2019: Issue 707, Week: 28th October - 1st November

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2019: Issue 707, Week: 28th October - 1st November

A Weekly Update from SMC (For private circulation only)

NEY

NEY

![]() Customized Plans

Customized Plans

![]() Comprehensive Investment Solutions

Comprehensive Investment Solutions

![]() Long-term Focus

Long-term Focus

![]() Independent & Objective Advise

Independent & Objective Advise

![]() Financial Planning

Financial Planning

Call Toll-Free 180011 0909

Visit www.smcindiaonline.com

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

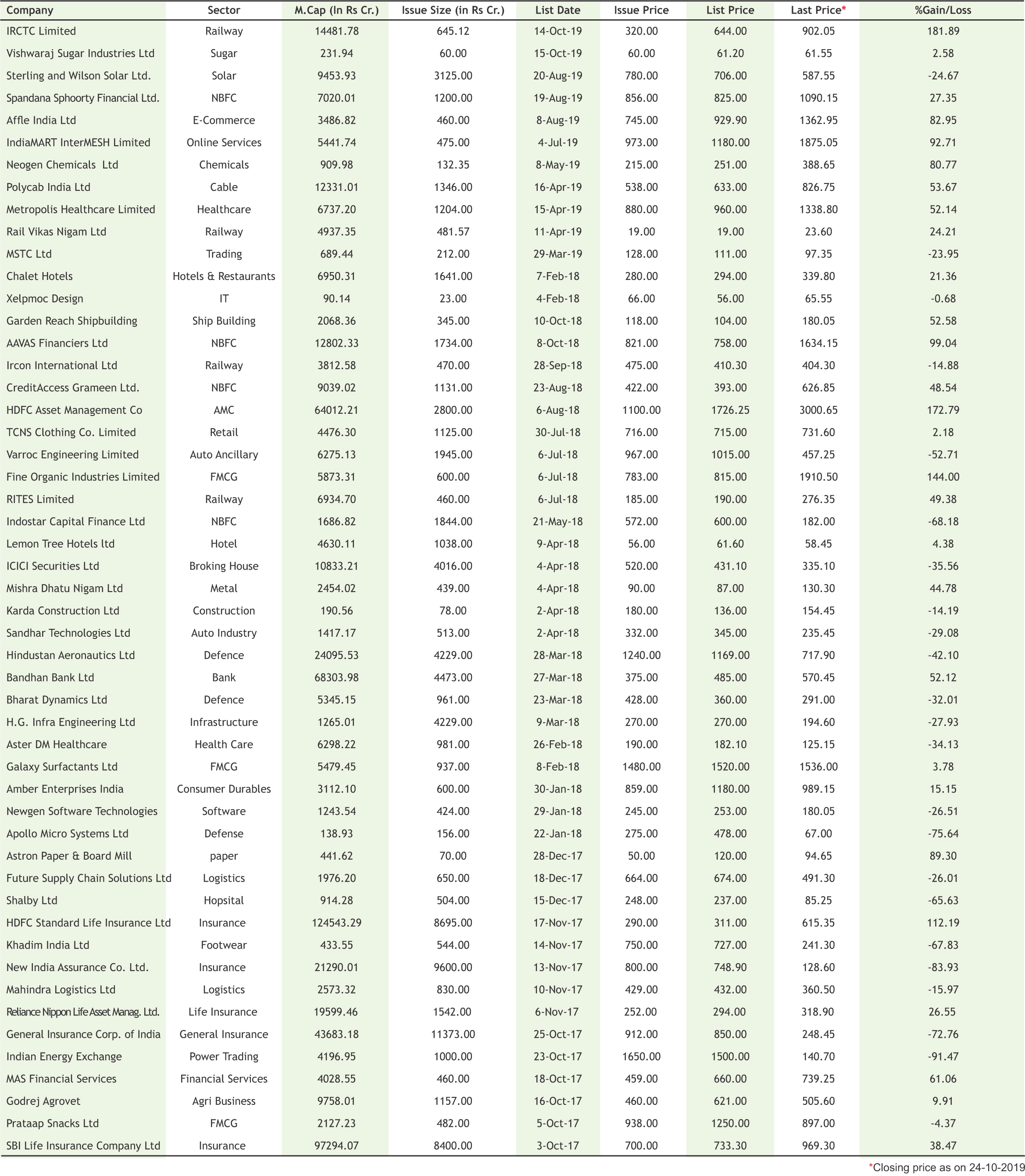

| IPO | 15 |

| FD Monitor | 16 |

| Mutual Fund | 17-18 |

I

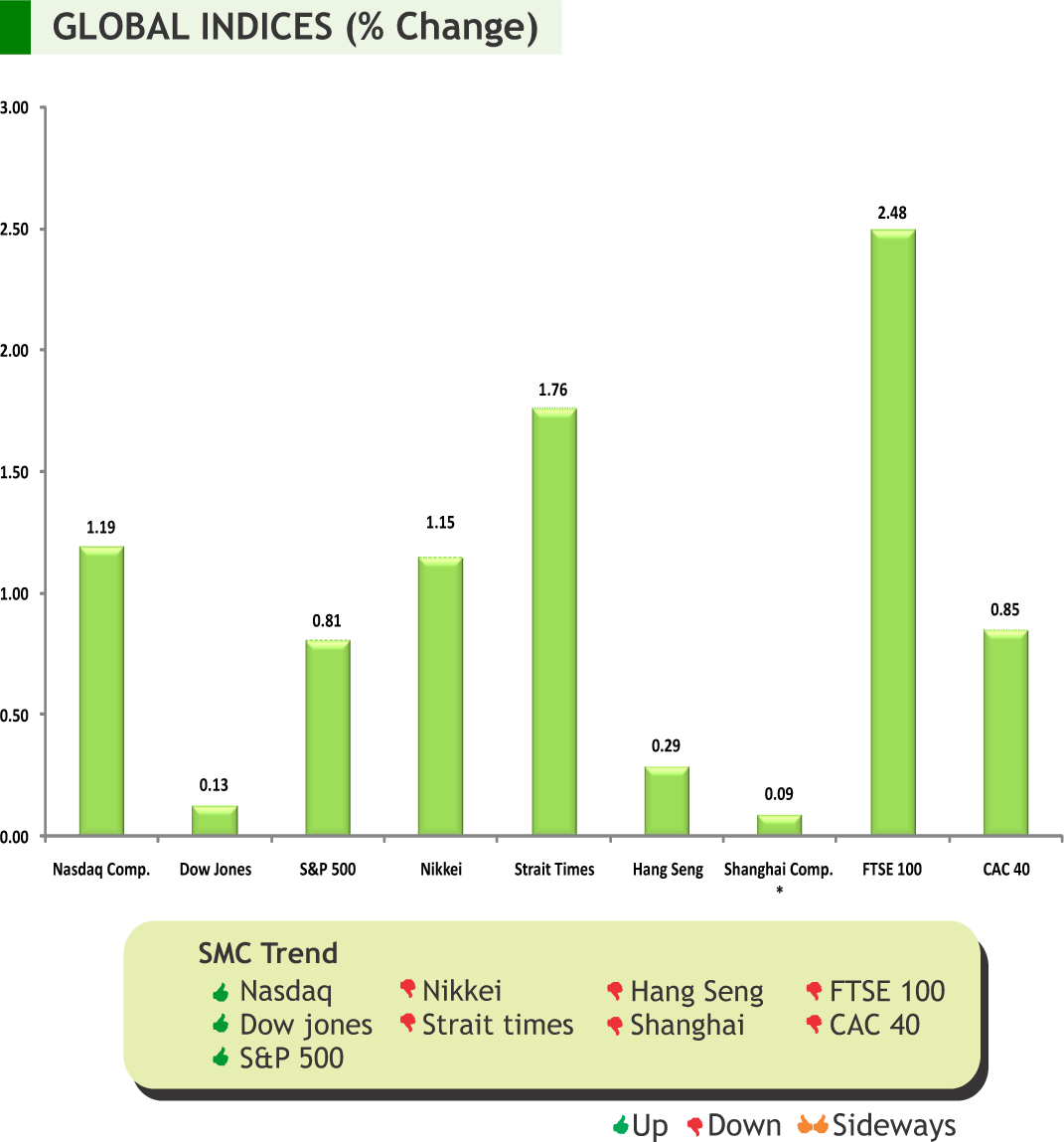

n the week gone by, the global stock markets remained volatile as the corporate earnings season rolled on. The trade war fears seem to have calmed down with talks between the U.S. and China progressing. Meanwhile, Chinese markets got support after US President Donald Trump said efforts to end a US-China trade war were going well. On the flip side, the U.S. economic data has hit a soft spot with weakness in retail sales and September durable goods orders. The People’s Bank of China unleashes 250 billion yuan into the financial system through the reverse repurchase agreement in its biggest open market operation since May. Investors across the globe sought more clues from corporate results as the earnings draws to a close - to gauge their respective country’s corporate health amid a slowing economy.

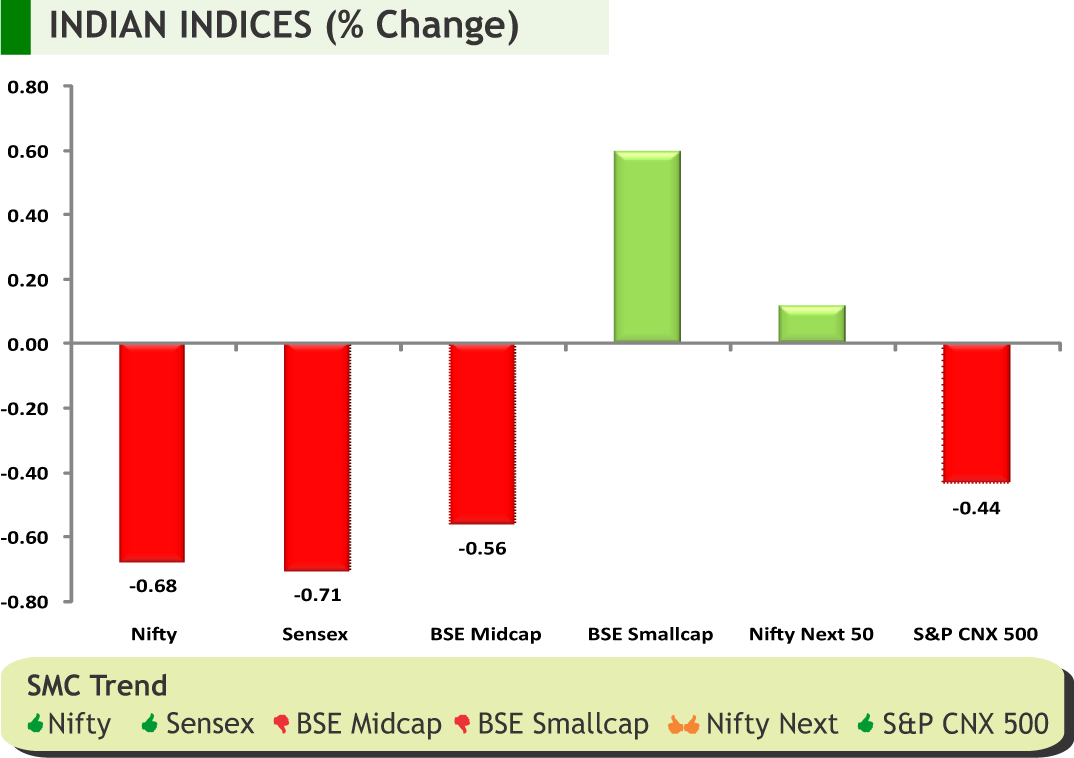

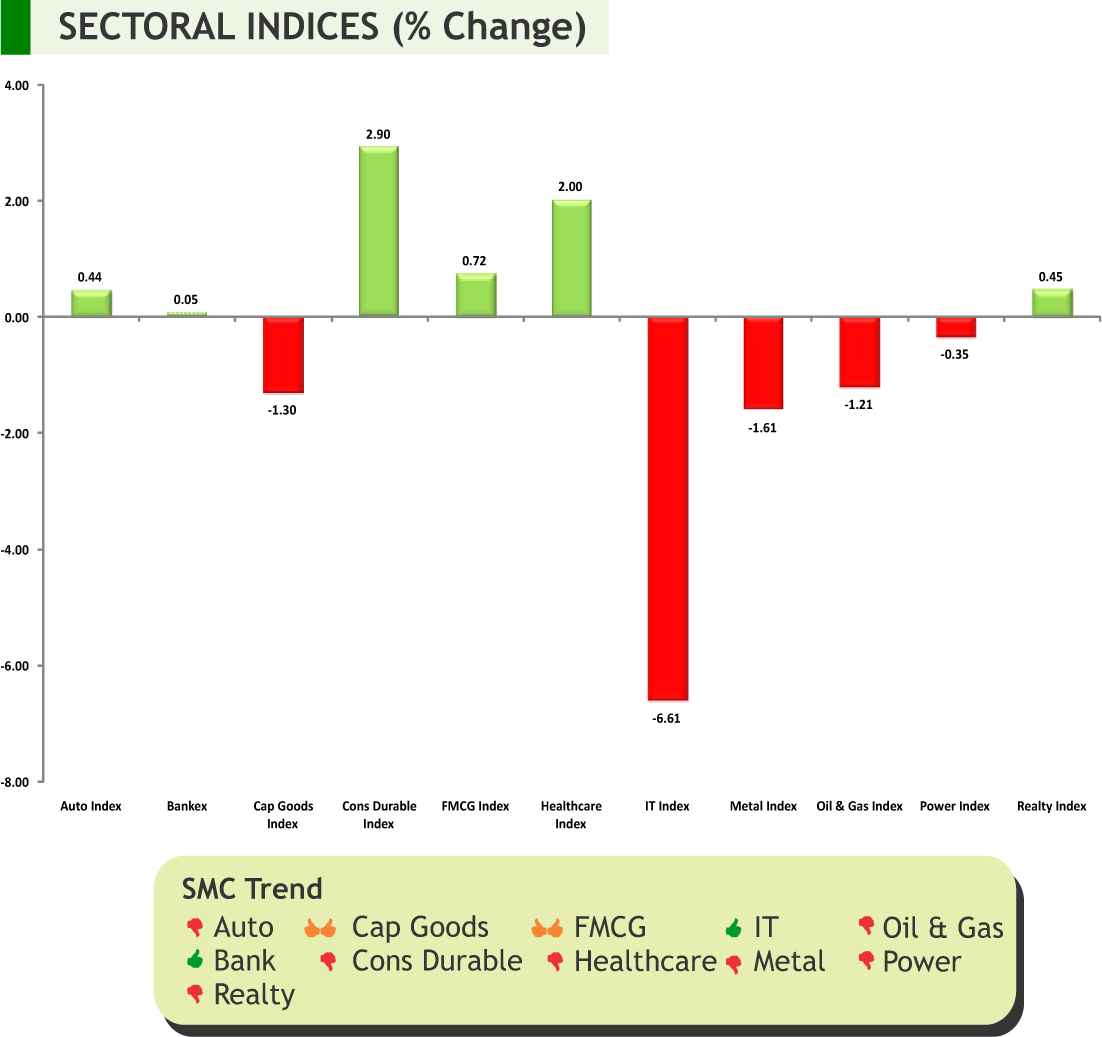

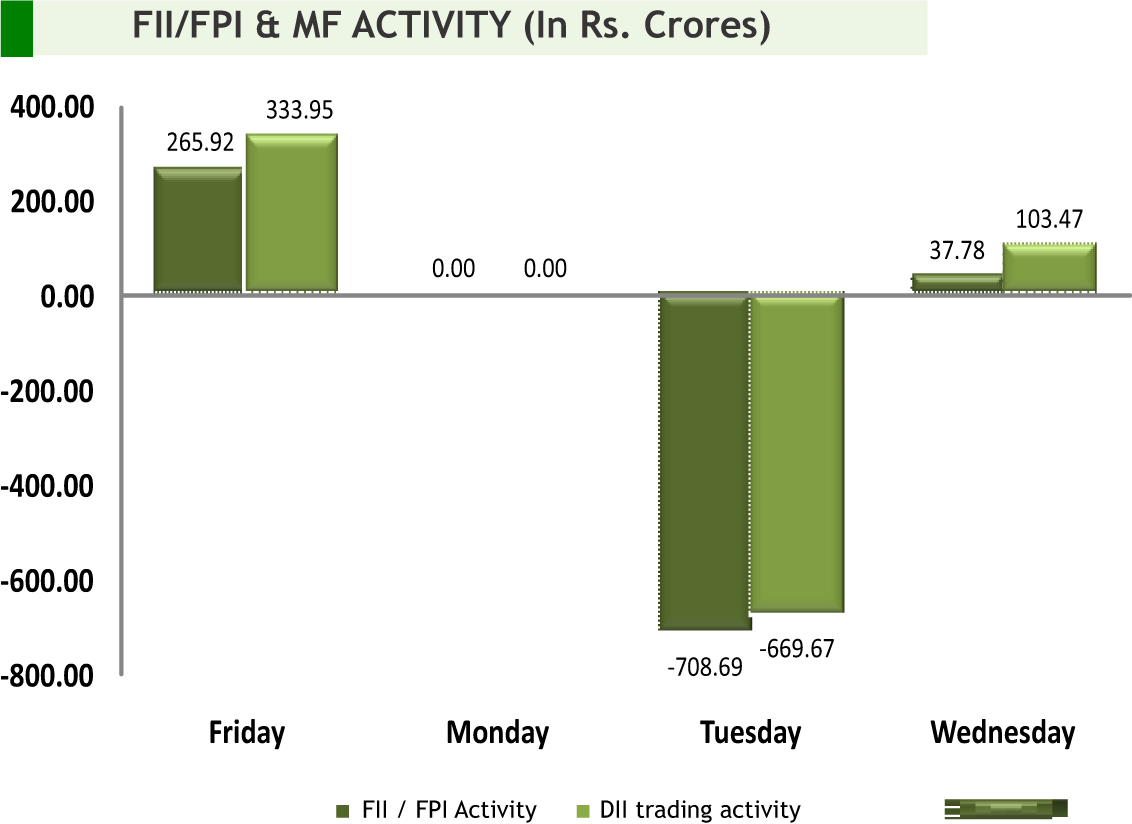

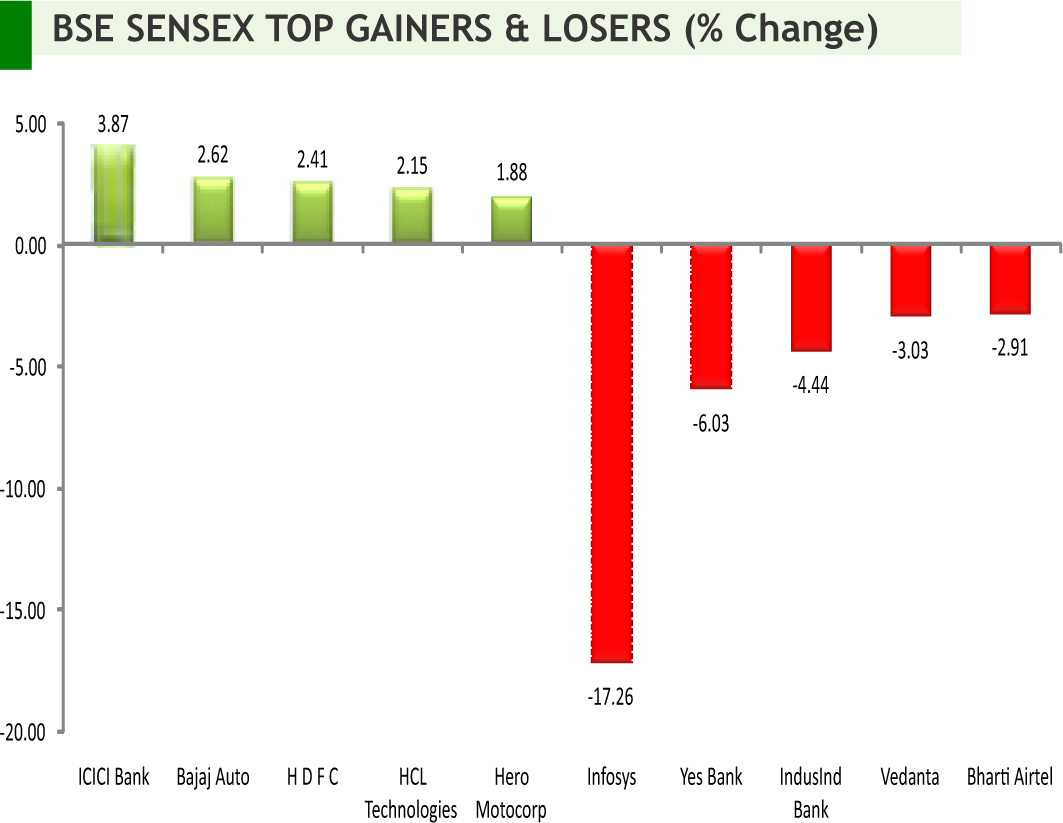

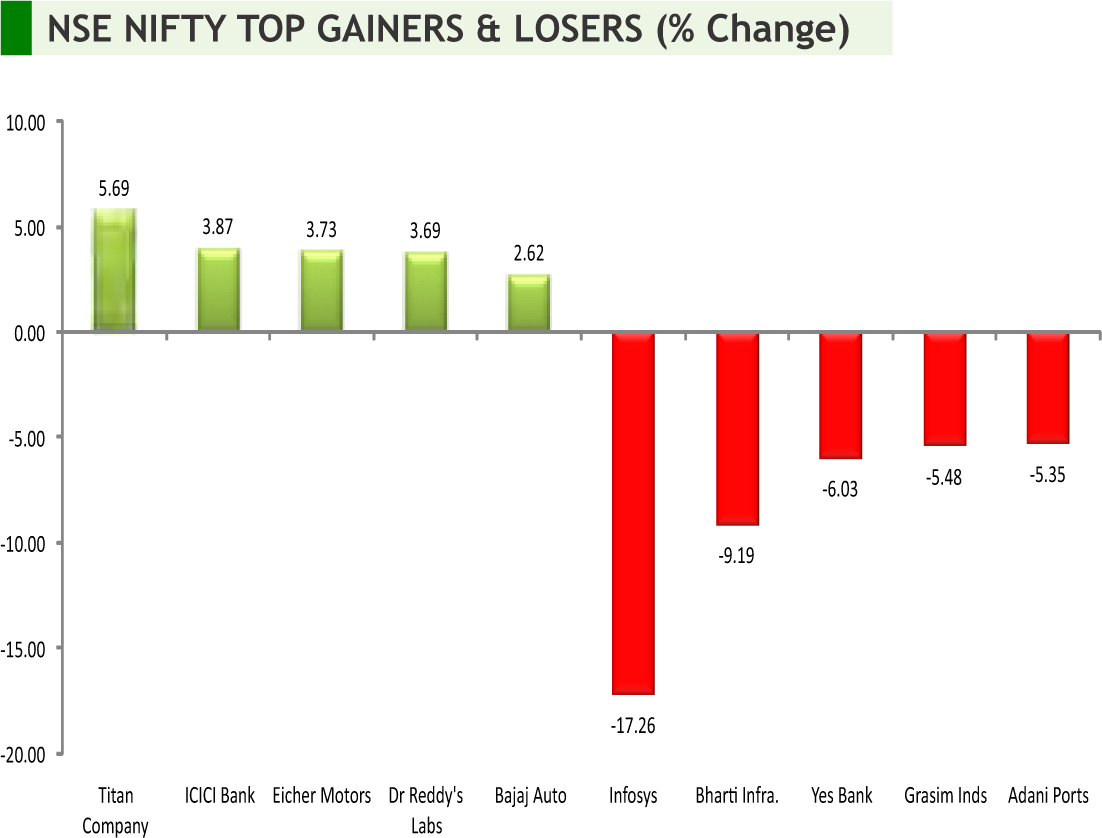

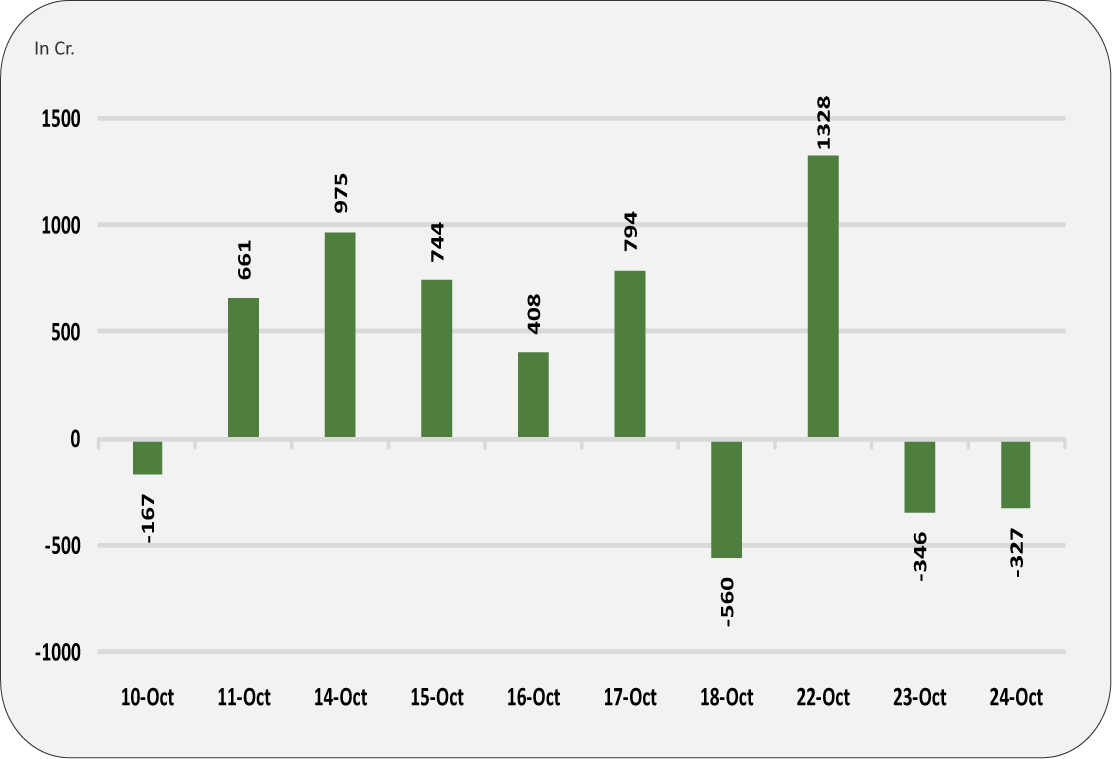

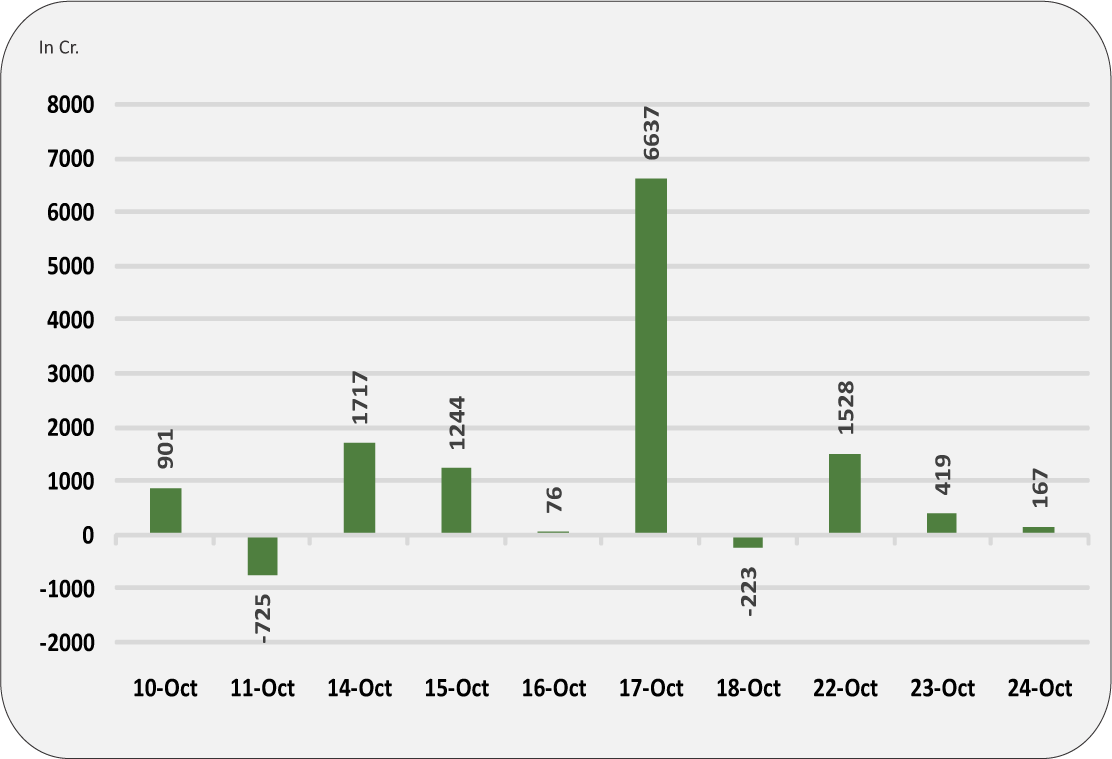

Back at home, domestic markets continued to trade with volatility ahead of earning results of the Indian corporate amid concerns over slowing global economic growth. Moreover, market participants also waited for any fresh directions on US-China trade talks and Brexit. The telecom stocks got badly hit after the Supreme Court on Thursday ruled in favour of the government on the AGR (adjusted gross revenue) issue. Markets are likely to remain volatile in the near-term till economic recovery is visible. Market is expected to get huge support if further stimulus measures by the government to boost consumption are announced, any green shoots in the financial sector and resolution of the US-China trade war. Going forward sectors such as Private Banks, insurance, consumer and retail may perform well. The Fed is widely expected to cut rates by a quarter points next week and its outcome is expected to give direction to the markets. Going forward, markets are expected take direction from the outflow and inflow of foreign funds, rupee movement, crude oil prices and global as well as domestic cues.

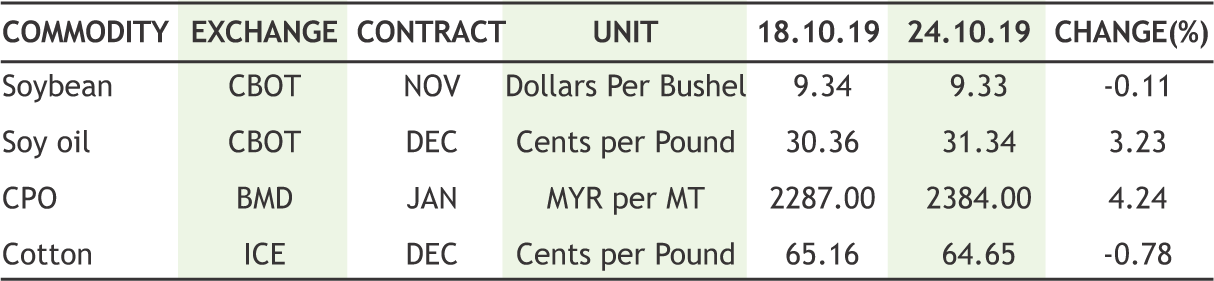

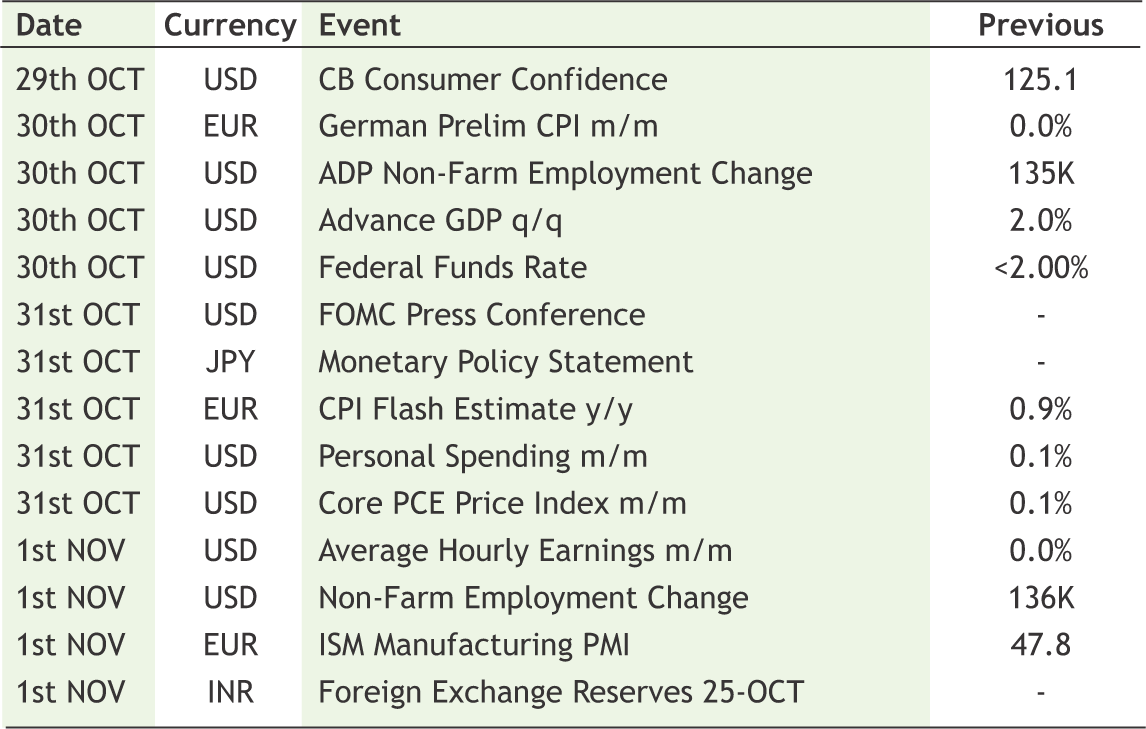

On the commodity market front, CRB strengthened further on some positive movements in bullion, energy and in some agri commodities. Even few base metals saw revival despite weaker economic data. Dollar index gained marginally from the lower level of 97 on Brexit issue after a downfall of two week. The European Central Bank left short term interest rates unchanged. The central bank also kept its forward guidance unchanged, suggesting that its main interest rates will remain at their current or lower levels until there’s strong evidence of a pickup in prices. Consumer Confidence (Oct), Pending Home Sales (MoM) (Sep), ADP Nonfarm Employment Change (Oct), GDP, FOMC Statement, Fed Interest Rate Decision, Nonfarm Payrolls (Oct), Unemployment Rate, ISM Manufacturing PMI of US, Manufacturing PMI (Oct) and Caixin Manufacturing PMI (Oct) of China, BoJ Monetary Policy Statement, BoJ Outlook Report (YoY), CPI of Euro Zone, GDP of Canada, etc are some very important triggers for this week.

“May the auspicious festival of lights, beautifully illuminate every corner of your life by adding sparkling moments of Love, Happiness, Success, and Joy. May you enjoy this festival with your loved ones with high spirits”.

Happy investing!!!

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Pharmaceuticals

• Dr Reddy's Laboratories Limited had initiated a voluntary nationwide recall of several lots of its ranitidine from the US market over confirmed contamination with N-Nitrosodimethylamine (MDMA) beyoond levels established by the US Food and Drug Administration (US FDA).

• Alembic Pharmaceuticals said its joint venture; Aleor Dermaceuticals has received approval from the US health regulator for its generic version of Temovate topical solution which is used to treat a variety of skin conditions.

• Biocon Ltd plans to sell insulin in low- and middle-income countries at a fraction of the current prices to achieve the $1-billion annual sales target for its biologics business by 2021-22.

Power

• Adani Green Energy Ltd (AGEL) has commissioned 50 megawatt wind generation capacity at Kutch in Gujarat. The company through its subsidiaries is implementing 725 MW wind projects in Kutch.

Oil & Gas

• Reliance Industries Ltd is on track to start production from a new gas field in the flagging KG-D6 block in the Bay of Bengal from mid-2020 even as output from its existing fields continued to fall. Reliance and its partner BP Plc of the UK had in June 2017 announced an investment of Rs 40,000 crore in the three sets of discoveries to reverse the flagging production in KG-D6 block.

Construction

• Vascon Engineers announced that the company has received Letter of Acceptance amounting to Rs 160 crores plus applicable taxes from Bangalore Metro Rail Corporation Ltd. (BMRC), i.e. a joint venture of Government of Karnataka & Government of lndia.

Telecom

• Bharti Airtel Ltd has acquired a minority stake of 8.82% in Bengalurubased software development startup Vahan Inc. The acquisition of Vahan is a part of Airtel’s Startup Accelerator Program to support growth of early-stage Indian tech startups. Vahan, which specialises in providing jobs by using artificial intelligence driven bot (web robot) and a messaging platform, is the first company to join the program.

• Reliance Jio has launched plans that come bundled with interconnect usage charges (IUC) usage. This comes after it announced that subscribers will have to get additional top-ups to make off net calls for compensating IUC paid by the operator. Under the new plans, Jio customers will not have to buy IUC top-up vouchers for making voice calls to other operators.

• The Supreme Court's decision in favour of DoT (department of telecommunications) could be a death knell for the telecom sector. The apex court has upheld most items that the DoT wanted to be included in the AGR (adjusted gross revenues) definition. AGR is the basis on which telcos share their revenues with the government (DoT) in the form of spectrum usage charges (SUC) and license fees. The total amount claimed by DoT from telcos is Rs 92,641 crore, which includes Rs 23,189 crore as the disputed amount, Rs 41,650 crore of the levy of interest, Rs 10,923 crore as penalty and Rs 16,878 crore as interest on penalty. Just about three years ago, the total dues were just Rs 29,474 crore.

INTERNATIONAL NEWS

• US new home sales slid by 0.7 percent to an annual rate of 701,000 in September after spiking by 6.2 percent to a revised rate of 706,000 in August. Economists had expected slump by 1.7 percent to a rate of 701,000 from the 713,000 originally reported for the previous month.

• US durable goods orders tumbled by 1.1 percent in September after rising by a revised 0.3 percent in August. Economists had expected durable goods orders to decline by 0.8 percent compared to the 0.2 percent uptick that had been reported for the previous month.

• US initial jobless claims dipped to 212,000, a decrease of 6,000 from the previous week's revised level of 218,000. Economists had expected jobless claims to inch up to 215,000 from the 214,000 originally reported for the previous week.

• US industrial production fell by 0.4 percent in September after climbing by an upwardly revised 0.8 percent in August. Economists had expected production to edge down by 0.1 percent compared to the 0.6 percent increase originally reported for the previous month.

• US housing starts plunged by 9.4 percent to an annual rate of 1.256 million in September after soaring by 15.1 percent to a revised 1.386 million in August.

• US business inventories came in virtually unchanged in August after climbing by a revised 0.3 percent in July. Economists had expected inventories to rise by 0.2 percent compared to the 0.4 percent increase originally reported for the previous month.

| Stocks | *Closing Price | Trend | Date Trend Changed | Rate Trend Changed | SUPPORT | RESISTANCE | Closing S/l |

|---|---|---|---|---|---|---|---|

| S&P BSE SENSEX | 39058 | UP | 08.02.19 | 36546 | 36300 | 35300 | |

| NIFTY50 | 11584 | UP | 08.02.19 | 10944 | 10900 | 10600 | |

| NIFTY IT* | 14899 | UP | 21.07.17 | 10712 | 15200 | 14800 | |

| NIFTY BANK | 29396 | UP | 30.11.18 | 26863 | 27700 | 27000 | |

| ACC | 1518 | DOWN | 04.10.19 | 1488 | 1560 | 1590 | |

| BHARTIAIRTEL | 375 | UP | 15.03.19 | 338 | 360 | 345 | |

| BPCL | 524 | UP | 30.08.19 | 355 | 470 | 450 | |

| CIPLA | 460 | UP | 25.10.19 | 460 | 430 | 420 | |

| SBIN** | 282 | DOWN | 02.08.19 | 308 | - | 290 | |

| HINDALCO | 182 | DOWN | 04.10.19 | 182 | 195 | 198 | |

| ICICI BANK | 469 | UP | 20.09.19 | 418 | 435 | 420 | INFOSYS | 637 | DOWN | 25.10.19 | 637 | 690 | 720 |

| ITC | 248 | DOWN | 31.05.19 | 279 | 260 | 270 | |

| L&T*** | 1425 | UP | 20.09.19 | 1412 | - | 1410 | |

| MARUTI | 7471 | UP | 13.09.19 | 6450 | 6600 | 6400 | |

| NTPC | 119 | DOWN | 16.08.19 | 118 | 126 | 130 | |

| ONGC | 140 | UP | 20.09.19 | 134 | 134 | 130 | |

| RELIANCE | 1431 | UP | 16.08.19 | 1278 | 1350 | 1320 | |

| TATASTEEL | 362 | DOWN | 10.05.19 | 487 | 365 | 375 | |

*NIFTYIT has broken the support of 15200 **SBIN has breached the resistance of 280 ***LT has broken the support of 1430

Closing as on 25-10-2019

NOTES:

1) These levels should not be confused with the daily trend sheet, which is sent every morning by e-mail in the name of "Morning Mantra ".

2) Sometimes you will find the stop loss to be too far but if we change the stop loss once, we will find more strength coming into the stock. At the moment, the stop loss will be far as we are seeing the graphs on weekly basis and taking a long-term view and not a short-term view.

| Meeting Date | Company | Purpose |

|---|---|---|

| 30/10/2019 | L&T Technology Services | Interim Dividend - Rs 7.50 Per Sh |

| 30/10/2019 | Cyient | Interim Dividend - Rs 6 Per Sh |

| 30/10/2019 | Asian Paints | Interim Dividend - Rs 3.35 Per Sh |

| 30/10/2019 | Granules India | Interim Dividend - Rs 0.25 Per Share |

| 30/10/2019 | HCL Technologies | Interim Dividend |

| 30/10/2019 | ICICI Pru. Life Insurance Co. | Interim Dividend - Re 0.80 Per Sh |

| Ex-Date | Company | Purpose |

|---|---|---|

| 29/10/2019 | Bharti Airtel | Quarterly Results |

| 29/10/2019 | Petronet LNG | Quarterly Results, Interim Dividend |

| 30/10/2019 | Container Corpn. | Quarterly Results |

| 30/10/2019 | Tata Global | Quarterly Results |

| 31/10/2019 | I O C L | Quarterly Results |

| 1/11/2019 | Dr Reddy's Labs | Quarterly Results |

| 4/11/2019 | Bharat Electron | Quarterly Results |

| 4/11/2019 | H D F C | Quarterly Results |

| 5/11/2019 | Berger Paints | Quarterly Results |

| 5/11/2019 | Dabur India | Quarterly Results, Interim Dividend |

| 5/11/2019 | Jindal Steel | Quarterly Results |

| 5/11/2019 | REC Ltd | Quarterly Results |

| 5/11/2019 | Tech Mahindra | Quarterly Results |

| 5/11/2019 | Titan Company | Quarterly Results |

| 5/11/2019 | Torrent Power | Quarterly Results |

| 6/11/2019 | Cipla | Quarterly Results |

| 6/11/2019 | Exide Inds. | Quarterly Results, Interim Dividend |

| 6/11/2019 | Godrej Consumer | Quarterly Results, Interim Dividend |

| 6/11/2019 | Lupin | Quarterly Results |

| 7/11/2019 | B P C L | Quarterly Results |

| 7/11/2019 | H P C L | Quarterly Results |

| 7/11/2019 | Sun Pharma.Inds. | Quarterly Results |

| 7/11/2019 | United Breweries | Quarterly Results |

| 8/11/2019 | Bank of Baroda | Quarterly Results |

| 8/11/2019 | Bharat Forge | Quarterly Results |

| 8/11/2019 | Century Textiles | Quarterly Results |

| Quarterly Results | Eicher Motors | Quarterly Results |

| 8/11/2019 | GAIL (India) | Quarterly Results |

| 8/11/2019 | GAIL (India) | M & M |

4

5

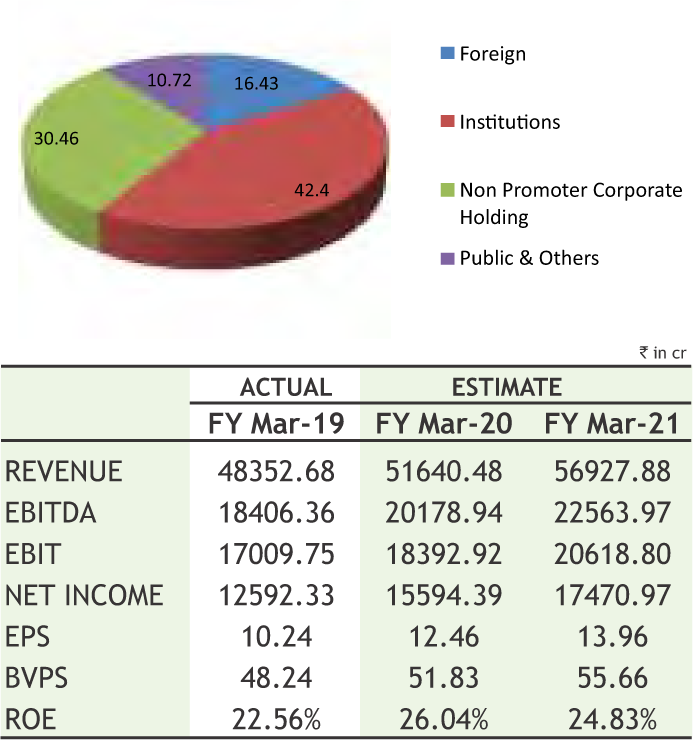

ITC LIMITED

CMP: 248.95

Target Price:321

Upside: 29%

| Face Value (Rs.) | 1.00 |

| 52 Week High/Low | 310.00/234.10 |

| M.Cap (Rs. in Cr.) | 305872.16 |

| EPS (Rs.) | 10.31 |

| P/E Ratio (times) | 24.15 |

| P/B Ratio (times) | 5.17 |

| Dividend Yield (%) | 2.30 |

| Stock Exchange | BSE |

Investment Rationale

• ITC's business encompasses Fast Moving Consumer Goods (FMCG), hotels, paperboards & specialty papers, packaging, agri-business, and information technology.

• According to the management of the company, the company is focusing to grow its FMCG business by entering newer segments and tapping opportunity in foods segment would be a catalyst for top line growth in the long run.

• During the Q2FY19, it’s FMCG &hotels business has reported growth of 6.5% & 18%, respectively. On the development front for hotel segment, ITC Royal Bengal, Kolkata receives excellent response, setting new benchmarks in culinary and service excellence in a relatively short span of time.

• The Company posted a steady performance during the quarter amidst a particularly challenging operating environment. Gross Revenue for the quarter stood at Rs.11750.16 crores, representing a growth of 6%, driven mainly by Paperboards, Hotels and FMCG-Others (excluding the Lifestyle Retailing Business). Profit after Tax at Rs.4023.10 grew by 36.2%. Total Comprehensive Income stood at Rs.3979.73 crores (previous year Rs.2754.55 crores).

• The Branded Packaged Foods Businesses delivered a steady performance during the quarter, anchored on innovative product launches and impactful communication campaigns in conventional and digital media. `Aashirvaad' atta, continuing its leadership position and ‘Bingo!' Potato Chips’ and ‘Tedhe Medhe’ continued to drive growth in the Snacks Business.

• The Personal Care Products Business delivered a robust performance and enhanced its market standing during the year, which has driven largely by sustained focus on innovation, product mix enrichment, expansion of distribution reach, proactive cost management and enhancing supply

chain responsiveness.

• In view of the long-term potential of the Indian hospitality sector, the company remains committed to enhancing the scale of the Business by adopting an 'asset-right' strategy that envisages building world-class tourism assets for the nation and growing the footprint of managed properties by leveraging its hotel management expertise.

Risk

• Non-discriminatory tax and regulatory regime on tobacco product

• Product pricing pressure related to FMCG others and personal care product

Valuation

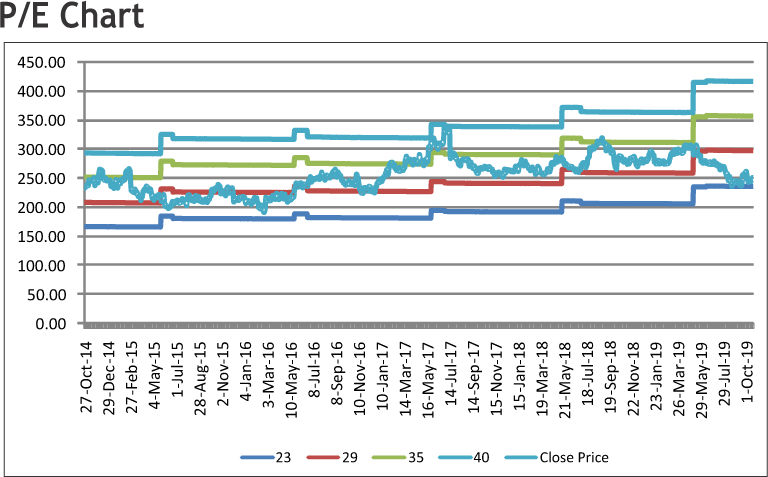

Despite an extremely challenging operating environment, the company has consolidated its leadership position in the industry and continued to improve its standing in key competitive markets across the country. This demonstrates the resilience of the company's portfolio of brands, superior consumer insights and its relentless focus on value creation. Thus, it is expected that the stock will see a price target of Rs.321 in 8 to 10 months time frame on an expected P/E of 23x and FY20 expected earnings (EPS) of Rs.13.96.

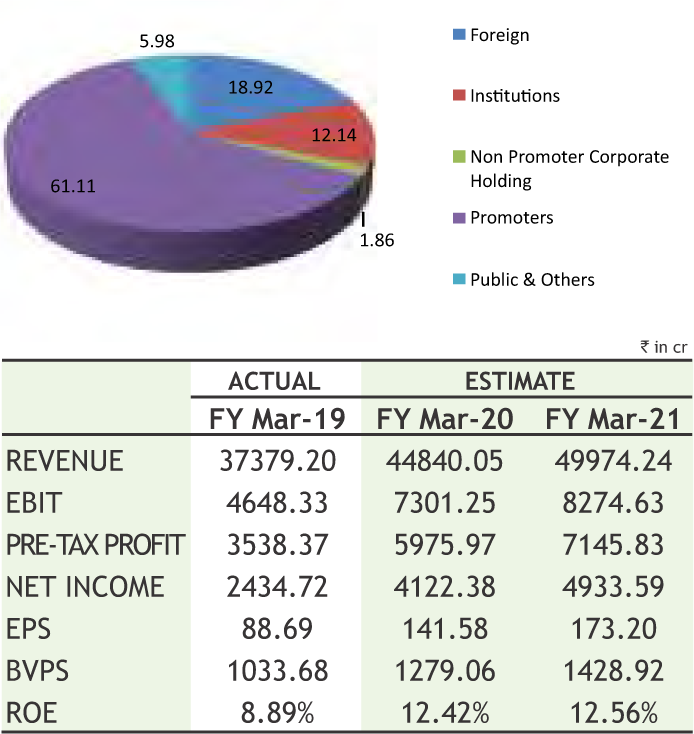

ULTRATECH CEMENT LIMITED

CMP: 4314.55

Target Price: 5023

Upside: 16%

| Face Value (Rs.) | 10.00 |

| 52 Week High/Low | 4903.90/3278.00 |

| M.Cap (Rs. in Cr.) | 124523.81 |

| EPS (Rs.) | 113.99 |

| P/E Ratio (times) | 37.85 |

| P/B Ratio (times) | 3.54 |

| Dividend Yield (%) | 0.25 |

| Stock Exchange | BSE |

Investment Rationale

• UltraTech completed the acquisition of Century's cement business recently. With this acquisition, UltraTech's cement manufacturing capacity stands augmented to 117.4 mtpa, including its overseas capacity. This makes UltraTech the 3rd largest cement company in the world.

• On developmental front, the Igrinding unit is undergoing trial run and as per the management should get operational in Q3YF20 itself. Further the board has approved expansion of 3.4 MT by adding grinding capacity in Odisha (greenfield) and West Bengal & Bihar (brownfield). The total investment for these capacities would be Rs. 940 crore.

• With capacities operating at above 100% levels during high demand periods, the management has decided to add grinding units in the east. The company currently has enough space to expand capacities in the North at Nathdwara location. The company has announced setting up of another WHRMS plant taking the total number of plants to 10 and capacity to 131 MW.

• In Q2 FY20, it consolidated net profit jumped 63.4% to Rs 583.11 crore on 4% rise in net sales to Rs 9,620.47 crore. EBITDA grew 32% to Rs 2,072 crore, while the EBITDA margin improved by 5% to 22% from 17% in Q2 FY19. Led by favourable pricing environment and increasing retail sales, the company achieved a 6.1% growth in realizations to Rs. 5208/tone.

• As per the management, on the basis of positive demand seen in North India in Q2 as many parts of North India were not impacted by heavy rains and

floods, there is a good possibility of a normalized demand for cement going forward.

Risk

• Demand Weakness due to delay in payment to contractors

• Fluctuation in prices of Raw materials

Valuation

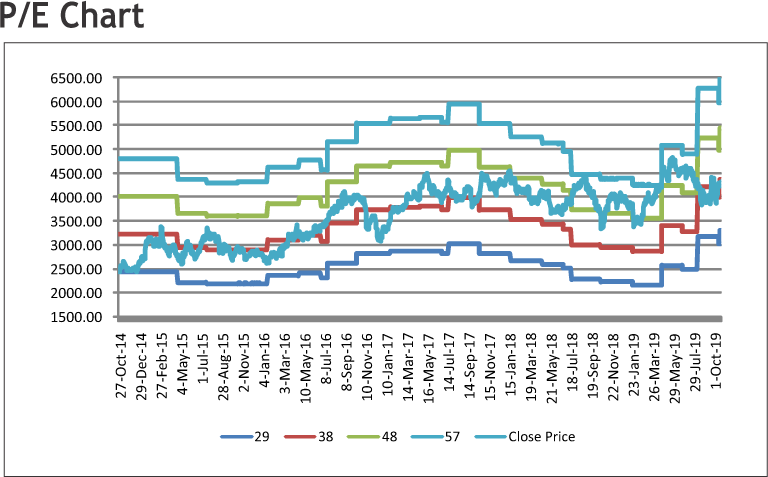

The Government's firm commitment to revive the economy and the thrust on infrastructure spending augurs well for the growth of cement demand. The company with its presence across all the zones in the country, is the best positioned to take advantage of the revival in cement demand. As seen in the earlier acquisitions, the management’s ability to turn around the acquired assets provides confidence in the company and the management expects similar performance even in the newly acquired Century assets. Thus it is expected that the stock will see a price target of Rs. 5023 in 8-10 months time frame on the PE multiple of 29 times its FY21E EPS of Rs. 173.20.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

The stock closed at Rs 702.60 on 25th October, 2019. It made a 52-week low of Rs 575 on 04th September 2019 and a 52-week high of Rs. 849.90 on 19th December 2018. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 676.32

As we can see on chart that stock had consolidated in the range of 600-700 for six months and formed an “Inverted Head and Shoulder” pattern on weekly charts, which is bullish in nature. Last week, stock ended on verge of breakout of same along with decent volume. So, we can expect more upside in coming days. Therefore, one can buy in the range of 690-695 levels for the upside target of 750-760 levels with SL below 665.

The stock closed at Rs 483.90 on 25th October, 2019. It made a 52-week low at Rs 277.35 on 04th February 2019 and a 52-week high of Rs. 488.80 on 24th October 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 391.39

Short term, medium term and long term bias are looking positive for the stock as it is trading in higher highs and higher lows sort of “Rising Channel” on daily charts, which is bullish in nature. Last week, stock ended with marginal gains and has continued its momentum, so follow up buying is expecting from current levels. Therefore, one can buy in the range of 475-478 levels for the upside target of 520-530 levels with SL below 450.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

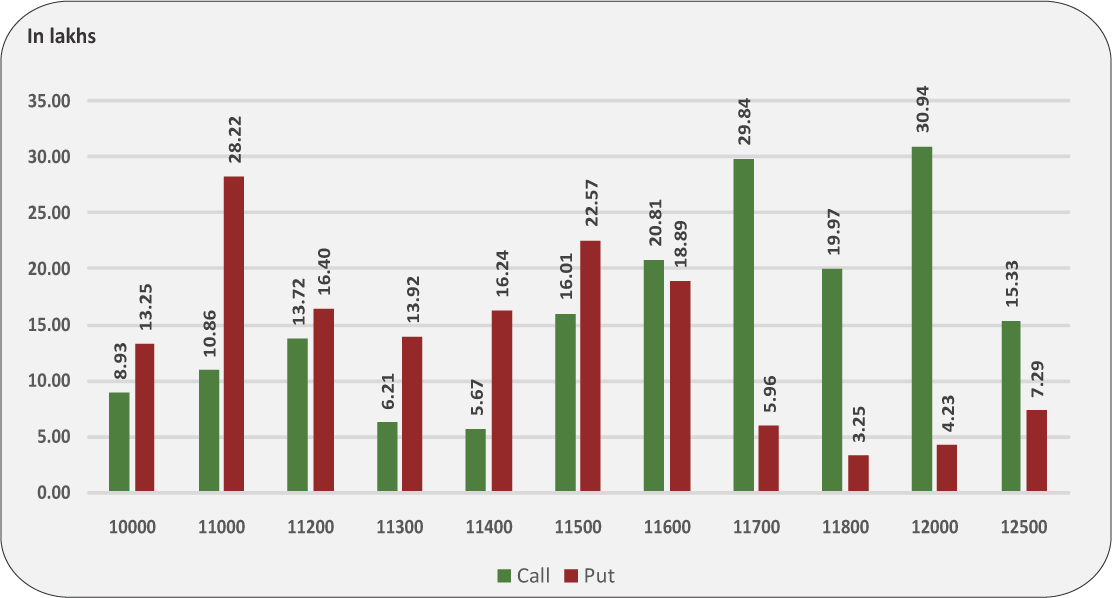

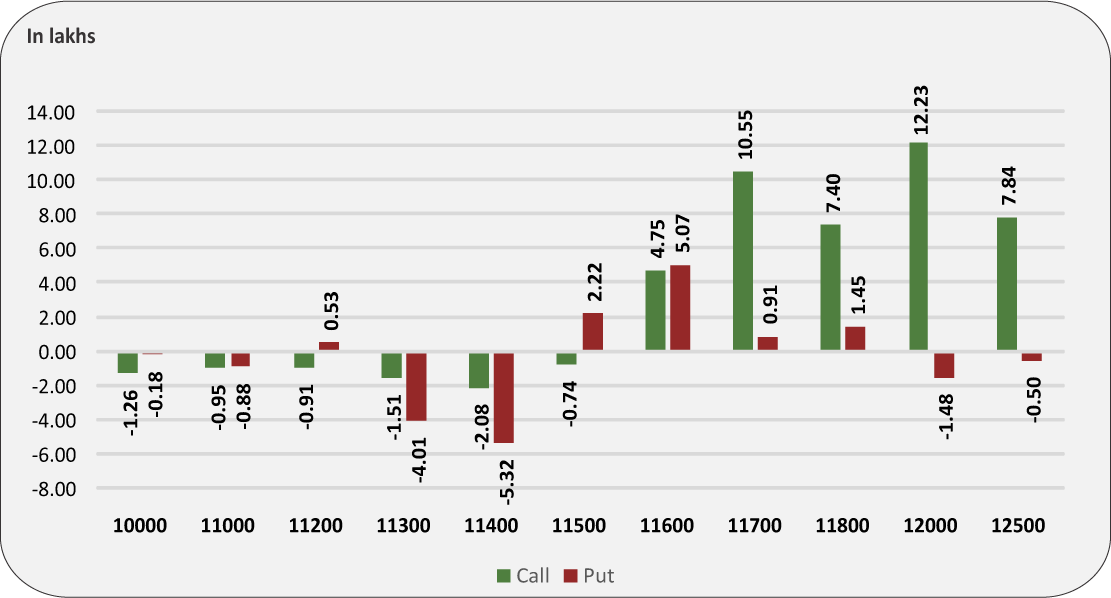

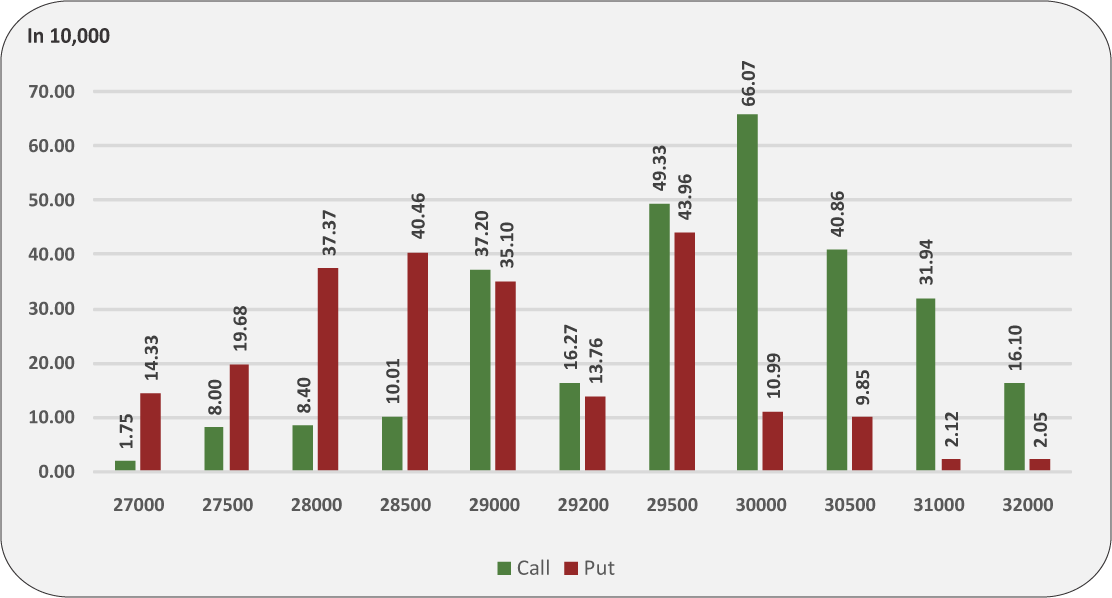

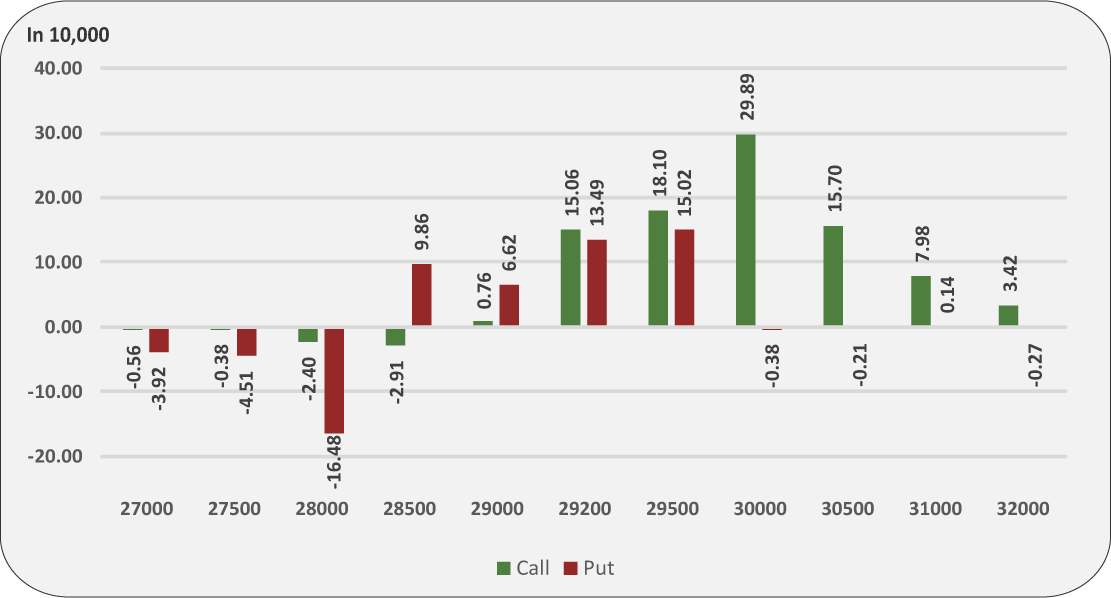

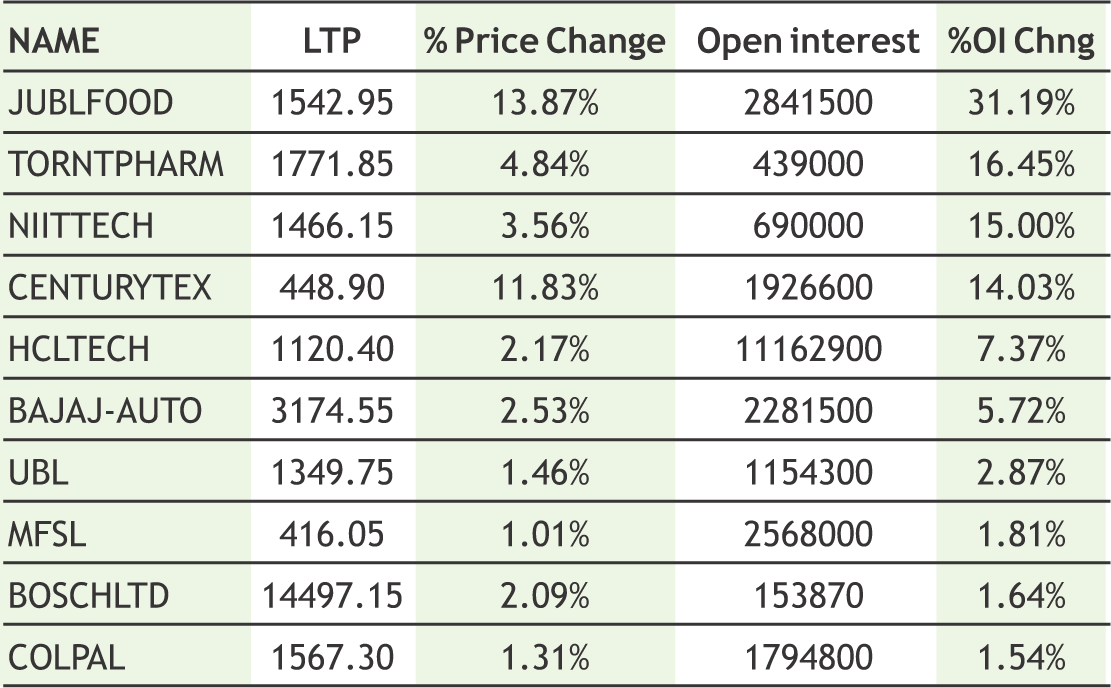

Indian markets remained volatile during last week with Nifty ending in the midst of marginal losses while Bank nifty closed with nearly 1% gains. During the week, majorly stock specific action remained under focus. On derivative front, the tug of war was seen among bulls and bears as call writers at 11600 strikes while put writers at 11500 strikes majorly kept the markets volatile. From the technical front, however, we expect that volatility will likely to grip market and any dip should be used to create fresh longs. The Implied Volatility (IV) of calls was up and closed at 14.90% while that for put options closed at 15.85%. The Nifty VIX for the week closed at 16.24% and is expected to remain volatile. PCR OI for the week closed at 1.03 which points towards put writing and is positive for markets. From technical front now Nifty and bank nifty both the indices are comfortably trading above its short and long term moving averages which suggest that current trend is likely to continue towards more upside. On higher side 11650 levels should act immediate hurdle for Nifty above which we can witness further short covering from call writers towards 11700-11750 levels in coming sessions.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

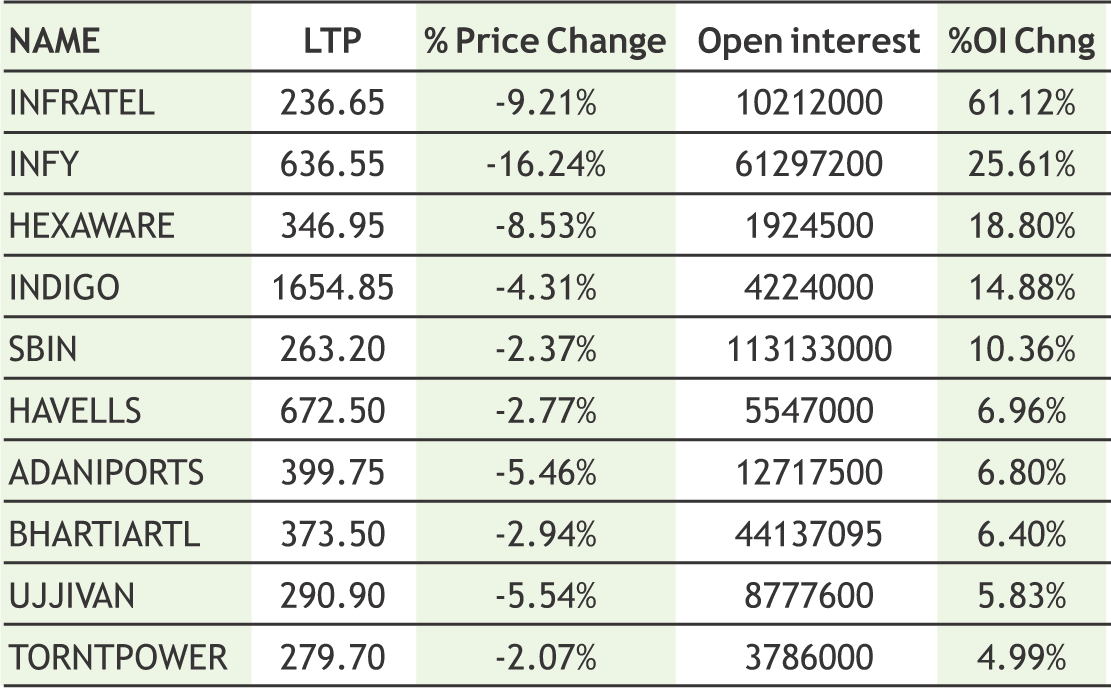

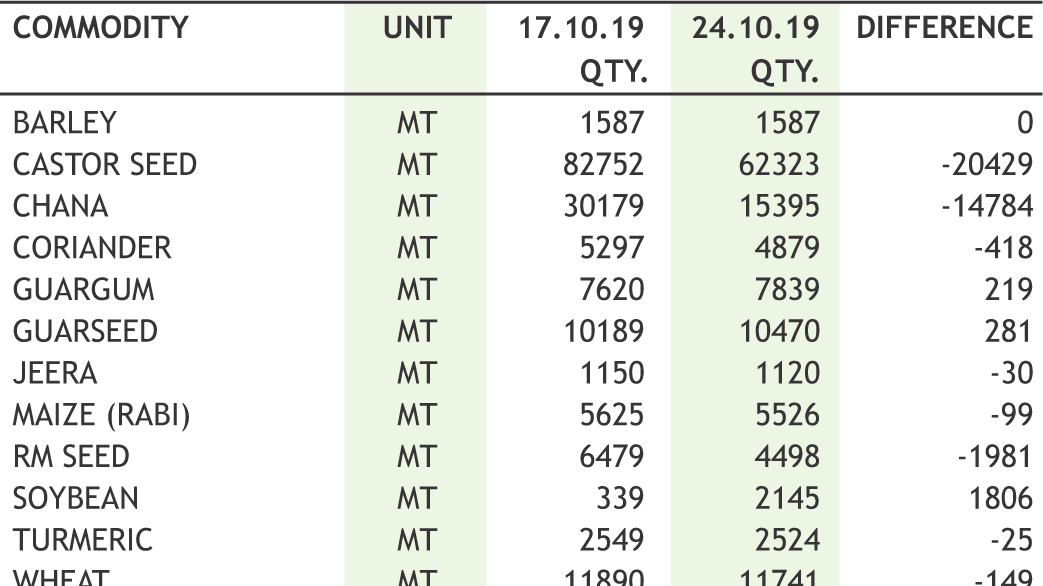

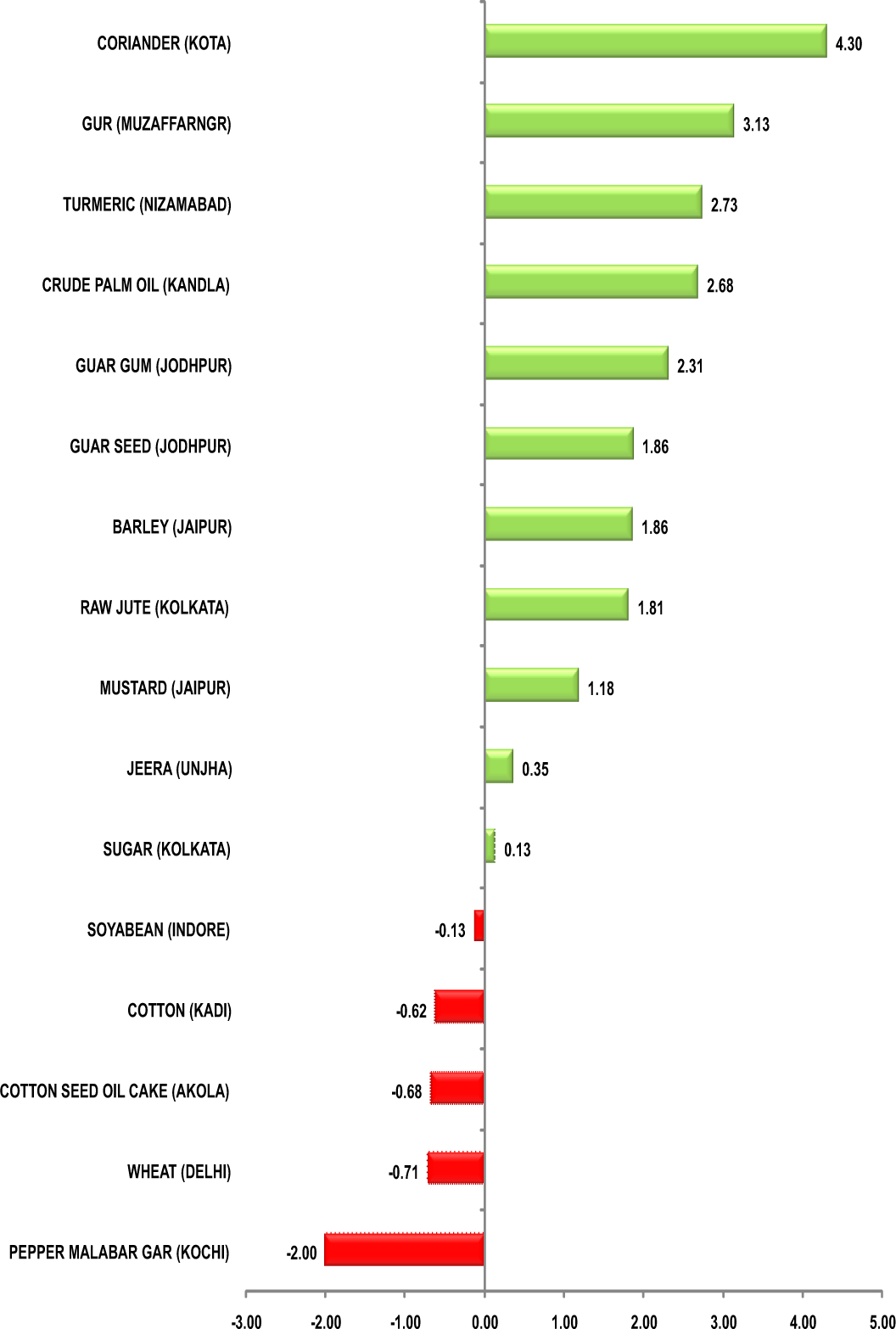

The short covering was seen in turmeric futures (Nov) and the commodity is likely to face resistance near 6200 levels. On the spot markets, the buyers are purchasing limited stocks; on an average 55% of the arrivals are being sold. Also on the supply side, only few bags of Salem Finger turmeric are arriving for sale at Regulated Marketing Committee. At the Erode Turmeric Merchants Association Sales yard, the finger turmeric was sold at Rs.5,500-6,906 a quintal, root variety Rs.5,008-6,455. Jeera futures (Nov) may remain trapped in the sideways to bearish zone of 16000-16700 levels. Spot jeera prices are trading on the lower side at the major Unjha market amid sluggish trade. While prices remained steady at the Rajkot market. Arrivals are steady around 8,000 bags and 500 bags at Unjha and Rajkot respectively. According to traders, both the buyers and sellers were very less in the market. There was no export demand. Trading was seen only on the basis of sporadic local demand. Dhaniya futures (Nov) is looking bullish as it can head towards 7000-7200 levels. The sentiments are positive due to robust demand in contrast with lower production this year and depleting stocks. Cardamom futures (Nov) is expected to take support near its 200 days moving average of 2580 levels & the downside may remain capped. According to traders, growers are holding their stock, which has resulted in low arrivals. In the last 10 days, prices have come down by around Rs.600 per kg and the current average is hovering around Rs.2300 per kg. The prices are expected to witness a recovery amid arrivals of good quality capsules at the auctions.

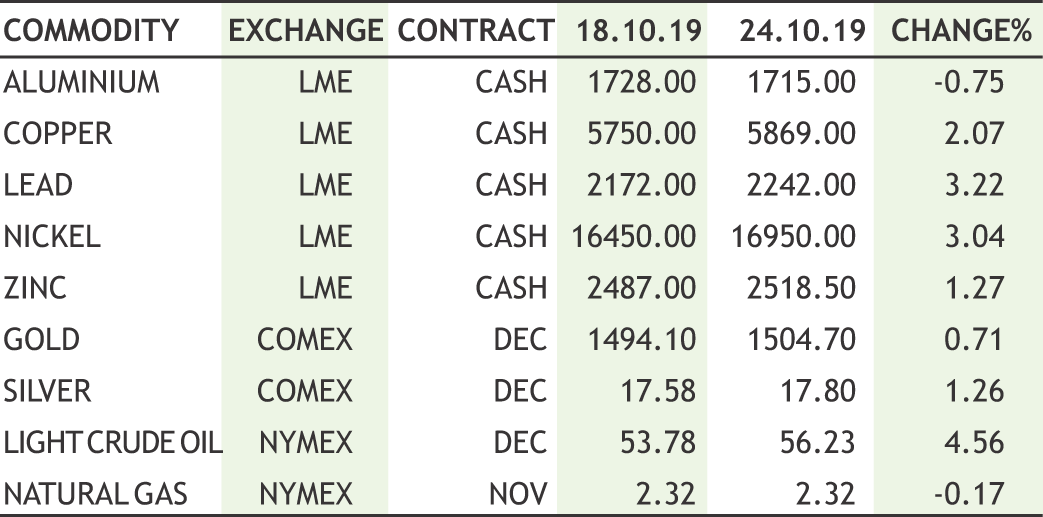

Bullion counter may witness upside momentum as expectation of rate cut in this week meeting i.e on 30th Oct and uncertainty regarding Brexit can give prices underlying support. Weak U.S. economic data has spurred expectations for another interest rate cut by the Federal Reserve. Gold can test 38900 while taking support near 37900 while silver can test 47500 while taking support near 45500. In making the rate cuts, Fed officials have stated that they are largely in response to fears of global slowing, U.S.-China tariffs and tame inflation rather than an indication that the U.S. economy is in trouble. New orders for key U.S.-made capital goods fell more than expected in September and shipments also declined a sign that business investment remains soft amid the fallout from the U.S.-China trade war. Meanwhile ECB held rates unchanged and continued its bond purchase program of €20billion per month. EU member states delayed a decision on whether to grant Britain a three-month Brexit extension, while Prime Minister Boris Johnson stated that if the deadline is deferred to the end of January he would call an election by Dec.12 to break Britain’s Brexit impasse. China’s net gold imports via Hong Kong fell 9% in September from the previous month mainly due to softer demand and possible measures by Beijing to prop up the yuan. From last year Diwali till now gold has given superior return as global growth worries, monetary policy easing by central banks, trade spat between China and U.S and duty hike on imports have pushed gold prices up sharply.

Soybean futures (Nov) will probably trade sideways to up in the range of 3730- 3850 levels. Overall, the bias will be on the positive side as the excessive rains this year is likely to lower the production for the year 2019 to 89.941 Lakh tonnes (+- 5%), lesser by 19.391 lakh tonnes (-17.7%) as compared to final estimates for kharif 2018. Average yield for the year 2019 is estimated as 836 kg/hectare as against 1009 kg/hectare during the year 2018. As of now, the market would be focusing on the arrivals of soybean from the kharif season. On the CBOT, U.S soybean futures (Nov) is expected to take support near 9.20, while face resistance 9.54 levels. In breaking news reported by Bloomberg, China is returning to the U.S. soybean market, and other major farm commodities and would spend some $20 billion over the next 12 months. All of this depends on President Trump and Xi Jinping signing the Phase 1 deal, expected by the market at the APEC Summit in Chile next month. The bullish trend is likely to prevail in mustard futures (Nov) & it has an upside potential to reach 4400 levels. The restricted arrivals from growing belts and demand from oil mills for crushing to meet the demand of winter season are mainly lifting the sentiments. In news, the Cabinet Committee on Economic Affairs has approved the increase MSP of Rapeseed & Mustard by Rs. 225 per quintal. CPO futures (Nov) may regain towards 590-600, while soy oil futures (Nov) can see an upside target of 775-780 levels respectively. Malaysian palm oil is trending bullish on account of implementation of the biofuels mandates in the form of palm oil.

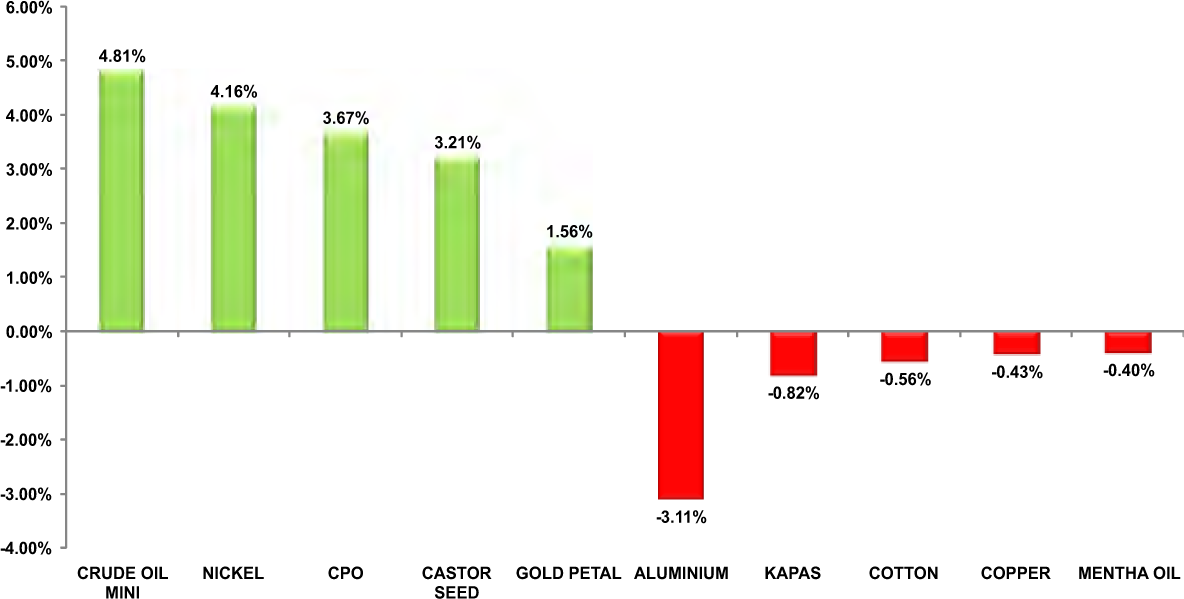

Crude oil prices may witness range bound movement as drop in stockpiles supported its prices while renewed concerns about fuel demand in light of gloomy economic growth forecasts can cap the upside. Crude oil may face resistance near 4150 while taking support near 3800 levels. Meanwhile Saudi Arabia, OPEC’s de facto leader, wants to focus first on boosting adherence to the group’s production-reduction pact with Russia and other non-members, an alliance known as OPEC+, before committing to more cuts. The prospects of deeper production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and its allies also helped support the market. OPEC, Russia and other producers have since January implemented a deal to cut oil output by 1.2 million barrels per day (bpd) until March 2020 to support the market. Natural gas may witness further recovery on colder than normal weather is forecasted to cover most of U.S. which will increase heating demand ahead of the beginning of the withdrawal season as it can test 185 while taking support near 165. There is a disturbance in the Gulf of Mexico which now has approximately a 60% chance of beginning a tropical cyclone according to the National Oceanic Atmospheric Administration. Natural gas storage injections in the United States have outpaced the previous five-year average so far during the 2019 injection season as a result of rising natural gas production. U.S. Energy Information Administration reported that domestic supplies of natural gas rose by 87 billion cubic feet for the week ended Oct. 18.

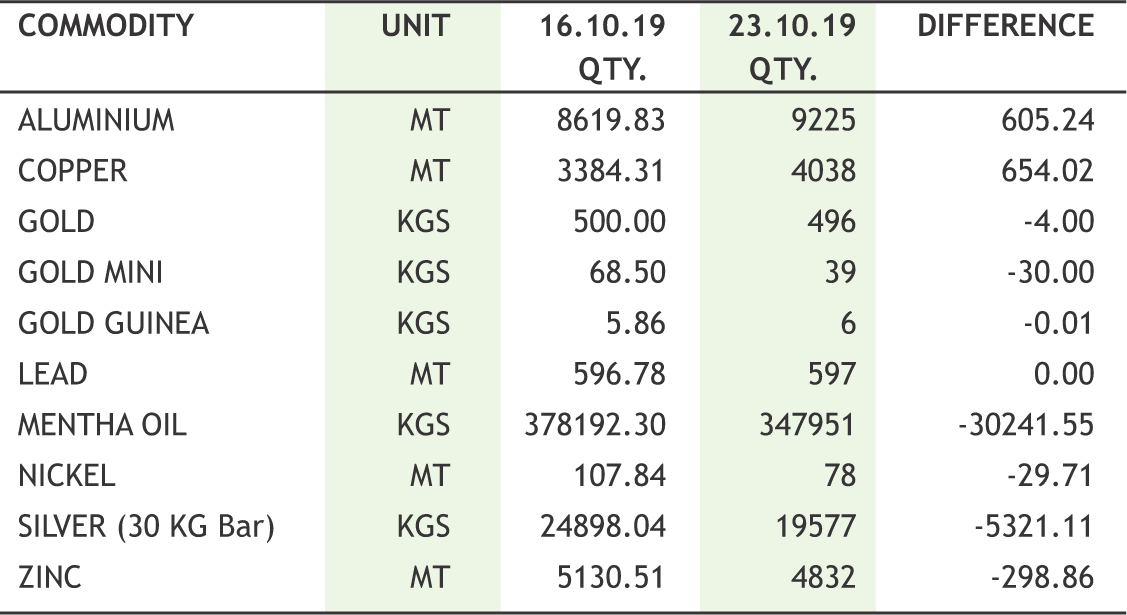

Cotton futures (Nov) may trade sideways to down in the range of 18970-19400 levels. Cotton traders across the nation are currently facing a huge dilemma over crop size and the likely behavior of prices in the coming months. The arrivals are expected to gather momentum in days to come. Also, the realistic estimate of the crop size may be available around November 10-15. The market participants are estimating cotton production ranging from 330 lakh bales on the lower side to 370 lakh bales on the higher side. In the international market, ICE cotton futures (Dec) is expected to face resistance near 66 cents per pound & trade in a sideways zone. The two sides are working to try to agree on a text for a “Phase 1” trade agreement announced by U.S. President Donald Trump on Oct. 11, in time for him to sign it with China’s President Xi Jinping next month at a summit in Chile. Chana futures (Nov) may witness profit booking towards 4400-4370, after the recent upside due to festive buying. The fundamental factor that may act as a catalyst is that the sowing has started in small pockets in the state of Madhya Pradesh. Mentha oil futures (Oct) may continue to hold on to the support near 1200 level for the third consecutive week. In days to come, we may see more of an upside coupled with lower level buying from the pharma industries for medicinal purpose ahead of winter season. Secondly, Mentha oil stocks at MCXaccredited warehouses were at 347950.75 Kgs at end of last week, lesser by - 30241.544 Kgs as compared to its previous week, according to data from the bourse.

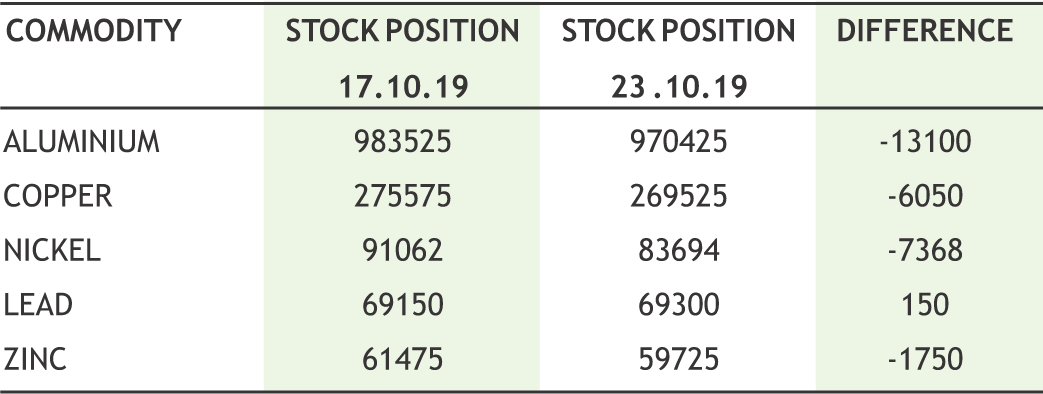

Base metal counter may witness range bound movement except Nickel which can move further upside on supply concerns. Copper may trade sideways as it can face resistance near 445 levels and support near 430 levels. Codelco had resumed normal operations after an umbrella group representing all its unions struck a deal with government officials. Meanwhile, Lead may also remain sideways as it can move range of 150-158 levels. Zinc may witness lower level buying as it can test 190 levels while taking support near 182 levels. Nickel prices can move with upside bias as it can test 1260 levels while taking support near 1170. Nickel plant in Indonesia would start operation ahead of schedule in the first half of 2020, and it reiterated production targets for this year. Nickel prices got support following shut down of a nickel project in Papua New Guinea after a slurry spill. Papua New Guinea has closed Metallurgical Corporation of China’s Ramu nickel operations in the country for spilling slurry into a bay in August and “for not adhering to remedial measures”. French miner and metals producer Eramet stated its Weda Bay Nickel plant in Indonesia would start operation ahead of schedule in the first half of 2020, and it reiterated production targets for this year. Aluminum can trade with sideways to weak bias as it can test 125 levels while facing resistance near 138 levels. United Company Rusal reported only a small rise in third-quarter aluminum sales from the previous quarter, pressured by a weaker market for the metal.

10

|

NATURAL GAS MCX (NOV) contract closed at Rs. 176.30 on 24th Oct’19. The contract made its high of Rs. 209.80 on 17th Sep’19 and a low of Rs. 171.30 on 11th Oct’19. . The 18-day Exponential Moving Average of the commodity is currently at Rs. 181.84. On the daily chart, the commodity has Relative Strength Index (14-day) value of 53.633.

One can buy between Rs. 173-177 for a target of Rs. 200 with the stop loss of Rs. 168.

SILVER MCX (DEC) contract closed at Rs. 45992.00 on 24th Oct’19. The contract made its high of Rs. 51489.00 on 17th Jun’19 and a low of Rs. 38000.00 on 4th Sep’19. The 18-day Exponential Moving Average of the commodity is currently at Rs. 45745.00. On the daily chart, the commodity has Relative Strength Index (14-day) value of 56.143

One can buy near Rs. 45600 for a target of Rs. 47500 with the stop loss of Rs. 44700.

GUARSEED NCDEX (NOV) contract was closed at Rs. 4024.00 on 24th Oct’19. The contract made its high of Rs. 4450.00 on 21st Aug’19 and a low of Rs. 3779.50 on 03rd Oct’19. The 18- day Exponential Moving Average of the commodity is currently at Rs. 3979.23. On the daily chart, the commodity has Relative Strength Index (14-day) value of 54.313.

One can buy near Rs. 3980 for a target of Rs. 4200 with the stop loss of Rs 3870.

11

• India hopes to sign energy deals with Saudi Arabia that include its participation in India's strategic petroleum reserve, during Prime Minister Narendra Modi's visit to the kingdom this week.

• MCX has launched a contract with delivery-based settlement and a one-gram trade lot. This means retail investors have another way to buy a gram of gold, stored in vault facilities of one's choice.

• China's nickel ore imports in September rose 24.6% from the previous month to their highest since at least 2016.

• Chile's Codelco had resumed normal operations after its unionized workers struck a deal with government officials.

• According to the International Nickel Study Group “global output of nickel is expected to increase to 2.48 million tonnes in 2020 versus 2.37 million tonnes in 2019”.

• International Copper Study Group stated that the market would return to a surplus of 281,000 tonnes in 2020 after a 320,000 tonne shortfall this year.

• China is willing to buy as much as $20 billion of US farm goods in the first year if a phase-one trade deal is signed with the US, Bloomberg reported.

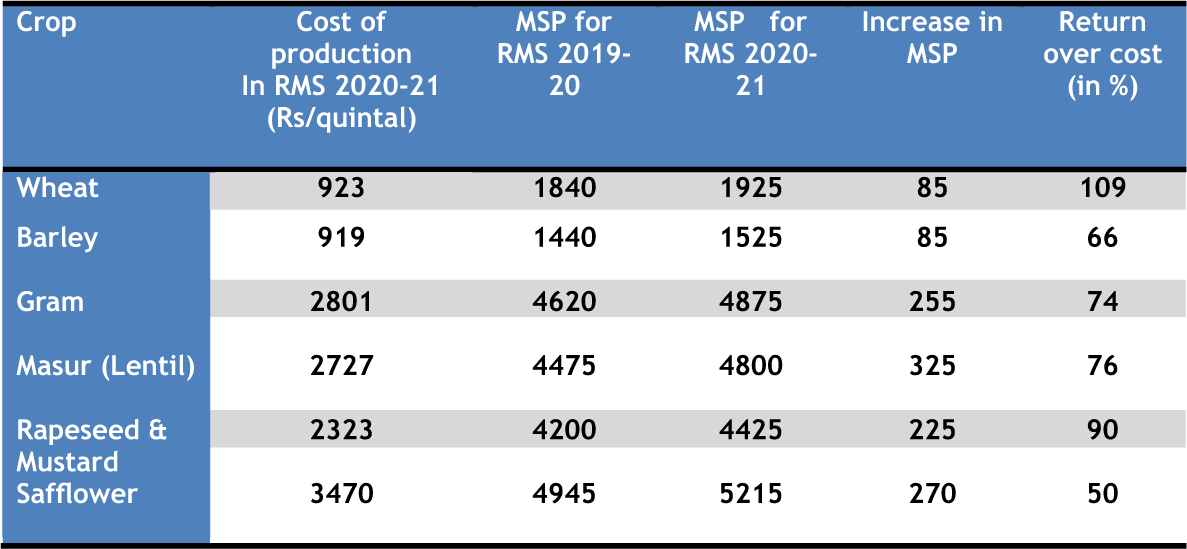

• The Cabinet Committee on Economic Affairs (CCEA) has approved the increase in the MSP for all mandated Rabi Crops of 2019-20 to be marketed in Rabi Marketing Season (RMS) 2020-21.

• The government has brought commodity options trading and settlement on a par with equities, paving the way for new norms for farmers and small and medium enterprises to step up hedging. Commodity options can now be settled directly.

In the week gone by, CRB strengthened further on some positive movements in bullion, energy and in some agri commodities. Even few base metals saw revival despite weaker economic data. Dollar index gained marginally from the lower level of 97 on Brexit issue after a downfall of two week. The European Central Bank left short term interest rates unchanged. The central bank also kept its forward guidance unchanged, suggesting that its main interest rates will remain at their current or lower levels until there’s strong evidence of a pickup in prices. A surprise weekly drawdown in U.S. crude stocks and OPEC jawboning about deeper production cuts have suddenly energized dreary trading in oil, pushing prices to three-week highs. Also supporting crude prices was a Reuters report from Wednesday hinting at the likelihood that attendees at the OPEC meeting set for December may considering deeper cuts than the 1.2-million-barrelsper-day cut agreed by the cartel and its key ally Russia almost a year back. On MCX, it crossed 4000 mark. Natural Gas continued it gradual upside move. In base metals, nickel saw some strong move on some bullish indications. LME on-warrant stocks sit at 30.2kt last, close to decade lows. Copper prices cooled off on some positive talk. Codelco suggests that Chuquicamata mine is running normally and unions at El Teniente mine have agreed to talks and dropped plans to halt operations. Aluminum saw sharp fall after a breaking down from a consolidation zone in MCX. Rio Tinto indicated it is to review its operations including the closure of Tiwai Point in New Zealand due to low Ali prices and high costs. Report is suggesting that this closure could help tighten the market as it accounts for 0.5% of global supply. On weaker than expected economic data’s gold and silver prices moved up. Once again it came above the mark of $1500.

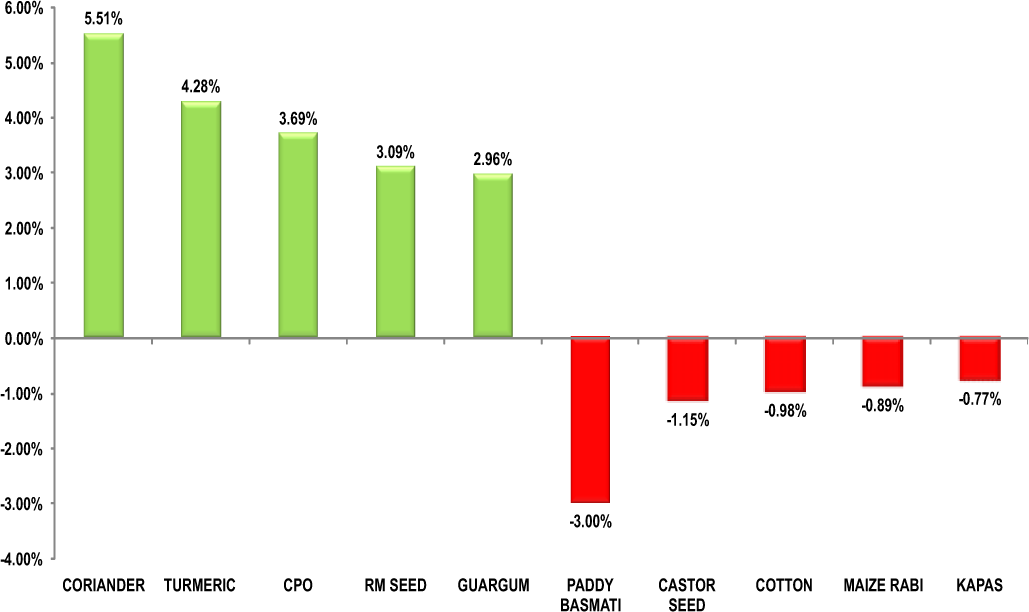

It was a strong week for oil seeds and edible oil futures; especially CPO and RM Seed. The Cabinet Committee on Economic Affairs (CCEA) on Wednesday decided to increase to the MSP for mustard and rapeseed was increased by Rs 225 per quintal to Rs 4425, while that of gram went up by 5.5 per cent to Rs 4875 a quintal over the previous season. Malaysian palm oil futures surged for a third straight session to hit a 16 month-high on Thursday, supported by expectations that exports in October could be higher than a month earlier. Some spices caught the attention with its sharp upside, and Dhaniya and turmeric were one of them. Spot coriander prices are quoting higher at the Ramganj and Baran markets in Rajasthan due to increase in demand at existing lower levels. While prices are also steady at other major markets in, Rajasthan, Gujarat and Madhya Pradesh.

|

|

12

|

|

The increase in MSP for Rabi marketing Season(RMS) 2020-21 is in line with the principle of fixing the MSPs at a level of at least 1.5 times of the all India weighted average cost of production (CoP), which was announced in the Union Budget 2018-19. Cost of production is one of the important factors in the determination of MSPs. This year's increase in MSP of Rabi crops for marketing Season 2020-21 provides return over all India weighted average cost of production is 109 per cent for wheat; 66 per cent for barley; 74 per cent for gram: 76 per cent for lentil; 90% for rapeseed & mustard and 50 per cent for safflower.

The Minimum Support Prices for all rabi crops of 2019-20 season to be marketed in 2020-21 is as follows:

|

• The government increased the Minimum Support Price (MSP) for wheat by Rs 85 to Rs 1,925 a quintal and for pulses by up to Rs 325 per quintal

• Barley MSP has also been increased by Rs 85 to Rs 1,525 per quintal for the current year from Rs 1,440 per quintal last year.

• To encourage cultivation of pulses, the highest increase in MSP has been recommended for lentil (Rs. 325 per quintal). The support price of masoor has been increased to Rs 4,800 per quintal for this year from Rs 4,475 per quintal last year.

• Similarly, the MSP of gram has been hiked by Rs 255 to Rs 4,875 per quintal for this year from Rs 4,620 per quintal last year.

• Among oilseeds, rapeseed/mustard MSP has been increased by Rs 225 to Rs 4,425 per quintal for 2019-20 rabi crop from Rs 4,200 per quintal during 2018-19.

• The minimum support price of safflower has been hiked by Rs 270 to Rs 5,215 per quintal for the current year from Rs 4,945 per quintal last year.

MSP has an important role

he MSP policy would have a favorable impact on farm income that will led to an economic growth as it assured farmers of a minimum of 50 percent as margin of profit. It is one of the important and progressive steps towards doubling farmers' income by 2022 and improving their welfare substantively. The implementation of Minimum Support Prices (MSP) will increase the income of farmers and purchasing capacity, which will have an impact on wider economic activity.

However the MSP hikes is expected to widen the fiscal deficit. The move may stoke inflation; prompt the Reserve Bank of India (RBI) to hike interest rate. It may also hit exports of wheat and Rapeseed meal badly as the domestic prices of these crops may go beyond international prices.

13

|

| 23rd OCT | Trump removed sanctions from Turkey over Syria offensive. |

| 24th OCT | India jumped 14 places to 63rd in ease of doing business rankings. |

| 24th OCT | Eurozone October PMI fairly painted the weak picture of the bloc. |

| 24th OCT | Boris Johnson called for a snap election on December 12. |

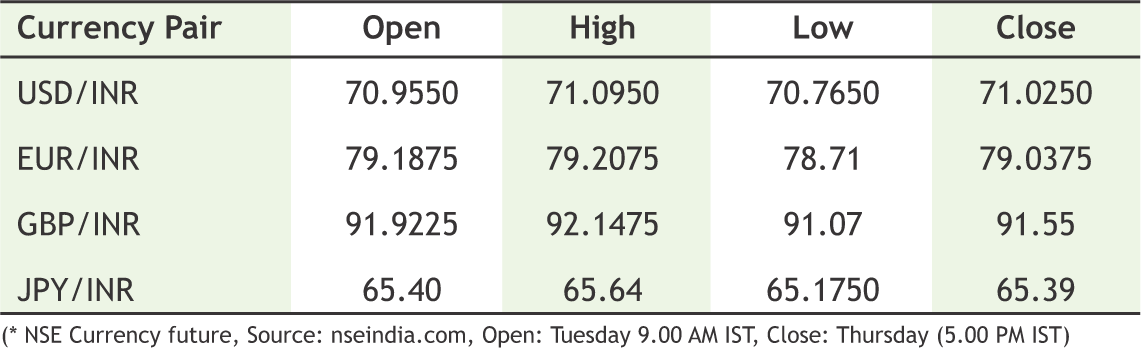

Indian rupee stuck in a mere 40 paisa range this week on mixed cues. The selling from FPI’s continued last week in equity markets, which created demand for US dollar while exit polls raised expectations of stable government in Maharashtra and Haryana strengthened Indian rupee. Meanwhile, crude oil prices started to hold ground near $52 and bounced towards $56, which can pose threat to Indian rupee in short term. However, Euro zone October PMI fairly painted the weak picture of the bloc after modest recovery in September. ECB president, Mario Draghi on its last governing council meeting defended status-quo in policy guidance. In-evidently euro will drift lower amid weak economic sentiment. From the Brexit front, the tug of war between political parties on UK PM’s Boris Johnson’s Brexit deal raised further uncertainties and the PM has to call for a snap election on December 12. Also, EU put Brexit delay on hold after UK PM threatened to pull deal if Labour party leader Jeremy Corbyn rejects general elections. Next week markets are likely to remain volatile on number of important economic numbers from US, Euro zone and UK and also monetary policies of US and Japan will be released.

DINR is likely to stay above 70.70 and move higher towards 71.45 in the next week.

|

USD/INR (NOV) contract closed at 71.22 on 24th Oct’19. The contract made its high of 71.2850 on 24th Oct’19 and a low of 70.9625 on 24th Oct’19 (Weekly Basis). The 14-day Exponential Moving Average of the USD/INR is currently at 71.40.

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 43.42. One can buy at 71.10 for the target of 71.70 with the stop loss of 70.80.

EUR/INR (NOV) contract closed at 79.37 on 24th Oct’19. The contract made its high of 79.5625 on 22nd Oct’19 and a low of 79.1625 on 24th Oct’19 (Weekly Basis). The 14-day Exponential Moving Average of the EUR/INR is currently at 79.22.

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 52.33. One can sell at 79.55 for a target of 78.95 with the stop loss of 79.85.

GBP/INR (NOV) contract closed at 91.8125 on 24th Oct’19. The contract made its high of 92.4175 on 22nd Oct’19 and a low of 91.4050 on 23rd Oct’19 (Weekly Basis). The 14-day Exponential Moving Average of the GBP/INR is currently at 90.63.

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 65.58. One can sell below 91.60 for a target of 90.80 with the stop loss of 92.

JPY/INR (NOV) contract closed at 65.6725 on 24th Oct’19. The contract made its high of 65.9225 on 23rd Oct’19 and a low of 65.44 on 24th Oct’19 (Weekly Basis). The 14-day Exponential Moving Average of the JPY/INR is currently at 66.13.

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 37.40. One can buy at 65.55 for a target of 66.15 with the stop loss of 65.25.

14

|

15

|

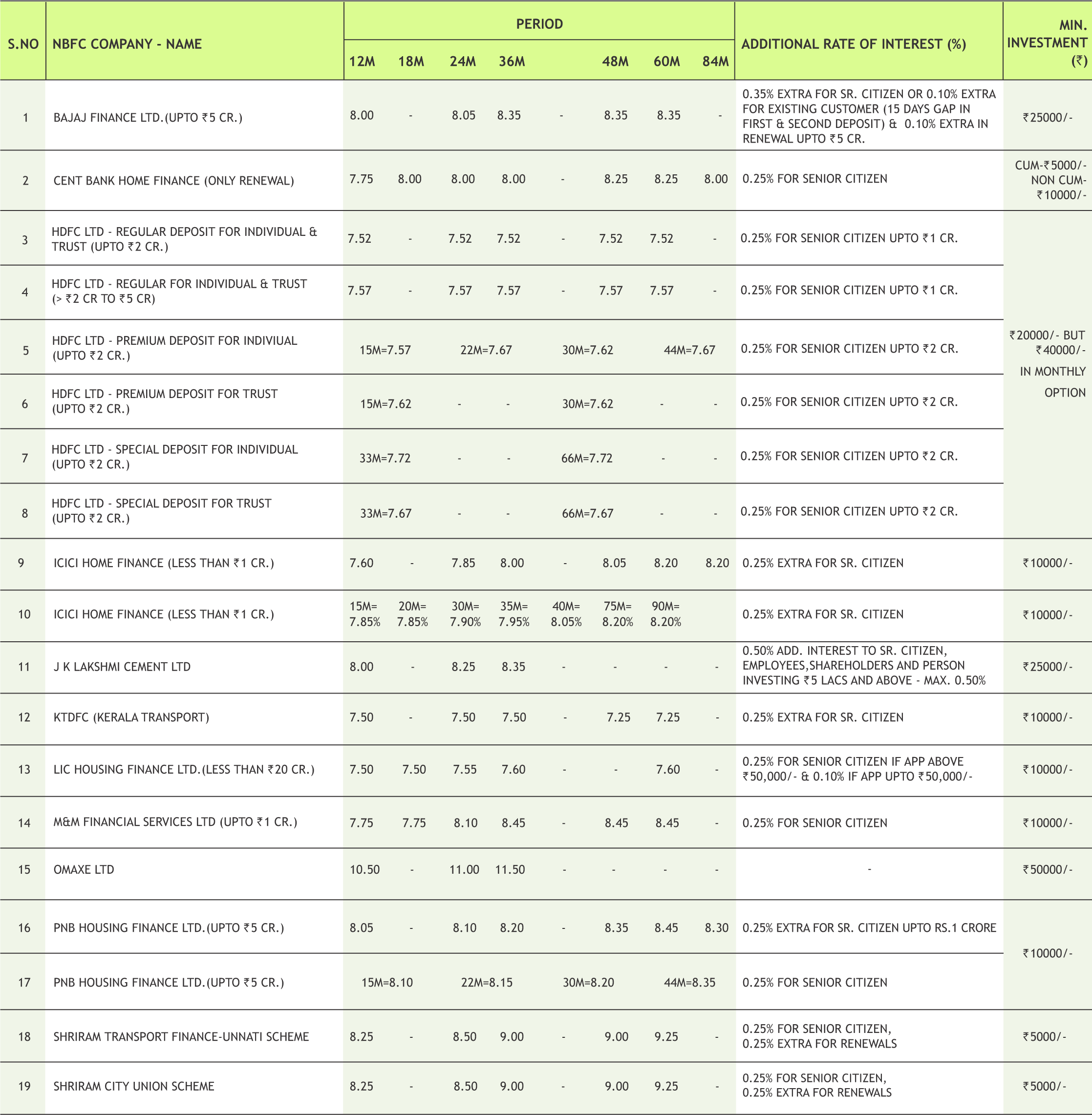

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

|

|

17

|

|

|

|

|

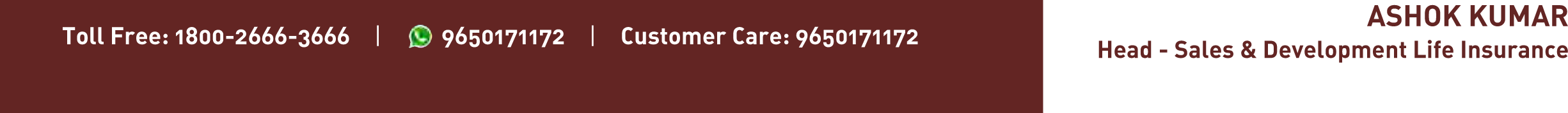

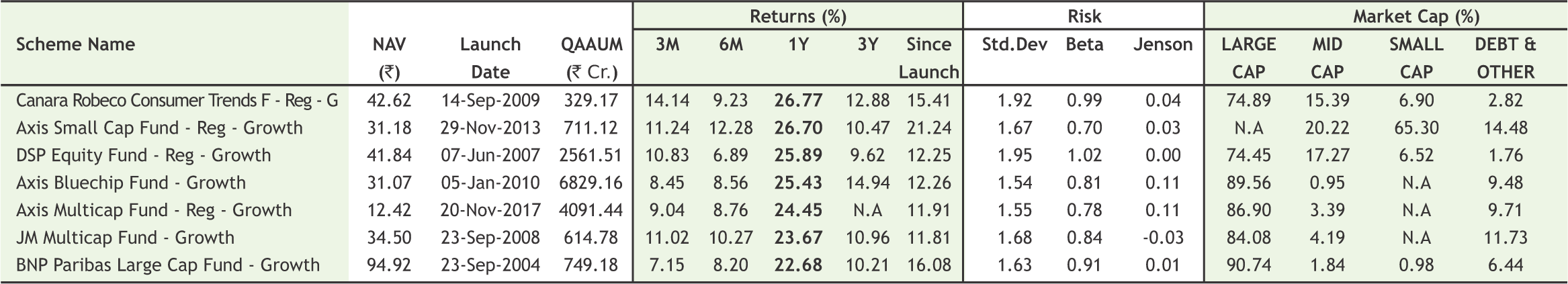

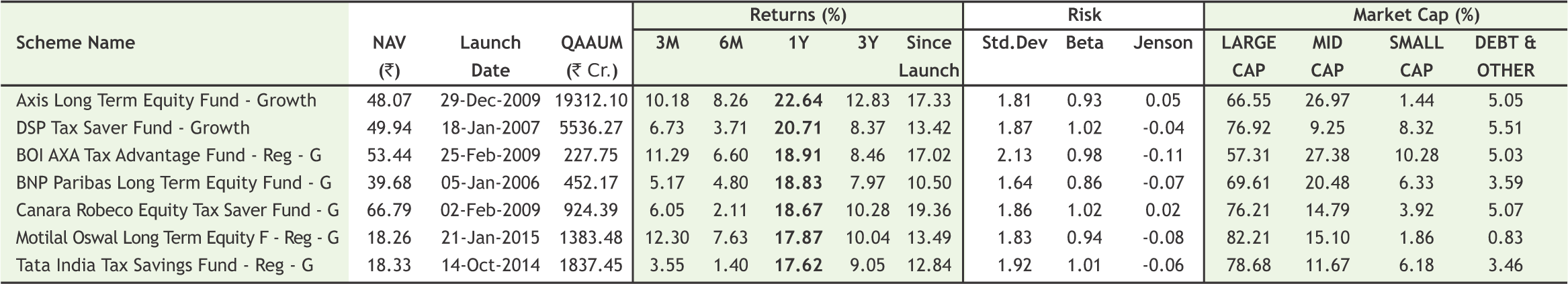

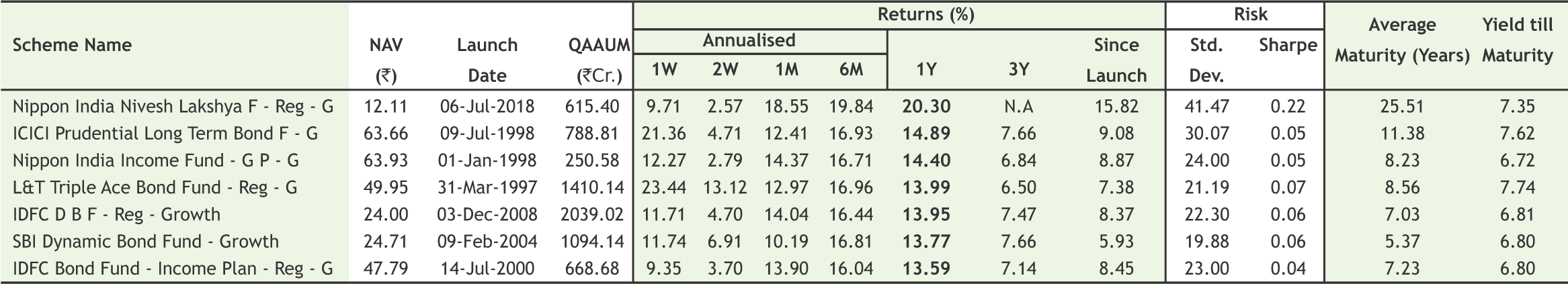

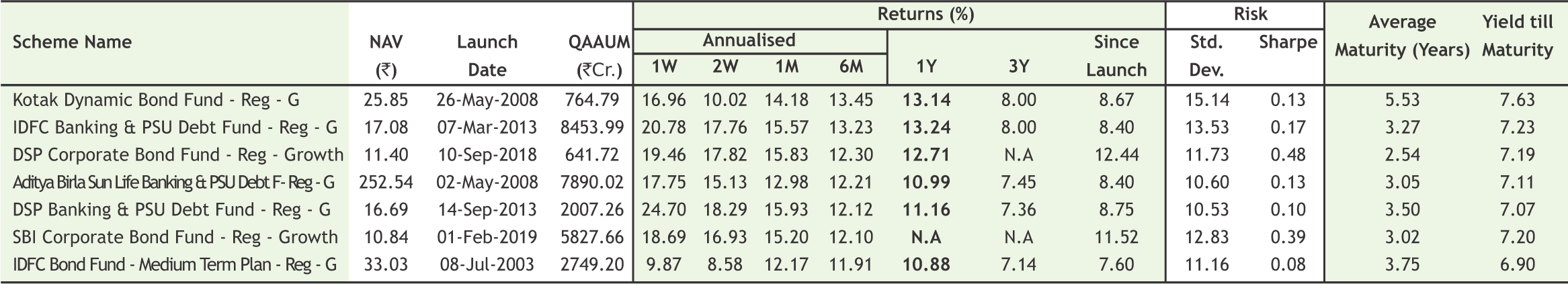

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

17

Mr. Ajay Garg (Director & CEO, SMC Group) & Mr. Nitin Murarka (Head - Research) during an Investor Awareness Seminar organized in association with NSE & NSDL held on Friday 18th October, 2019 at Hotel India Awadh, Lucknow.

Dr. D. K. Aggarwal (CMD, SMC Investments & President, PHDCCI) along with Dr. Najma Heptulla, Hon’ble Governor of Manipur during a conclave of local craft by entrepreneurs, traditional artisans and MSMEs of Manipur for promoting entrepreneurship held on 10th October 2019.

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in