2020: Issue 724, Week: 24th - 28th February

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2020: Issue 724, Week: 24th - 28th February

A Weekly Update from SMC (For private circulation only)

NEY

NEY

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

| IPO | 15 |

| FD Monitor | 16 |

| Mutual Fund | 17-18 |

I

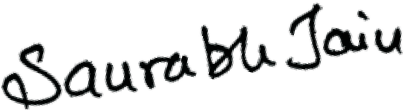

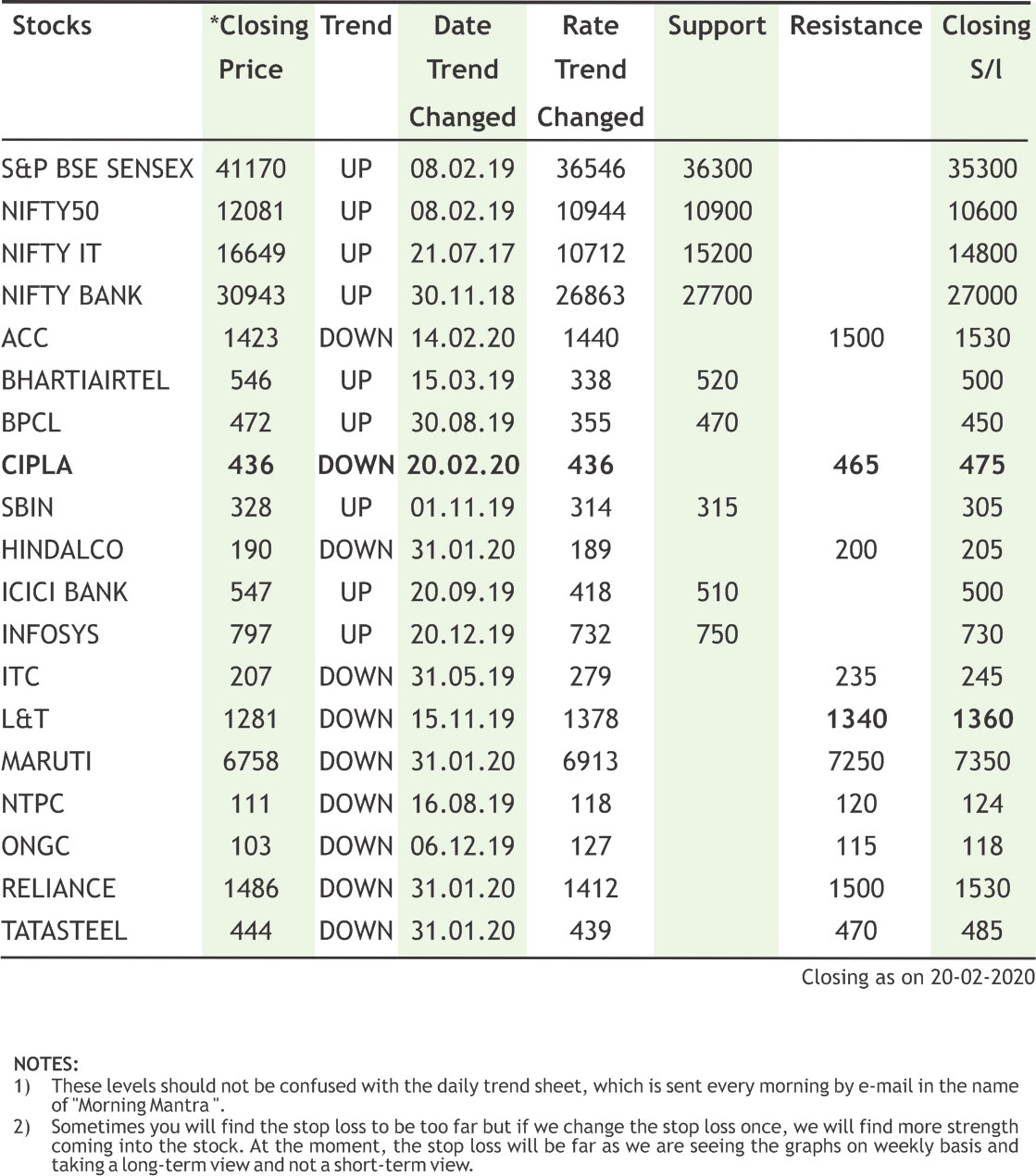

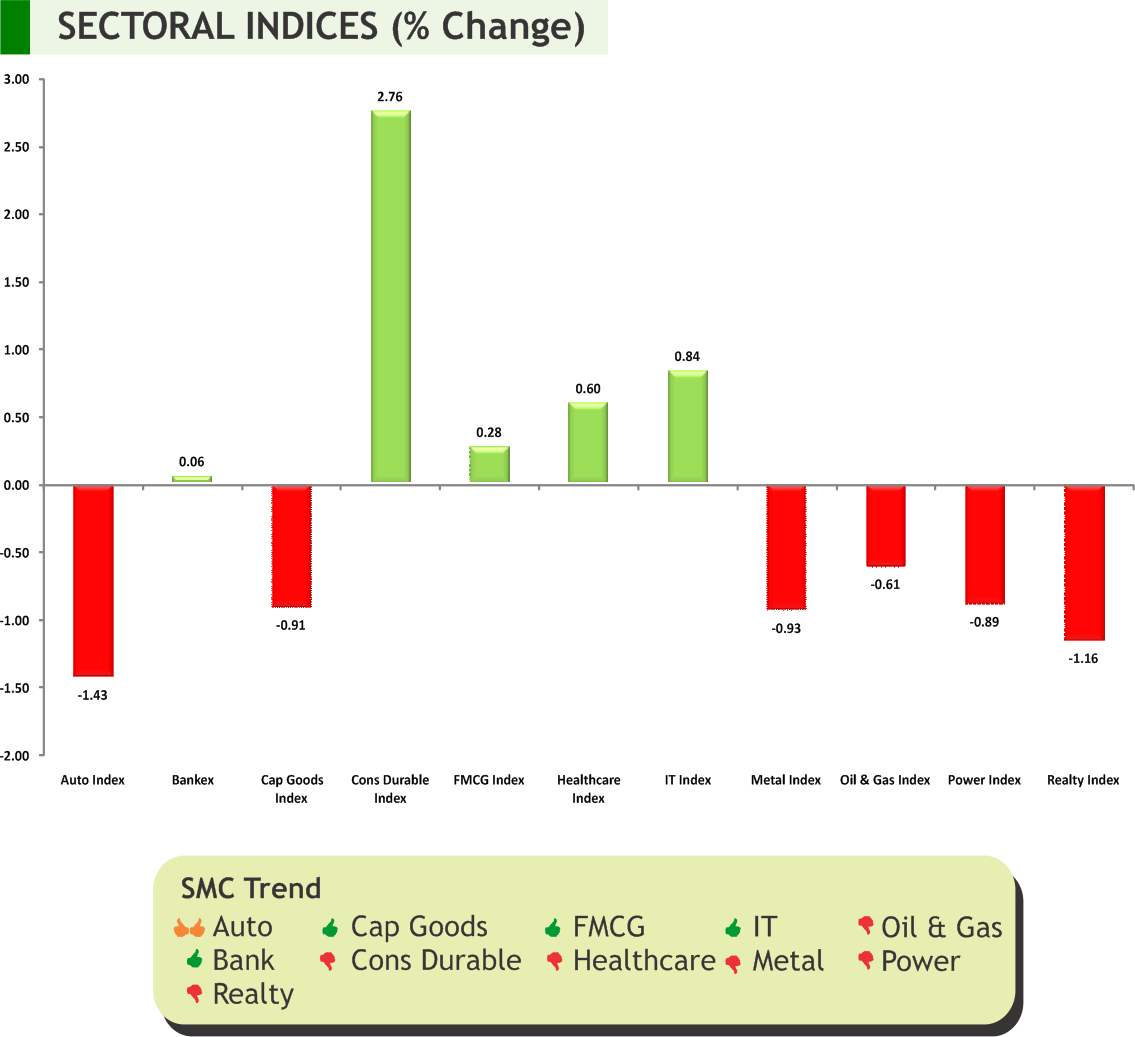

n the week gone by, market looked optimistic that China would take more I measures to prop up its economy which eased concerns about the economic impact of the coronavirus epidemic. In line with the expectation, China cut the benchmark lending rate on Thursday, as the authorities move to lower financing costs for businesses and support an economy hit by a fast-spreading coronavirus epidemic. Meanwhile, Federal Reserve policymakers were cautiously optimistic about their ability to hold interest rates steady this year, minutes of the central bank’s last policy meeting showed, even as they acknowledged new risks caused by the coronavirus outbreak.

Back at home, domestic market got cheered after the Finance Minister announced that the government would announce measures to tackle the financial fallout from the coronavirus outbreak amid a fall in new cases in China. Actually, investors have been engaged in a tug of war between bullish and bearish camps about what the virus could do to business activity both in hard-hit areas like China and elsewhere across the globe. In another development, Union Cabinet has approved Rs. 4600 crore for dairy farming as also the benefit under subvention scheme have been hiked to 2.5% and this is likely to give some boost to the rural sector. The recent December-quarter corporate earnings season was a mixed bag with a slightly cautious tone from the management of the companies. Undoubtedly Corporate tax rate cuts continued supporting earnings growth. However, there is a fear among investors that supply disruptions due Coronavirus spread could weigh on March quarter results. Ratings agency Moody's has slashed its 2020 growth projection for India to 5.4% from 6.6% forecast earlier on the back of slower recovery, citing largely domestic factors and cautioning that global economy will be adversely impacted by the novel coronavirus outbreak. Going forward, besides, other factors such as crude oil prices, rupee movement, inflow and out flow of the FII’s and DII’s fund, market will continue to keep a close watch on rising coronavirus cases in China.

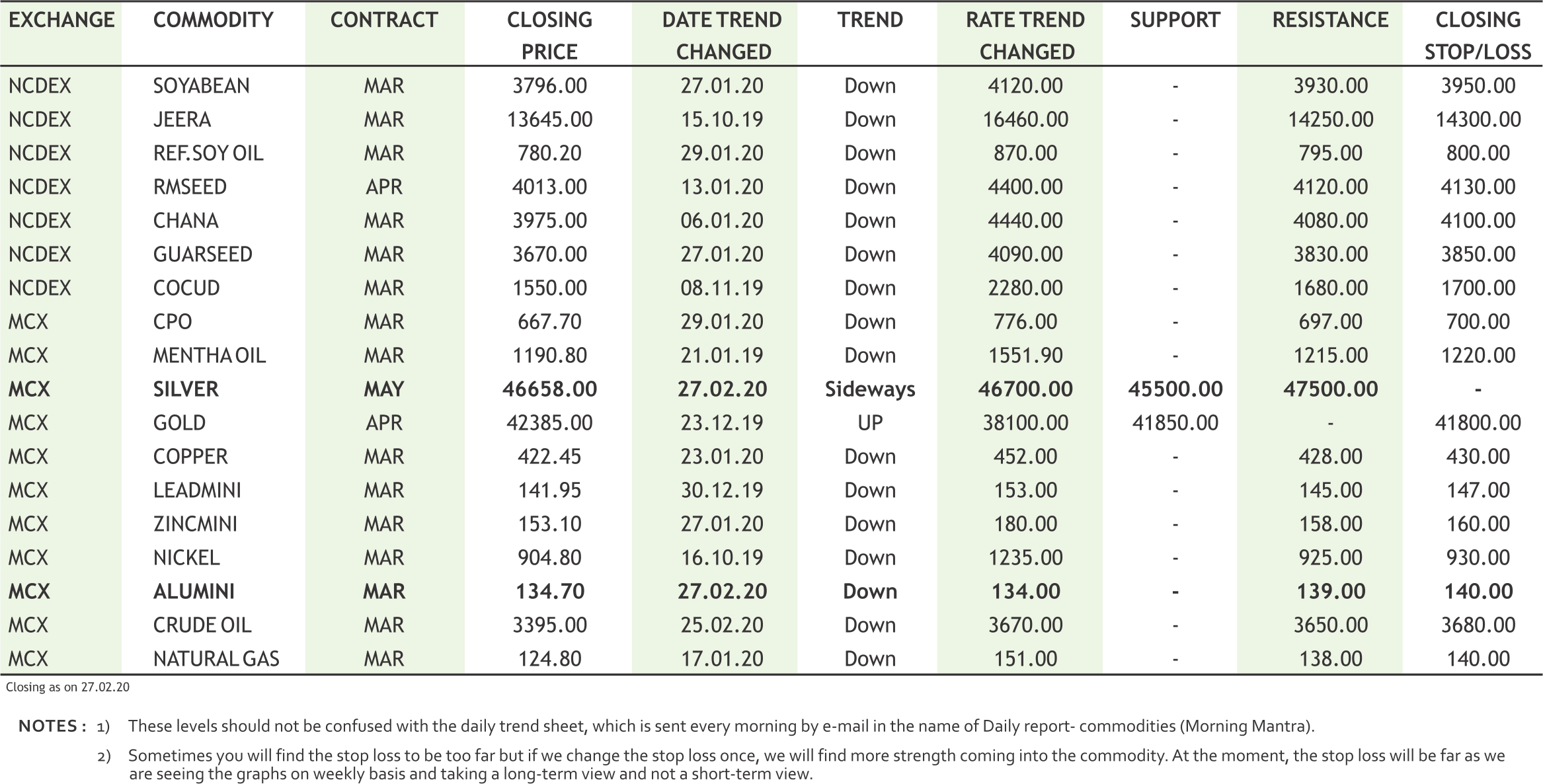

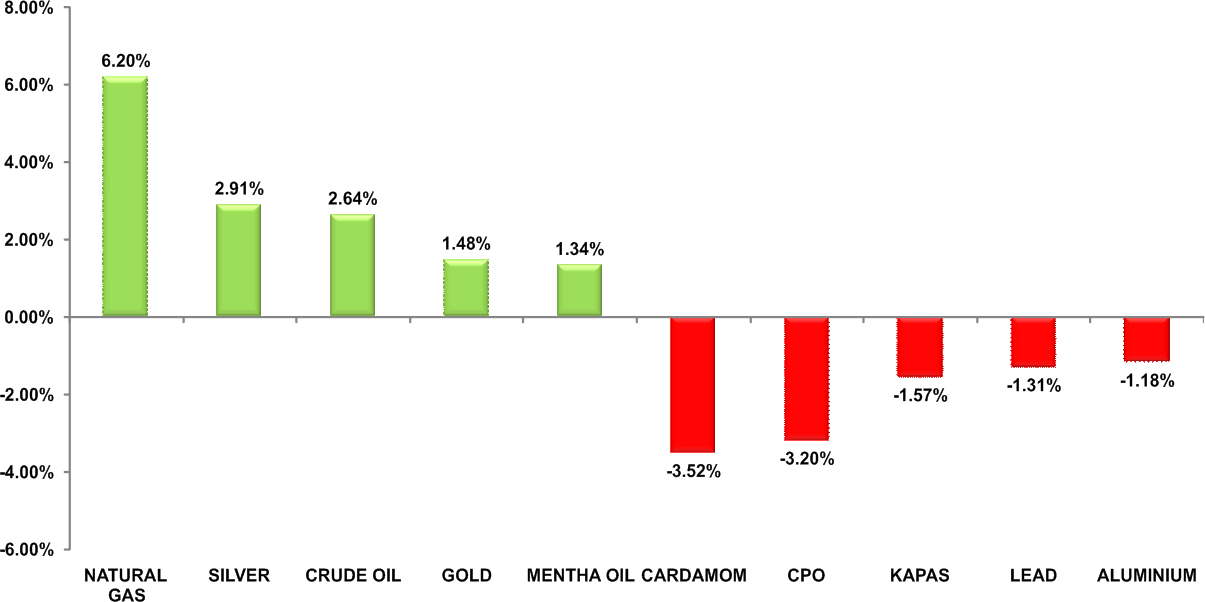

On the Commodity market front, CRB gained for continuous second week as the fear of coronavirus faded to some extent. Gold prices hit a seven-year high on last Wednesday on expectations of further monetary policy easing to cushion the economic impact of the Covid-19 outbreak. Bullion counter may continue its upside momentum as yellow metal continued to hover around its seven year peak in COMEX midst panic regarding coronavirus outbreak as central banks prepare more easing measures to prop up sagging economies. Gold may move towards 42200 levels while taking support near 41000 levels and silver can test 49000 levels while taking support near 46200 levels. Crude oil prices may extend its bounce back as its prices are getting lift from news of U.S. sanctions on Russia Rosneft firm and Libya continuous output cut reducing the supply glut pressure from the markets. Crude oil may recover towards 4000 while taking support near 3660. Base metal counter may remain weak but short covering at lower levels can be seen. ECB's Lagarde Speaks at ECB and Its Watchers Conference, CPI, Consumer Confidence Index¸ Durable Goods Orders and GDP of US etc are strong triggers for commodities market this week.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Information Technology

• HCL Technologies announced that it will open a Global Delivery Center (GDC) in Hartford, Connecticut to offer digital transformation services to clients in the smart manufacturing, insurance, aerospace, and defense industries. With the GDC, HCL will invest in the area and create local jobs with the help of a strong ecosystem regionally and at the state level.

• HCL Technologies announced a new large contract with New Zealand dairy co-operative Fonterra to modernise and manage the entire technology infrastructure Fonterra employees around the world use every day. The multi-year partnership with HCL Technologies will consolidate Fonterra's technology suppliers and bring together the Coop's IT infrastructure services under one umbrella.

• Tata Elxsi has partnered with Tata Motors in developing their unified Connected Vehicle Platform that powers the Nexon EV range of electric cars. With a collaborative approach, Tata Motors & Tata Elxsi developed a cloud based IoT Platform which provides Tata Motors with a common standard technology stack that delivers the scalability and high performance required to support the entire range of electric, commercial and passenger vehicles.

Cables

• Sterlite Technologies has secured new orders worth Rs 1500 crore in 2020 so far. These orders have ranged from continued business development in its core areas of optical connectivity solutions and network services to emerging areas such as software virtualization.

Pharmaceuticals

• Aurobindo Pharma has received Establishment Inspection Report (EIR) with Voluntary Action Initiated (VAI) status from USFDA for its Unit IV, a general injectable formulation manufacturing facility of the company.

Capital Goods

• Havells India launched country’s first intelligent Fan - Carnesia-I with smart mode. The new fan is one of the most technologically advanced - IoT fan that will add convenience and comfort to consumer’s fastpaced life. The intelligent fan range comes at an attractive consumer price of approx. Rs 4500.

Power

• As a part of its strategic plan to grow and maintain leadership in the renewable energy sector, Tata Power has now expanded its rooftop solar services to 70 cities across the country. Tata Power Solar, a wholly-owned subsidiary of Tata Power, has been the market leader in rooftop segment for six years now.

Healthcare

• Thyrocare Technologies announced the launch of cancer screening profile. This consists of Easycheck360™, a cancer screening test for early detection of Datar Cancer Genetics and Thyrocare's popular wellness profile Aarogyam which is available for Rs 8999.

Construction

• Sadbhav Infrastructure Projects (SIPL) announced that lndlnfravit Trust has completed the acquisition of six out of nine operational NHAI road projects (BRTPL, DPTL, HYTPL, SUTPL, NSEL and BHTPL) of the company for total equity value of Rs 1891 crore.

INTERNATIONAL NEWS

US housing starts slumped by 3.6 percent to an annual rate of 1.567 million in January after soaring by 17.7 percent to a revised rate of 1.626 million in December. Economists had expected housing starts to tumble by 11.4 percent to a rate of 1.425 million from the 1.608 million originally reported for the previous month.

• US producer price index for final demand climbed by 0.5 percent in January after rising by 0.2 percent in December. Economists had expected producer prices to inch up by 0.1 percent.

• US business inventories inched up by 0.1 percent in December after slipping by 0.2 percent in November. The uptick in inventories matched economist estimates.

• Eurozone construction output dropped 3.1 percent month-on-month in December, after a 0.7 percent rise in November. In October, output fell 0.7 percent. The decline was driven by a 3.6 percent decrease in building construction and a 1.4 percent fall in civil engineering.

• The value of core machine orders in Japan was down 12.5 percent on month in December - coming in at 824.8 billion yen. That missed forecasts for a decline of 8.9 percent following the 18.0 percent surge in November.

• China's central bank cut the interest rate on medium Term loans to lessen the impact of the novel coronavirus, or Covid-19, outbreak on the economy. The People's Bank of China reduced the medium term lending facility, or MLF, by 10 basis points to 3.15 percent.

|

|

4

5

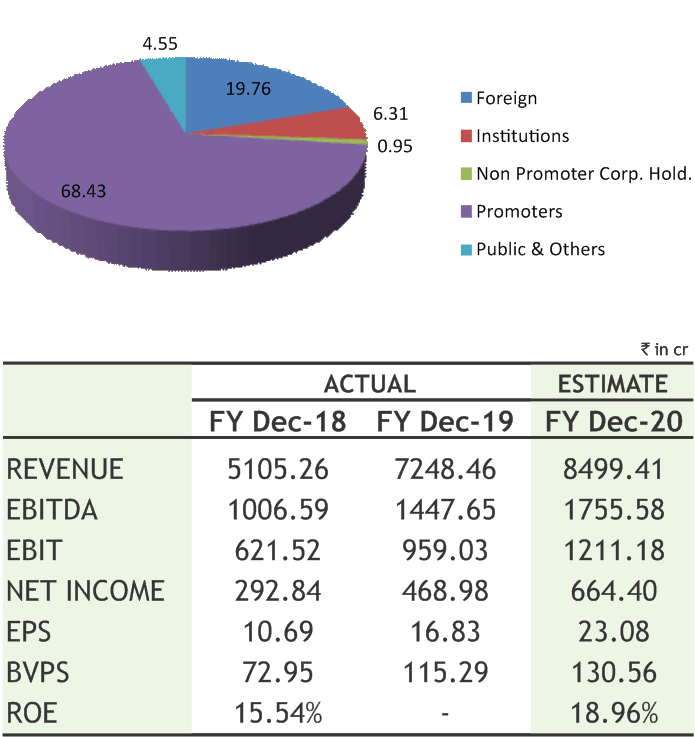

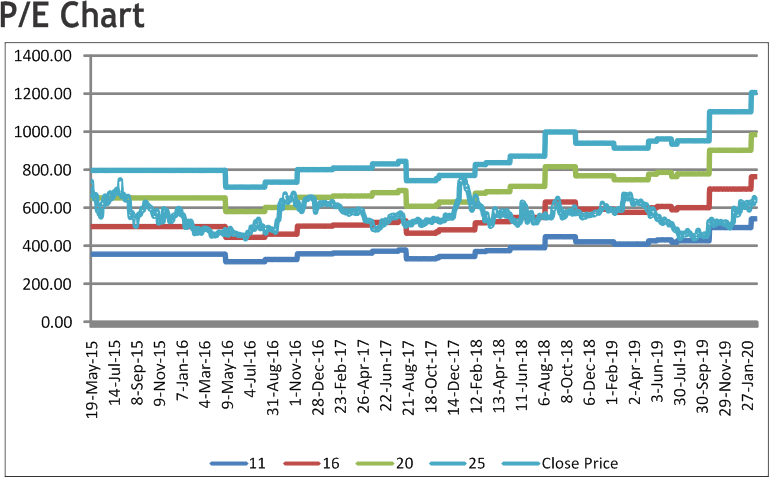

Varun Beverages Limited

CMP: 819.25

Target Price: 1062

Upside: 30%

| Face Value (Rs.) | 10.00 |

| 52 Week High/Low | 869.95/512.29 |

| M.Cap (Rs. in Cr.) | 23650.82 |

| EPS (Rs.) | 16.25 |

| P/E Ratio (times) | 50.42 |

| P/B Ratio (times) | 7.11 |

| Dividend Yield (%) | 0.32 |

| Stock Exchange | BSE |

Investment Rationale

• Varun Beverages Limited (VBL) is a key beverage player. It has presence across 6 countries, 3 in the Indian Subcontinent (India, Sri Lanka, Nepal) contributing 80% to revenues, while 3 in Africa (Morocco, Zambia and Zimbabwe) contributing 20%.

• It is one of the largest franchisee of PepsiCo in the world (outside USA). The company produces and distributes a wide range of carbonated softdrinks (CSDs), as well as a large selection of non-carbonated beverages (NCBs), including packaged drinking water sold under trademarks owned by PepsiCo.

• It has acquired franchise rights for southern and western India territories from PepsiCo and third party franchisee w.e.f. from February 2019 and May 2019, respectively. Hence, its market share has been increased to about 82% from 51% earlier.

• During CY19, it has delivered a top line growth of 40%, EBITDA growth of 44%, and PAT growth of 58% in 2019. The performance was primarily driven by robust volumes reported in both the Indian and International markets.

• The management of the company expects that the company would continue to build upon key position in the beverage industry with presence in the fast growing markets, solid infrastructure and a well-entrenched distribution network. Furthermore, the company is constantly looking at opportunities to innovate and upgrade product portfolio to tap the shift in consumer preferences across existing and new markets.

• Total sales volumes were up 44.9% YoY at 492.7 million cases as compared to 340 million cases in CY 2018. Further, organic volume growth for the full year stood at 17.2% supported by robust performance in India (Organic Growth 13.1%) as

well as International territories (Organic Growth 34%). Morocco, Zimbabwe and Sri Lanka have all grown in double digits during the year

• During the Q4CY19, consolidated revenue from operations jumped 54.14% to Rs 1239.53 crore as compared to Rs 804.13 crore reported in Q4 December 2018. It has reported a 142.2% jump in consolidated EBITDA to Rs 115.74 crore.

Risk

• Changes in regulations and customer preferences

• Competition

Valuation

According to the management, recent acquisitions of rights of PepsiCo India would benefit and make able to successfully integrate and increase profitability of the company. Moreover, it is expected that realizations would increase driven by manufacturing of Tropicana juices and the recently launched dairy based beverages. Thus, it is expected that the stock will see a price target of Rs.1062 in 8 to 10 months time frame on a expected P/Ex of 46x and CY20 EPS of Rs.23.08.

Aarti Drugs Limited

CMP: 673.90

Target Price: 838

Upside:24%

| Face Value (Rs.) | 10.00 |

| 52 Week High/Low | 705.00/419.30 |

| M.Cap (Rs. in Cr.) | 1570.19 |

| EPS (Rs.) | 48.28 |

| P/E Ratio (times) | 13.96 |

| P/B Ratio (times) | 2.76 |

| Dividend Yield (%) | 0.17 |

| Stock Exchange | BSE |

Investment Rationale

• Aarti drugs limited (ADL) is engaged in the manufacturing of Active Pharmaceutical Ingredients (APIs), Pharma Intermediates and Specialty Chemicals with its wholly-owned subsidiary- Pinnacle Life Science Private Limited. Products under APIs include Ciprofloxacin Hydrochloride, Metronidazole, Metformin HCL, Ketoconazole, Ofloxacin etc. whereas Specialty Chemicals includes Benzene Sulphonyl Chloride, Methyl Nicotinate etc .

• It has 11 manufacturing facilities of which nine manufacturing facilities are located at Tarapur, Maharashtra and two manufacturing facilities at Sarigam, Gujarat. It has also got approval from WHO-GMP, EUGMP, accreditation from JAPAN, IDL, ANVISA, ISO, TGA Australia, COFEPRIS and COS. ADL has a strong product portfolio of about 121 products of which top 5 products (API) contribute to 50.80% of FY19 sales and top 10 products contribute 73.08% of sales in FY19.

• On the development front, it has recently expanded its anti-diabetic capacity and currently scaling up its production quantities for the same. Further brown field CAPEX would be done in the current financial year to expand few capacities in anti-inflammatory therapeutic category. Exports markets are slowly opening up for formulation division and as per management view, it would drive the margins for that division.

• It has diversified client base, including most of the major pharmaceuticals players in India, European and Gulf countries. Domestic sales account for 48% of total sales followed by exports to regulated market at 43% and around 9% to unregulated markets.

• In the December FY20 quarter, it has recorded consolidated quarterly revenue of Rs.473.51 Crores with year-on-year growth of 24.57%. Domestic sales of the API segment grew by

approximately 26.39% and exports by 5.27%. Entire growth of the API segment is driven by volume growth. Formulation segment revenues grew by around 72.50% o on year-on-year basis.

• The management of the company expects to improve on its gross margins in recent future due to better efficiencies in production and due to continuous improvement in working capital. Moreover, the company was able to further reduce its debt.

Risk

• Strict Regulatory Norms

• Currency fluctuation

Valuation

The company has expanded its operation worldwide and continues to expand further in European Continent along with positive synergy through tie ups. It is expected that it will help to show strong track record in the subsequent financial years. Moreover, its Anti Diabetic products are expected to generate good double digit growth in the revenue in coming years. Thus, it is expected that the stock will see a price target of Rs.838 in 8 to 10 months time frame on 1 year average P/Ex of 13.78x and FY21 EPS of Rs.60.79.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

The stock closed at Rs 13.2.25 on 20th February 2020. It made a 52-week low of Rs 90.45 on 11th October 2019 and a 52-week high of Rs. 138.75 on 28th June, 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 113.31

As we can see on charts that the stock is forming an “Inverted Head and Shoulder” pattern on weekly charts, which is bullish in nature. Apart from this, it is trading in higher highs and higher lows on daily charts along with high volumes. So buying momentum is expected to continue for coming days. Therefore, one can buy in the range of 128-130 levels for the upside target of 146-150 levels with SL below 119.

The stock closed at Rs 1341.30 on 20th February, 2020. It made a 52-week low at Rs 909.05 on 24th July 2019 and a 52-week high of Rs. 1359.40 on 20th February, 2020. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 1119.99

The Stock witnessed correction from all time high of 1650 levels to 900 levels in single down swing while trading in lower highs and lower lows. Then after, it has been consolidated in wide range of 900 to 1300 levels for 15 months with positive bias. Last week, it has given the breakout of same along with high volumes so buying momentum may continue for coming days. Therefore, one can buy in the range of 1320-1330 levels for the upside target of 1500-1530 levels with SL below 1260 levels.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

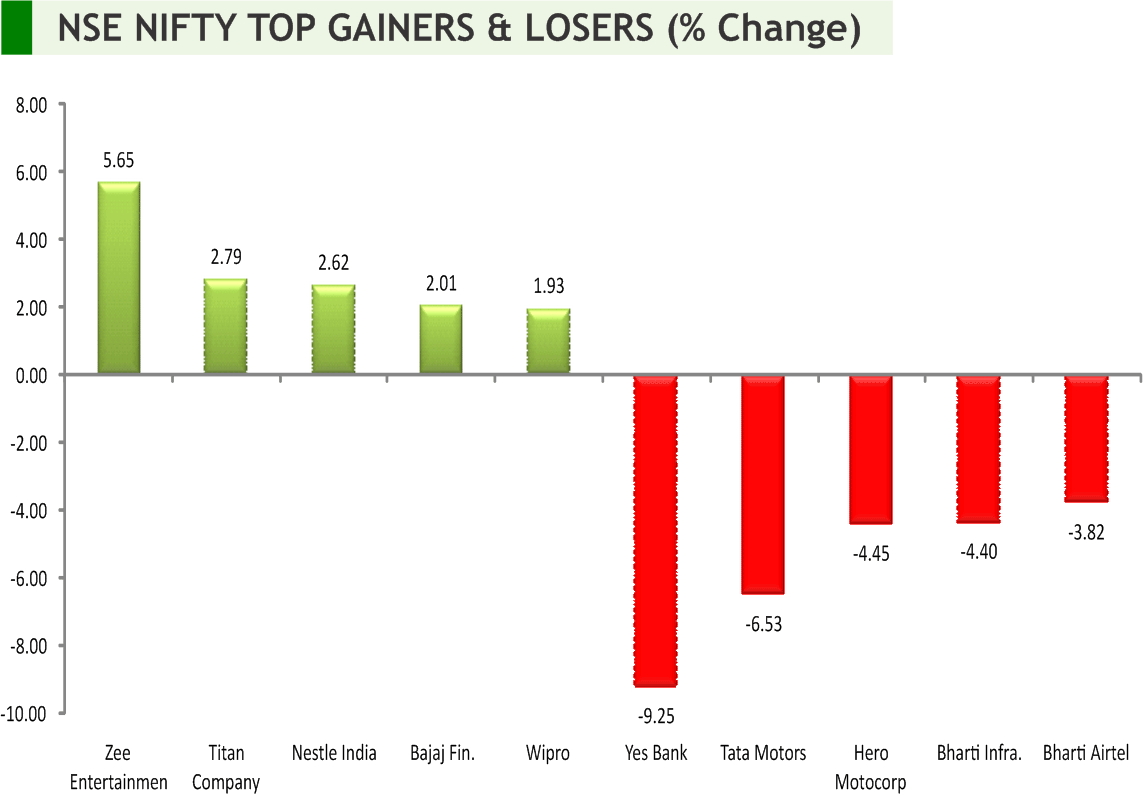

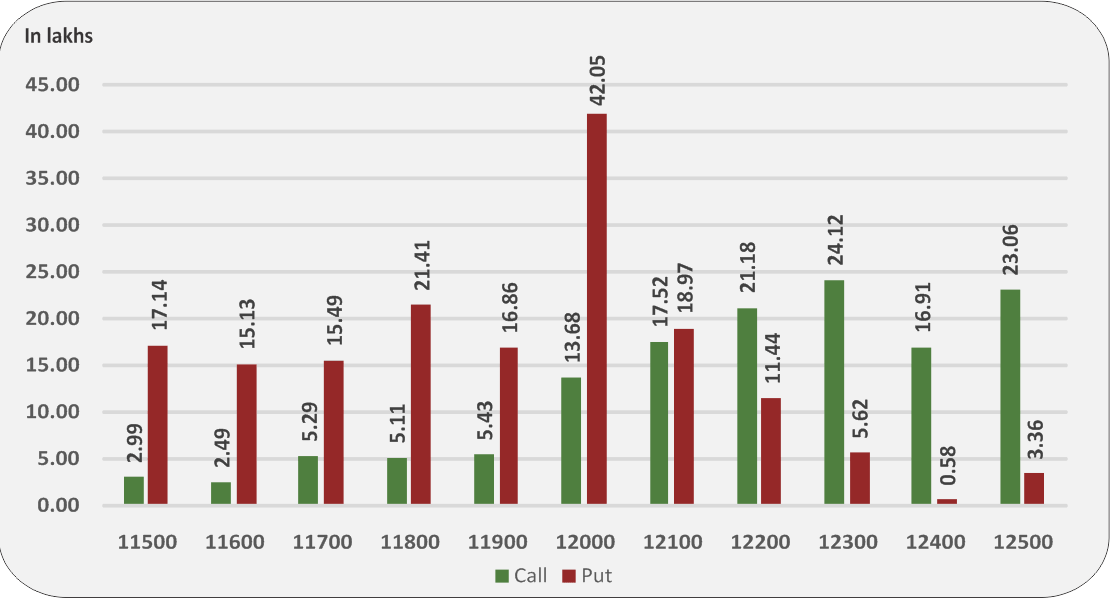

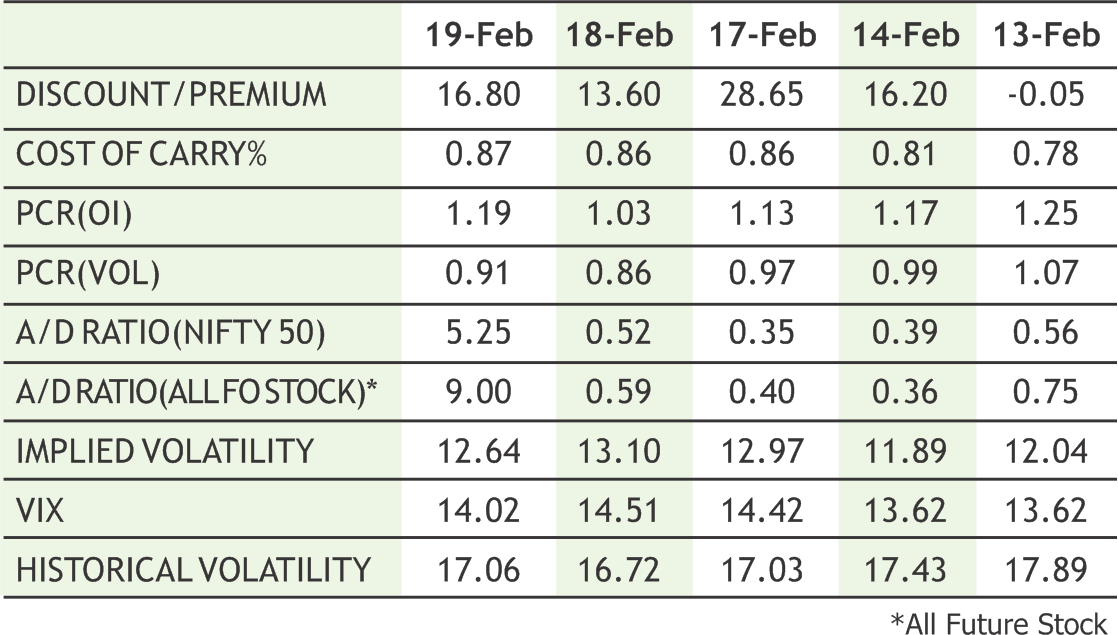

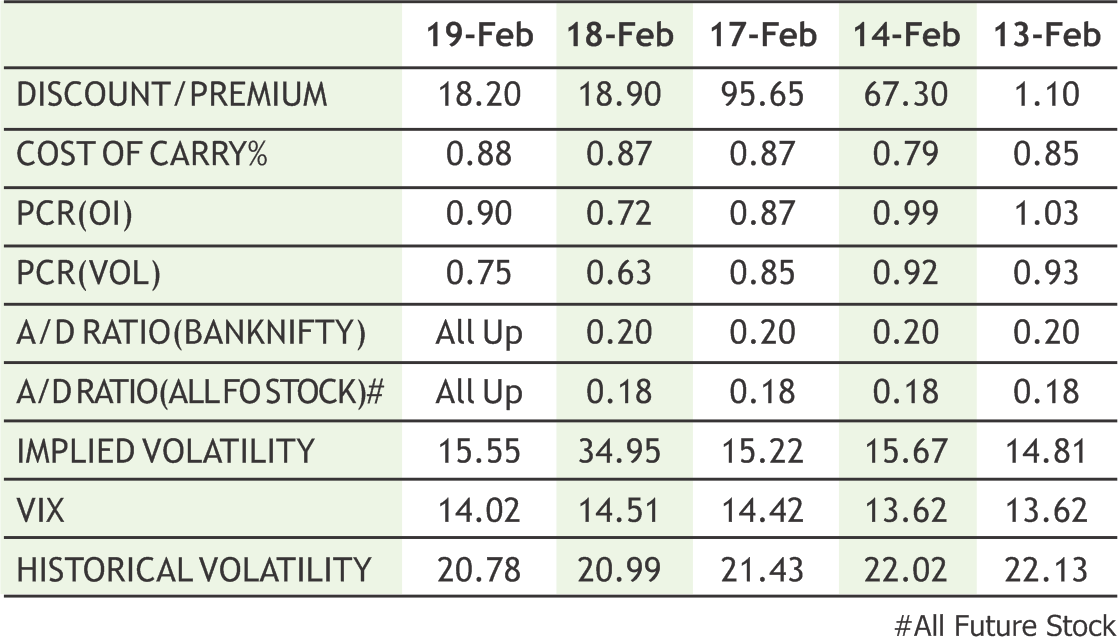

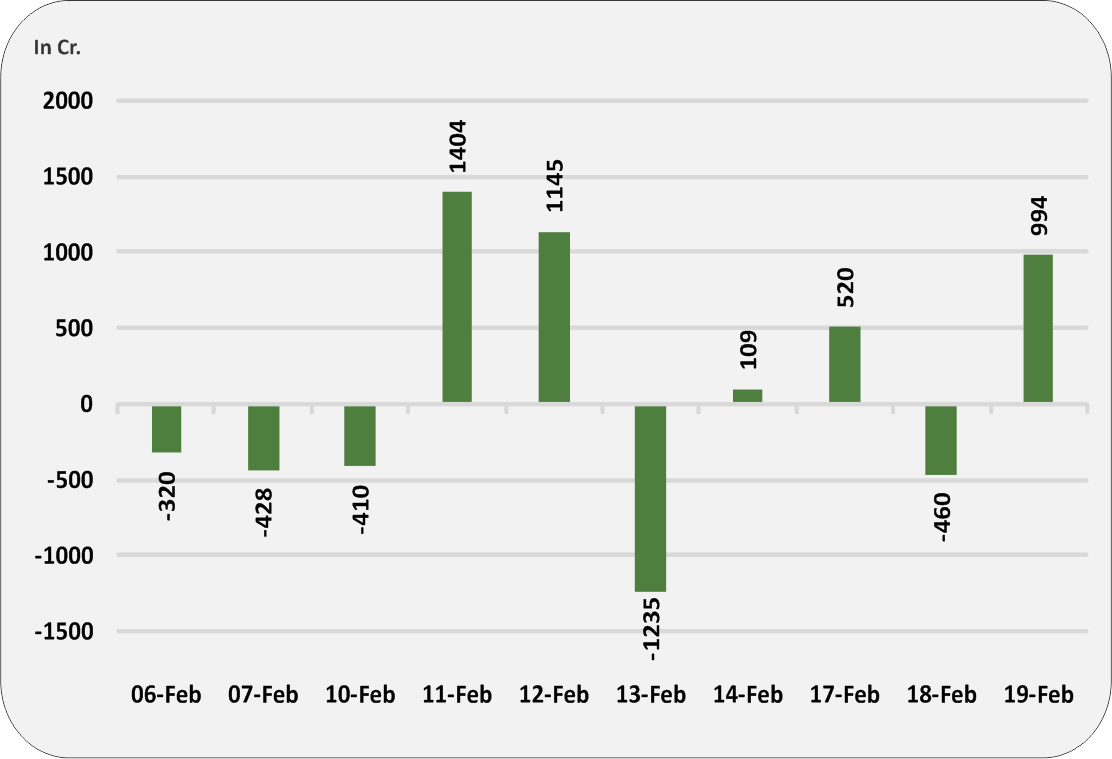

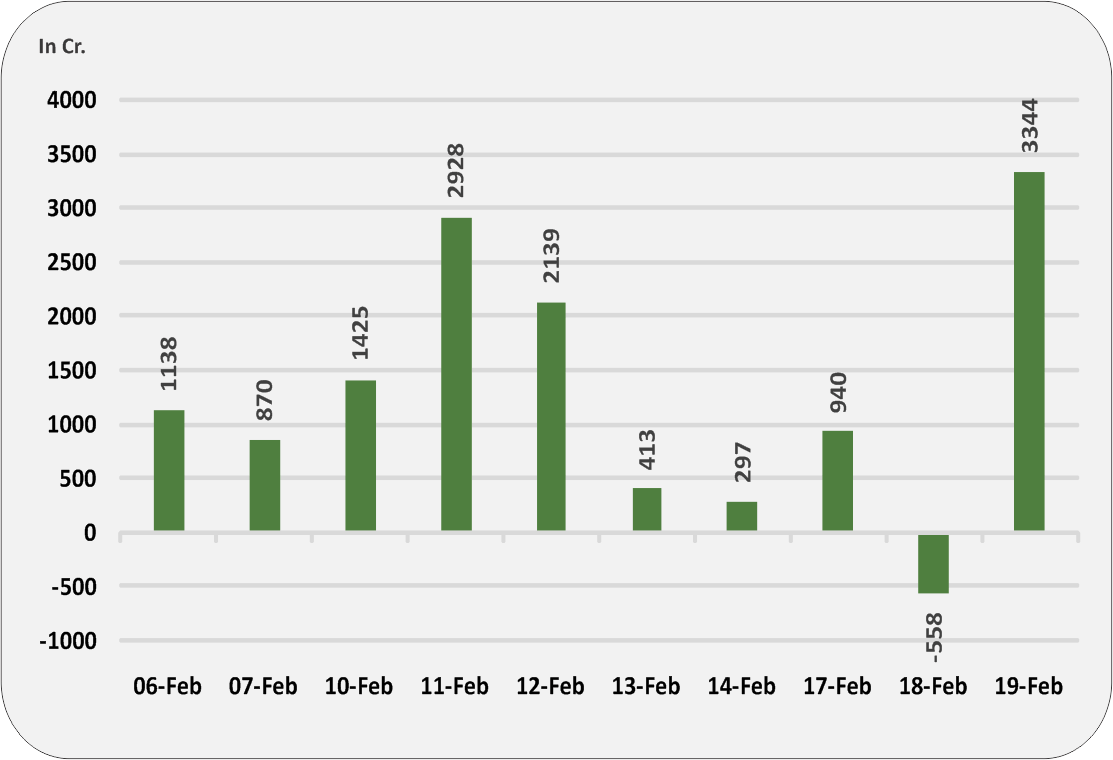

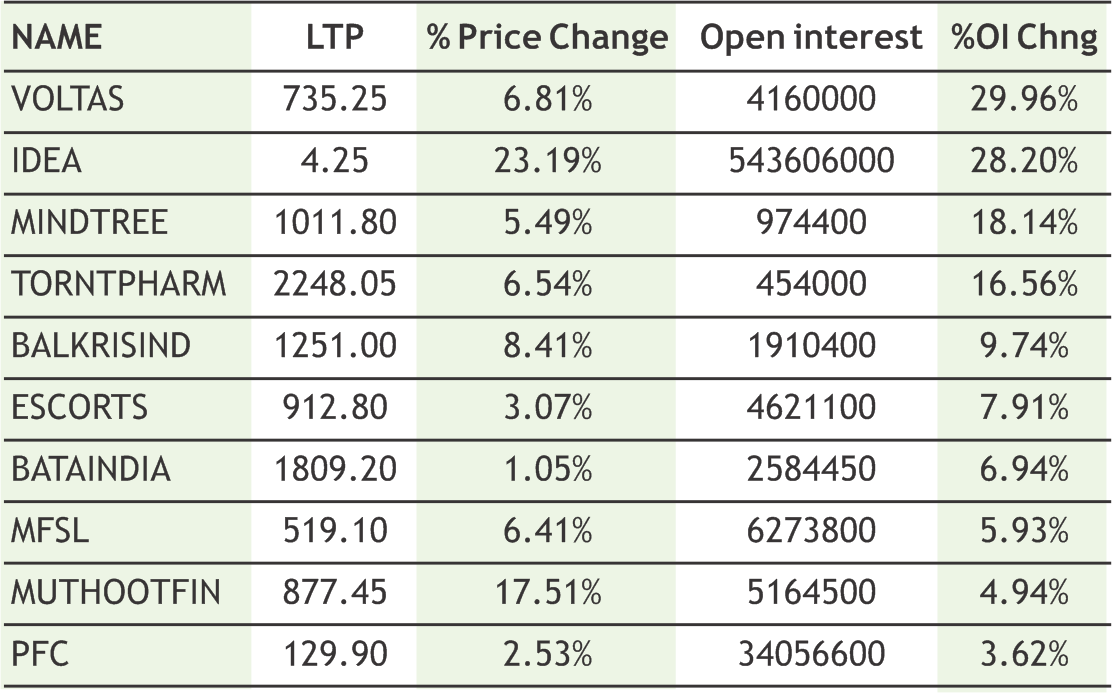

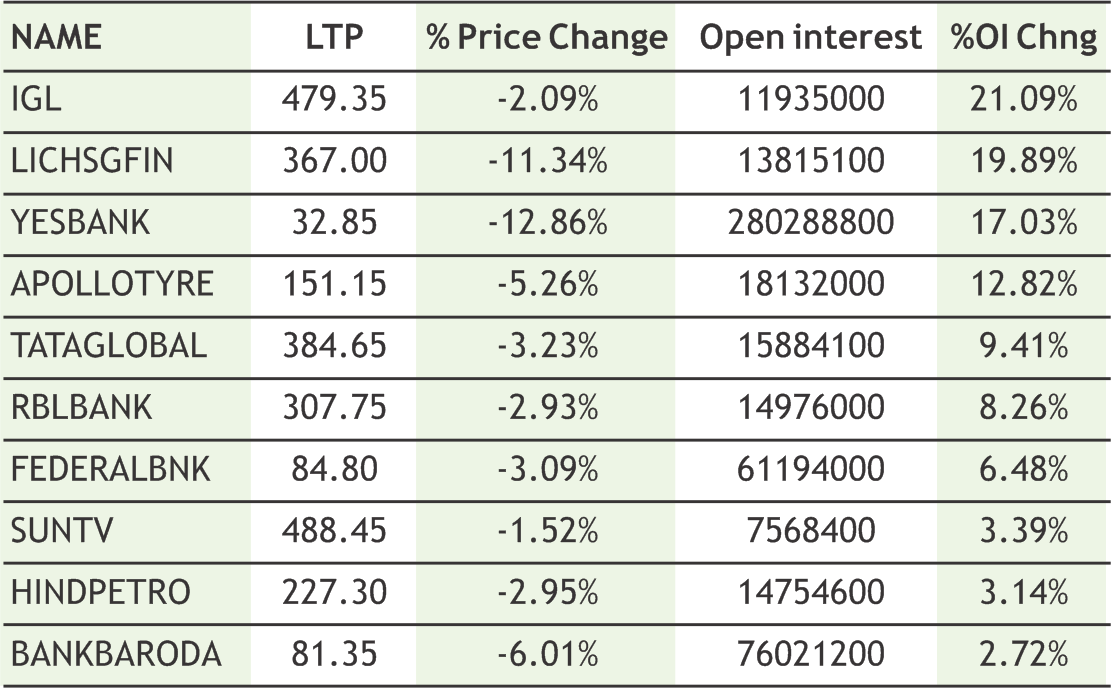

Indian markets remained highly volatile in the week gone by with Nifty seen swinging in broader range of 12150-11900 levels and settled the week with marginal losses while banknifty also ended the week on a negative note to close below 31000 level. In last hour of a trade of Thursday’s session, selling pressure was seen at higher levels as long unwinding was witnessed ahead of extended weekend. From derivative front, the tug of war between bulls and bears at 12100 strike kept the Nifty volatile and in coming week as well the volatility is likely to grip the market ahead of monthly futures and options expiry. The Implied Volatility (IV) of calls closed at 12.64% while that for put options closed at 13.20%. The Nifty VIX for the week closed at 14.02% and is expected to remain volatile. PCR OI for the week closed at 1.19. From the technical front, the secondary oscillators suggest further consolidation into the prices in Nifty with some volatility on the cards as tug of war between bulls and bears likely to continue. However as far levels are concerned Nifty has a stiff resistance at 12200 levels while 11900 should provide immediate support. While bias is likely to remain range bound as far Nifty is holding within 11900-12200 levels.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

Turmeric futures (March) is expected to face resistance near 6335-6390 levels. The upside may remain capped as the sentiments of the spot markets are not upbeat due to sufficient supply in the market and sluggish demand. The rising supply of the new crop in Nizamabad, the benchmark market, and expectations of a bigger crop may also dampen sentiments. According to traders, the arrival of new turmeric in the mandis is gradually increasing. It is believed that with the rise in arrivals, pressure on prices may increase after Holi. Jeera futures (March) will continue to face resistance near 14000 & witness a plunge towards 13000-12800 levels. On the spot, prices are seen falling as arrivals of the new jeera crop are expected to gain momentum in the coming weeks. Currently, demand for the new crop is weak due to high moisture content. Another major reason for this bearishness is also being attributed to the outbreak of coronavirus in China, which is the largest buyer of the spice commodity from India. Coriander futures (March) may continue to witness selling from 6300 & trader lower towards 6000-5900 levels.The new crop of coriander has started arriving at the benchmark market of Ramganj in Rajasthan last week with a daily supply at 500 bags. Currently, arrivals are coming from Jhalawar in Rajasthan, and are expected to peak after Mar 15 when daily arrivals may touch 50,000-60,000 bags in the state. The quality of the new crop is inferior right now because of high moisture level of 15-20%, against the normal of 5-8%. The new crop is being sold at 5,000-6,000 rupees per 100 kg, and the old crop is available at 6,000-6,500 rupees.

Bullion counter can continue its upside momentum as yellow metal continued to hover around its seven year peak in COMEX midst panic regarding coronavirus outbreak as central banks prepare more easing measures to prop up sagging economies. Bond yields hovering at the 4 year lows and ETFs are witnessing continuous inflows hence giving support to the precious metals pack. Impact of the coronavirus outbreak on economic activity in China is inducing safe haven buying in bullion counter. The death toll has crossed 2100 with over 75,000 people infected by the coronavirus. However, fall in the number of cases due to the Coronavirus outbreak might limit the uptrend for Gold. China’s central bank trimmed the interest rate on its medium term loans to counter the economic fallout from the virus break out. Rigorous stimulus measures by China boosted the risk appetite amongst investors in turn limiting the upside for Gold. Gold may move towards 42200 levels while taking support near 41000 levels and silver can test 4900 levels while taking support near 46200 levels. U.S. Federal Reserve policymakers were cautiously optimistic about their ability to hold interest rates steady this year, minutes of the central bank's last policy meeting showed, even as they acknowledged new risks caused by the outbreak. Betting on US interest rates now sees just a 1-in-6 chance that the Fed will leave its cost of borrowing unchanged by year-end, down from 2-in-5 this time a month ago. A year-long corporate earnings recession has fueled anxiety about the business cycle, while the spread of coronavirus is expected to have major repercussions on China and its key trading partners.

Soybean futures (March) is expected to take support near 3830 levels & witness upside levels of 3950-4000 levels. Factors such as lower level buying accompanied with the news coming from international market that China will probably boosts its agricultural imports from U.S after issuing a list of products that will be eligible for tariff waivers will support the counter. The new list follows has 696 American products, which includes U.S soybeans. In days to come, we may see a turnaround in mustard futures (April) towards 4040-4080 levels, taking support near 3980 levels on the back of lower estimates of crop this season. The government estimated lower mustard crop for 2019-20 (JulJun) at 91.13 lakh tons as against 92.56 lakh tonsin 2018-19. Soy oil futures (March) is expected to witness a consolidation in the range of 795-825 levels. On CBOT, soy oil is under pressure as market participants are still questioning the China’s ability to fulfill the trade agreement has been questionable due to the coronavirus outbreak. There is more room for CPO futures (Mar) to down for 665-630 levels. It is reported that the Crude palm oil coming from Nepal is of Indonesian and Malaysian origin and are routed through Nepal for duty exemption. This is hitting edibleoil refiners in eastern and northern India.Surprisingly a fact has been notice that at Zonal Joint DGFT Kolkata, has recently issued the license for import of 18,500 tn of RBD Palmolein from Nepal with condition that the produce will be of Nepal origin. The Solvents Extractors' Association of India has expressed displeasure over issuance of licence for duty-free refined palm oil imports fromNepal.

Crude oil prices may extend its bounce back as its prices are getting lift from news of U.S. sanctions on Russia Rosneft firm and Libya continuous output cut reducing the supply glut pressure from the markets. The US decided to blacklist trading subsidiary of Russia’s Rosneft which Trump administration said provided a financial lifeline to Venezuela’s government. Adding further support to crude futures was belief that negative oil demand effects due to outbreak of coronavirus will be easing as data shows new cases are falling. The attack in Tripoli is latest escalation between Haftar causing crude output to fall to around 123,000 Bpd from 1.2 Mbpd. Libya's internationally recognized leader Fayez al-Serraj dashed hopes of reviving peace negotiations last week after the Libyan National Army (LNA) of Khalifa Haftar shelled the port of the capital, which is held by al-Serraj's government. Crude oil may recover towards 4000 while taking support near 3660. Meanwhile OPEC+ stated that they would further trim their output to counter the slumping demand due to the coronavirus outbreak in the major Crude consumer, China Further production cuts by OPEC might lead to severe supply disruptions which pushed the prices higher. Natural gas can extend its bounce back as it can test 155 while taking support near 130 amid slightly colder weather conditions in US. The weather is expected to become colder than normal for the next 8-14 days throughout the United States turning much cooler in the North East which is expected to remain warm during this period.

Cotton futures (Feb) is expected to remain stable in the range of 19000-19450 levels. There is good news that India's cotton imports have come to a standstill as weak domestic prices have made overseas purchases economically unviable. Indian mills are now waiting to see what Cotton Corp of India will do mid-March, which is the fag end of the season, when the supply actually gets constrained.Procurement by the state-owned agency under minimum support price in the current 2019-20 (Oct-Sep) marketing year has exceeded 5.8 mln bales (1 bale = 170 kg). On the international market, ICE cotton futures (Mar) is taking support near 67.80-67.00 cents per pound. The sentiments are positive after China said it would give tariff exemptions on imports from United States to fulfill trade-deal commitments. Beijing's announcement comes after the Phase 1 trade deal between the two countries took effect on Feb. 14 and is the third round of tariff exemptions China has offered on U.S. goods.Chana futures (March) may trade with a downside bias & see 3950-3900 levels owing to prospects of higher output this season. As per Second Advance Estimates for 2019-20, the Chana or Gram production in the country is seen at 11.22 million tonnes. This marks a spurt of 12.87% compared to previous year. The total Pulses production in the country during 2019-20 is estimated at 23.02 million tonnes, higher by 2.76 million tonnes than the Five years' average production of 20.26 million tonnes.Guar seed (March) is projected to plunge further towards 3700- 3650, while guar gum (March) can see 6300-6000 levels on the lower side. Lower exports of derivatives, large carryover stocks and expectations of relatively higher output have are leading sharp drop in the spot markets.

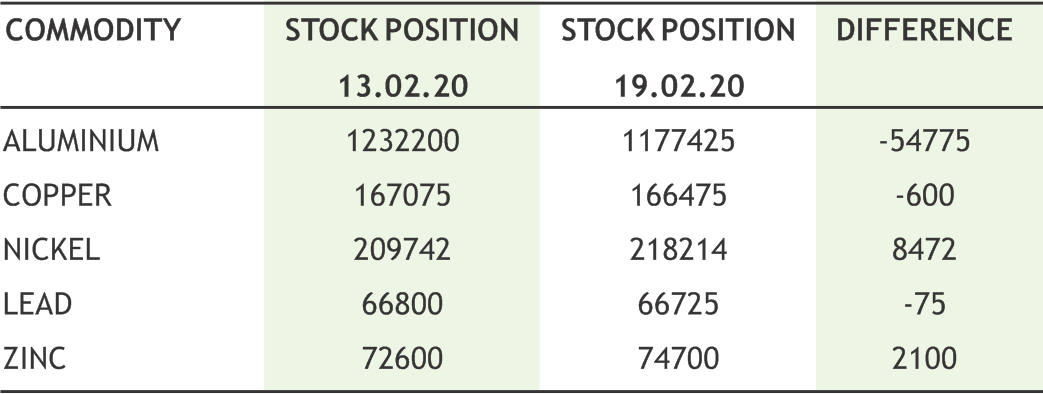

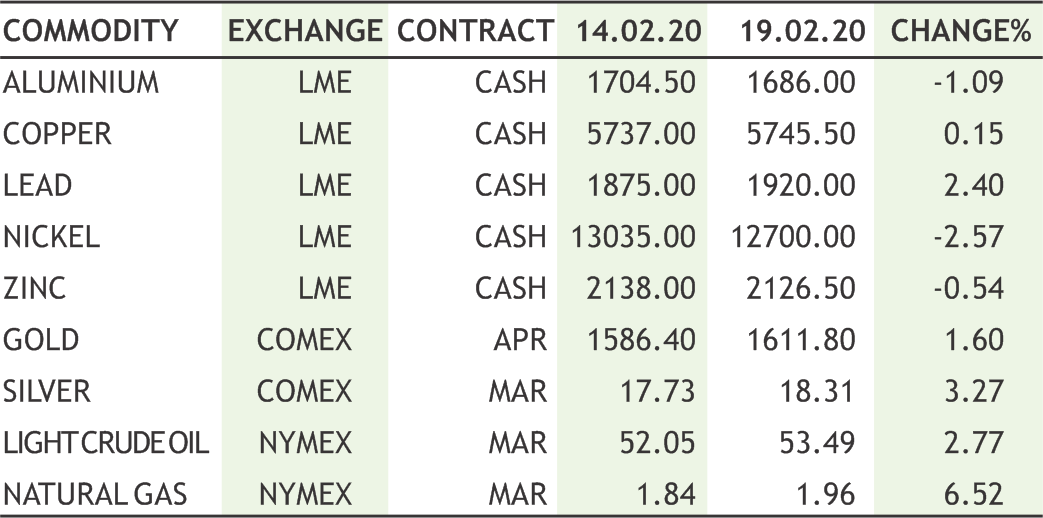

Base metal counter may remain on weaker path but short covering at lower levels can be seen. Copper may test 440 levels while taking support near 425. Spot charges for processing copper concentrate in China have risen to their highest in eight months owing to the coronavirus outbreak. Copper stocks, at more than 262,000 tonnes, are at their highest since mid -March and nearly double the level on January 19. China cut benchmark lending rate last week as widely expected, as authorities move to lower financing costs for businesses and support an economy jolted by a severe coronavirus outbreak. Meanwhile, lead may remain in red as it can test 143 while taking resistance near 150 levels. Meanwhile LME lead premium for cash metal over the 3M contract surged to $68 it is highest since 2011 from only $6 a week ago, suggesting an acute shortage of nearby metal. Zinc may witness some short covering towards 173 levels while taking support near 160. The global zinc market's deficit rose to 23,100 tonnes in December from a deficit of 200 tonnes in November, data from the ILZSG showed. Zinc stocks in warehouses certified by the LME hit their lowest in nearly three decades but this was deceptive because a lot of metal was being held in other depots. Nickel prices can recover towards 960 levels while taking support near 925 levels. Meanwhile demand for electric vehicle batteries is pushing up production of nickel, especially in Indonesia, where the government is moving to benefit from its natural resources. Aluminium prices can recover towards 141 levels while taking support near 136 levels.

10

|

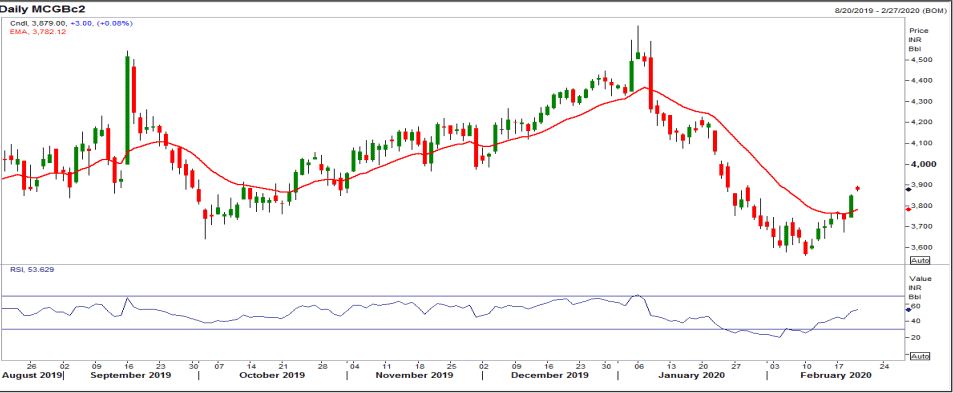

CRUDE MCX (MAR) contract closed at Rs. 3850.00 on 19th Feb’2020. The contract made its high of Rs. 4604.00 on 06th Jan’2020 and a low of Rs. 3562.00 on 10th Feb’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 3779.40. On the daily chart, the commodity has Relative Strength Index (14-day) value of 51.763.

One can buy near Rs. 3790 for a target of Rs. 4000 with the stop loss of Rs. 3685.

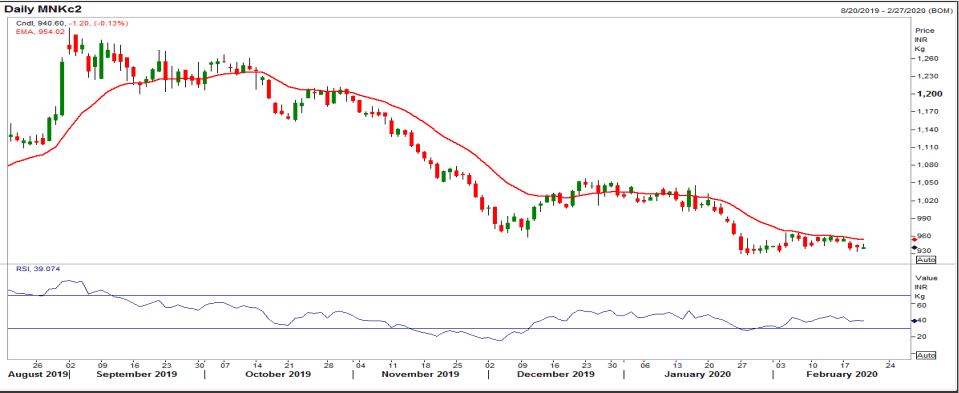

NICKEL MCX (MAR) contract closed at Rs. 941.8 on 19th Feb’2020. The contract made its high of Rs. 1025.80 on 20th Jan’2020 and a low of Rs. 930.00 on 28th Jan’2020. The 18- day Exponential Moving Average of the commodity is currently at Rs. 953.45. On the daily chart, the commodity has Relative Strength Index (14-day) value of 39.424.

One can sell near Rs. 955 for a target of Rs. 880 with the stop loss of Rs. 992.

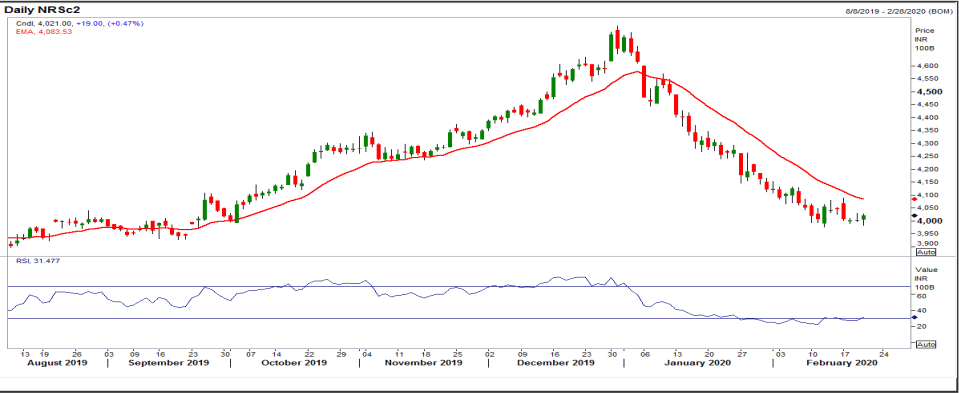

RMSEED NCDEX (APR) contract was closed at Rs. 4002.00 on 19th Feb’2020. The contract made its high of Rs. 4635.00 on 31st Dec’19 and a low of Rs. 3975.00 on 12th Feb’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 4081.42. On the daily chart, the commodity has Relative Strength Index (14-day) value of 31.539.

One can buy near Rs. 4000 for a target of Rs. 4120 with the stop loss of Rs 3940.

11

Ÿ As per Second Advance Estimates for 2019-20, total foodgrain production in the country is estimated at record 291.95 million tonnes which is higher by 6.74 million tonnes than the production of foodgrain of 285.21 million tonnes achieved during 2018-19.

Ÿ The government approved major changes in the Pradhan Mantri Fasal Bima Yojana (PMFBY) making it optional for farmers.

Ÿ China will temporarily waive value-added tax (VAT) for the bonded delivery of commodity futures that are to open to overseas investment.

Ÿ MCX plans to launch a gold futures contract based on the Indian gold standard to improve domestic price discovery. It is also working on a new lead contract that can allow delivery of domestically recycled lead on the exchange platform.

Ÿ U.S. homebuilding fell less than expected in Jan while permits surged to a near 13-year high, pointing to sustained housing market strength.

Ÿ Freeport Indonesia, operator of Grasberg, the world's Second -biggest copper mine, expects to start construction of a new smelter in August 2020.

Ÿ According to EIA “U.S. shale oil output is expected to rise by about 18,000 barrels per day (bpd) in March to a record 9.18 million bpd, driven by gains in the Permian Basin”.

Ÿ China will grant exemptions on retaliatory duties imposed against 696 U.S. goods, the most substantial tariff relief to be offered so far, as Beijing seeks to fulfill commitments made in its interim trade deal with the United States.

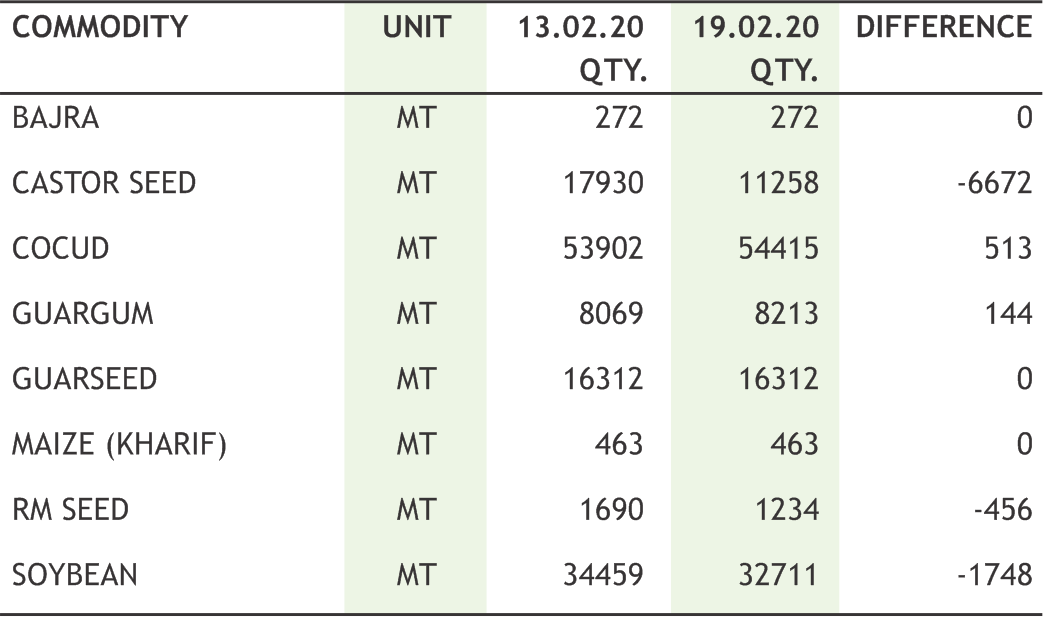

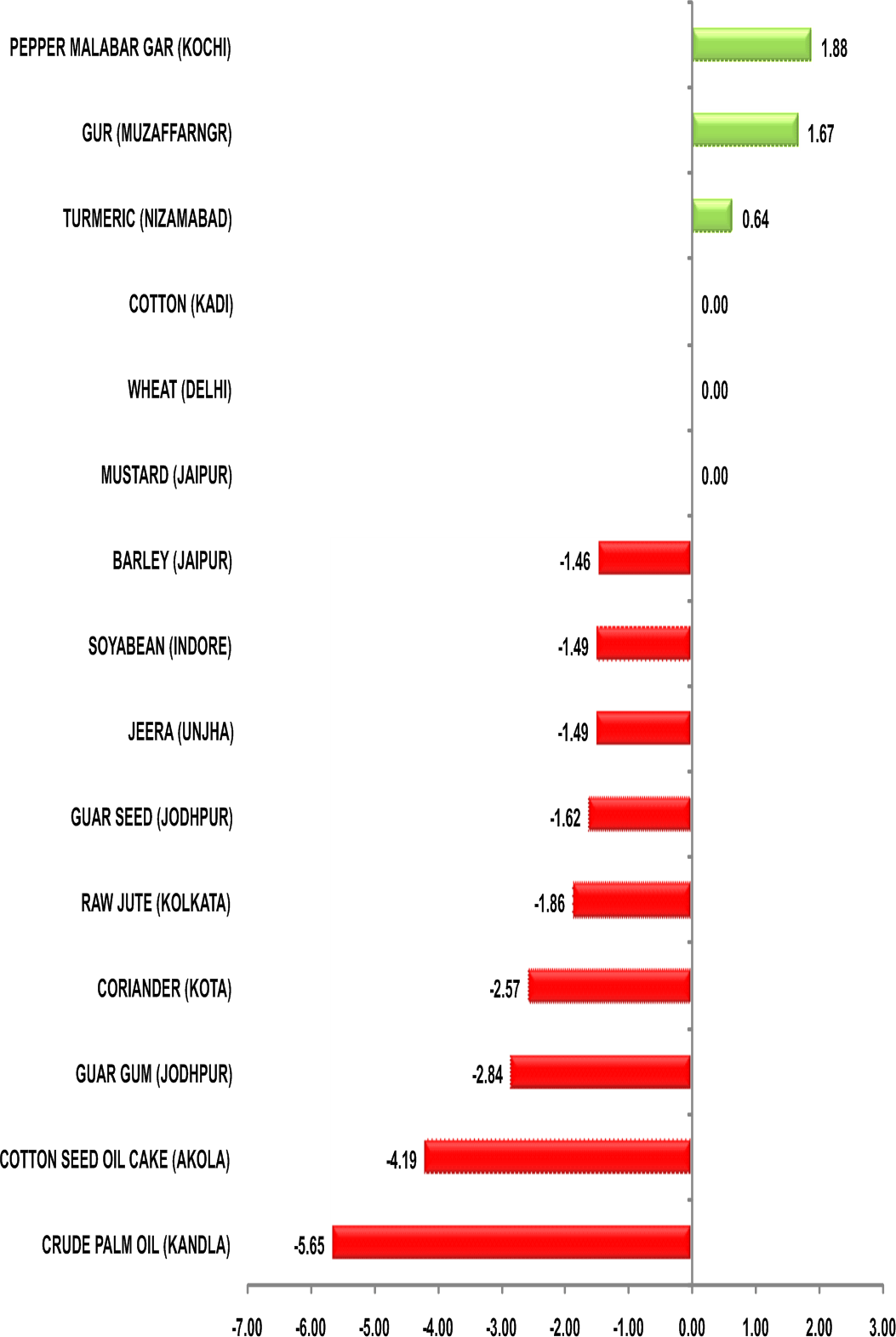

CRB gained for continuous second week as the fear of coronavirus faded to some extent. Gold prices hit a seven-year high on last Wednesday on expectations of further monetary policy easing to cushion the economic impact of the Covid-19 outbreak. Energy counter revived last week. Bond yields, which normally fall when gold rises, rose by one to two basis points along the Treasury curve. Silver brightened along with gold. Crude prices saw massive jump from lower side as the market worried about crude supply disruptions and demand concerns were cushioned after a sharp drop in new coronavirus cases at the epicenter of the outbreak. Tensions in Libya that have led to a blockade of its ports and oilfields have shown no signs a resolution, while U.S. sanctions on a subsidiary of Russian state oil major Rosneft to cut Venezuelan crude from the market have helped rekindle global oil supply worries. Natural gas saw some value buying. Base metals refused to take any upturn despite cut in numbers of casualty as trading activities are still on halt. China is already struggling with a huge corporate debt problem; some took the view that bailouts were likely to be followed by loan defaults and ever-greater problems with the Chinese financial system – a development that hardly makes havens like gold less attractive.

In spices, only turmeric shone on good value buying; rest of the spices nosedived. Jeera was weak. New jeera crop is being sold 23% lower from last year because of high moisture content in the new crop. Supply is coming from Saurashtra region with a moisture level of 12-13%, against the normal of below 8%. Even coriander was weak as the supply side is heavier as the new coriander has started arriving in the mandis of Rajasthan & the moisture content is very high in the new crop. Amidst all the negative news, the cotton prices are expected not to witness much correction as the Cotton Corporation of India (CCI) is set to procure more than 5 million bales from farmers in 2019/20, the highest in five years. Impact reflected in the price action of futures contract and it closed in green territory. It is being estimated that guar derivative exports are likely to fall by about 20% in 2019-20 (Apr-Mar). The replacement of guar gum with cheaper alternatives such as polyacrylamide, carboxymethyl cellulose, xanthan gum, and partially hydrolyzed polyacrylamide pressurized the guar counter. Oil seeds and edible oil counter were bearish on weak international market. In international market, soybean is under pressure as the market waited for Chinese purchases, the day after Beijing said it would issue exemptions on retaliatory import duties imposed on nearly 700 U.S. goods, including soybeans.

|

|

12

|

|

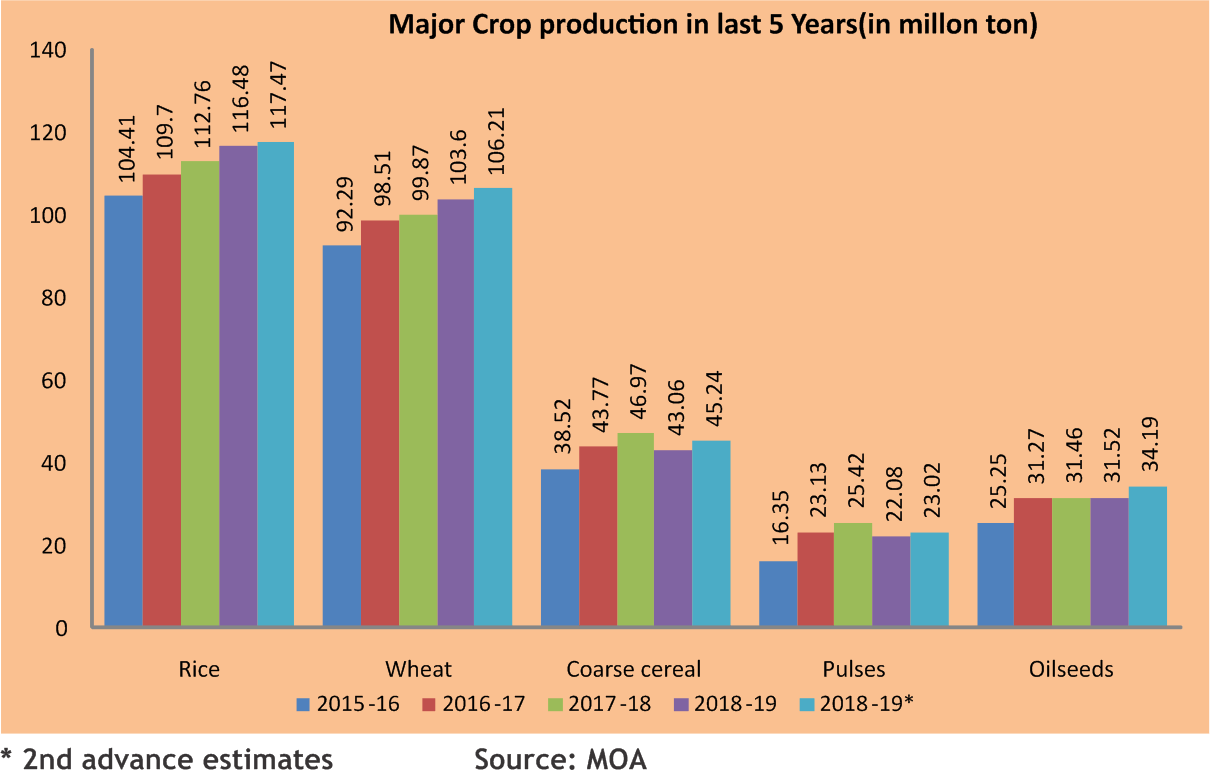

The 2nd Advance Estimates of production of major crops for 2019-20 have been released by the Department of Agriculture, Cooperation and Farmers Welfare on 18th February 2020. As per Second Advance Estimates for 2019-20, total Foodgrain production in the country is estimated at record 291.95 million tonnes which is higher by 6.74 million tonnes than the production of foodgrain of 285.21 million tonnes achieved during 2018-19. The production during 2019-20 is higher by 26.20 million tonnes than the previous five years’ (2013-14 to 2017-18) average production of foodgrain. Accordingly, the production of most of the crops for the agricultural year 2019-20 has been estimated higher than their normal production due to better rainfall during the monsoon season (June to September, 2019).

• Total production of Rice during 2019-20 is estimated at record 117.47 million tonnes. It is higher by 9.67 million tonnes than the five years’ average production of 107.80 million tonnes.

• Production of Wheat during 2019-20 is estimated at record 106.21 million tonnes. It is higher by 2.61 million tonnes as compared to wheat production during 2018-19 and is higher by 11.60 million tonnes than the five years’ average production of 94.61 million tonnes.

• Production of Nutri / Coarse Cereals estimated at 45.24 million tonnes, which is higher by 2.18 million tonnes than the production of 43.06 million tonnes achieved during 2018-19. Further, it is also higher by 2.16 million tonnes than the five years’ average production.

• Total Pulses production during 2019-20 is estimated at 23.02 million tonnes which is higher by 2.76 million tonnes than the five years’ average production of 20.26 million tonnes.

• Total Oilseeds production in the country during 2019-20 is estimated at 34.19 million tonnes which is higher by 2.67 million tonnes than the production of 31.52 million tonnes during 2018-19. Further, the production of Oilseeds is higher by 4.54 million tonnes than the five years’ average production.

• Total production of Sugarcane in the country during 2019-20 is estimated at 353.85 million tonnes. The production is higher by 4.07 million tonnes than the five years’ average sugarcane production of 349.78 million tonnes.

• Production of Cotton is estimated at 34.89 million bales (of 170 kg each) is higher by 6.85 million bales than the production of 28.04 million bales during 2018-19. Production of Jute & Mesta is estimated at 9.81 million bales (of 180 kg each).

Although the bumper production spells good for farmers, government and for better economic growth, but not always a guarantee for cheering farmers. Adequate supply of agriculture produce keep food inflation under check, but it also weigh on prices to slide below the production cost that increase the misery of farmers. The government has to face daunting task of ensuring farmers a fair and remunerative price for their produce. The lack of procurement processes and infrastructure are forcing farmers to distress sell their produce in the open market.

13

|

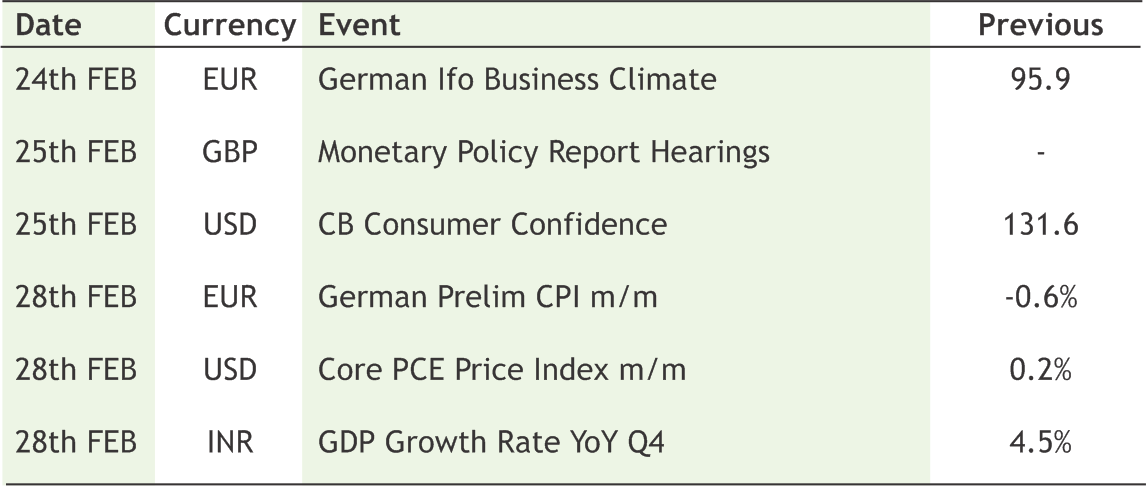

| 17th FEB | Central Bank of China Pumps 300 Billion Yuan Into Financial System. |

| 17th FEB | PBoC trimmed one year Prime Lending Rate by 10 bps and five year by 5 bps to support the economy. |

| 19th FEB | Moody’s lowers growth forecast for Asia-Pacific Region to 5.2% for 2020 |

| 19th FEB | Fed minutes revealed policymakers cautiously optimistic on US economy despite new risks |

| 20th FEB | Brexit Pressure kept Pound to Euro Exchange Rate Outlook Down from Multi-Year-Best |

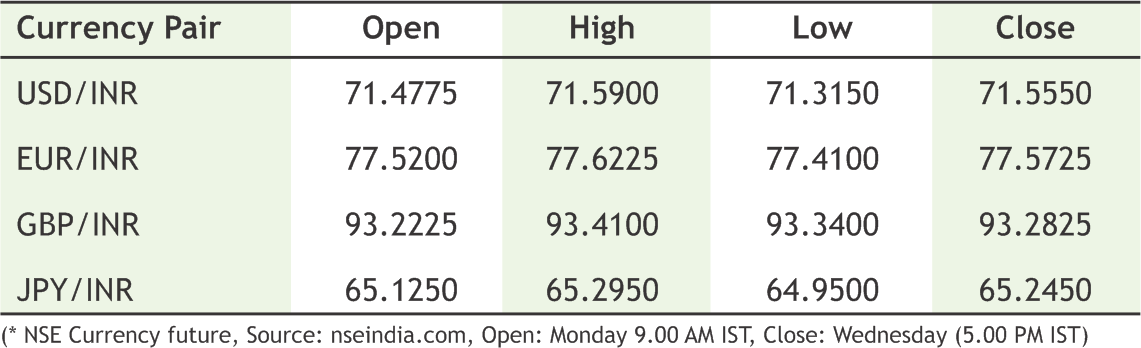

Indian Rupee headed lower once again as bid above 71.50 was strong enough to lift the pair higher. Although weakness in rupee was overlooked amid high carry trade helped the domestic unit along with corporate dollar flows. Indeed rupee alone cannot hold its ground in Asia as its pairs are falling substantially amid on-going epidemic crisis in China. Meanwhile Chinese Central Bank trimmed one year Prime Lending Rate by 10 bps and five year by 5 bps to support the economy. Chinese Yuan and its catch-up currency are weighing including Indian Rupee, Australian Dollar and other Asia peers. Japanese Yen fell the most in nine months against US Dollar undermining the modest safe heaven appeal. Strong US economic data and falter in Japanese recent quarterly GDP which hit five year low helped the USD/JPY pair to catch the differential growth. Although such surge in dollar against yen will not hold last as US Treasury yields likely to fall further based on dollar flows into treasury securities and further yield differential will weigh the yen to appreciate further. On global pairs, euro plunged to two year lows amid ongoing slowdown in the bloc economy as well low yielding carry pushed the bloc currency to fall further. Flash PMIs of eurozone and second cut US quarterly GDP will drive the FX volatility next week.

USDINR is likely to stay above 71.50 and move higher towards 72.20 in the next week.

|

USD/INR (FEB) contract closed at 71.5550 on 18-Feb-2020. The contract made its high 71.5900 on 18-Feb-2020 and a low of 71.3150 on 17-Feb-2020 (Weekly Basis). The 21-day Exponential Moving Average of the USD/INR is currently at 71.47.

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 52.74. One can buy at 71.60 for the target of 72.20 with the stop loss of 71.25

EUR/INR (FEB) contract closed 77.5725 on 18-Feb-2020. The contract made its high of 77.6225 on 17-Feb-2020 and a low 77.4100 on 18-Feb-2020 (Weekly Basis). The 21-day Exponential Moving Average of the EUR/INR is currently at 78.41

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 26.77. One can sell at 77.60 for a target of 76.80 with the stop loss of 78.00.

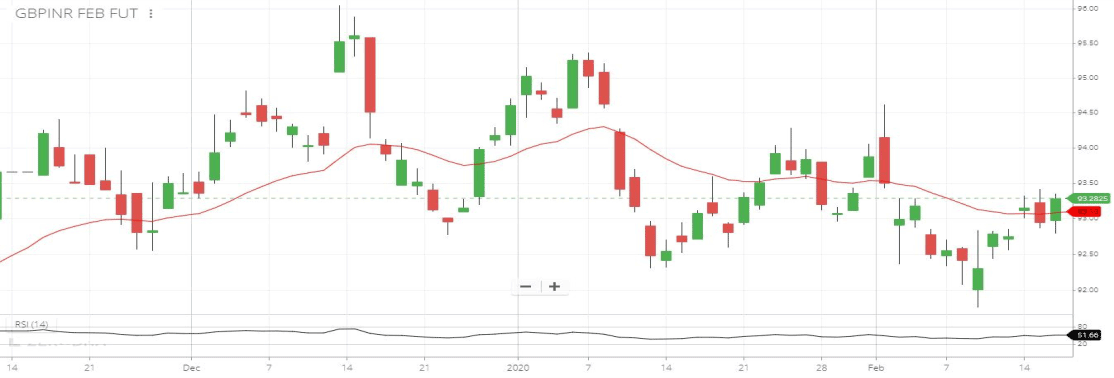

GBP/INR (FEB) contract closed at 93.2825 on 18-Feb-2020. The contract made its high of 93.4100 on 18-Feb-2020 and a low of 92.7825 on 18-Feb-2020 (Weekly Basis). The 21-day Exponential Moving Average of the GBP/INR is currently at 93.10.

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 51.65. One can buy at 92.40 for a target of 93.40 with the stop loss of 92.00.

JPY/INR (FEB) contract closed at 65.2450 on 18-Feb-2020. The contract made its high of 65.2950 on 18-Feb-2020 and a low of 64.9500 on 17-Feb-2020 (Weekly Basis). The 21-day Exponential Moving Average of the JPY/INR is currently at 65.30.

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 47.35. One can buy at 64.20 for a target of 65.10 with the stop loss of 63.80

14

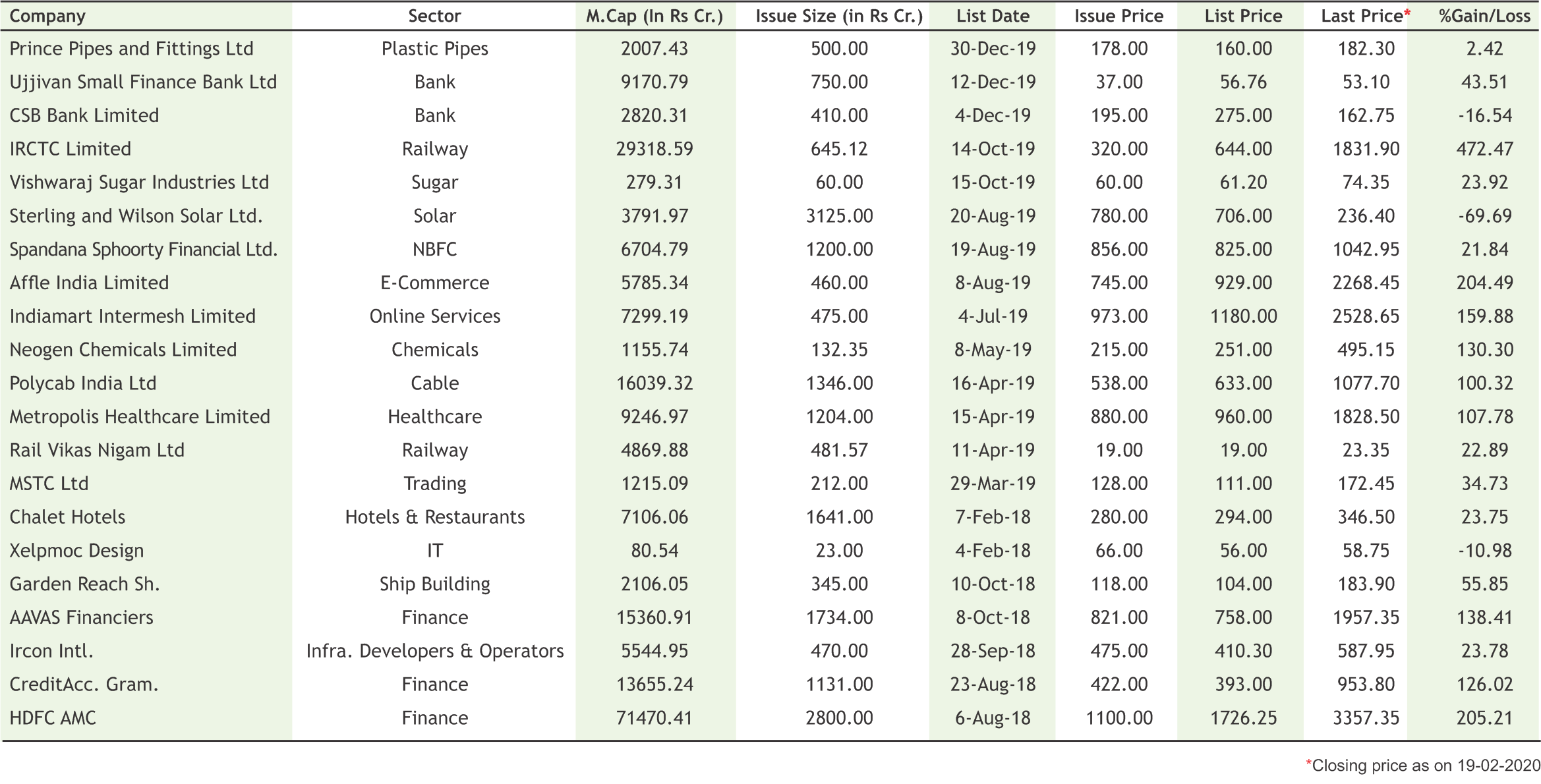

Barbeque Nation files IPO papers with SEBI to raise up to Rs 1,200 crore

Casual dining restaurant chain Barbeque Nation Hospitality has filed a DRHP (Draft Red Herring Prospectus) with market regulator Sebi for an initial public offering (IPO). The IPO comprises a fresh issue of shares worth Rs 275 crore and an offer for sale (OFS) of up to 98,22,947 equity shares. The restaurant chain may consider a pre-IPO placement of up to Rs 150 crore, as per its DRHP. The company will utilise the proceeds of the issue to repay an outstanding borrowing of Rs 205 crore in part or full and for general corporate purposes. IIFL Securities Limited, Axis Capital Limited, Ambit Capital Private Limited, and SBI Capital Markets Limited are the book running lead managers to the issue. As per the DRHP, 50% of the offer will be available for allocation to qualified institutional buyers (QIBs). Further, up to 15% shall be available for allocation on a proportionate basis to non-institutional bidders and the remaining 35% will be available for retail individual bidders. Promoters Sayaji Hotels, Sayaji Housekeeping Services, Kayum Dhanani, Raoof Dhanani and Suchitra Dhanani hold 60.24% stake in the company.

Mukesh Trends Lifestyle receives approval for IPO

Ahmedabad-based textile manufacturer Mukesh Trends Lifestyle (MTLL) has received approval from capital market regulator SEBI for its initial public offering. The company had filed its draft red herring prospectus (DRHP) with SEBI on September 27, 2019. The company sought approval for its public issue of up to 1 crore equity shares of face value of Rs 10 each, according to the DRHP filed with SEBI. As per the prospectus, company proposed to utilise issue proceeds for setting up of a manufacturing unit for knitted denim fabrics and working capital requirement. Company is engaged in the business of fabric processing, including bleaching, dyeing, printing and finishing of grey fabric to produce finished knitted and woven fabrics. MTLL commenced its commercial production in 1990 with an installed capacity of 5 million meters per annum for the production of woven fabrics. In April 2016, company diversified its manufacturing facilities to manufacture knitted fabrics by starting a separate commercial division for processing and printing knitted fabrics with an installed capacity of 3,600 MT per annum. The book running lead manager to the issue is Pantomath Capital Advisors.

ESAF Small Finance Bank hunts for investors ahead of IPO

ESAF Small Finance Bank is looking to bring big names on board before its IPO hits the markets in the first quarter of next financial year. The Keralabased bank had filed draft papers in January and plans to raise up to Rs 300 crore in a pre-IPO placement. It is yet to receive regulatory approval for the issue. "We are discussing with some HNIs who are interested to invest with a long-term perspective. If some marquee names show interest, it will be a good sign for other set of investors in the IPO offer," said K Paul Thomas, MD & CEO, ESAF SFB, adding that the discussions are on a preliminary stage and nothing has been finalised as of now. If the bank is successful in getting the pre-IPO funding, the amount will be deducted from the IPO size. ESAF SFB said that the promoter stake is likely to come down by 15-20 percent post-IPO, based on current market trends. The micro-finance lender is also open to acquisition as one of the options in the process going ahead.

|

15

|

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

|

|

|

|

|

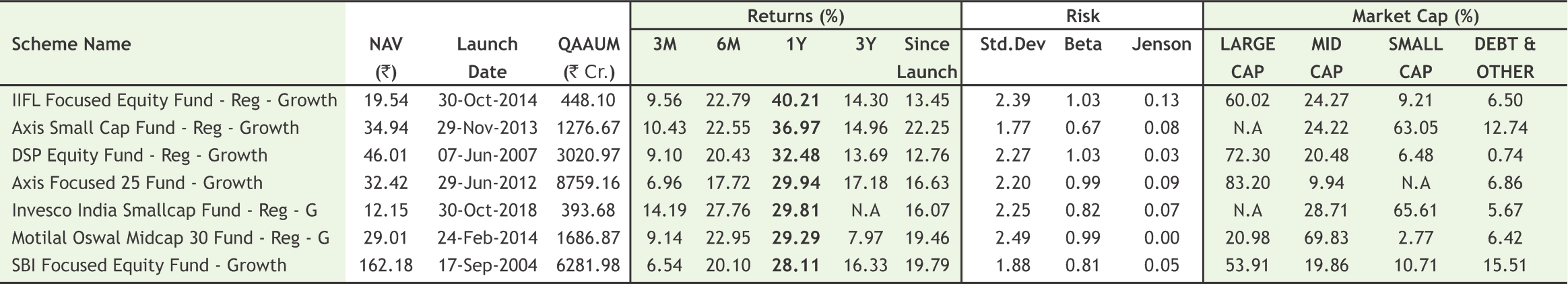

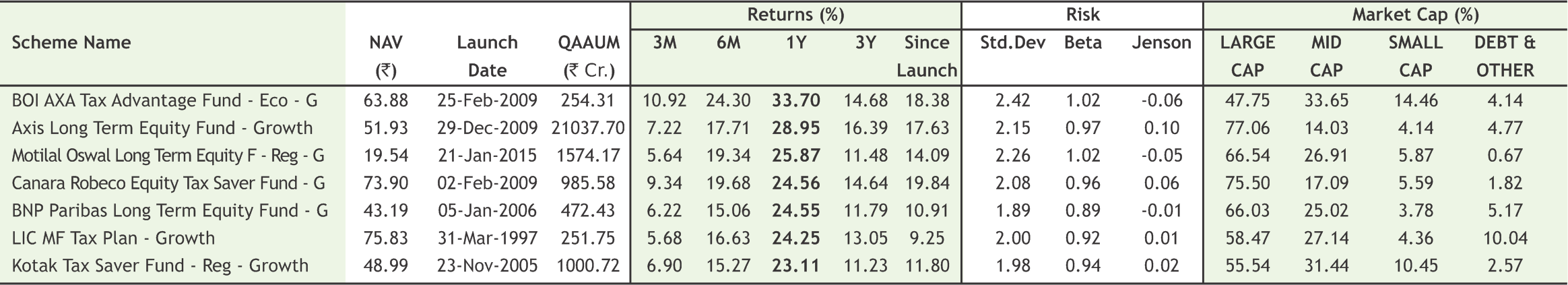

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

18

Some glimpse of SMC's Participation in ANMI's 11th International Convention "Redefining Capital Markets: A Must for $5 trillion Economy" held on 15th February, 2020 at Hotel The Lalit, New Delhi.

Dr. D K Aggarwal (CMD, SMC Investments & President, PHDCCI) during the meeting with Dr. V K Singh (Retd.), Hon’ble Minister of State for Road Transport and Highways, Government of India on 18th February, 2020.

SMC distributing Face masks for protection against the Corona Virus at Head Office, Delhi.

![]() Customized Plans

Customized Plans

![]() Comprehensive Investment Solutions

Comprehensive Investment Solutions

![]() Long-term Focus

Long-term Focus

![]() Independent & Objective Advise

Independent & Objective Advise

![]() Financial Planning

Financial Planning

Call Toll-Free 180011 0909

Visit www.smcindiaonline.com

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in