2019: Issue 668, Week: 28th January – 1st Febru700

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2019: Issue 668, Week: 28th January – 1st Febru700

A Weekly Update from SMC (For private circulation only)

NEY

NEY

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

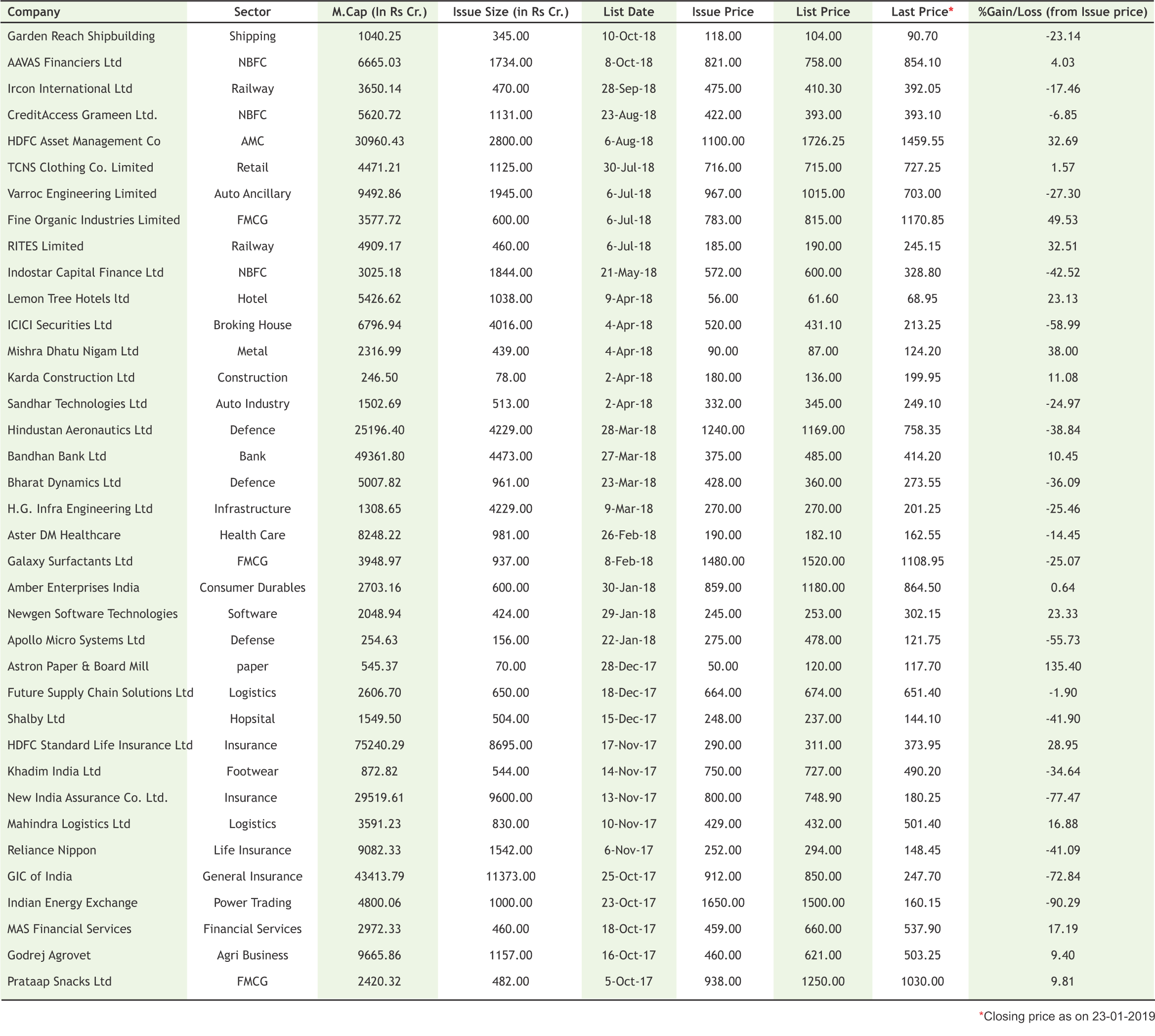

| IPO | 15 |

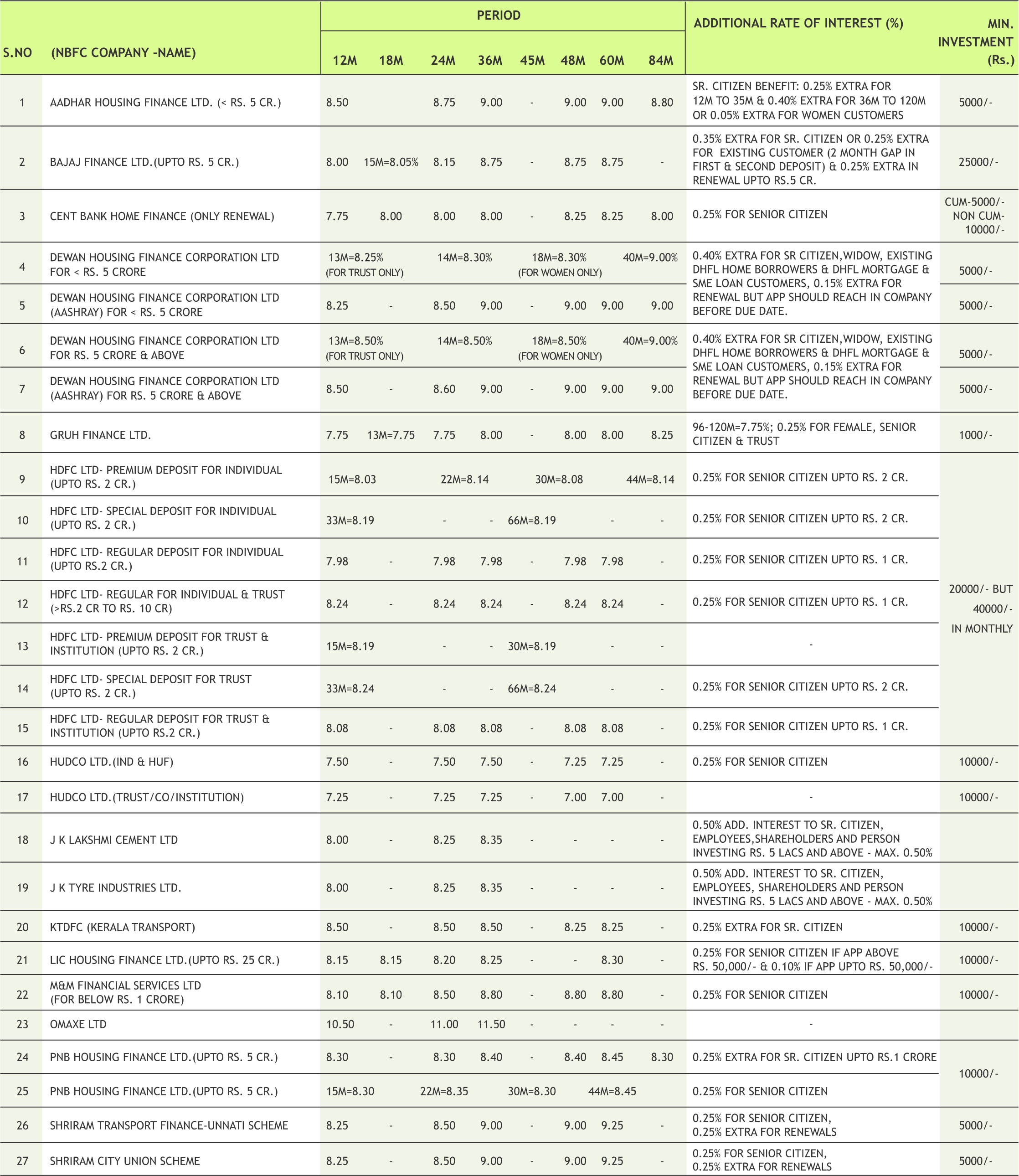

| FD Monitor | 16 |

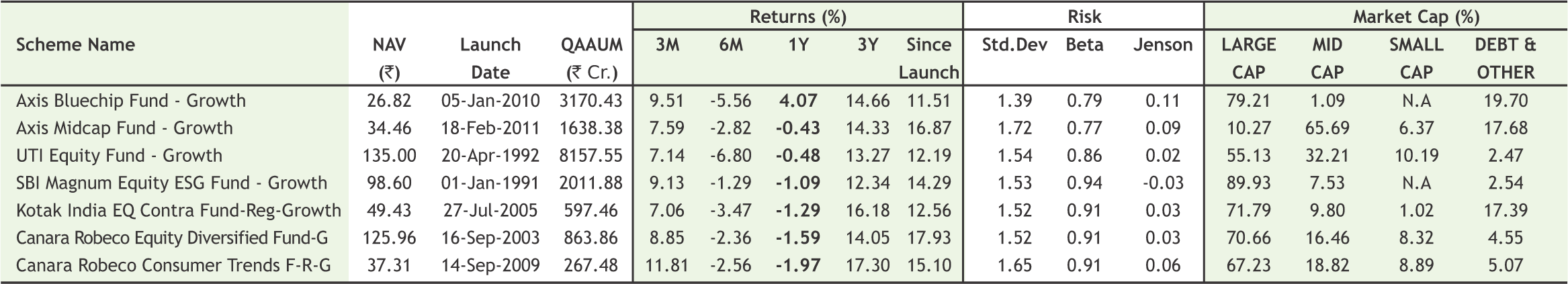

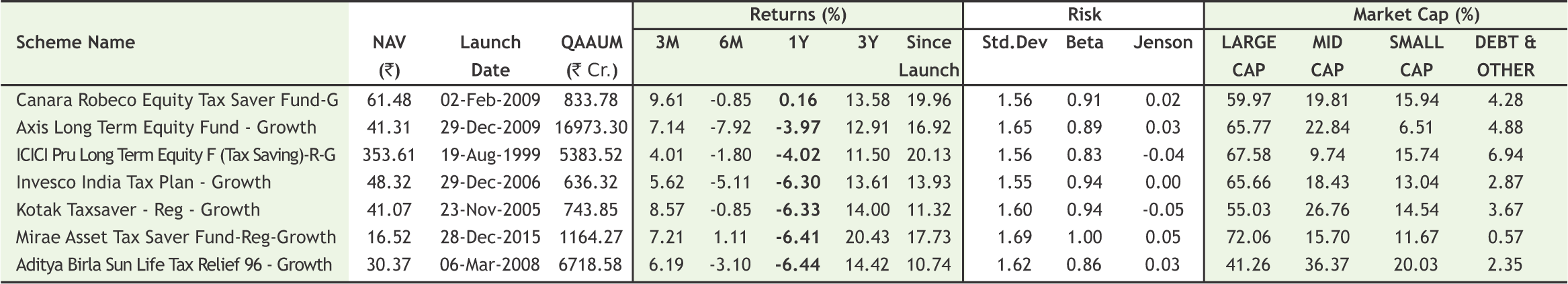

| Mutual Fund | 17-18 |

G

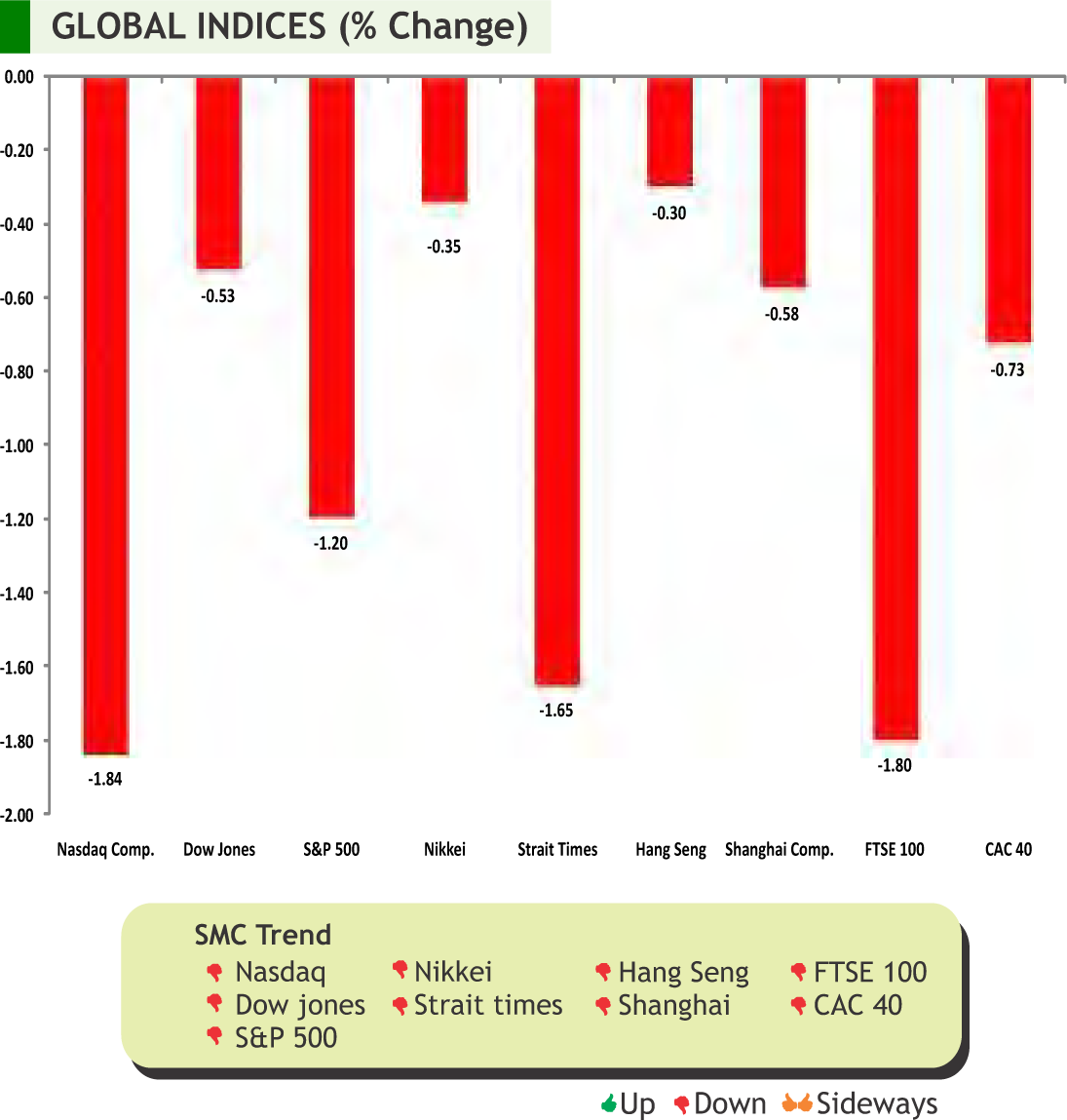

lobal stock markets showed mixed reactions as market participants waited for fresh developments on U.S. and China trade talks. Major policy makers attending the World Economic Forum in Davos, Switzerland advocated single view that though the world economy is experiencing weakness but it is nowhere near a recession. Commodity prices especially crude showed weakness in response to the weak growth data out of China and the U.S. government shutdown. International Monetary Fund cut its growth forecast for the world economy for the second time in three months to 3.5 per cent this year. Bank of Japan in the monetary policy review meeting kept policy unchanged as it cut its inflation outlook for fourth consecutive time.

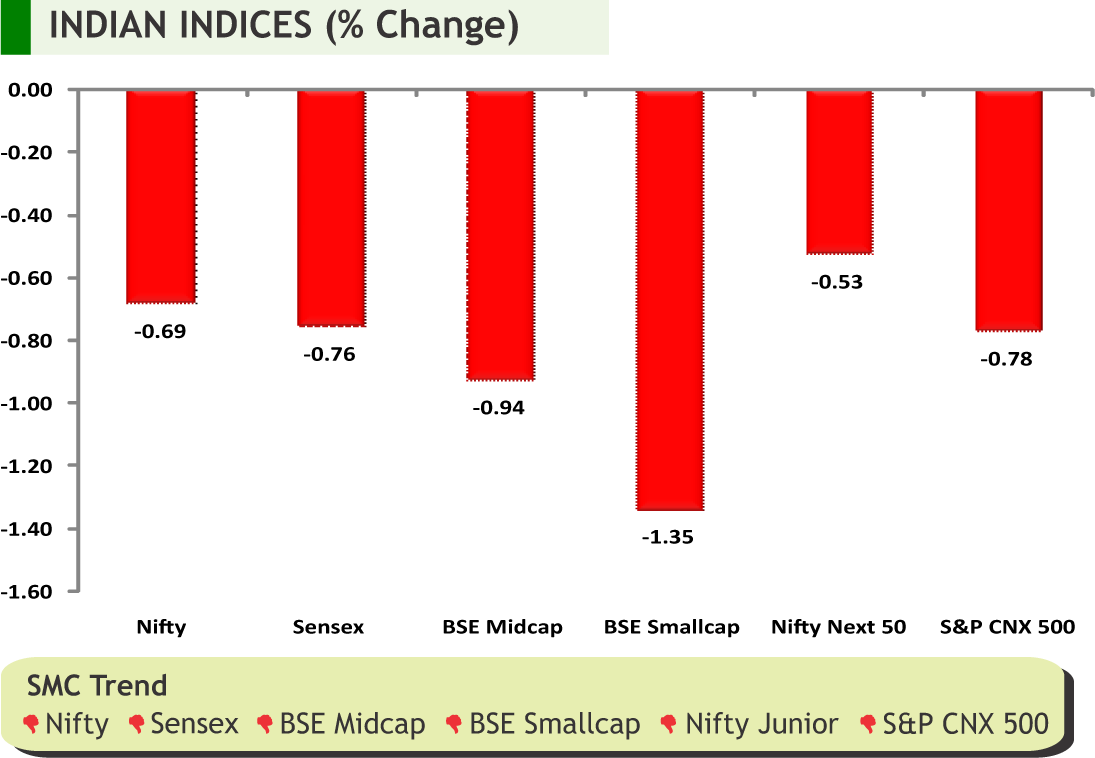

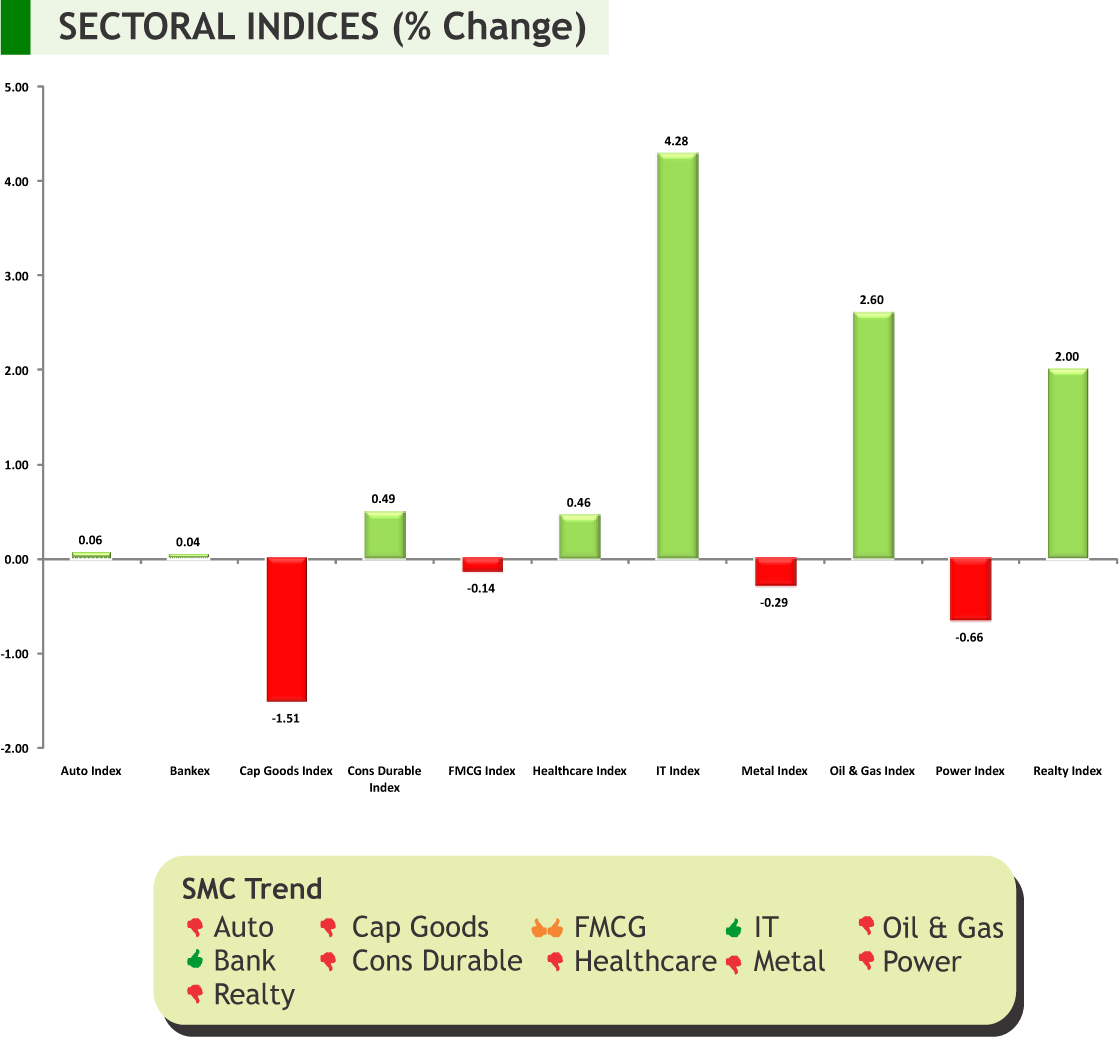

Back at home, domestic markets witnessed volatile trade tracking lacklustre global cues as political uncertainty in the US and worries about weakening global economic growth weighed on investor sentiment. The December quarter earnings have been a mixed bag so far. Market participants are taking a cautious approach due to global headwinds and other domestic factors. Meanwhile, the IMF report says that India’s economy is poised to pick up in 2019, benefiting from low oil prices and a slower pace of monetary tightening than previously expected as inflation pressures ease. Also according to the UN's World Economic Situation and Prospects (WESP) 2019, India's GDP growth is expected to accelerate to 7.6% in 2019-20 from an estimated 7.4% in the current fiscal ending March 2019. Going to next week, market will continue to remain volatile ahead of expiry of January -series futures and options (F&O) contracts and interim Budget, which will be presented on February 1.

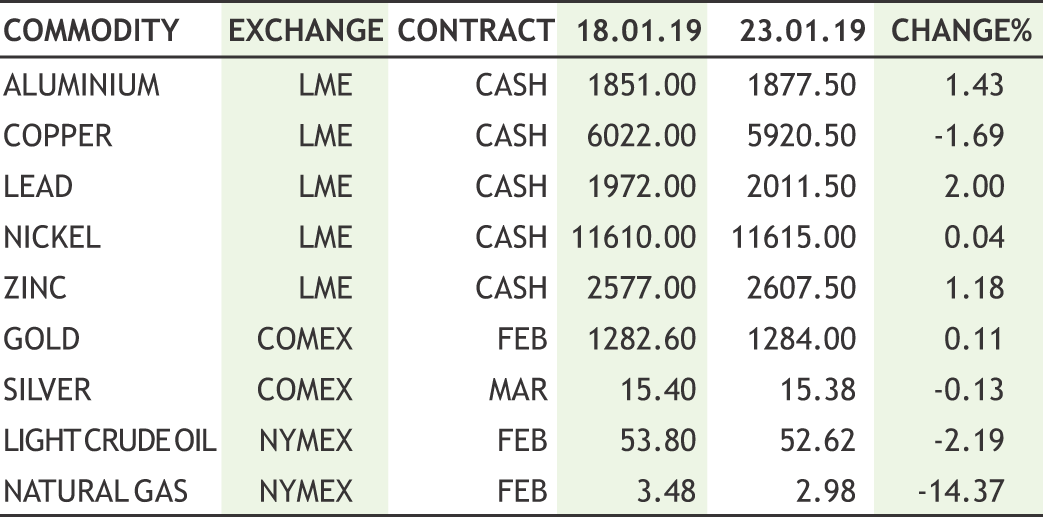

On the commodity market front, CRB rally cooled off after profit booking from higher levels; it also ignored the downside in dollar index. Dollar index moved down as the partial U.S. government shutdown, now in its 34th day has hurt investor sentiment. Bullion counter may remain on upside path as renewed fears about a slowdown. Gold is expected to move further higher and may test the level of 32600. Crude oil can test upside level of 3950 while taking support 3650 levels in MCX. Advance Goods Trade Balance , Consumer Confidence Index , GDP, FOMC Rate Decision, Interest Rate on Excess Reserves, Personal Consumption Expenditure Core, Change in Non-farm Payrolls, Unemployment Rate and ISM Employment of US, Canadian Manufacturing PMI, CPI and GDP of Euro Zone, German Unemployment Claims Rate, Manufacturing PMI of China, GDP of Canada, CPI of Australia and many more data and events scheduled this week from major economies, which will give significant impact on commodities prices.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Economy

• Glenmark Pharmaceuticals received tentative nod from the US health regulator for Abiraterone Acetate tablets, used in the treatment of prostate cancer. The approved product is a generic version of Janssen Biotech Inc' Zytiga tablets 250 mg which had a annual sales of approximately $1.3 billion.

• Lupin received approval from the US health regulator to market Levothyroxine Sodium tablets used for treatment of hypothyroidism in the strengths of 25 microgram (mcg), 50 mcg, 75 mcg, 88 mcg, 100 mcg, 112 mcg, 125 mcg, 137 mcg, 150 mcg, 175 mcg, 200 mcg, and 300 mcg.

Technology

• Infosys has entered into a partnership with HPE Green Lake, for its new consumption-based IT model. The cloud platform focuses on outcomebased consumption and simplifies IT and freeing up resources.The partnership will help enterprises make smart infrastructure investments, paying for what they consume, while benefiting from the security offered by a trusted managed services provider.

Oil & Gas

• Indian Oil Corporation signed a memorandum of understanding for an investment of Rs 7,941 crore over the next five years to this effect with the Tamil Nadu government at the Global Investors Meet in Chennai. It would also invest Rs 5,100 crore on its retail outlet network (Petrol Bunk) expansion and also plans to upgrade its storage infrastructure over the next three years at its POL (Petrol Oil & Lubricant) Terminals in Tamil Nadu, at an investment of Rs 1,824 crore.

Capital Goods

• BHEL has bagged an order from Maharashtra State Power Generation Company (Mahagenco) for its ongoing 660-megawatt coal-based supercritical thermal power project at the Bhusawal Thermal Power Station (Unit VI).The project is being executed on the engineeringprocurement-construction (EPC) basis at Jalgaon district of Maharashtra. With this, the revised order value for the Bhusawal Thermal Power Station Unit VI project is now around ₹3,750 crore.

Metals

• JSW Group signed a memorandum of understanding (MoU) with the Andhra Pradesh Economic Development Board (APEDB) at the World Economic Forum, Davos. The company has proposed an investment of Rs 4,500 crore for building a jetty at Ramayapatnam Port and also set up an integrated steel complex surrounding coastal areas of Prakasam district in Andhra Pradesh.

Auto

• Tata Motors launched sport utility vehicle (SUV) Harrier at a starting price of Rs 12.69 lakh (ex-showroom, Mumbai) with top-variant being priced at Rs 16.25 lakh. Harrier is the first Tata car to be built on the Optimal Modular Efficient Global Advanced Architecture (Omega) which is derived from the Land Rover platform.

INTERNATIONAL NEWS

• U.S. Industrial Production Rises in December, the Federal Reserve released a report showing industrial production rose by 0.3 percent in December after climbing by a downwardly revised 0.4 percent in November. Economists had expected industrial production to edge up by 0.2 percent compared to the 0.6 percent advance originally reported for the previous month.

• UK budget deficit for December exceeded economists' expectations and was the second lowest figure for the month in 18 years. The public sector net borrowing, or PSNB, was GBP 3 billion in December, which was GBP 0.3 billion more than a year ago.

• The Bank of Japan kept its monetary policy unchanged, but downgraded the inflation forecasts, primarily driven by a sharp fall in oil prices. The Policy Board of the BoJ voted 7-2 to purchase government bonds so that the yield of 10-year JGBs will remain at around zero percent.

• Japan had a merchandise trade deficit of 55.286 billion yen in December, the Ministry of Finance said. That missed expectations for a deficit of 35.3 billion yen following the 737.7 billion yen shortfall in November.

• China's gross domestic product climbed a seasonally adjusted 1.5 percent on quarter in the fourth quarter of 2018, the National Bureau of Statistics said. That was in line with expectations and down from 1.6 percent in the third quarter.

| Stocks | *Closing Price | Trend | Date Trend Changed | Rate Trend Changed | SUPPORT | RESISTANCE | Closing S/l |

|---|---|---|---|---|---|---|---|

| S&P BSE SENSEX* | 36195 | DOWN | 05.10.18 | 34970 | - | 36500 | |

| NIFTY50** | 10850 | DOWN | 05.10.18 | 10316 | - | 11000 | |

| NIFTY IT | 14972 | UP | 21.07.17 | 10712 | 13600 | 13400 | |

| NIFTY BANK | 27266 | UP | 30.11.18 | 26863 | 25900 | 25400 | |

| ACC | 1420 | DOWN | 24.01.19 | 1420 | 1480 | 1500 | |

| BHARTIAIRTEL | 302 | DOWN | 25.01.18 | 453 | 330 | 340 | |

| BPCL | 354 | UP | 16.11.18 | 322 | 345 | 330 | |

| CIPLA | 501 | DOWN | 26.10.18 | 604 | 535 | 545 | |

| SBIN | 288 | UP | 02.11.18 | 286 | 270 | 260 | |

| HINDALCO | 205 | DOWN | 04.01.19 | 211 | 225 | 230 | |

| ICICI BANK | 365 | UP | 02.11.18 | 355 | 350 | 340 | INFOSYS | 732 | UP | 14.12.18 | 706 | 690 | 670 |

| ITC*** | 279 | UP | 11.01.19 | 295 | - | 275 | |

| L&T | 1295 | DOWN | 18.01.19 | 1318 | 1350 | 1370 | |

| MARUTI | 7041 | DOWN | 14.09.18 | 8627 | 7600 | 7800 | |

| NTPC | 140 | DOWN | 26.10.18 | 159 | 147 | 152 | |

| ONGC | 142 | DOWN | 05.10.18 | 147 | 150 | 154 | |

| RELIANCE | 1247 | UP | 30.11.18 | 1168 | 1150 | 1130 | |

| TATASTEEL | 461 | DOWN | 26.10.18 | 552 | 490 | 510 | |

*SENSEX has breached the resistance of 35700 **NIFTY has breached the resistance of 10700 ***ITC has broken the support of 280

Closing as on 24-01-2019

NOTES:

1) These levels should not be confused with the daily trend sheet, which is sent every morning by e-mail in the name of "Morning Mantra ".

2) Sometimes you will find the stop loss to be too far but if we change the stop loss once, we will find more strength coming into the stock. At the moment, the stop loss will be far as we are seeing the graphs on weekly basis and taking a long-term view and not a short-term view.

| Meeting Date | Company | Purpose |

|---|---|---|

| 28/01/2019 | Escorts | Quarterly Results |

| 28/01/2019 | Tata Power Co. | Quarterly Results |

| 29/01/2019 | H D F C | Quarterly Results |

| 29/01/2019 | Bajaj Fin. | Quarterly Results |

| 29/01/2019 | Bank of Baroda | Quarterly Results |

| 29/01/2019 | Axis Bank | Quarterly Results |

| 29/01/2019 | HCL Technologies | Quarterly Results,Interim Dividend |

| 29/01/2019 | Bajaj Finserv | Quarterly Results |

| 30/01/2019 | Castrol India | Accounts,Dividend |

| 30/01/2019 | LIC Housing Fin. | Quarterly Results |

| 30/01/2019 | ICICI Bank | Quarterly Results |

| 30/01/2019 | NTPC | Quarterly Results, Interim Dividend,Bonus Issue |

| 30/01/2019 | I O C L | Quarterly Results |

| 30/01/2019 | Bajaj Auto | Quarterly Results |

| 31/01/2019 | Hero Motocorp | Quarterly Results |

| 31/01/2019 | Vedanta | Quarterly Results |

| 31/01/2019 | UPL | Quarterly Results |

| 31/01/2019 | Dabur India | Quarterly Results |

| 31/01/2019 | Bharti Airtel | Quarterly Results |

| 1/2/2019 | Berger Paints | Quarterly Results |

| 1/2/2019 | Dr Reddy's Labs | Quarterly Results |

| 1/2/2019 | Titan Company | Quarterly Results |

| 1/2/2019 | St Bk of India | Quarterly Results |

| 4/2/2019 | Exide Inds. | Quarterly Results |

| 5/2/2019 | H P C L | Quarterly Results |

| 5/2/2019 | GAIL (India) | Quarterly Results, Interim Dividend |

| 5/2/2019 | Marico | Quarterly Results, Interim Dividend |

| 5/2/2019 | Tech Mahindra | Quarterly Results |

| Ex-Date | Company | Purpose |

|---|---|---|

| 29/01/2019 | Shree Cement | 250% Interim Dividend |

| 28/01/2019 | Siemens | 350% Dividend |

| 29/01/2019 | Wipro | 50% Interim Dividend |

4

5

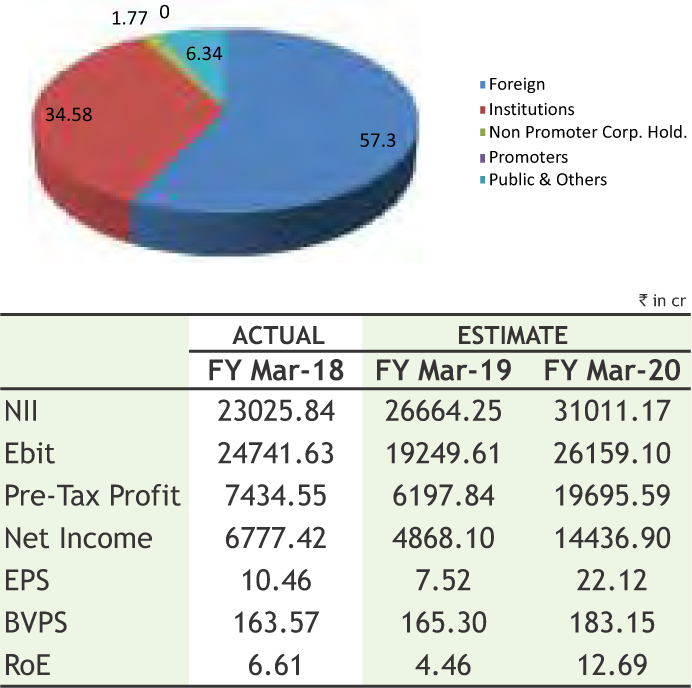

FINOLEX INDUSTRIES LIMITED

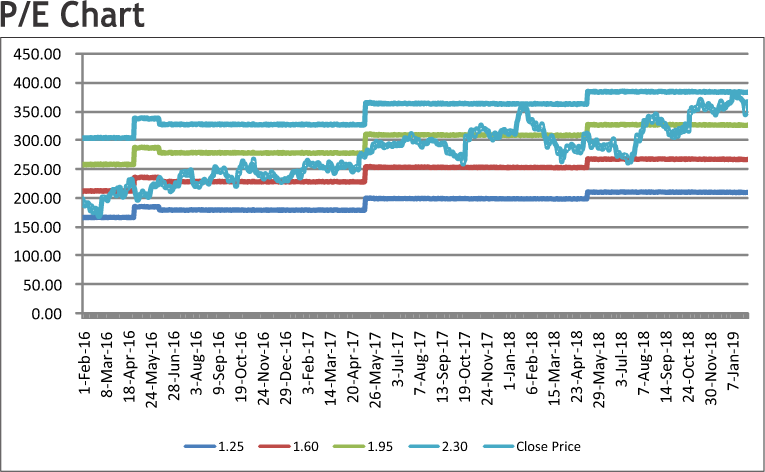

CMP: 537.75

Target Price: 621

Upside:15%

| Face Value (Rs.) | 10.00 |

| 52 Week High/Low | 712.90/463.40 |

| M.Cap (Rs. in Cr.) | 6673.48 |

| EPS (Rs.) | 24.39 |

| P/E Ratio (times) | 22.04 |

| P/B Ratio (times) | 2.39 |

| Dividend Yield (%) | 1.86 |

| Stock Exchange | BSE |

Investment Rationale

• Finolex Industries Limited is the leading supplier of PVC Pipes & Fittings for the agriculture and non-agricultural sectors. Its state-of-the-art manufacturing plants at Pune and Ratnagiri in Maharashtra and Masar in Gujarat provide excellent resources to better serve its customers. It has three main business segments: PVC resin, Pipes and fittings, Power.

• On the development front, PVC Resin manufacturing facility in Ratnagiri, set in technical collaboration with Uhde GmbH, Germany with Hoechst technology, provides a consistent supply of superior quality resin to its pipe manufacturing plants.

• At present, the total capacity of Pipes and Fittings is at 370,000 MT. The company plans to increase its capacity by 10-15% every year to meet the additional demand with a capex of Rs800-1,000 mn in FY19 and FY20. Moreover, the management of the company has maintained the guidance of double digit volume growth for FY19.

• The company is also expected to increase its consumer-focused pipes and fittings capacity by CAGR of 10% over the next five years and according to management, pipes and fittings would drive future volume growth.

• It does not have any long-term debt with FY18 net debt/EBITDA of 0.02x and consistently paying dividends over the years. Moreover, despite its capex plans, the company will be able to generate strong cash flows over the next three years.

• During the September quarter 2018, PVC Resin volume registered a y-o-y increase of 7.2% to 43,461 MT. Income from operations excluding duties and taxes was at Rs 542.6 crore for Q2FY19 up 14.2% against Rs 475.3 crore in Q2FY18. Profit

after tax was at Rs 76.4 crore for Q2FY19 up 170.0% against Rs 28.3 crore for Q2FY18. Both, PVC resin and Pipes segments have continued to perform well during the quarter.

Risk

• Industry Risk : slowdown in demand for pipes

• Fluctuation in commodity prices

Valuation

The company has a healthy balance sheet with almost no debt on its books and robust return ratios amid healthy dividend payouts. Moreover, strong demand, limited spare capacity, the introduction of higher margin PVC product would drive the margins of the company. The company not only makes a large share of the pipes and fittings but it also manufactures the PVC resin. It is India’s only PVC company with such ‘backward integration’ and according to the management, it is well-placed to benefit from the country’s transformation. We expect the stock to see a price target of Rs.621 in 8-10 month time frame on an expected P/E of 19x and FY20 (E) Earnings Per Share of Rs.32.68.

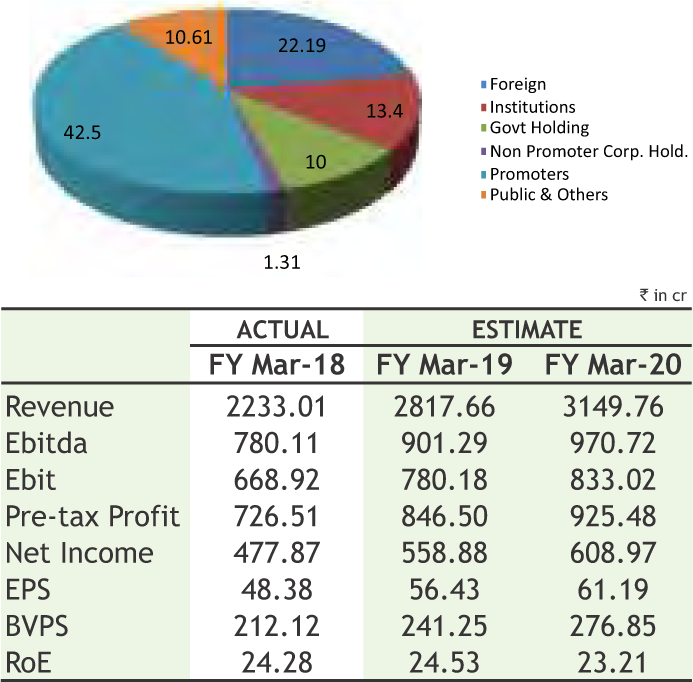

GHCL LIMITED

CMP: 255.25

Target Price:294

Upside:15%

| Face Value (Rs.) | 10.00 |

| 52 Week High/Low | 357.50/189.50 |

| M.Cap (Rs. in Cr.) | 2524.72 |

| EPS (Rs.) | 33.12 |

| P/E Ratio (times) | 7.78 |

| P/B Ratio (times) | 1.47 |

| Dividend Yield (%) | 1.93 |

| Stock Exchange | BSE |

Investment Rationale

• GHCL is engaged in primarily two segments consisting of Inorganic Chemicals (mainly manufacture and sale of Soda Ash) and Home Textile division (comprising of yarn manufacturing, weaving, processing and cutting and sewing of home textiles products). It is the largest manufacturer of Soda ash and contributes to around 25% of the country’s demand.

• It is the likely beneficiary of the favorable demand supply dynamics of domestic soda ash industry in light of the tight supply situation in the Asian market due to the curtailment of capacity from China. It has sound liquidity position on account of its healthy cash flow generation from operations.

• It has its own cost competencies owing to captive mines of lignite, limestone and salt resulting in healthy operating performance along with its high brand recall value. Its cotton yarn operations also have a healthy operating efficiency aided by significant availability of relatively cheaper source of captive power.

• On the developmental front, it has envisaged a Rs. 150 crore capital allocation for volume growth and modernization in spinning and also plans an increase in the Soda Ash production by another 50,000 MT by March 2020 with a capex of Rs. 260 crores. Soda ash production increased by 9,000 tonne during Q3 FY19 owing to brownfield expansions.

• In Q3 FY19, revenue was up 18% to Rs 875 crore YoY. PAT during the quarter grew 44% to Rs 102 crore. Inorganic segment revenue grew 11% benefitting from higher realization due to price increase taken to offset cost increase in last few quarters and higher trading volumes. Textile segment revenue also increased 34%,

which was due to volume growth coupled with better pricing and favorable dollar rate.

Risk

• Capacity addition by competitors

• Foreign exchange fluctuation

Valuation

GHCL has an established position in the domestic soda ash industry. It is constantly clocking EBITDA margins above 30% from past few quarters because of the ability to pass on the higher raw material/energy prices through periodic increases in product prices. Also, going ahead, its recent expansion and plans to further expand its chemicals and textile business are likely to support its overall margins and returns. The company is optimistic about the Home Textiles division with the improvement visible in last three quarters and expects better margins in FY20 on new product launches. We expect the stock to see a price target of Rs.294 in 8 to 10 months time frame on an expected P/E of 7x and FY20E earnings of Rs. 41.94.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

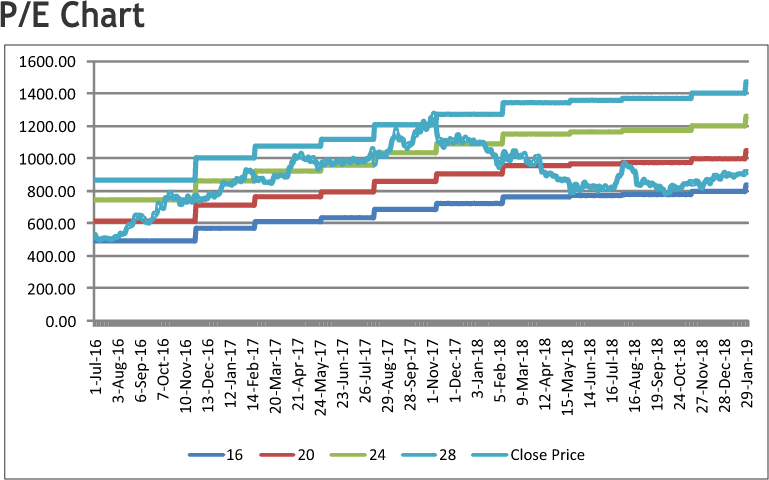

The stock closed at Rs 226.30 on 24th January, 2019. It made a 52-week low at Rs 202.05 on 17th May 2018 and a 52-week high of Rs. 259.45 on 31st January 2018. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 222.74

We can see on charts that stock has consolidated in the stiff range and formed an “Inverted Head and Shoulder” pattern on weekly charts, which is considered to be bullish. Moreover, it is likely to close on verge of breakout of same along with huge volumes. Apart from this, it also manages to trade above 100 WEMA, which also gives positive outlook for coming days, so one can initiate long in the range of 220-222 levels for the upside target of 240-245 levels with SL below 210.

The stock closed at Rs 727.75 on 24th January, 2019. It made a 52-week low at Rs 563.65 on 19th February 2018 and a 52-week high of Rs. 780.80 on 03rd October 2018. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 676.85

Short term, medium term and long term bias are positive for the stock as it is continuously trading above 200DEMA. From past few weeks, it was consolidated in the range of 640 to 770 levels with positive bias and formed a “continuation Triangle” on weekly charts, which is bullish in nature. Last week, stock gained over 2.5%, had given the breakout of pattern and also managed to close above the same. So, follow up buying is expected to continue in coming days. Therefore, one can buy in the range of 710-715 levels for the upside target of 770-790 levels with SL below 670.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

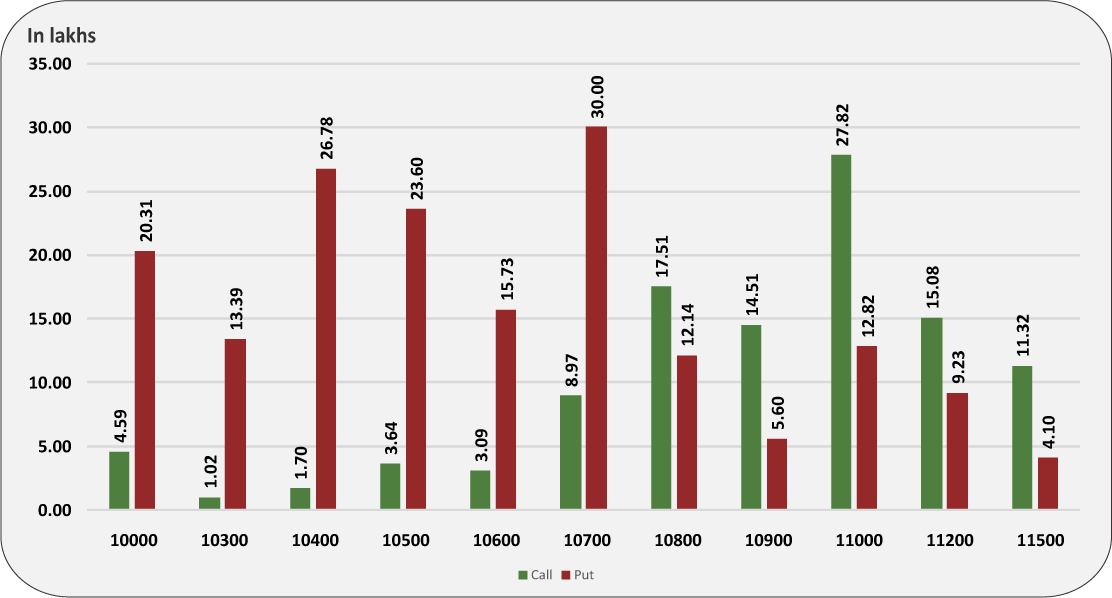

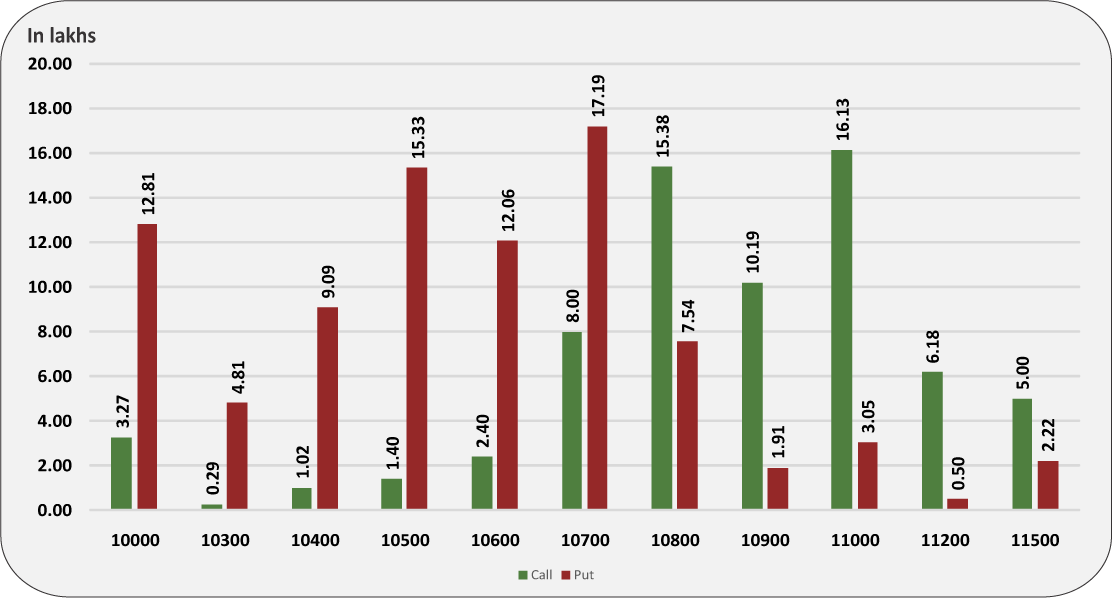

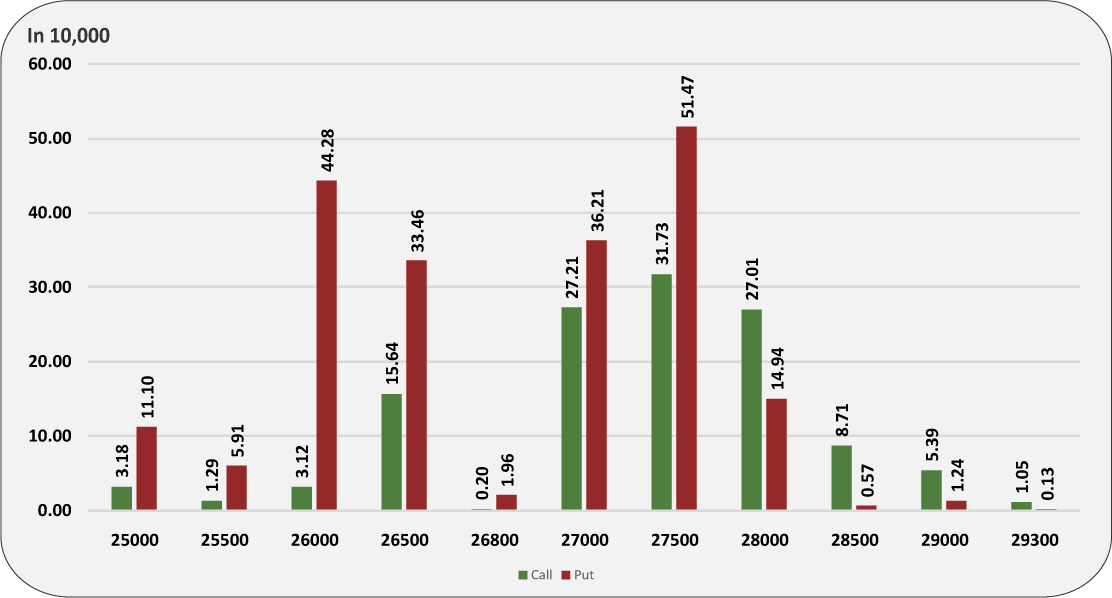

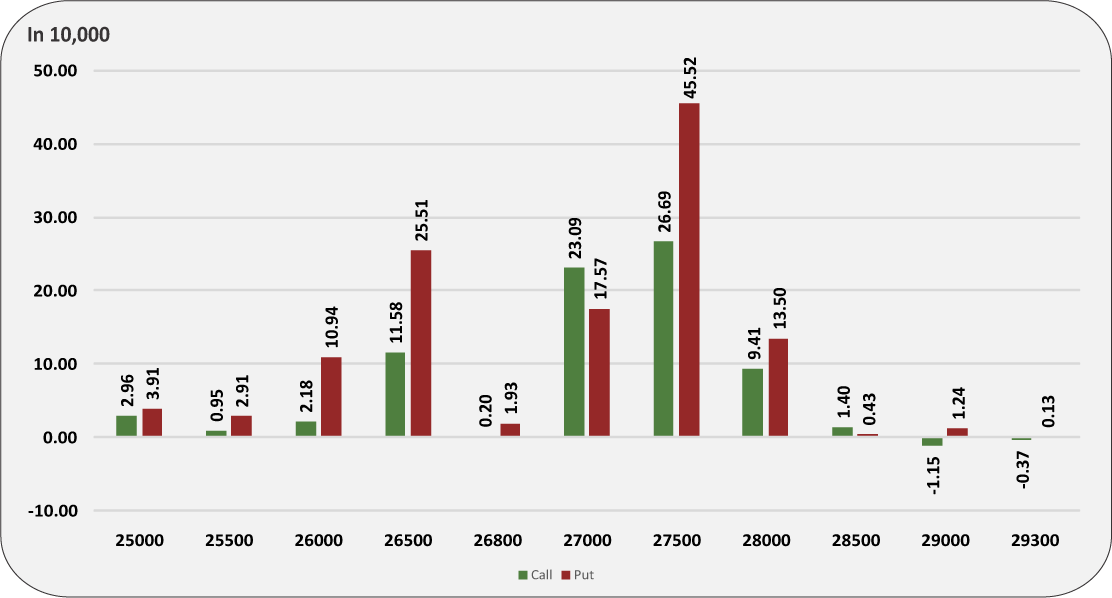

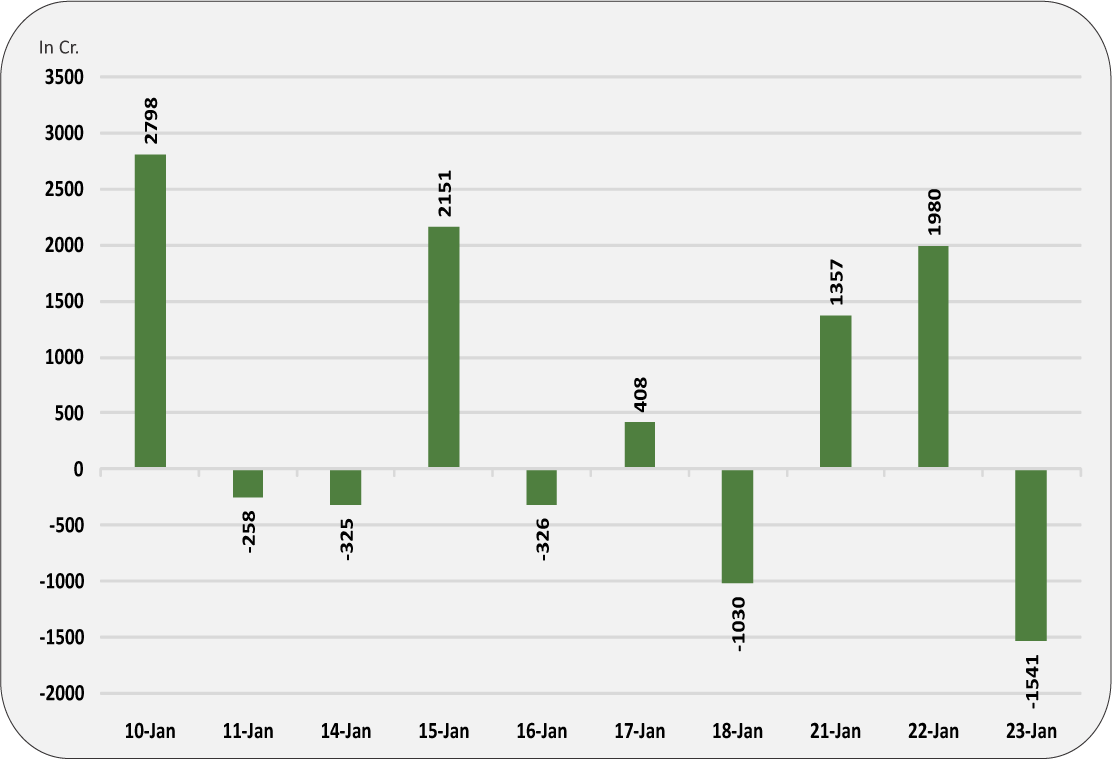

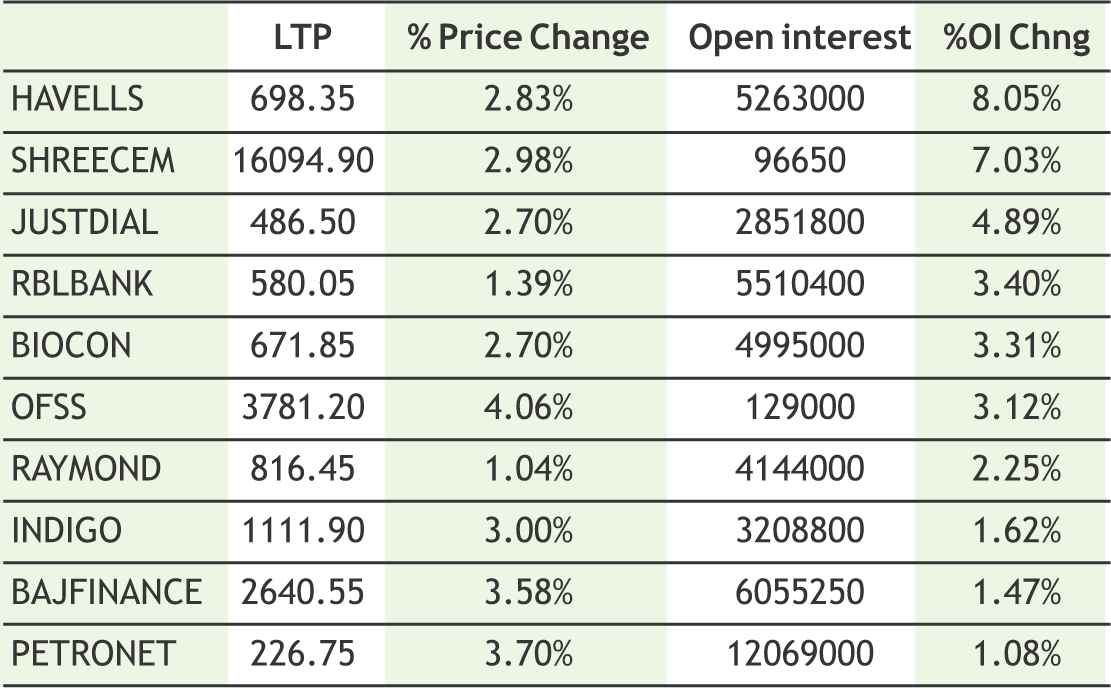

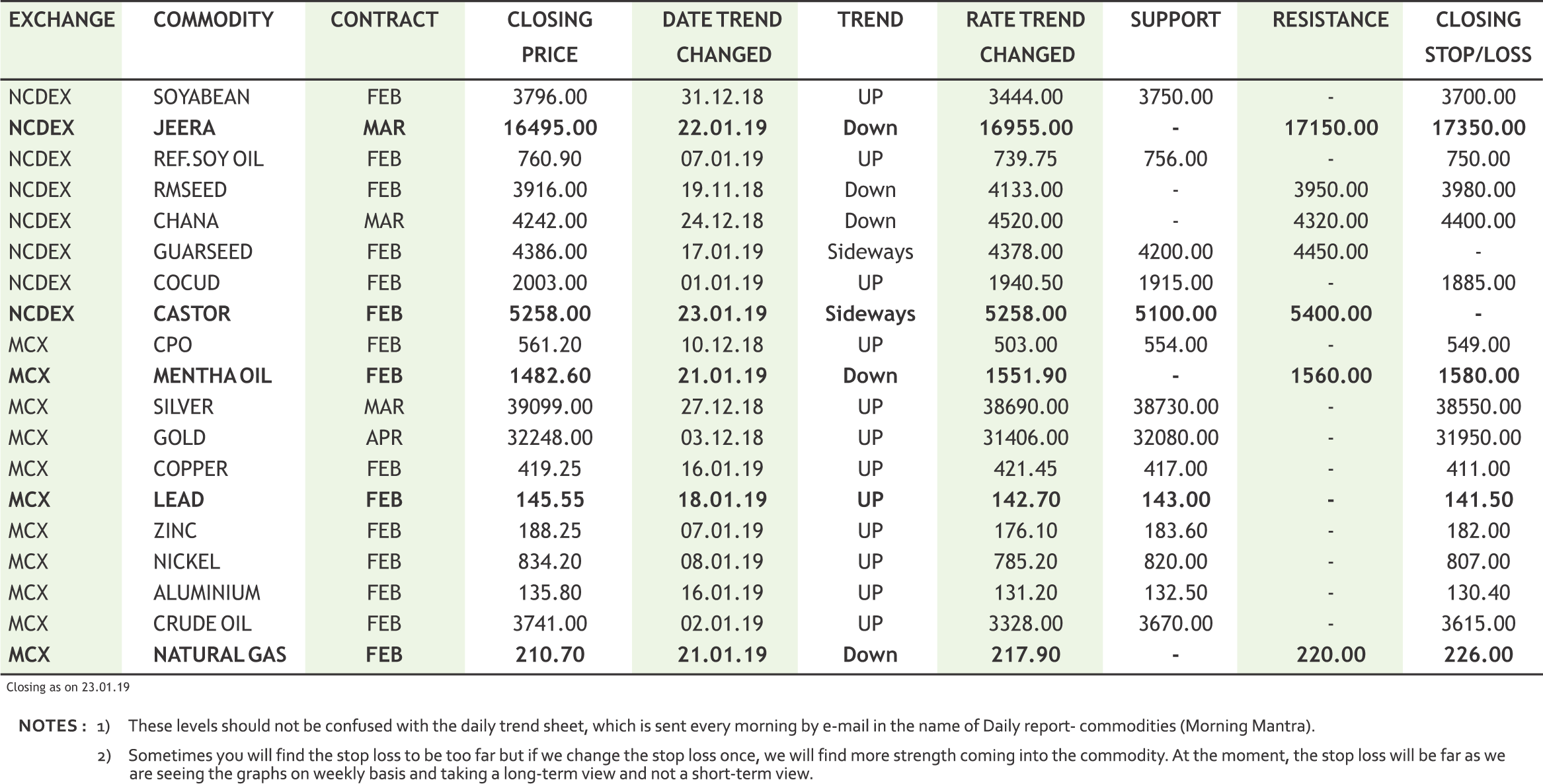

Nifty is trading between support and resistance for last 10 trading session. In recent sideways movement, call writers and puts writes were seen active selling both calls and puts. Therefore nifty is likely to trade sideways in the expiry week. Writers are seen active in 11000, 10900 calls and simultaneously selling 10800, 10700 strikes puts. The Implied Volatility (IV) of calls closed at 16.97% while that for put options closed at 16.20%. The Nifty VIX for the week closed at 18.09% and is expected to remain sideways. Among Nifty Call options, the 11000-strike call has the highest open interest of more than 40 lakh shares and in put side 10800- strike put has the highest open interest of over 30 lakh shares in open interest respectively. The PCR OI for the week closed up at 1.02 which indicates unwinding of some puts indicates caution. On the technical front, 10750-10800 spot levels is the support zone and Nifty is most likely to expire in the band of 10750 to 10950 levels in Jan expiry.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

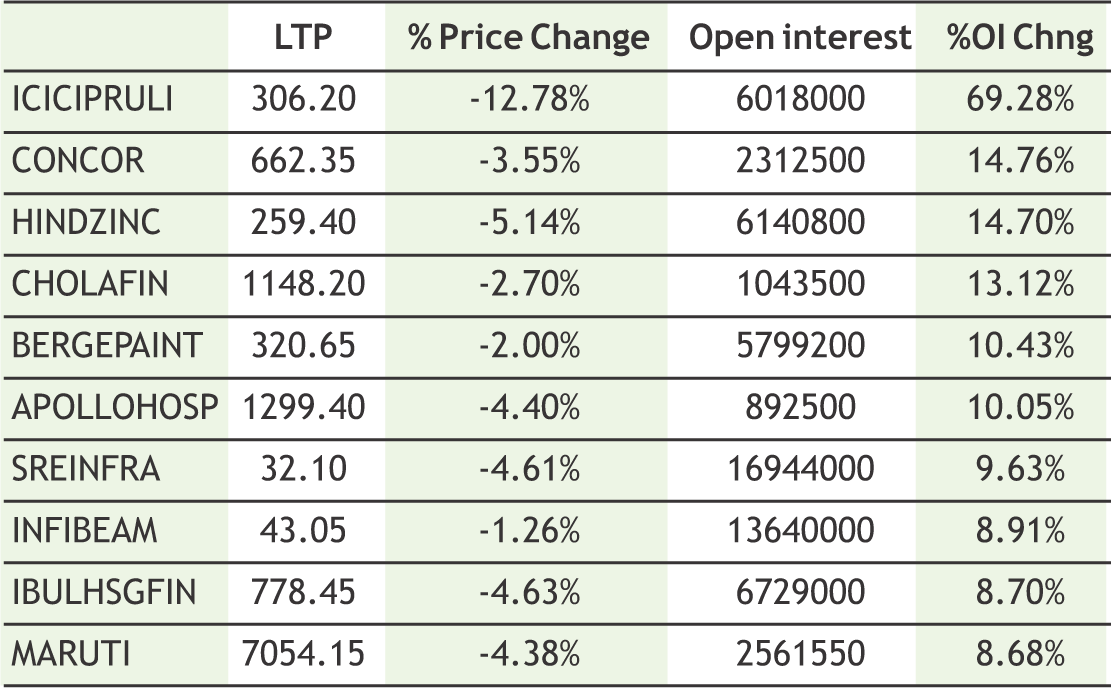

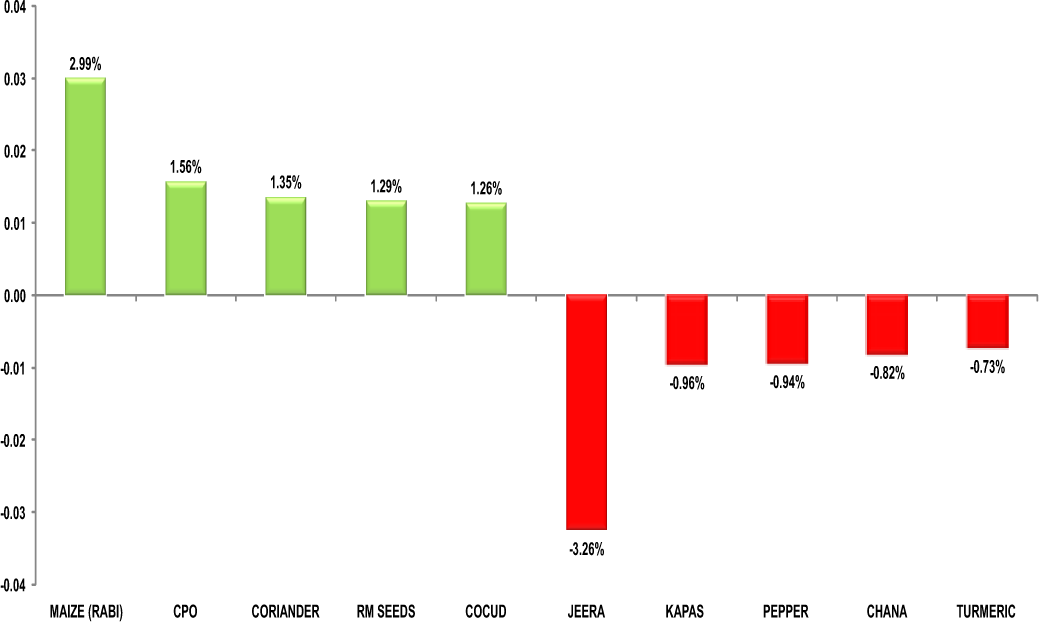

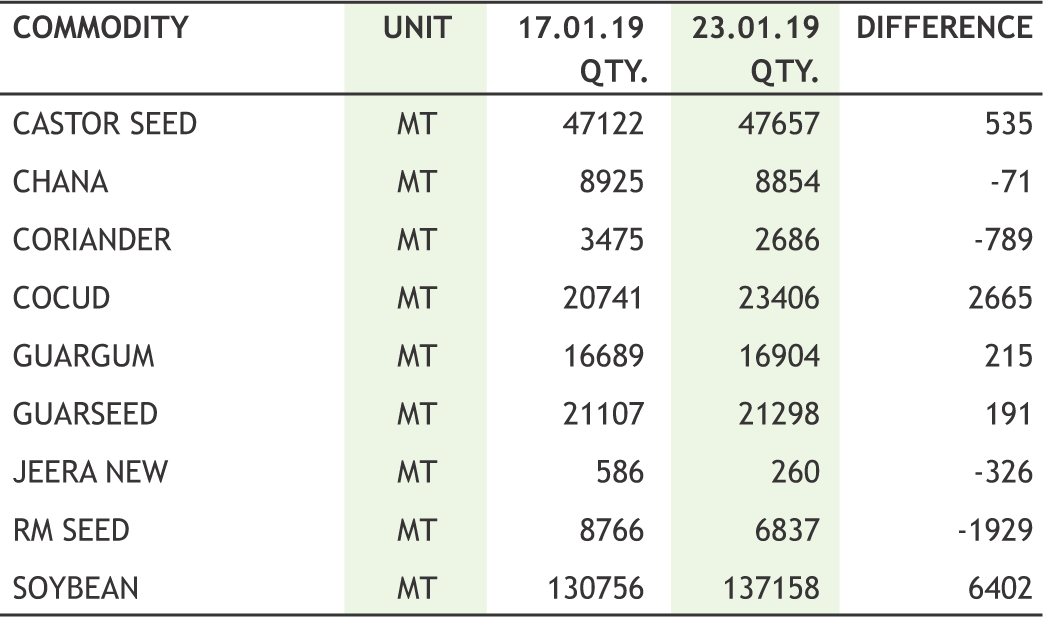

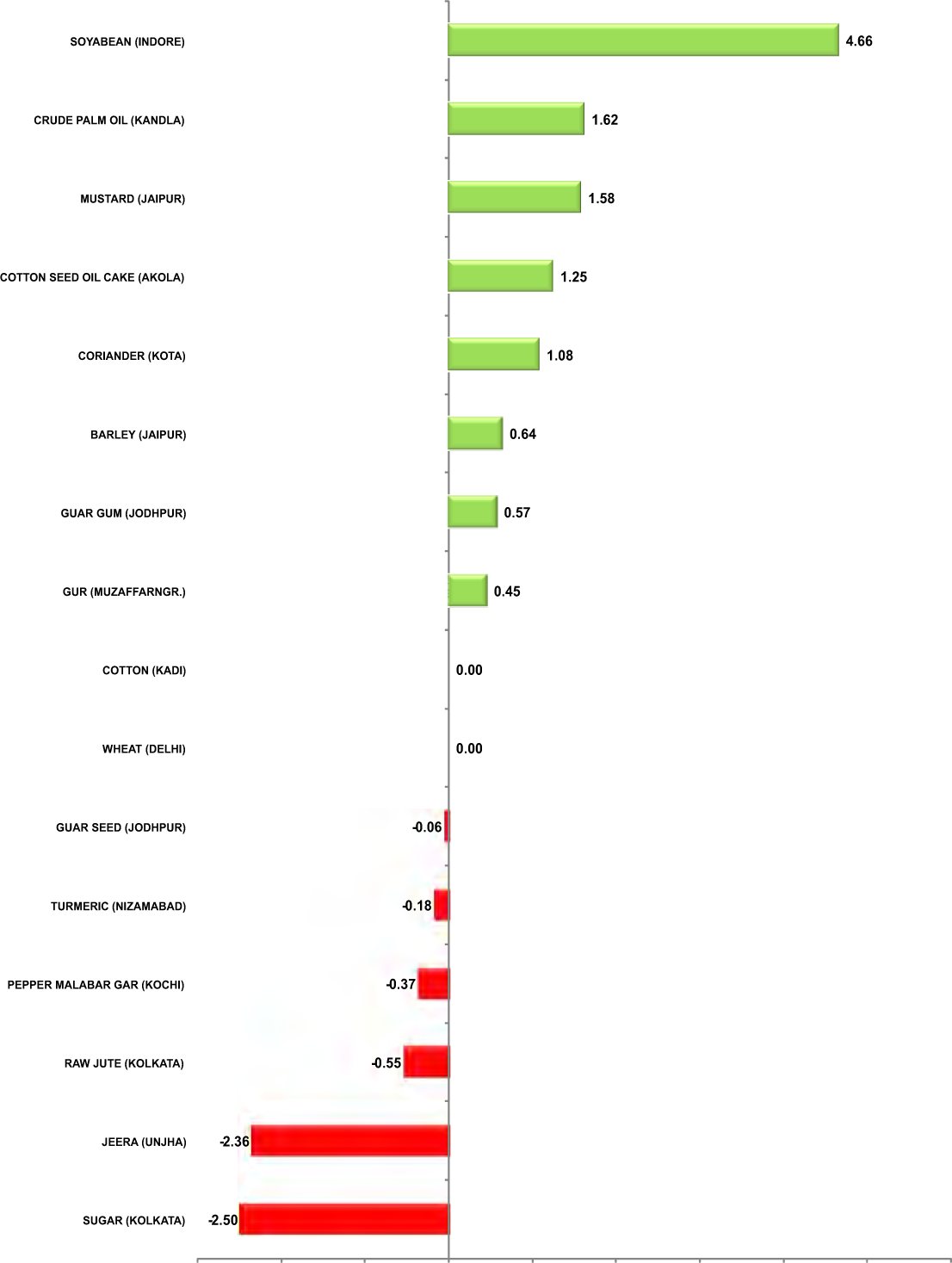

Turmeric futures (Apr) is on the verge of breaking the major support near 6400 & may witness more correction near 6315-6200 levels. On the supply side, at present, there is no report of new crop arrival at major markets but it may start in the coming weeks. It is being anticipated that the farmers will bring good number of new turmeric-Mysore variety for sale to Erode markets. On the contrary, demand from North India is being reported to be sluggish due to prevailing cold wave conditions. As far export demand is concerned it has also subdued. An extended bearish trend can be seen in jeera futures (Mar) as it can test 16000-15500 levels. The positive crop prospects due to favorable weather conditions have created bearish sentiments among the market participants. Crop variation of 5-10% is normal and can be compensated by the similar carry-forward stock of last season. Apart from production estimates, the prices will also take a cue from the export market. Coriander futures (Feb) is expected to trade with negative bias & test 6400-6350 levels. The market participants are cautious & keeping a close watch on the growth of the crop. The sudden change in weather over the last 2-3 days has been considered beneficial for the standing crops. The bullish trend in cardamom futures (Feb) is likely to persist taking support near 1545 levels. This season there is going to be a gap in availability between now and the next crop that can be expected in late June or early July. Seeing this, whatever material is arriving at the auctions, at present, is being picked up by the trader.

Bullion counter may remain on upside path as renewed fears about a slowdown, exacerbated by economic data from the U S and Japan and the International Monetary Fund’s latest downgrade to global growth projections assisted the bullion counter. Uncertainty about Brexit deal and Sino US trade war are another factors supporting the yellow metal market. On the Brexit front, British Prime Minister Theresa May sought to break the parliamentary deadlock over Brexit by proposing to seek further concessions from the European Union on a plan to prevent customs checks on the Irish border. Gold can move further higher as it can test the level of 32600 while taking support near 31800 while silver can test 39800 taking support near 38500. Meanwhile, uncertainty over prolonged closure of the US government might weigh on the market sentiments in turn increasing the demand for Gold. Reflecting investor appetite for gold, holdings of SPDR Gold, the largest gold-based ETF, was at its highest since June 2018. U.S. home sales tumbled to their lowest level in three years in December and house price increases slowed sharply, suggesting a further loss of momentum in the housing market. Bank of Japan cut its inflation forecasts last week, but maintained its massive stimulus programme, with Governor Haruhiko Kuroda warning of growing risks to the economy from trade protectionism and faltering global demand. Russia has overtaken China to become the world’s fifth largest official sector holder of gold as western sanctions drove buying by its central bank to record highs in 2018.

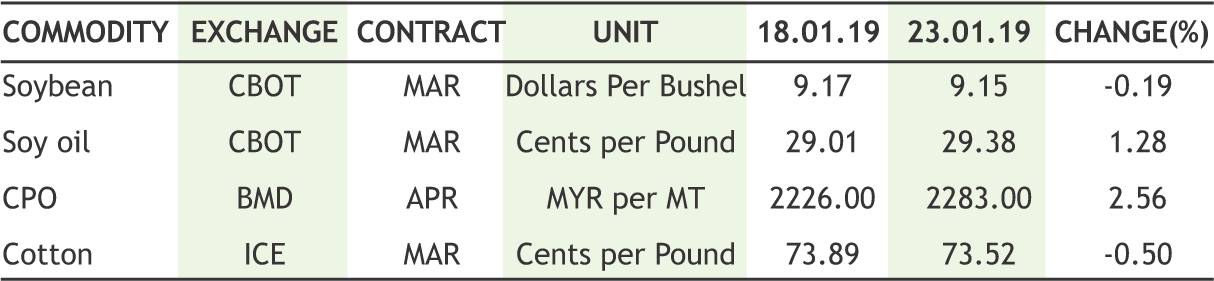

The bullish trend of soybean futures (Feb) is likely to get dimmed as it might witness profit booking towards 3700 facing resistance near 3900 levels. There are talks that Iranian state-owned animal feed importer SLAL had last week issued international tenders to purchase 2 lakh tonnes of soymeal, to be submitted by Jan 22. The Indian market was earlier expecting that due to UN sanctions on Iran's banking and trade finance, no international firm will bid for it and as a result Indian firms will finally export the required quantity as Iran uses the rupees it receives for its crude exports to cover its animal feed demand amid US sanctions that have crimped the country's ability to import necessities. However as per market sources, an international trading firm has bid for 1.32 lakh tonnes of soymeal at Euro 377CNF Iranian port for March/April Shipment. This soymeal is of Brazil origin. Hence, if deal from Iran does not materializes then price for soymeal and soybean may fall further. Mustard futures (Feb) may consolidate in the range of 3860-3960 levels. The upside is expected to remain capped as the market is expecting fresh stocks in the coming couple of weeks. The buyer’s interest shall be minimum for the old crop and any such offloading shall keep the physical prices under bearish tone. Meanwhile, now 2.54 lakh tonnes of balance stocks are available with Nafed & the liquidation will continue in days to come. CPO futures (Feb) is likely to face resistance near 570 levels & trade with a negative bias owing to profit booking. Moreover, higher imports of palm oil to India may exert a supply pressure over the counter.

Crude oil prices may remain on upside path but profit booking at higher levels cannot be denied. Production cuts by OPEC nations and declining rig counts are supporting the prices while concerns over global growth are capping the gains. Crude oil can test upside level of 3950 while taking support 3650 levels in MCX. Potential U.S. sanctions on Venezuela’s crude oil exports would cut off nation from Gulf Coast refiners that are among its biggest customers, likely forcing it to send more crude to China, India or other Asian countries. Oil markets have been underpinned this year by production cuts led by the Organization of the Petroleum Exporting Countries (OPEC), aimed at reining in an emerging supply overhang. Whether OPEC's efforts will be successful will also depend on the development of oil production in the United States, where crude output jumped by 2 million barrels per day (bpd) in 2018 to an unprecedented 11.9 million bpd. The boom was largely fuelled by onshore shale oil drilling. And the US Energy Information Administration (EIA) expected shale output to rise further; it stated that output growth would slow in the coming years. Natural gas counter can remain downbeat as its prices can dip towards 200 levels while facing resistance at near 230 .US midday forecasts called for less severe weather in February than previously expected. Meanwhile, U.S. natural gas output was projected to increase to record 77.6 Bcfd in February.

Cotton futures (Jan) is likely to test 20500 levels on the downside due to lack of demand. In Gujarat, ginners are staying away from fresh buying, while in Karnataka and Telangana, the majority of them are operating in a single shift and the lack of demand from textiles mills. Meanwhile in Karnataka, about half the 300 mills have already shut down owing to lack of business. Guar seed futures (Feb) will probably remain steady taking support near 4200 levels, while guar gum futures (Feb) may remain stable above 8300 levels. A probability forecast for El Niño and La Niña (ENSO) by the IMD indicated maximum probability for ENSO neutral conditions (neither an El Niño event nor a La Niña event in February this year. Propensity towards a deficient monsoon is more during El Nino conditions & if the forecast turns to be true, then it will hamper the output of guar in 2019-20 (Oct-Sept), and positive signal to the prices. Chana futures (Mar) is expected to plunge further towards 4090 levels taking negative cues from the spot markets. A sluggish trend in chana is being witnessed in the domestic markets amid increased availability of the government stock and the rise in selling pressure of chana by the NAFED, especially in the states of Madhya Pradesh and Rajasthan. Additionally, millers are not actively engaged in buying as demand in sale counters for Chana dal and besan is poor. Sentiments are still weak as arrivals of new crop are likely to improve and also on continued selling of stock at lower rates by government agency as they are holding major old stocks.

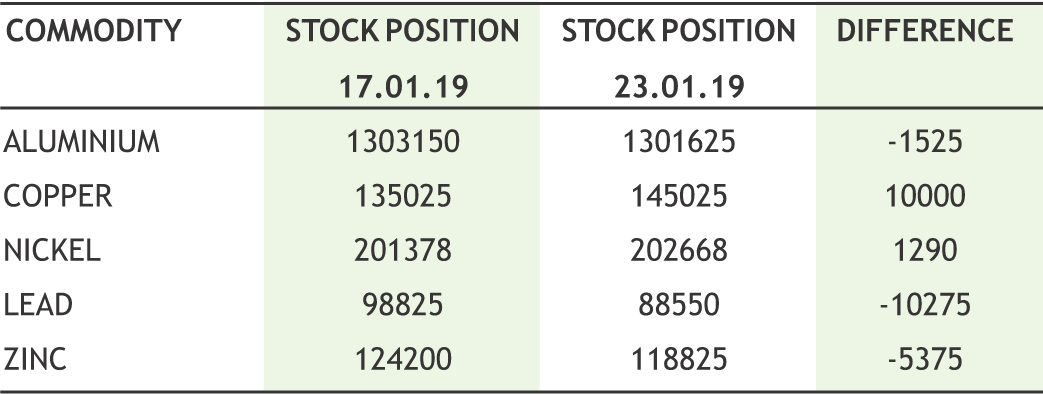

In base metal counter, prices may bounce back further on falling stock piles and supply concerns. Copper may trade on mixed path as it can face resistance near 430 levels while taking support near 410 levels. The union of supervisors at Chilean state miner Codelco’s Gabriela Mistral mine has rejected the company’s final offer for a new collective labour agreement, raising the spectre of a strike in the coming days. According to the National Bureau of Statistics “China's December refined copper output rose by 4.5 percent yearon-year to 839,000 tonnes, its highest monthly total in 2018”. Meanwhile Lead may find support near 140 and can bounce towards 149. Aluminium can continue its bounce back and can test 139 taking support near 130 levels. Meanwhile Aluminium cancelled warrants, or metal earmarked for removal from LME warehouses, have surged in the past 10 days to nearly 400,000 tonnes from 235,000 tonnes in the middle of January, accounting for around one third of the LME’s 1.3 million tonnes of stock. Nearly 3 million tonnes of (Chinese aluminium) smelting capacity has closed and inventories are drawing on a counter-seasonal basis. Zinc can bounce further and can test 192 levels. As per the ILZSG “The global zinc market deficit widened to 96,600 tonnes last November from a revised deficit of 52,000 tonnes in October”. Nickel can continue its recovery further as it can test 860 taking support near 800 levels. Global nickel market deficit narrowed to 4,900 tonnes last November from the previous month’s deficit of 10,600 tonnes.

10

|

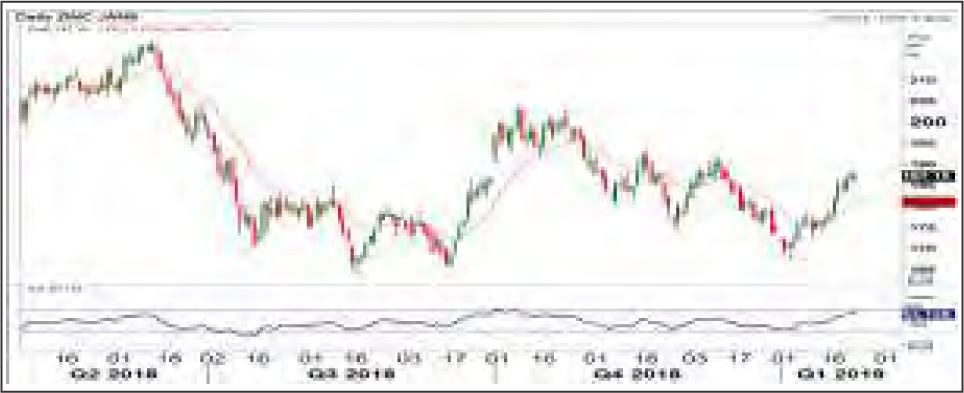

ZINC MCX (FEB) contract closed at Rs. 188.25 on 23rd Jan’19. The contract made its high of Rs. 200.70 on 10th Oct’18 and a low of Rs. 166.60 on 3rd Jan’19. The 18-day Exponential Moving Average of the commodity is currently at Rs. 181.05. On the daily chart, the commodity has Relative Strength Index (14-day) value of 66.21.

One can buy at Rs. 183.50 for a target of Rs. 187.50 with the stop loss of Rs. 181.50.

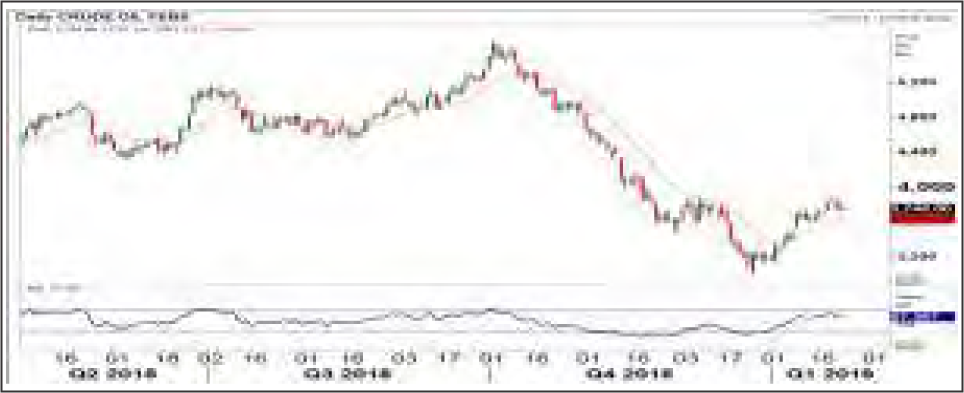

CRUDEOIL MCX (FEB) contract closed at Rs. 3741 on 23rd Jan’19. The contract made its high of Rs. 5689 on 4th Oct’18 and a low of Rs. 3037 on 26th Dec’18. The 18-day Exponential Moving Average of the commodity is currently at Rs. 3670. On the daily chart, the commodity has Relative Strength Index (14-day) value of 55.10.

One can sell at Rs. 3790 for a target of Rs. 3690 with the stop loss of Rs. 3840.

SYOREF NCDEX (FEB) contract was closed at Rs. 760.90 on 23rd Jan’19. The contract made its high of Rs. 782 on 17th Oct’18 and a low of Rs. 706.75 on 26th Dec’18. The 18- day Exponential Moving Average of the commodity is currently at Rs. 750.14. On the daily chart, the commodity has Relative Strength Index (14-day) value of 64.482.

One can sell at Rs. 766 for a target of Rs. 754 with the stop loss of Rs 772.

11

• China’s economy cooled in the fourth quarter under, dragging 2018 growth to the lowest level in nearly three decades.

• U.S. oil output from seven major shale formations is expected to rise by nearly 63,000 barrels per day (bpd) in February to a record 8.179 million bpd.

• Chilean copper miner Antofagasta Plc ended the year with annual output at the higher end of its forecast, boosted by record fourth-quarter production.

• Chinese oil refiners raised their output to a record in 2018, led by state-run oil majors which maximised operations on firm profit-margins.

• SEBI has directed commodity exchanges to align trading lot size with delivery lot size to remove barriers in physical delivery of the commodity and adhere to the global standard.

• Karnataka's maize output is seen falling 33 percent on year to 3.64 million tonnes in 2018-19 (July-June) due to a sharp fall in yield, according to the second advance estimate of state's farm department.

• The Indian Sugar Mills Association (ISMA) revised downward the country's sugar output for the second time to 30.7 million tonne (MT) for the ongoing marketing year 2018-19.

• The volume of world exports of soybeans in December 2018 decreased by 5.5% as compared with the same month a year earlier and amounted to 8.37 million tons, according to experts from Oil World.

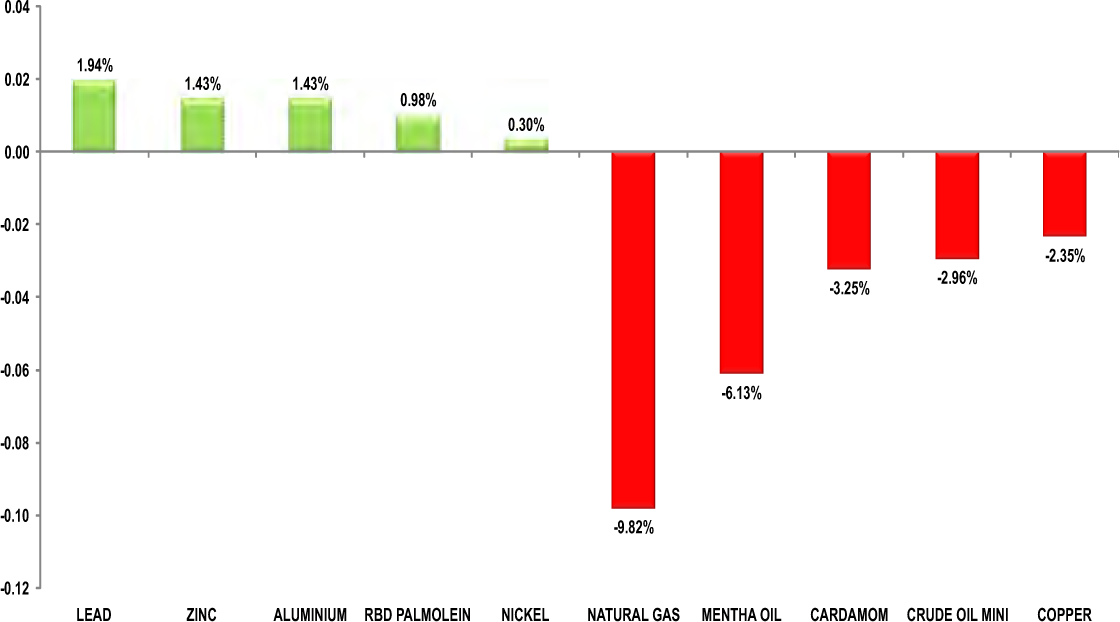

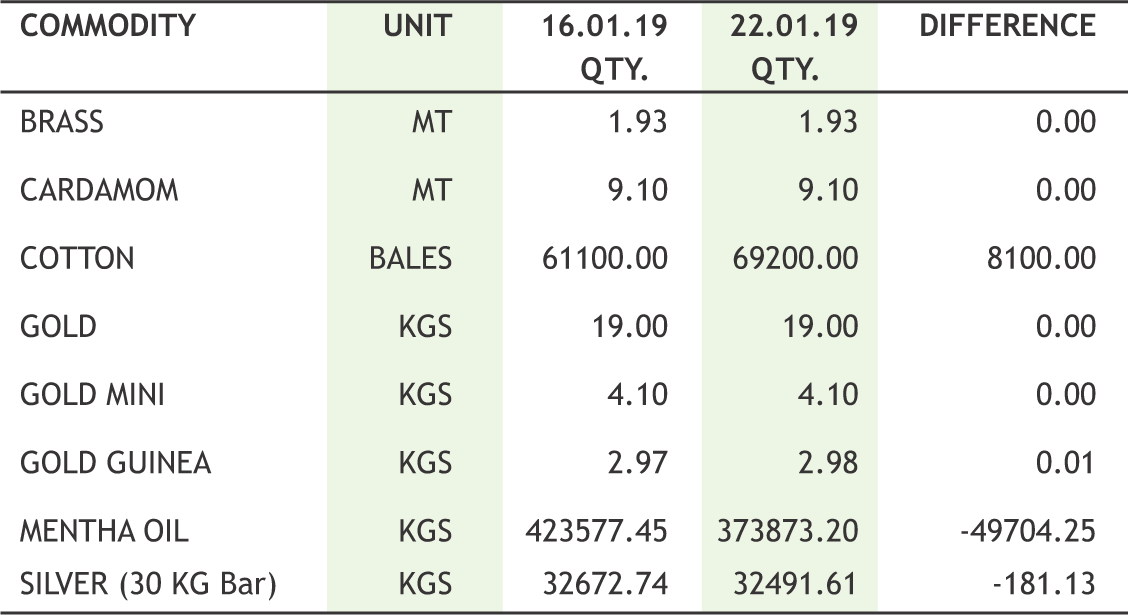

CRB rally cooled off after profitbooking from higher levels; it also ignored the downside in dollar index. Dollar index moved down as the partial U.S. government shutdown, now in its 34th day and has hurt investor sentiment. Global growth concerns have also pressurized commodities prices. IMF cut its 2019 and 2020 global growth forecasts, citing a bigger-than-expected slowdown in China and the Eurozone. Gold prices rose as the dollar declined due to concern that the prolonged U.S. government shutdown will limit economic growth and also the global growth is slowing. Silver saw some correction in both MCX and COMEX. White House economic adviser Kevin Hassett has said that the U.S. economy could see zero growth in the first three months if the partial government shutdown lasts for the whole quarter. Oil prices slipped as the European Union seeks to circumvent U.S. trade sanctions against Iran. Falling U.S. gasoline prices and rising crude output in the United States were also pressuring the crude market. Furthermore, U.S. crude stockpiles rose sharply last week, while gasoline and distillate inventories built. Natural gas prices were hammered, despite a forecast of colder than normal weather and inventories that are 11% below the 5-year average range for this time of year. Supply rises as dry natural gas production continues to grow. According to data from the EIA the average total supply of natural gas rose by 1% compared with the previous report week. In industrial metals, copper and nickel prices dipped whereas lead, zinc and aluminum prices got augmented. London copper prices edged down after economic growth in top metals consumer China slowed to its weakest in 28 years. Zinc prices moved upon supply tightness. The global zinc market deficit widened to 96,600 tonnes last November from a revised deficit of 52,000 tonnes in October.

In agri soya counter, both refined soya oil and soyabean prices saw a pause in rally on profitbooking from higher side. CPO was unstoppable though on better demand and strong technical. While mustard seed caught up rally of this counter finally and witnessed some buying momentum. Weak demand for mentha oil in domestic and overseas markets, high availability of stocks and talk of import of the synthetic variant kept prices subdued. Spot coriander prices edged higher at major markets in Gujarat, Rajasthan and Madhya Pradesh due to better buying, tracking firmness in futures.

|

|

12

|

|

Recently the government of India has cut import duties on crude and refined palm oil from Southeast Asian countries to comply with preferential trade pacts with them. The duties have been cut to provide tariff concessions under the IndiaASEAN Free Trade Agreement. The extra tariff concessions also given to Malaysia under the India-Malaysia Comprehensive Economic Cooperation Agreement (IMCECA) established on 24 September 2010. Under this preferential tariff pact, the bound rate for India’s import is 50% for refined palm oil and 40% for its crude version, effective from Jan 1, 2019.

The duty on crude palm oil from Malaysia, Indonesia and other members of the Association of South East Asian Nations was cut to 40 per cent from 44 per cent, while the tax on refined palm oil was cut to 45 per cent from 54 per cent if imported from Malaysia and to 50 per cent, if purchased from Indonesia or other member-nations of Asian, the ministry of finance said in a notification. The government had last increased import duties on edible oils in March 2018 to control imports of cheaper edible oils, and safeguard the interests of domestic refiners and oilseed farmers. Higher duties in India had been hurting exports of Southeast Asian countries.

India is the world’s largest importer of palm oil, while Indonesia and Malaysia are the leading producers. According to Solvent Extractors Association, the country’s edible oil consumption is estimated at 23.5 million tonnes for 2018-19. India imports 60 per cent — 15.5 million tons annually — of its edible oil requirements, largely from Malaysia, Indonesia followed by soyabean oil from Argentina and Brazil, sunflower oil from Ukraine and Russia and canola oil from Canada. India's domestic palm oil production is only 3,00,000 tonnes and imports 8 million tonnes of palm oil annually.

Even this, with the rupee strengthening to Rs 69.50 from Rs 74.40 against the dollar and international markets at a 6-7 year low, edible oil prices in India were at the lowest. Beside this, with the difference between crude and refined palm oil reducing from 10 per cent to now 5 per cent, refineries in the country is also facing a difficult time.

Nevertheless, the governments of Indonesia and Malaysia have requested India to reduce the taxes on import of palm oils, but the Indian government is also considering the safeguard of domestic stakeholders and will not lower it below the bound rates. However, Indian government is evaluating a request by Indonesia to keep import duties on refined products at the same level as Malaysia. In return, Indonesia has offered to buy sugar and rice from India. Indonesia is a net importer of rice, while India is one of the top exporters of rice as well as sugar.

Indonesia has suggested a trading arrangement under the India-ASEAN free trade agreement (FTA) so that import duty on refined palm oil and sugar is harmonised to 45 per cent and 5 per cent, respectively, to facilitate trade. Indonesia is working on an agreement with India to buy rice to get over its temporary deficit of the cereal. India is willing to sell 500,000 tonnes of rice to Indonesia, but also wants Indonesia to cut its export duty on crude palm oil which has threatened the India’s refining industry.

Thus the current bargaining to export rice & sugar to south-east Asian country using its dependence on palm oil imports indicate India is diverting its weakness in strength.

13

|

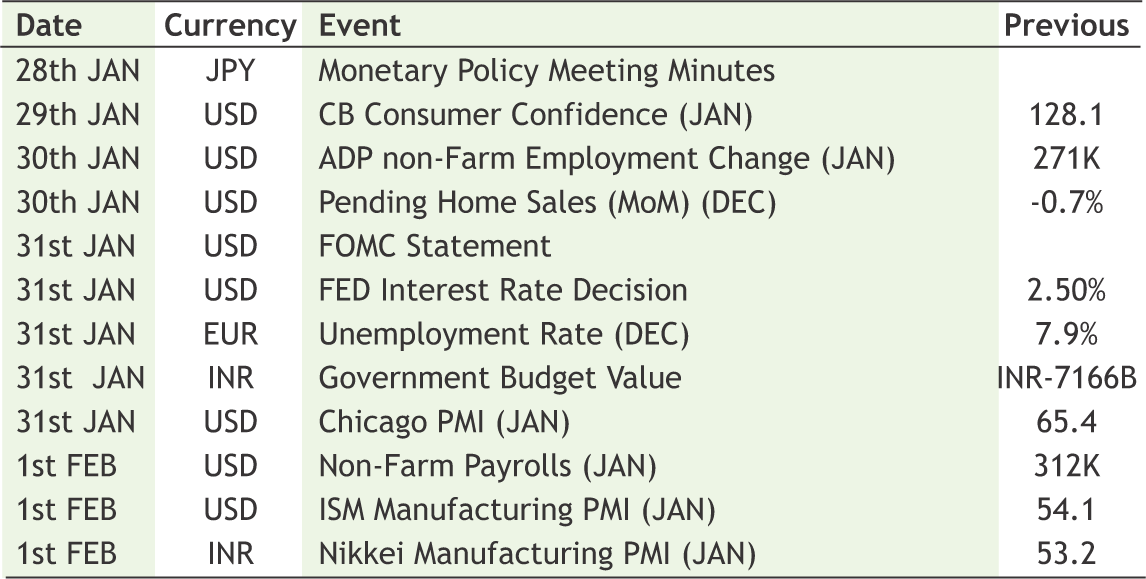

| 21st JAN | RBI has started two quarterly surveys of manufacturing, services, infra sectors. |

| 21st JAN | IMF cut its projection for global growth to 3.5% in 2019. |

| 21st JAN | Goldman Sachs sees India rate cut next month as inflation slows. |

| 22nd JAN | RBI reluctant to change FPI portfolio limits introduced last year |

| 22nd JAN | US Secterary of State, Pompeo voices optimism on U.S.-China trade. |

| 23rd JAN | BOJ maintained massive stimulus as Kuroda warns of growing risks. |

| 23rd JAN | France said Iran-EU trade mechanism should be established in 'coming days' |

| 23rd JAN | PM Conte sees Italian economy surging from mid-2019. |

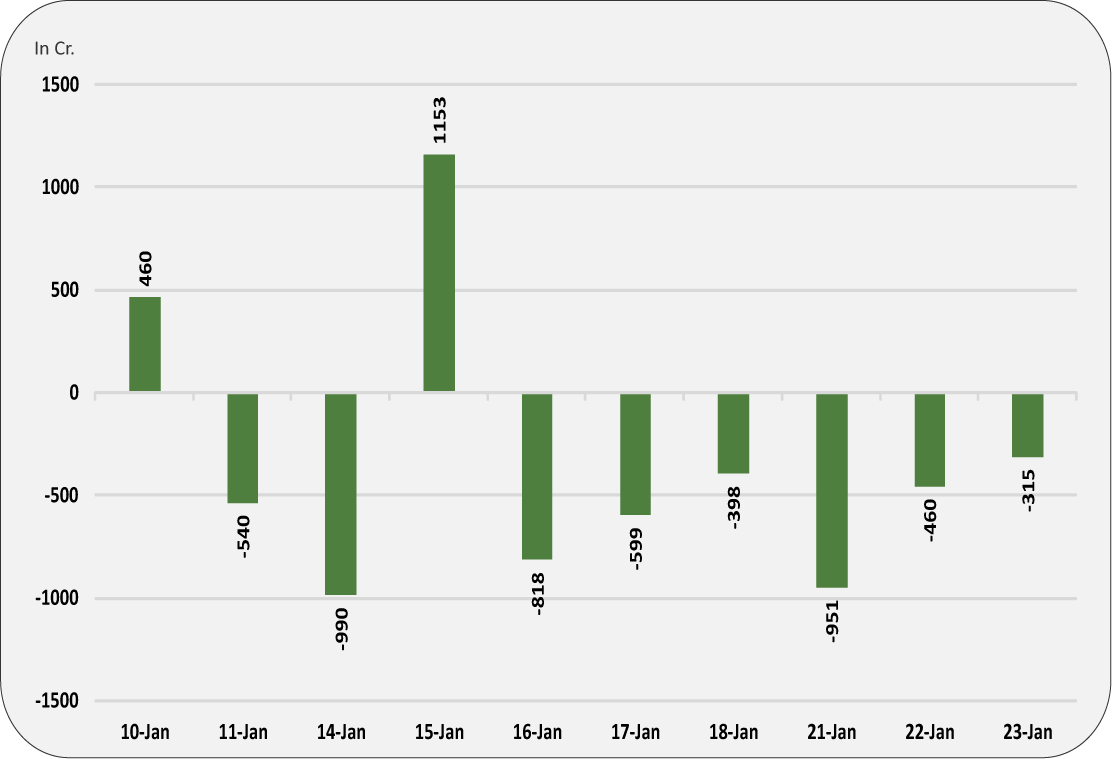

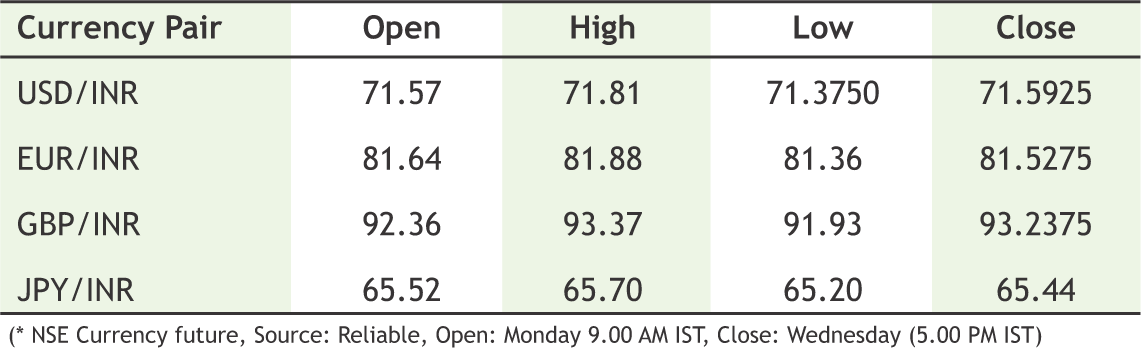

Last week, rupee traded in mere 0.6% range due to lack of important news flow from global as well as the domestic. Indian bond yields fell last week but crude oil prices eased off the highs which kept INR in tight range. The lack of action from RBI in bond markets and lack of significant from political front enforced the controlled volatility in markets. FPI outflows from the capital markets crossed Rs. 4000 crores in January and the even the open market operations from RBI took a breather after a while. Meanwhile on the cross currency front, sterling appreciated against Dollar on persistence of suspense on Brexit. The weakness in JPY extended further after BOJ maintained massive stimulus as BOJ governor warned of growing risks. Also, the weakness in Euro was led by fragile economic numbers from Europe area. Also, the risks of no-brexit deal persist in Europe area. Next week, the interim budget presentation of Modi led government will drive the markets further; the eyes would be on the quantum of fiscal deficit which could also decide the fate of general elections outcome. Expect USDINR to stay within 71 and 71.90.

|

USD/INR (FEB) contract closed at 71.5925 on 23rd Jan’ 19. The contract made its high of 71.81 on 21st Jan’19 and a low of 71.3750 on 23rd Jan’ 18 (Weekly Basis). The 14-day Exponential Moving Average of the USD/INR is currently at 71.27

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 54.94. One can buy at 71.26 for the target of 71.86 with the stop loss of 70.96.

EUR/INR (FEB) contract closed at 81.5275 on 23rd Jan’ 19. The contract made its high of 81.88 on 21st Jan’19 and a low of 81.36 on 23rd Jan’19 (Weekly Basis). The 14-day Exponential Moving Average of the EUR/INR is currently at 81.50

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 48.56. One can buy above 81.40 for a target of 82 with the stop loss of 81.10.

GBP/INR (FEB) contract closed at 93.2375 on 23rd Jan’ 19. The contract made its high of 93.37 on 23rd Jan’19 and a low of 91.93 on 21st Jan’18 (Weekly Basis). The 14-day Exponential Moving Average of the GBP/INR is currently at 91.90

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 69.01. One can buy at 93 for a target of 93.60 with the stop loss of 92.70.

JPY/INR (FEB) contract closed at 65.44 on 23rd Jan’ 19. The contract made its high of 65.70 on 22nd Jan’19 and a low of 65.20 on 23rd Jan’19 (Weekly Basis). The 14-day Exponential Moving Average of the JPY/INR is currently at 65.37

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 52.43. One can buy at 64.90 for a target of 65.50 with the stop loss of 64.60.

14

Chartered Speed gets Sebi's nod for IPO

Fleet bus operator Chartered Speed has received markets regulator Sebi's approval to raise an estimated Rs 273 crore through initial public offering. The company, which had filed its draft papers with Sebi in September 2018, received "observations" from the regulator on January 11,2019. Going by the draft papers, the IPO comprised fresh issuance of equity shares worth up to Rs 225 crore, besides, an offer of sale of around Rs 48 crore. In the offer for sale, promoters -- Pankaj Kumar Gandhi and Alka Pankaj Gandhi -- will sell shares of Rs 24 crore each. Proceeds raised through fresh issue will be used to purchase passenger transportation vehicles, investment in its subsidiary firm, Chartered Bus Pvt Ltd and other general corporate purposes. Chartered speed Ltd is engaged in the business of providing passenger mobility solutions across various modes of surface transport in India. Equirus Capital Private Ltd will manage the issue and the equity shares will be listed on the BSE and NSE.

|

15

|

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

Aditya Birla Sun Life Mutual Fund has launched Bal Bhavishya Yojna on Jan 22

Aditya Birla Sun Life Mutual Fund will launch Aditya Birla Sun Life Bal Bhavishya Yojna on January 22, an open-ended scheme for those looking to invest for their children. It will have a lock-in of at least five years or till the child attains the age of majority (whichever is earlier), according to a press release from the fund house. Subscription to the scheme, which will remain open until February 5, will offer two investment plans – wealth and savings. Under the wealth plan, at least 65 percent of the corpus will be allocated to equity and equity-related instruments and the balance in fixed income securities and in units issued by Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs). Under the savings plan, the scheme will invest 75-90 percent of assets in debt and money market securities, with the balance in equities and units issued by REITS and InvITs. The Aditya Birla Sun Life Bal Bhavishya Yojna aims to help investors meet future financial requirements for a child like expenditure incurred towards higher education, career goals and marriage.

17

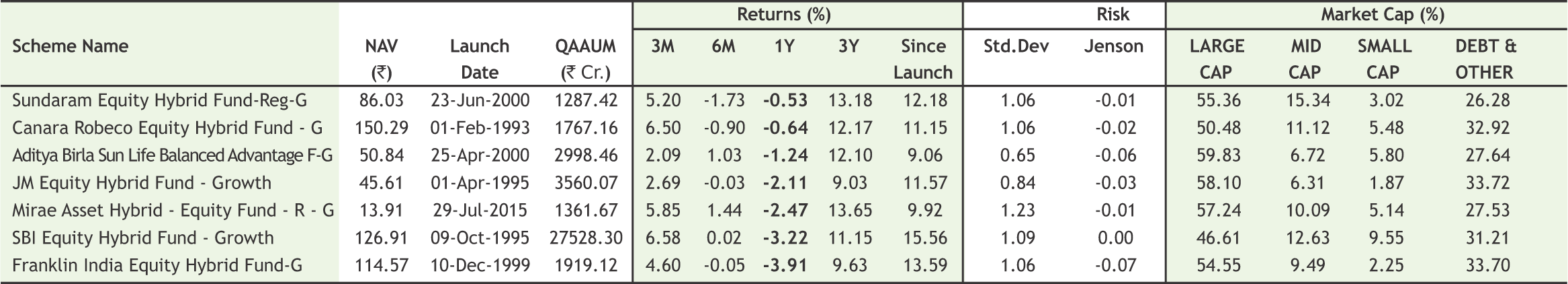

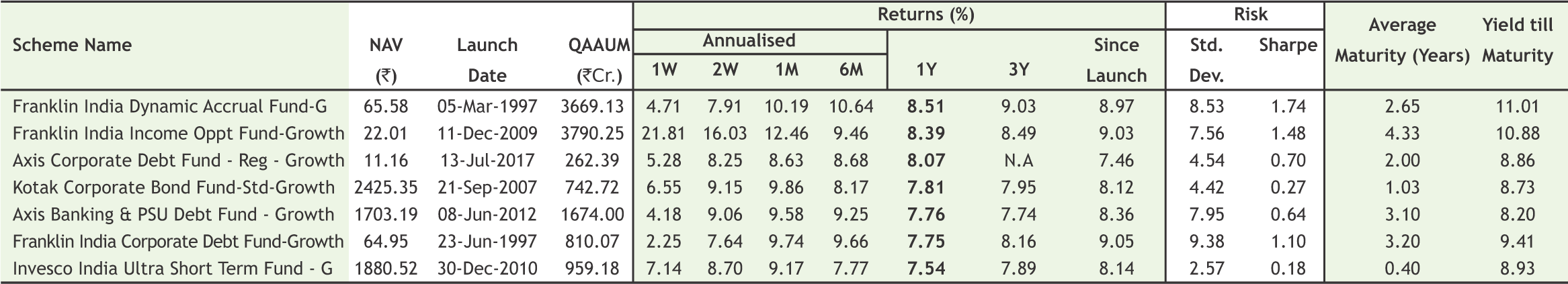

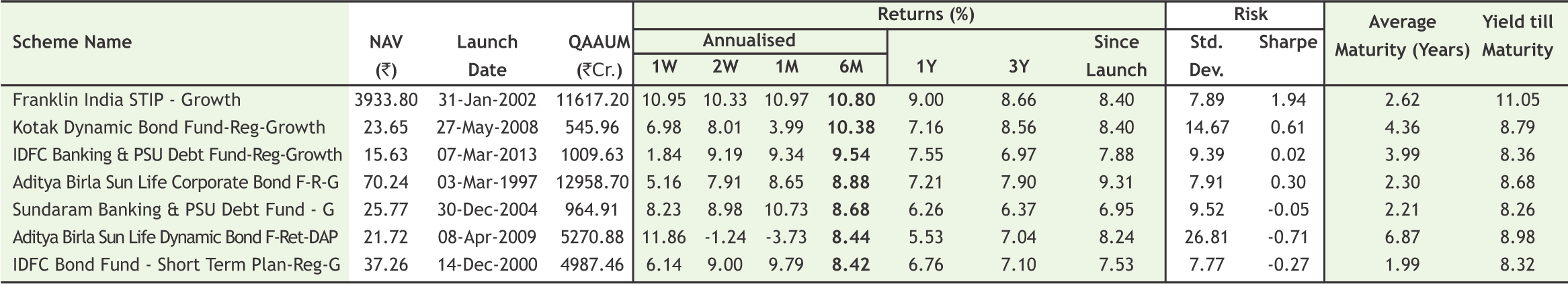

|

|

|

|

|

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

17

Mr. Ajay Garg (Director & CEO, SMC Global Securities Ltd), Ms. Nidhi Bansal (Regional Director, SMC Global Securities Ltd), Mr. Uday Prabhakar Powale (Zonal Head, SMC Global Securities Ltd) and Ms. Kuntal V Bhat (Deputy Vice President, SMC Global Securities Ltd) during the ANMI 10th International Convention - "Capital Markets in the Age of Disruption" held on Saturday, 12th January, 2019 at Hotel Grand Hyatt, Mumbai.

SMC participated in the Annual Sports Fest of IIM Indore - Ranbhoomi 2019 held from 18th to 20th January, 2019 at IIM Campus, Indore.

SMC on the occasion of Netaji Subhash Chandra Bose Jayanti 2019 organised Sit and Draw competition along with Aditya Birla Capital to promote Mutual Fund on Wednesday, 23rd January, 2019 at Netaji Club, Malda, West Bengal.

www.smcindiaonline.com

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in