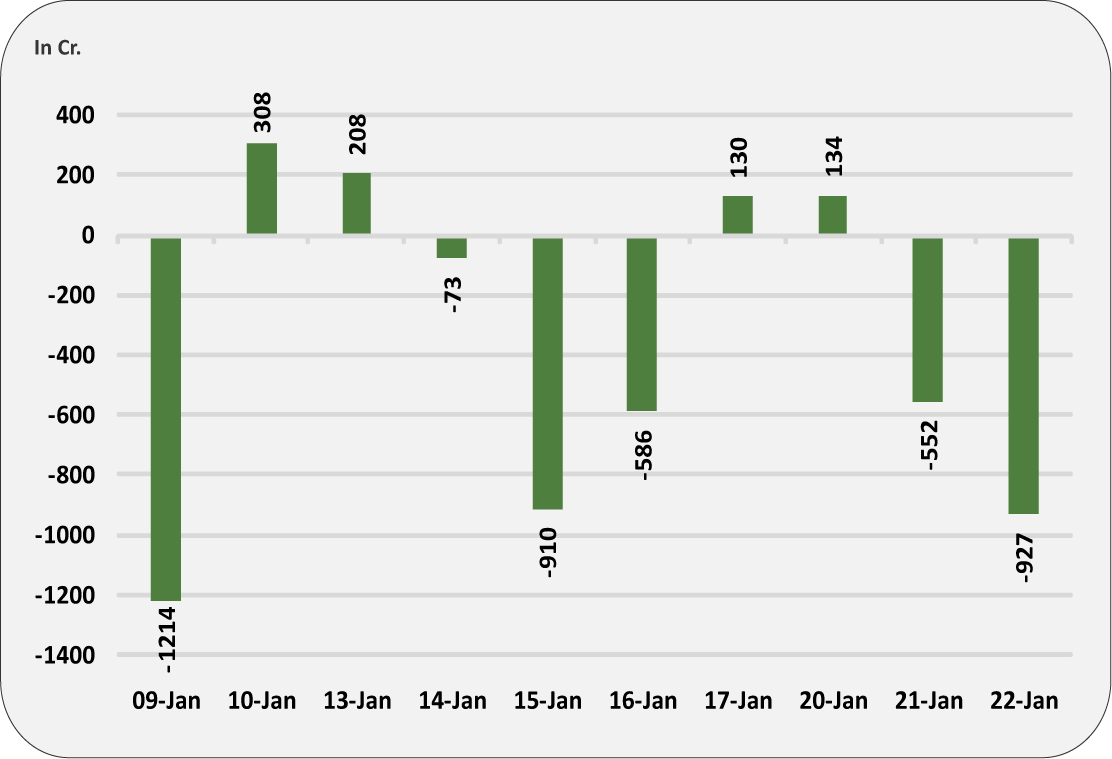

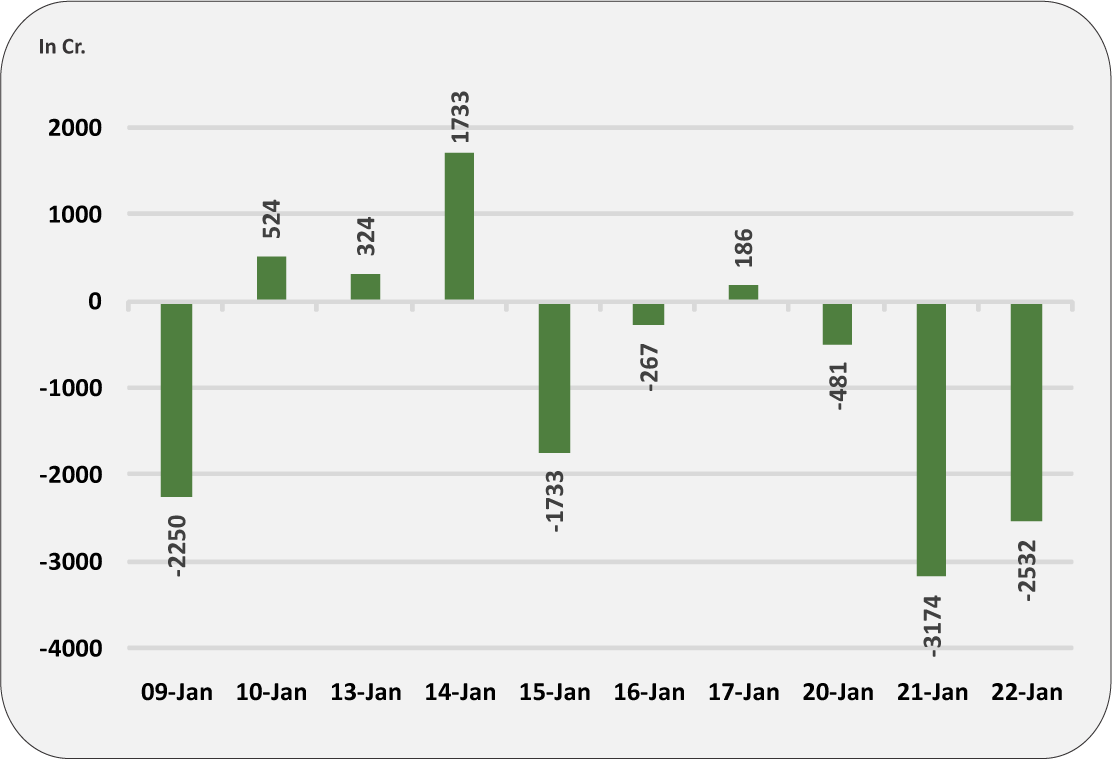

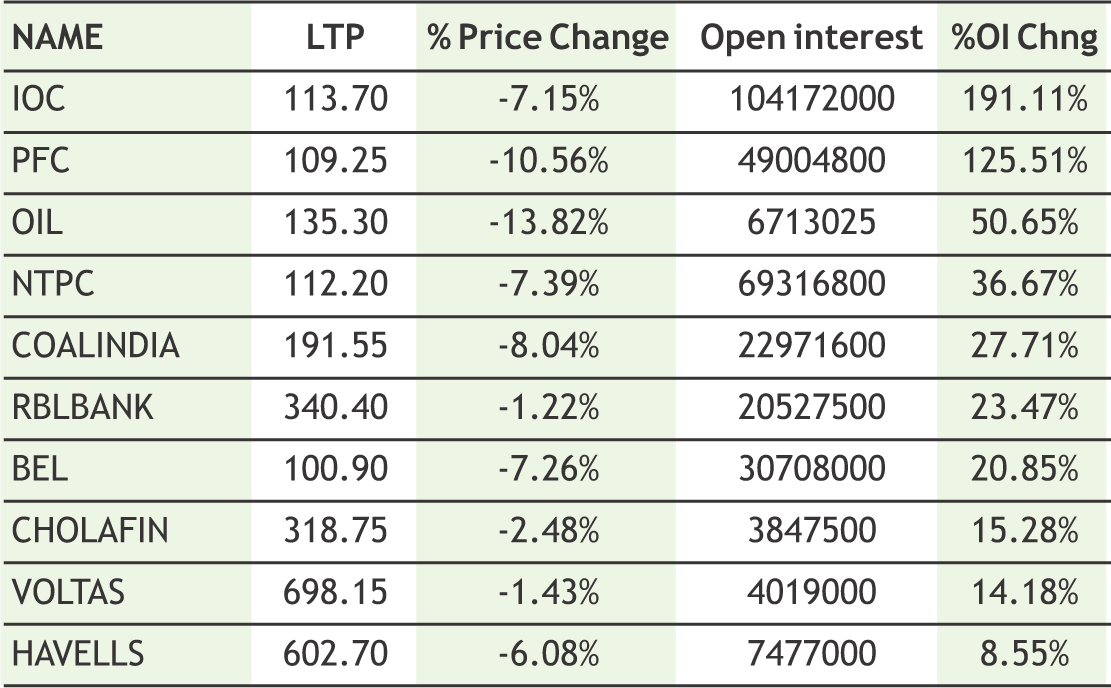

Indian markets slide sharply last week with Nifty shedding nearly 1.35% and Banknifty fell more than 1.75% week on week basis to end the week in red zone. However, some relief rally was seen in Thursday’s session after three day consecutive fall as sentiments got lifted by banks and auto stocks. From derivative front, now 12100 should act as major support for the Nifty as put writers seen adding hefty open interest build up in 30th January expiry. However, on higher side still 12300 would be a major resistance for nifty. From technical front, it is expected that as far Nifty is trading in range of 12100 to 12300 the bias is likely to remain range bound with stock specific action onto the radar. The Implied Volatility (IV) of calls closed at 15.64% while that for put options closed at 16.10%. The Nifty VIX for the week closed at 16.36% and is expected to remain volatile. PCR OI for the week closed at 1.05. In coming week we believe that traders should remain cautious as far index is concerned as volatility is likely to grip the market ahead of upcoming Union Budget and as far levels are concerned Banknifty is likely to take support at 30750-30500 zone and on higher side 31400 would act as strong hurdle.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

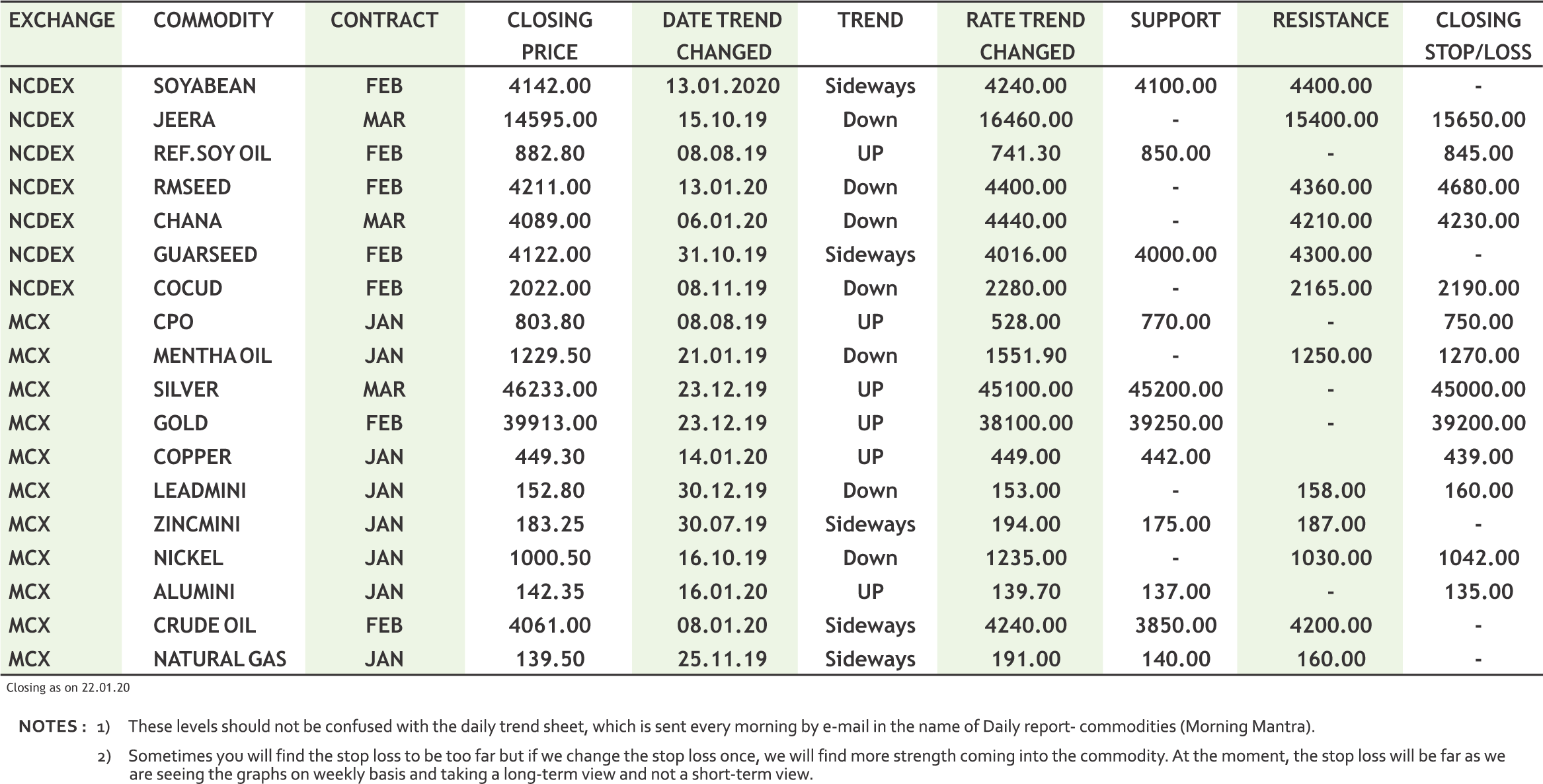

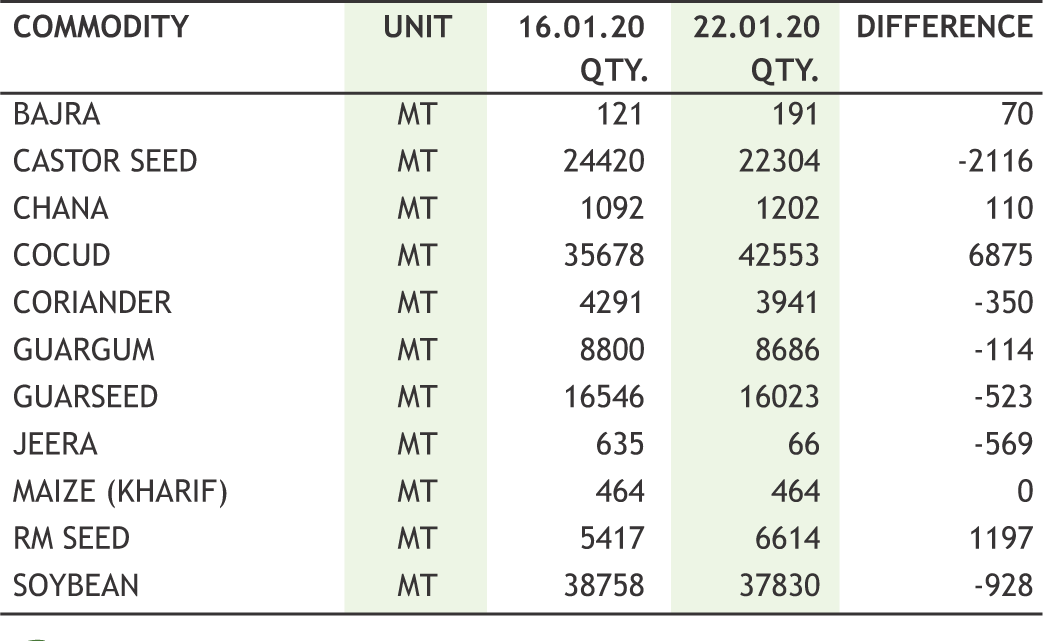

Turmeric futures (Mar) is expected to witness correction towards 6030-5960 levels. The outlook for turmeric remains weak as arrivals of the fresh crop have started in key spot markets of Nizamabad, and are likely to gain momentum in the coming weeks. This season, crop has been delayed by a fortnight as late rains led to poor weather conditions and drying the crop took more time than usual which hampered the arrivals and moisture has increased. Prices are also likely to decline due to expectations of a rise in production in 2019-20 (Jul-Jun) to 1.5-1.6 million bags, against over 1.2 million bags last year, according to industry estimates. Jeera futures (Mar) have witnessed the steepest correction this month & this downtrend is likely to continue till it tests 14000-13500 levels. The overall sentiment is weak owing to sharp increase in acreage in Gujarat and Rajasthan and favourable weather conditions across the growing regions may lead to rise in production. Jeera growers in Rajasthan and Gujarat are expecting about 25-30 percent higher yield over last year. Though official numbers are still not out, indications from traders and farmers point to a crop size of about 5 lakh tonnes as against about 4.1 lakh tonnes in the previous year. Dhaniya futures (Apr) will probably continue to consolidate in the range of 6210-7140 for the third consecutive week. This season the sowing has been good in Gujarat and Madhya Pradesh, which has boosted the new crop estimates. While the carry over stock is likely to be only half of last year as the crop fell over 20 percent to 567,000 tonnes in 2019.

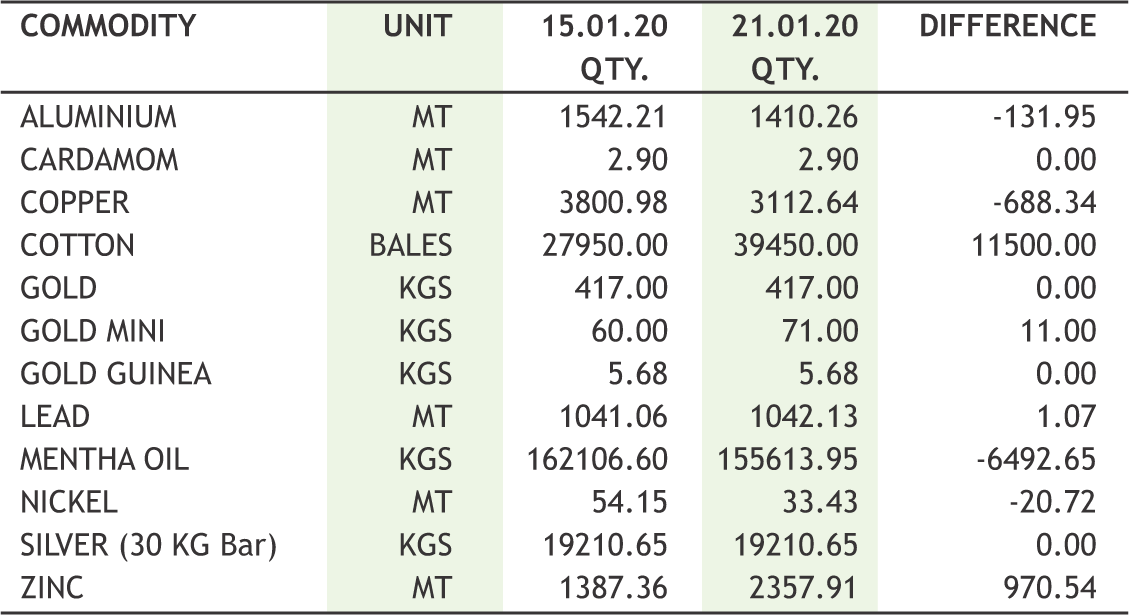

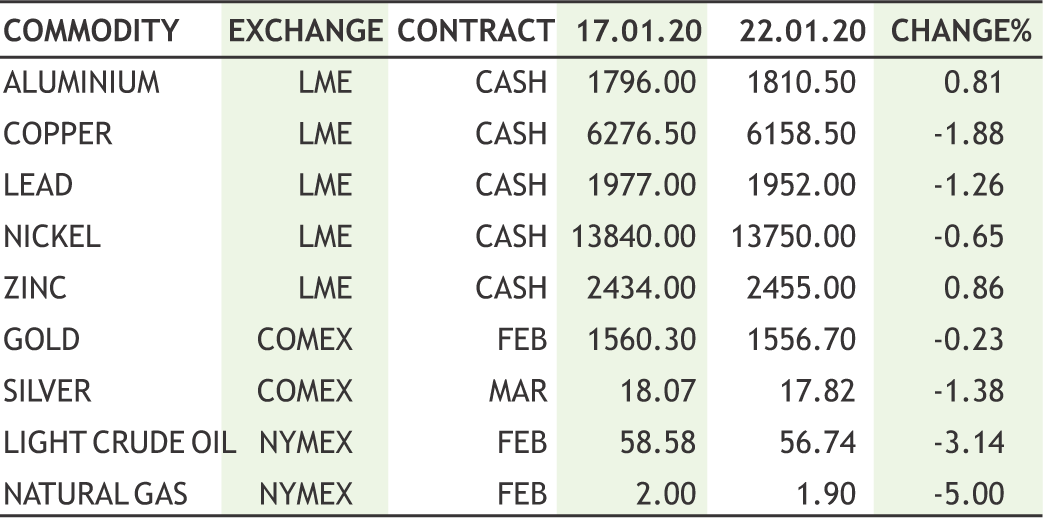

Bullion counter can extend its weakness as easing of US China trade war tensions and lack safe haven demand will continue to keep the prices under pressure. But any escalation in Middle East tensions can cap the downside to some extent. US Treasury Secretary stated that fresh deal signed with China, Mexico and Canada could boost the US economy and growth would outperform projections including those by the IMF. Gold may dip lower towards 39400 while taking resistance near 40600 whereas silver may decline towards 45200 while taking resistance near 47000. Precious metal prices were supported in the recent past after IMF mentioned that global growth appears to have bottomed out but there is no rebound in sight. For 2020 and 2021, the IMF trimmed back its global growth forecasts. Meanwhile investors assessed the risk of a global epidemic from a coronavirus outbreak from China that could have an impact on economic growth. According to a top International Monetary Fund “Global growth appears to have bottomed out but there is no rebound in sight and risks ranging from trade tensions to climate shocks make the outlook uncertain”. Philadelphia Federal Reserve Bank President Patrick Harker stated that a robust labour market was boosting consumer confidence and lifting the U.S. economy, despite headwinds such as a global slowdown and trade uncertainty. The Bank of Japan is set to keep monetary policy steady and signal its cautious optimism over the global outlook, reinforcing market expectations that the rising cost of prolonged easing will keep the hurdle for further stimulus high China’s gold consumption fell for the first time in three years in 2019, as high prices and an economic slowdown hit buying in the world’s biggest market for the metal.

Soybean futures (Feb) is expected to witness selling in the range of 4215-4235 & may attempt to break the support near 4095 to test 4050-4000 levels taking negative cues from the international market. The sentiments of the oilseeds complex from soybean to soy oil on the Chicago Board of Trade are bearish as they are under pressure from expectations for a massive harvest in rival supplier Brazil. Meanwhile, lack of new demand from China loomed over the market. Beijing pledged to increase imports of U.S. farm products in an initial trade deal with Washington last week. Traders say there have been no confirmed sales. There is more downside yet to be seen in mustard futures (Feb) and may test 4175-4100 levels. The market participants are on the selling side on the likelihood of a bigger crop this year. Conducive weather conditions are seen weighing on mustard prices in wholesale markets. CPO futures (Feb) is expected to hold on to the support near 770, while the upside may get extended towards 810. Soy oil futures (Feb) may consolidate in the range of 860-900 levels. The downside may remain capped on anticipation of a cut in import duty on edible oil. It is reported that the consumer affairs ministry has proposed that the commerce ministry slash the import duty on edible oils to cool prices in domestic markets. According to the consumer affairs ministry, the import duty on crude palm oil should be reduced by 500 basis points and that on refined palm oils by 300 bps. It has also proposed a 10- percentage point cut in import duty on soft oils.

Crude oil prices may remain on weaker path as growing record U.S production eclipsed the supply disruptions in Libya. Meanwhile EIA released its Drilling Productivity Report, in which they forecast that US shale production would increase by 22Mbbls/d over February to 9.2MMbbls/d, with increases driven predominantly by the Permian, and to a lesser extent the Bakken region. The more recent pressure appears to be reflective of growing concerns over the Wuhan virus outbreak, and the potential hit may have on growth. President Donald Trump, in Davos described U.S. as being in energy revolution that has reawakened the powerful machinery of U.S. enterprise, encouraging U.S. shale producers to crank out even more oil than the current record high of 13 Mbpd in order to retain country’s energy independence. Crude oil may dip lower towards 4000 while facing resistance near 4300. Libya's National Oil recently declared force majeure on the loading of oil from two major oil fields after the latest development in a long-running military conflict saw forces loyal to commander Khalifa Haftar ordering the shutdown of facilities in the east and south of the country. Natural gas can remain on weaker bias and may test 120 by taking resistance near 150. U.S. natural gas futures dropped to a fresh three-year low below key level of $2 on forecasts for mild winter weather through early February, despite record liquefied natural gas (LNG) exports and signs of a production slowdown. The weather in the U.S. Lower 48 states so far this winter has been much milder than usual with average daily temperatures three degrees Fahrenheit higher than normal in December last year.

Cotton futures (Feb) is expected to trade sideways in the range of 19920- 20300 levels. The downside may remain capped as the arrivals coming to the spot markets are on the lower side. Total new crop arrivals so far this 2019-20 season have reached 1,48,56,000 bales, down 5.14 percent from 1,56,61,000 bales arrived during the same period last year. On the international market, traders and farmers are keeping a close eye on China's demand following the initial trade deal between the United States and China. Further on the subject of the New Year in China, the nation has not yet made any significant purchases of US agricultural commodities since the signing of the Phase One agreement, and it seems that they are now unlikely to do so before the first week in Feb. Chana futures (Mar) is likely to fall further towards 4000-3900 levels. Sentiments are constantly under pressure due to progress in Rabi Chana sowing and Government holding major stocks. Even steady arrivals of new domestic Chana are being witnessed in spot markets of Karnataka and Maharashtra that will continue to pressurize chana prices in short term. The buyers are also on the sidelines and demand in chana dal and besan from wholesaler, retailer counters has been reported slack. Mentha oil futures (Jan) may go down further to test 1200-1190 levels. At present, fresh arrivals are coming onto the spot markets from Madhya Pradesh. Moreover, the sowing for the new season is expected to commence from next month and the market participants are expecting that the acreage is likely to be higher this season.

Base metal counter may remain on mixed path. Copper may recover towards 460 levels while taking support near 440 levels. Copper inventories in London Metal Exchange-registered warehouses jumped by a third overnight, providing a boost to supplies in LME depots after months of erosion. The global world refined copper market showed a deficit of 33,000 tonnes in October, down from 89,000 tonnes in September. Meanwhile, lead may remain sideways and may move in the range of 149-156 levels. Zinc may take support near 179 levels and can recover towards 190. Stocks of zinc in LME warehouses are close to 20-year lows at about 50,000 tonnes, having been on a downtrend since October 2015. Visible inventories including those on the LME, in warehouses monitored by the ShFE and those held by producers are estimated at about 1.1 million tonnes. Meanwhile worries about nearby availability of zinc on the LME market has pushed cash metal to a premium of nearly $20 a tonne over the 3 months, having been at a discount in December. Nickel prices can move with sideways bias as it may face resistance near 1060 while taking support near 1000 levels. The China Iron and Steel Association recently forecasted that Chinese steel demand of about 890 million tonnes for 2020, up 2% from 2019. Aluminium prices can recover towards 147 levels by taking support near 138 levels. China estimate of national output last year was 35.8 million tonnes, slightly higher than the official assessment of 35.0 million tonnes released by the National Bureau of Statistics.

10

|

CRUDE MCX (FEB) contract closed at Rs. 4048.00 on 22nd Jan’2020. The contract made its high of Rs. 4663.00 on 06th Jan’2020 and a low of Rs. 3965.00 on 23rd Jan’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 4195. On the daily chart, the commodity has Relative Strength Index (14-day) value of 31.889.

One can buy between Rs. 3870-3900 for a target of Rs. 4180 with the stop loss of Rs. 3810.

NICKEL MCX (FEB) contract closed at Rs. 995.50 on 22nd Jan’2020. The contract made its high of Rs. 1051.20 on 23rd Dec’19 and a low of Rs. 982.80 on 02nd Dec’19. The 18-day Exponential Moving Average of the commodity is currently at Rs. 1016.27. On the daily chart, the commodity has Relative Strength Index (14-day) value of 39.897.

One can sell near Rs. 1020 for a target of Rs. 960 with the stop loss of Rs. 1050.

REF SOYA NCDEX (FEB) contract was closed at Rs. 882.80 on 22nd Jan’2020. The contract made its high of Rs. 950.00 on 30th Dec’19 and a low of Rs. 803.10 on 26th Nov’19. The 18-day Exponential Moving Average of the commodity is currently at Rs. 899.30. On the daily chart, the commodity has Relative Strength Index (14-day) value of 42.947.

One can sell between Rs. 890-895 for a target of Rs. 860 with the stop loss of Rs 905.

11

• The DGCX announced that it broke its annual volumes and AOI records last year, making 2019 its most successful year since launch. The Exchange traded 23.06 million contracts in 2019 , beating its previous record of 22.26 million contracts traded in 2018.

• Global aluminium production fell by 1.0% last year in its first annual contraction since the Global Financial Crisis in 2009.

• The global nickel market deficit tightened to 1,266 tonnes in November 2019 from a revised shortfall of 3,077 tonnes in the previous month, the International Nickel Study Group (INSG) stated.

• Ivory Coast produced a record 32.478 tonnes of gold in 2019, up 35% from 24.06 tonnes in 2018.

• U.S. homebuilding surged to a 13-year high in December as activity increased across the board.

• BP has pulled out of Iraq's giant Kirkuk oilfield after its $100 million exploration contract expired with no agreement on the field's expansion.

• China's refined copper output rose 11.6% year-on-year in December to a monthly record high of 930,000 tonnes. Output for the whole of 2019 rose 10.2% yearon-year to 9.78 million tonnes- the National Bureau of Statistics (NBS).

• The China Iron and Steel Association recently forecast Chinese steel demand of about 890 million tonnes for 2020, up 2% from 2019.

CRB travelled in a slim spread in the week gone by as investors were in fix amid mix triggers. The U.S. dollar was only marginally up despite concerns surrounding the coronavirus outbreak in Wuhan. The virus, which causes a type of pneumonia, has spread to multiple countries outside China, including the U.S. and Japan. The safe-haven metal gold gained earlier this week as some fear a potential virus outbreak could weaken tourist visits during the upcoming key Chinese holiday period. In later part of the week it traded in range. Oil prices dropped as the International Energy Agency's (IEA) forecast of a market surplus in the first half of this year was enough to cancel out concerns about military disruptions that have slashed Libya's crude output. About 95% of Libya’s oil supply could be at risk, yet crude traders are barely alarmed, underscoring the market’s bigger worries over the mammoth recent builds in U.S. fuel supplies. Base metals traded mix on their own fundamentals. Amid mild weather conditions, natural gas prices broke through a months-long consolidation to crumble to the lowest level since 2016. Copper, lead and nickel prices were down whereas zinc and aluminium prices flared up. Copper consumption outside of China fell 2% in the first 10 months last year. Demand in China offset a global decline and apparent usage worldwide edged 0.2% higher over the same period, ICSG said in a report. Even a larger than expected decline in inventories last week could not prevent the collapse.

In spices, turmeric prices were bearish on quality issue. The quality is inferior due to cold weather just before the harvest. Also, the demand is thin in ready markets and traders are also focusing on the higher moisture levels. Bearish sentiments persisted in whole oilseeds complex in domestic as well as in the international markets amid cautiousness around the uncertainty of soybean imports by China from U.S & back at home, the improving prospects of oilseeds production this Rabi season. It was only CPO which saw some short covering amid trade tussle with Malaysia. If India’s refined imports from Malaysia drops from about 2.6 million tons a year to reach to 2018 levels, about 2 million tons of Malaysian processed products worth $1.4 billion may need new buyers. Many Indian palm oil buyers have started shifting to Indonesia amid concerns that Modi’s government may restrict purchases from Malaysia or hike import taxes. Cotton counter was weak amid lower buying from mills as well as exporters amid a downtrend in the global market.

|

|

12

|

|

After killing of Iranian IRGC leader Soleimani and the Iranian missile retaliation, oil prices, which had spiked on the risk of an all-out war between the US and Iran and the possible fallout of oil and gas production in the region, are now falling back to pre-Soleimani assassination levels as the U.S. President Donald Trump said to impose sanctions on Tehran instead of another military strike. The attacks did not destroy major energy infrastructure of Iraq that could have disrupted global crude supply but the situation remains volatile and the likelihood of possible strikes on tankers or oil facilities in the region remains. Even if no direct war is expected, the conflict is not over. The current status of the conflict is like a smoldering peat-fire. You can feel the heat but you don’t see the flames.

Despite no direct conflict between both sides, a proxy war via Hezbollah, Hamas or the proIranian Shi’a militias in Iraq, against the main oil and gas operations of Western and Arab national oil companies will continue to plague the region, and these conflicts could escalate further if Iran continues its current nuclear program. Tehran could escalate the proxy war by Hezbollah or Hamas.

However OPEC added that there is no risk of an oil shortage if hostilities do flare up. OPEC reiterated that they don’t see any risk that Iran will close the Strait of Hormuz. There’s so much oil in the market right now that a single disruption, or even a small series of disruptions in the Middle East, doesn’t impact the world supply. However, OPEC’s confidence that there is enough spare capacity in the market is a political statement to quell existing fears. The spare capacity of OPEC at present is almost totally in the hands of two main players, Saudi Arabia and the UAE, while the rest of the members are struggling to reach even their own set targets. In case of a military confrontation between Iran (or proxies) and the US, a real possibility exists that total OPEC spare capacity is taken out. Although U.S. shale production and Brazilian production has gone up, no other producer could substitute a possible loss of Saudi Arabia's production. Earlier, Abqaiq attack in September 2019 had disrupted a capacity of 5.7 million barrels per day of light crude.

India gets about 40% of oil from the Middle East and 20% from Iraq. India switched to Iraq when they lost Iran and Venezuela because of the U.S. sanctions. India may not face crude oil shortage if the tensions in the Middle East escalate even to a war, as many countries such as Saudi Arabia, or other Middle East countries can assure supplies to the country. However, increase in prices could affect India's fiscal deficit and consumer price index in the long run.

Although the risk of escalation in oil prices seems to be fading, but the current risks in the Middle East, The East-Mediterranean and Libya cannot be ignored. The above scenarios could all have a detrimental impact on oil and gas production and exports from the middle-east as Just the fear of disruption of Iraqi oil supply has caused a shock in the world’s oil markets.

13

|

| 20th JAN | The IMF slashed India’s growth forecast by 1.3 percentage points to 4.8% for 2019-20. |

| 21th JAN | The US Senate rejected Democratic bids to subpoena documents on the first day of the impeachment trial of Donald Trump. |

| 21th JAN | The Bank of Japan nudged up its economic growth forecasts and was cautiously optimistic about the global outlook. |

| 22nd JAN | Asian currencies drifted lower amid fear of spread of Coronavirus. |

| 22nd JAN | Sterling lifted higher after UK CBI Manufacturing Order Book Balance improved to -22 vs. -23 expected |

Indian Rupee continued the negative streak in this week as Importers led buying of greenback pushed rupee to fell below 71.00. Notably in Davos summit, IMF downgraded global growth in 2020, highlighting the drag came from India's revised down growth in 2019. Although some modest green shoots can be found from domestic economic data - IIP printed well in November and business surveys in Manufacturing as well as services rose highest in December after several months of lags. Admittedly such green shoots will lead upward pressure in core inflation which may lead RBI to switch to tightening phase quickly than expected which is again another check for rupee to remain negative. From China, sudden concerns about an outbreak of Sars-like coronavirus spook the Asian currencies. Meanwhile sterling pared last week losses after UK job markets strengthen in the three months to the end of November easing concerns over the state of the economy and a possible interest rate cut. The rise in employment could convince policymakers to delay any change in interest rates until March when they will have more information about the post-election economic trends in their upcoming meet next week.

USDINR is likely to stay above 71.00 and move higher towards 71.80 in the next week

|

USD/INR (JAN) contract closed at 71.1600 on 22nd Jan 2020. The contract made its high 71.2900 on 21nd Jan 2020 and a low of 71.0800 on 20nd Jan 2020 (Weekly Basis). The 14-day Exponential Moving Average of the USD/INR is currently at 71.53.

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 45.11. One can buy at 71.20 for the target of 71.90 with the stop loss of 70.90.

EUR/INR (JAN) contract closed 79.0300 on 22nd Jan 2020. The contract made its high of 79.2175 on 21nd Jan 2020 and a low 78.9325 on 20nd Jan 2020 (Weekly Basis). The 14-day Exponential Moving Average of the EUR/INR is currently at 79.30.

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 41.84. One can buy at 78.80 for a target of 79.50 with the stop loss of 78.50.

GBP/INR (JAN) contract closed at 93.1900 on 22nd Jan 2020. The contract made its high of 93.2657 on 22nd Jan 2020 and a low of 92.2000on 21nd Jan 2020 (Weekly Basis). The 14-day Exponential Moving Average of the GBP/INR is currently at 93.17.

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 53.34. One can buy at 93.20 for a target of 94.30 with the stop loss of 92.80.

JPY/INR (JAN) contract closed at 64.8375 on 22nd Jan 2020. The contract made its high of 64.8850 on 21nd Jan 2020 and a low of 64.5700 on 20nd Jan 2020 (Weekly Basis). The 14-day Exponential Moving Average of the JPY/INR is currently at 65.05.

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 45.51. One can buy at 64.80 for a target of 65.80 with the stop loss of 64.50

14

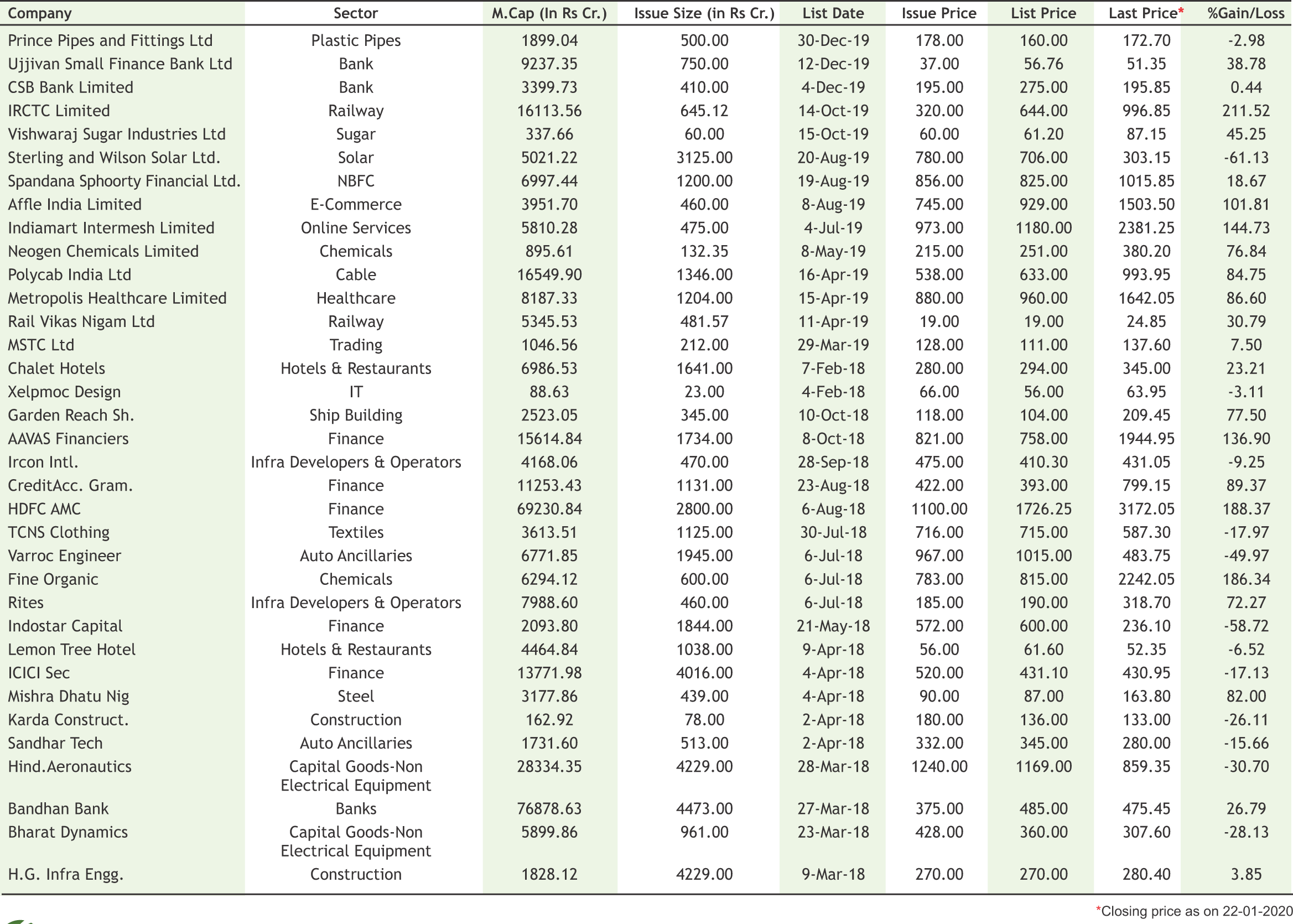

ITI sets price band at Rs 72-77 per share for Rs 1,400cr FPO

State-owned telecom technology Company ITI on January 22 has fixed the price band of Rs 72-77 for its follow-on or further public offering (FPO). The issue, which will open for subscription on January 24, comprises a fresh issue of up to 18 crore equity shares and additional issue of up to 18 lakh to be reserved for eligible employees. "The board of directors approved the minimum bid lot for further public offer at 150 equity shares and in the multiples of 150 equity shares thereafter," ITI said in its BSE filing. The company is aimed to raise Rs 1,399.86 crore at the higher end of price band through the public issue which will close on January 28. The funds raised through FPO will be utilised for funding its working capital requirements as well as repayment of existing debt. ITI clocked a turnover of Rs 919 crore and a PAT of Rs 168 crore in Q3FY20. It has an order book of Rs 11,051 crore, including large turnkey projects and AMCs.

IRFC files IPO draft papers with Sebi

Indian Railway Finance Corporation has filed draft papers with markets regulator Sebi for its initial public offering (IPO). The public issue is of up to 140,70,69,000 equity shares of which up to 93,80,46,000 equity shares are fresh issue, and up to 46,90,23,000 equity shares are offer for sale, according to the draft red herring prospectus (DRHP). The net proceeds from the offer are proposed to be utilised towards augmenting the company's equity capital base to meet future capital requirements arising out of growth in business and general corporate purposes, it said. IDFC Securities, HSBC Securities and Capital Markets (India), ICICI Securities and SBI Capital Markets are the book running lead managers to the issue.

CAMS files IPO papers with SEBI, may raise Rs 1,600 crore

Computer Age Management Services (CAMS), the financial infrastructure and services provider to the mutual fund industry, has filed its draft red herring prospectus (DRHP) with capital markets regulator Securities and Exchange Board of India (SEBI) for its initial public offering (IPO) on January 9. The public issue consists an offer for sale (OFS) of 1,21,64,400 equity shares by the Great Terrain Investment Ltd (an affiliate of Warburg Pincus), NSE Investments, Acsys Investments, HDFC and HDB Employees Welfare Trust. The issue includes an eligible employee reservation of up to 1.5 percent of the post-offer paid-up equity share capital. The AUM of equity mutual funds serviced by CAMS grew from Rs 2,18,000 crore as of March 31, 2015 to Rs 6,64,300 crore as of March 31, 2019, at a CAGR of 32.1 percent, and as of September 30, 2019 was Rs 6,70,100 crore. The book running lead managers to the offer are Kotak Mahindra Capital Company, HDFC Bank, ICICI Securities and Nomura Financial Advisory and Securities (India).

|

15

|

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

Mutual funds add 68 lakh folios in 2019

Mutual fund industry added 68 lakh folios in 2019 taking the total tally to 8.7 crore, which suggests investors' understanding about market risks associated with such schemes. According to the data, the number of folios with 44 fund houses rose to 8.71 crore at the end of December 2019 from 8.03 crore at the end of December 2018, registering a gain of 68 lakh folios. In comparison, over 1.38 crore investor accounts were added in 2018, more than 1.36 crore in 2017, nearly 70 lakh in 2016 and close to 56 lakh in 2015, data available with markets regulator Sebi showed. The number of folios under equity and equity-linked saving schemes rose by 12.75 lakh to 6.25 crore at the end of December 2019, which is much lower than 1.2 crore added in the preceding year. Debt-oriented scheme folios count dropped by 43 lakh to 71 lakh. The number of investors' account stood at 1.13 crore. Assets under management (AUM) of the industry rose by over 13 per cent (Rs 3.15 lakh crore) to Rs 26.77 lakh crore at the end of December, up from Rs 23.62 lakh crore at the end of December 2018 on the back of measures taken by regulator Sebi for boosting investor confidence.

Axis MF becomes third fund house to launch ESG fund

Axis Mutual Fund will be launching Axis ESG Equity Fund on January 22, which will remain open until February 5, the fund house announced on January 20. Currently, SBI Mutual Fund and Quantum Mutual Fund offer this scheme. The open-ended multicap scheme will be investing in companies demonstrating sustainable practices across environment, social and governance theme. The scheme will invest up to 30 percent in global sustainable companies. The scheme will exclude sectors/themes that are deemed harmful from a societal perspective. For instance, exclude tobacco, liquor and defence stocks. The fund will be managed by head of equities Jinesh Gopani, and Hitesh Das, who will manage investments in foreign securities. The minimum investment in the fund is Rs 5,000 and in multiples of one rupee thereafter and the fund will be benchmarked against Nifty 100 ESG TRI Index.

17

|

|

|

|

|

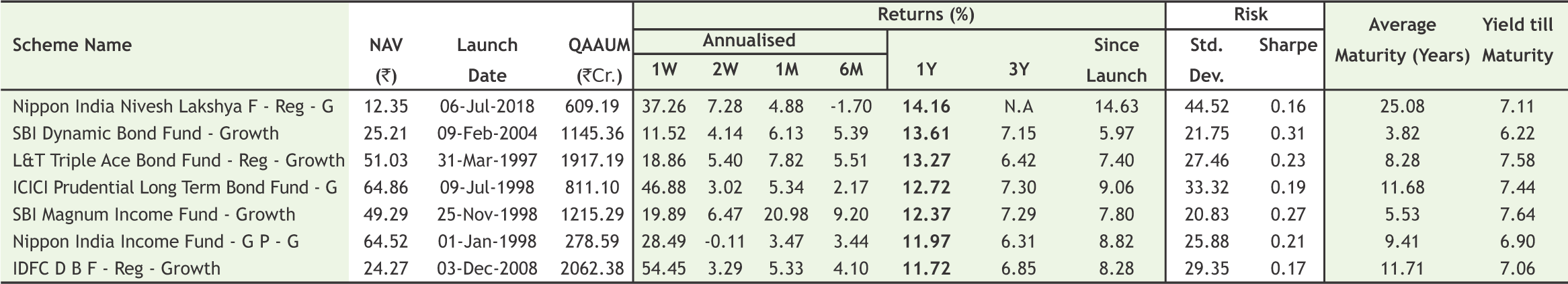

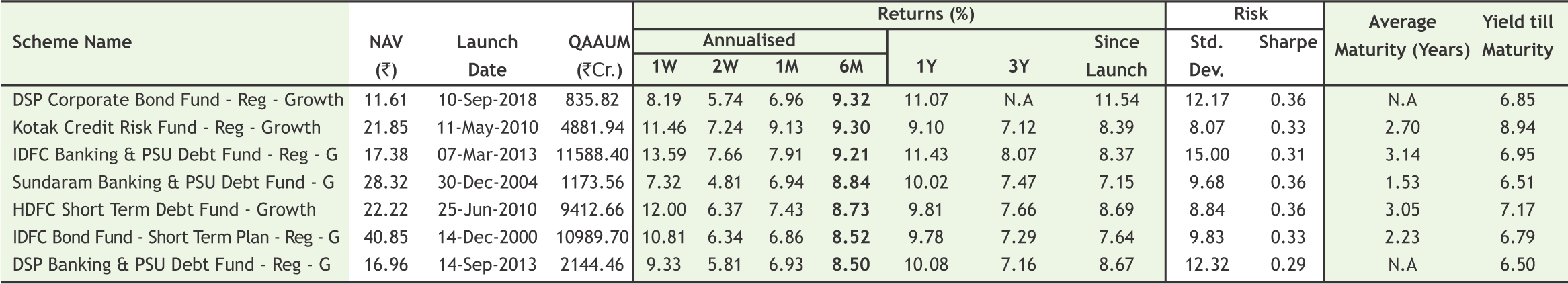

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

18

Dr. D K Aggarwal (CMD, SMC Investments & President, PHDCCI) during the meeting with Shri Ajay Bhushan Pandey, Revenue Secretary, Government of India on 11th December, 2019 at New Delhi.

Mr. Pulin Behari Das (Vice President, SMC Global Securities Ltd.) and Mr. Smruti Ranjan Sahoo (Area Manager, SMC Global Securities Ltd.) during the inauguration of SMC's New Branch at Sambalpur, Odisha.

Zumba session organised for SMC Employees at SMC Insurance Noida Branch.

![]() Customized Plans

Customized Plans

![]() Comprehensive Investment Solutions

Comprehensive Investment Solutions

![]() Long-term Focus

Long-term Focus

![]() Independent & Objective Advise

Independent & Objective Advise

![]() Financial Planning

Financial Planning

Call Toll-Free 180011 0909

Visit www.smcindiaonline.com

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in