INDUSTRY & FUND UPDATE

Inflows into equity mutual funds plunges 27% to Rs 81,600 crore in FY20

Investors pumped Rs 81,600 crore into equity-oriented mutual fund (MF) schemes in 2019-20, registering a decline of 27 per cent from Rs 1.12 lakh

crore inflows in the preceding fiscal. However, this was the sixth successive year of net inflows in equity mutual funds, according to data by the

Association of Mutual Funds in India (AMFI). The flows into equity funds in the last fiscal were lower than the flows in 2018-19, primarily due to the

equity markets displaying volatility which made some investors take a break from making fresh equity investments. According to the data, net inflows

into equity funds, which also include equity-linked saving schemes (ELSS), were Rs 81,600 crore in the last fiscal as against Rs 1,11,858 crore in 2018-

19. Net inflows in these funds were Rs 1,71,069 crore in 2017-18, Rs 70,367 crore in 2016-17, Rs 74,024 crore in 2015-16 and Rs 71,029 crore in 2014-

15. However, they had witnessed a net outflow of Rs 9,269 crore in 2013-14. Of the total inflow in the latest fiscal, investors poured Rs 11,485 crore in

March, which was the highest level in the year. Also, they had invested Rs 10,730 crore in February, the highest level in 11 months.

Mutual fund NFOs hit by COVID19 pandemic; new launches postponed

In March, Sebi received just a single New Fund Offer (NFO) filing request, from Nippon India Mutual Fund. A month later, in May, SBI Mutual Fund filed

for two NFOs. Interestingly, both these requests were for passive funds. The Coronavirus pandemic has hit the number of NFO requests from fund

houses since January this year. There were 11 NFO filings in January, which fell to 6 in the March and to 2 in May. According to mutual fund participants,

fund houses have put on hold their plans to launch new products due to the coronavirus pandemic. As coronavirus spread beyond continents and in

India, the stock markets across the world started to fall.

SEBI eases compliance norms for liquid funds

Markets regulator SEBI gave three more months till June 30 for liquid funds to comply with the requirement of holding at least 20 percent of their

assets in liquid assets like cash and government securities. Besides, the timelines for submission of cyber security audit reports as mandated by SEBI

has been extended by two months till August 31, Securities and Exchange Board of India (SEBI) said in a circular. Also, the timelines for filing scheme

annual reports for 2019-20 has been extended by one month till August 31, it added. The new rule, aimed at improving risk management and ensuring

sufficient liquidity, was to become effective from April 1. Further, the regulator has given more time till June 30 for complying with the norms

pertaining to amortisation based valuation for money market and debt securities.

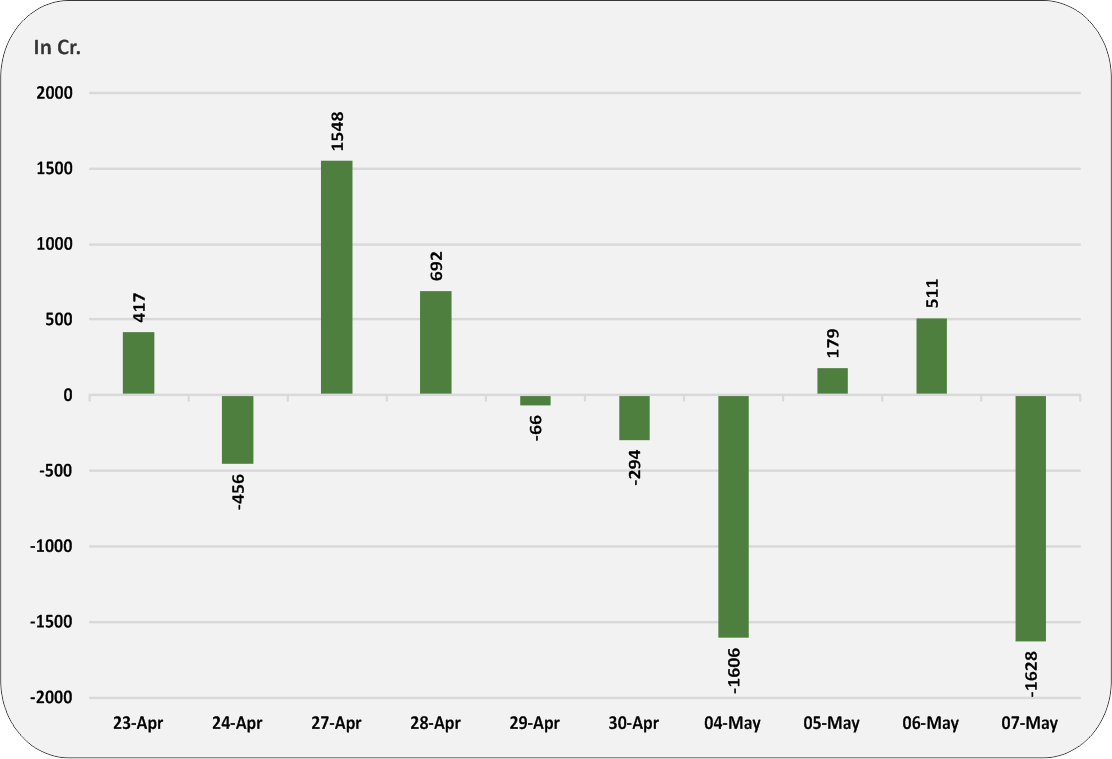

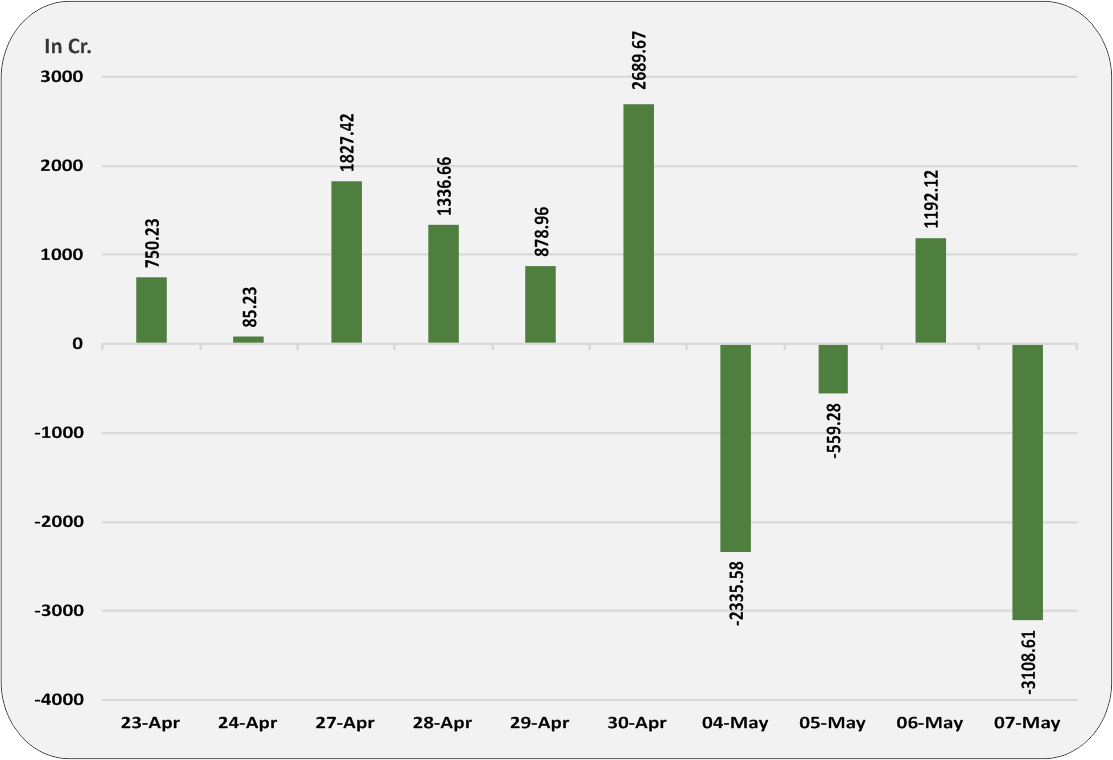

After RBI infusion, net redemptions under Credit Risk Funds down by 81.5%, claims AMFI

The Association of Mutual Funds in India (AMFI) on May 3 claimed that net redemptions under Credit Risk Funds have dropped 81.5 percent after the

Reserve Bank of India (RBI) announced a special liquidity measure of Rs 50,000 crore for the mutual fund industry. Net redemptions under Credit Risk

Funds stood at Rs 2,949.49 crore as on April 24 and peaked at Rs 4,294.36 crore on April 27, AMFI has said. Thereafter, for three days — April 28, 29 and

30 — the Net Redemptions under Credit Risk Funds stood at Rs 1,847.29 crore, Rs 1,251.17 crore and Rs 793.99 crore, respectively.

RBI extends regulatory benefits under SLF-MF to all banks

The Reserve Bank of India (RBI) extended the regulatory benefits under the special liquidity facility for mutual funds (SLF-MF) to all banks. The banks

claiming the regulatory benefits would be required to submit a weekly statement, the central bank said in its release. “Based on requests received

from banks, it has now been decided that the regulatory benefits announced under the SLF-MF scheme will be extended to all banks, irrespective of

whether they avail funding from the Reserve Bank or deploy their own resources under the mentioned scheme,” RBI said. Earlier, the RBI had provided

a Rs 50,000-crore shot in the arm to stressed mutual funds by unveiling a special liquidity facility for the sector, days after Franklin Templeton Mutual

Fund decided to close six debt schemes.

Manulife Investment Management acquires 49 percent in Mahindra AMC

Mahindra & Mahindra Financial Services Limited (Mahindra Finance), completed the proceedings for divestment of 49 percent stake in its whollyowned subsidiary, Mahindra Asset Management Company Private Limited (Mahindra AMC), to Manulife*, a leading global financial services group.

Manulife has invested US$ 35 million (~INR 265 crore) in the 51:49 joint venture, which aims to expand its fund offerings, drive fund penetration, and

achieve long term wealth creation in India. The joint venture brings together Mahindra Finance's domestic market strength and track record of

building successful businesses and partnerships, with Manulife's global wealth and asset management capabilities and richness of experience in

servicing the needs of consumers in Asia and around the world across developed and developing markets. Manulife is a leading international financial

services group, providing wealth and asset management and life insurance solutions for individuals, groups and institutions around the world, with

assets under management and administration of over US$ 915 billion as of December 31, 2019.

NEY

NEY